Zoho Expense: Quick detailsBeginning worth for paid plan: $3/lively consumer Key options:

|

Zoho Expense is a cloud-based, stand-alone enterprise expense monitoring app provided by Zoho. Zoho Expense can be out there as a part of the Zoho One bundle plan.

That will help you determine if Zoho Expense is true for your online business’s wants, we are going to do a deep dive into its pricing plans, options, execs and cons on this thorough Zoho Expense evaluate.

Soar to:

Zoho Expense’s pricing

Free

This plan is free for as much as three customers. Options embody:

- 5 GB receipt storage.

- 20 receipt autoscans.

- Multi-currency bills.

- Mileage bills.

Normal

The Normal plan prices $3 per lively consumer per thirty days billed yearly, or $5 per lively consumer per thirty days billed month-to-month. It requires a minimal of three customers and helps limitless customers. A 14-day free trial is accessible for this plan. Options embody:

- 20 receipt autoscans per consumer.

- Company card reconciliation.

- Money advances.

- Multi-level approval.

Premium

The Normal plan prices $5 per lively consumer per thirty days billed yearly, or $8 per lively consumer per thirty days billed month-to-month. It requires a minimal of three customers and helps limitless customers. A 14-day free trial is accessible for this plan. Options embody:

- Journey requests.

- Buy request.

- Superior approval.

- Per Diem automation.

Enterprise

The Enterprise plan prices $8 per lively consumer per thirty days billed yearly or $12 per lively consumer per thirty days billed month-to-month. It requires a minimal of 200 customers and helps limitless customers. Options embody:

- TMC/OTA integration.

- ERP integration.

- Single Signal On (SAML).

- Devoted account supervisor.

If in case you have greater than 500 customers, you will need to contact Zoho Expense for a customized quote. You too can go for the Zoho One plan, which bundles all of Zoho’s software program merchandise — greater than 40 instruments in all, together with Zoho Expense — right into a single reasonably priced worth plan that prices $37 per thirty days per worker, billed yearly.

Zoho Expense’s key options

Receipt administration

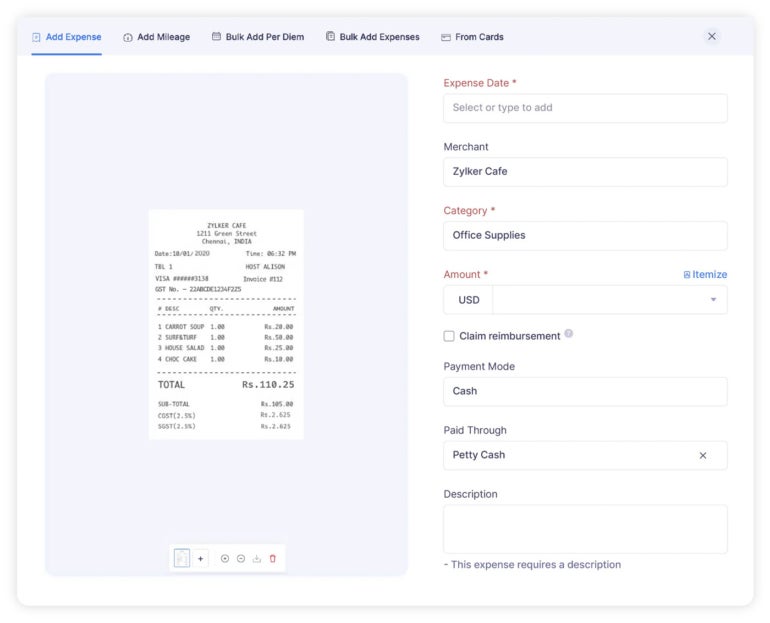

Determine A

Workers can add receipts to Zoho Expense in a number of methods (Determine A): take a photograph utilizing the cellular app, drag-and-drop an current picture out of your desktop, ahead an e mail affirmation for a reservation or import receipts from different cloud functions. The app’s superior autoscan function reads receipts in 14 languages and creates expense data for them. Bulk importing of receipts is accessible on all plans, together with the free model.

Expense administration

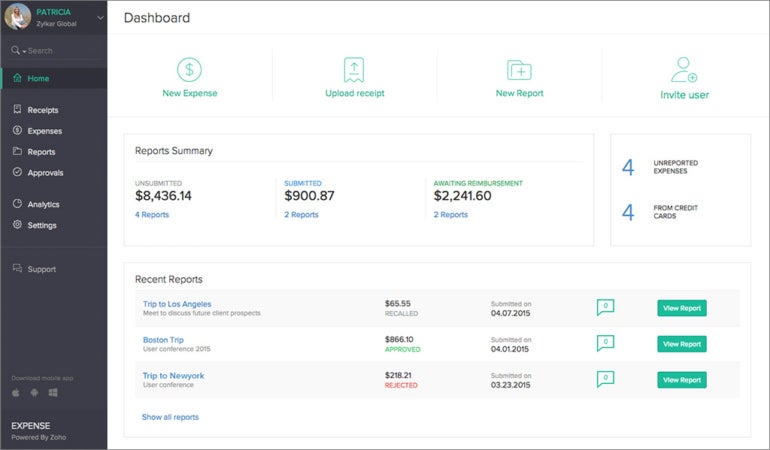

Determine B

As soon as receipts are within the instruments, the dashboard provides you a high-level view of their standing (Determine B). You possibly can itemize bills so they’re tax exempted appropriately and break up shared bills by quantity, day or customized class. Admins can management what workers see, eliminating pointless fields to keep away from confusion. They’ll additionally set a per diem price for workers based mostly on location.

Mileage monitoring

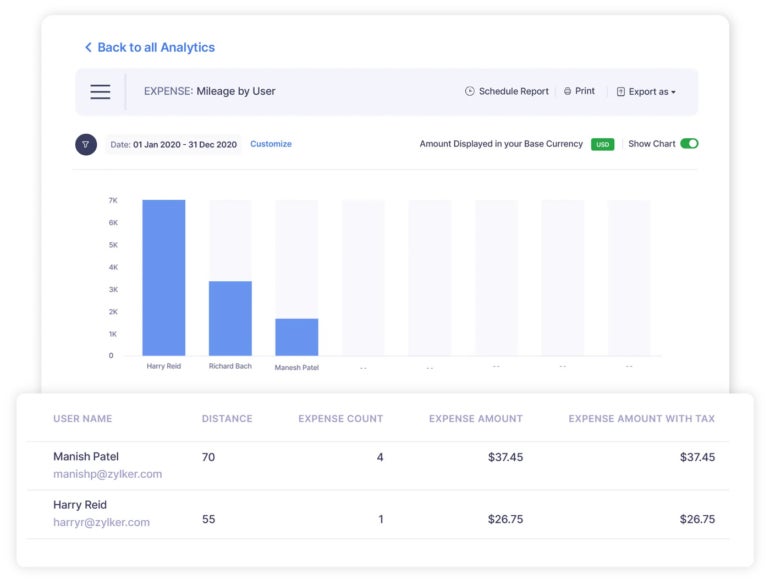

Determine C

Miles might be tracked in 4 methods on Zoho Expense (Determine C): by way of GPS, distance coated, point-to-point map areas and odometer readings. Admins can set customized mileage charges for various autos, insurance policies, departments or value facilities. Run mileage stories for every consumer to see how a lot they’ve tracked for a customized time frame.

Card administration

You possibly can join company, pay as you go or private bank cards to Zoho Expense, so purchases will robotically be logged within the system, making it simple to reconcile enterprise bills. With Direct Feed Integration (DFI), company card feeds might be fetched straight from Visa, Mastercard and Amex (American Categorical), eliminating the necessity for a intermediary and enhancing safety.

Expense management and approvals

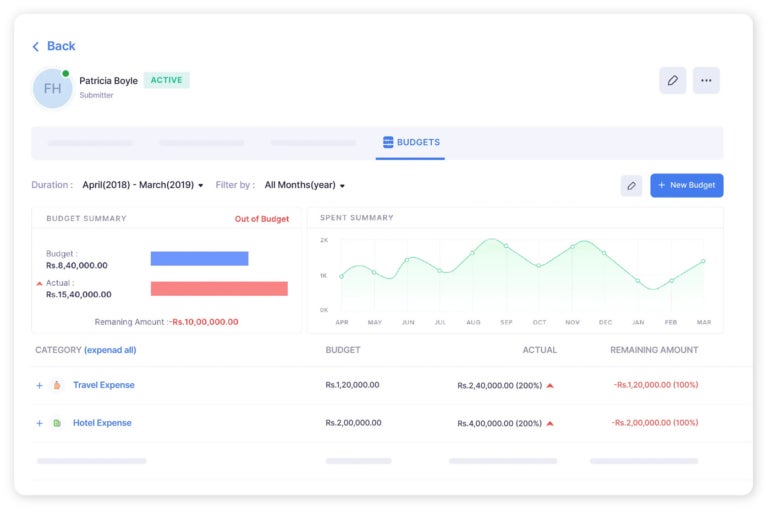

Determine D

Admins can arrange expense guidelines based mostly on mounted quantities, mileage limits and extra; these limits might be every day, weekly, month-to-month or a customized length. They’ll additionally institute expense insurance policies for various manufacturers, departments or value facilities, which is able to then set off a notification if a coverage is violated. Total funds limits (Determine D) may also be created for sure expense classes or sorts, and the system will warn or block workers when their buy request is about to exceed the funds. Easy, custom-made approval workflows eradicate repetitive work and preserve bills in verify.

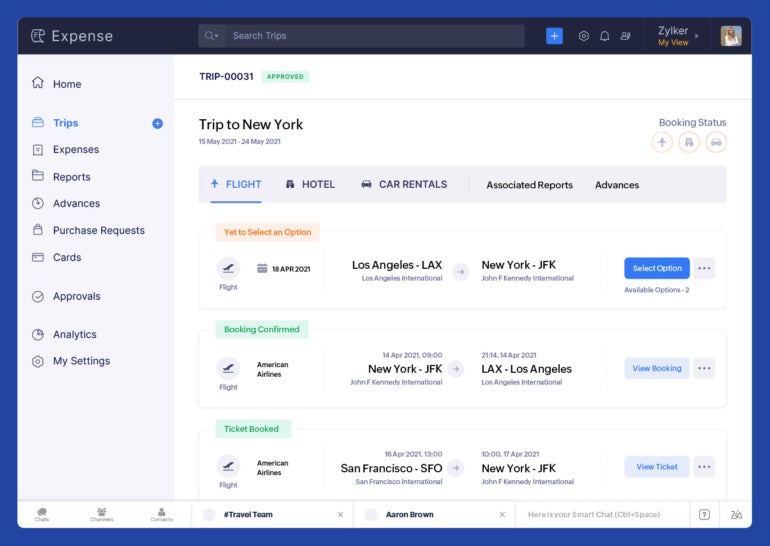

Journey expense administration

Determine E

Zoho Expense does supply journey expense administration options (Determine E), although these are restricted to the Premium and Enterprise plans. The self-booking instrument helps workers e-book their very own journey whereas following firm spending insurance policies. The system will freeze a fare whereas awaiting approval to keep away from worth surges and notify workers of worth alerts to allow them to re-book at a decrease fare. The system additionally automates visa requests and journey coverage compliance.

Expense stories

Determine F

Workers can simply create and submit expense stories for approval with Zoho Expense (Determine F), which is able to robotically generate distinctive numbers for you. You possibly can group associated bills like air journey, lodging and meals to simplify the report. Workers can even apply money advances to the report back to offset reimbursement quantities and guarantee right calculations.

Zoho Expense execs

- Reasonably priced, clear pricing plans that can work for a lot of small companies.

- Endlessly free plan out there.

- Integrates with common accounting software program, together with QuickBooks.

- Integrates seamlessly with different Zoho Merchandise.

- Visually interesting and colourful interface.

- Many customizable automation choices.

Zoho Expense cons

- Steeper studying curve, particularly for individuals who haven’t used a Zoho product earlier than.

- Free plan’s storage is proscribed.

- Onboarding and setup processes might be prolonged.

- Should improve to the Premium plan for journey expense administration.

- Accountants are much less more likely to be accustomed to Zoho vs. QuickBooks.

- Buyer help might be improved.

Zoho Expense integrations

Zoho Expense integrates with different Zoho merchandise in addition to many common third-party companies, like these:

- Apply accounting and bookkeeping with Zoho Books, QuickBooks, Sage Accounting and Xero Accounting.

- Create and ship custom-made invoices with Zoho Bill.

- Handle journey bills with Get There and Routespring.

- Ship reimbursement funds with CSG Forte, ICICI Financial institution and HSBC.

- Submit rideshares for expense reimbursement with Uber, Lyft and Bolt.

- Reclaim VATs after worldwide journey via Taxback Worldwide and WAY2VAT.

- Handle paperwork with Dropbox, Google Drive and Microsoft OneDrive.

- Message coworkers with Slack.

Who’s Zoho Expense finest for?

Zoho Expense is a no brainer for any firm that already makes use of Zoho merchandise, particularly different finance instruments like Zoho Books and Zoho Invoices. Since Zoho makes use of the identical login for all its merchandise, it’s simple so as to add one other to your software program stack, they usually all combine seamlessly with one another.

Zoho Expense can be an important alternative for small companies on the lookout for an reasonably priced standalone expense administration instrument. Many options, akin to QuickBooks, bundle the expense administration perform along with accounting, stock administration and different options. This will increase the worth of competitor’s plans and will saddle SMBs with further performance they don’t want or need.

That being mentioned, if you happen to do want extra finance-related options past simply expense administration, you’ll have to look into different Zoho instruments for that. Thankfully, most different Zoho merchandise, together with Zoho Books accounting, supply a free tier of service in addition to reasonably priced paid plans. Relying on what degree of performance you want, it’d really be cheaper to mix a number of of Zoho’s merchandise as an alternative of springing for a costlier all-in-one various like QuickBooks.

If Zoho Expense isn’t best for you, try these options

For all its benefits, Zoho Expense isn’t the correct alternative for each enterprise. Some firms want extra performance than only a standalone expense administration app. Whereas Zoho does supply Zoho Books and Zoho Bill, these instruments aren’t practically as common amongst accountants as QuickBooks, which might additionally complicate issues come tax season. Listed here are some Zoho expense options to think about.

FreshBooks

FreshBooks is a extra reasonably priced various to QuickBooks that features limitless expense monitoring on its base plan, which begins at $17 a month. FreshBooks additionally contains different accounting and invoicing options for an all-in-one platform. FreshBooks is a good alternative for companies which can be on the lookout for an accounting software program that features expense monitoring however don’t need to spend as a lot cash as QuickBooks requires.

QuickBooks

QuickBook is the trade commonplace in accounting software program, and it gives receipt seize and expense administration for all pricing tiers, which begin at $30 a month. Its recognition implies that each accountant might be accustomed to it, whereas the identical can’t be mentioned for Zoho Expense. QuickBooks additionally incorporates every little thing into one platform, whereas Zoho breaks out capabilities into separate merchandise like Zoho Expense, Zoho Books and Zoho Bill.

Expensify

Expensify is a well-liked stand-alone expense administration instrument that may be very similar to Zoho Expense, together with its free plan. Along with commonplace expense administration options like receipt seize, the corporate gives its personal Expensify card, which makes capturing bills a breeze. You possibly can nonetheless use the app with your individual bank cards.

Overview methodology

To evaluate Zoho Expense, we signed up for a free trial of the Premium plan. We additionally watched demo movies, consulted consumer opinions and checked out product documentation. We thought-about options akin to receipt administration, mileage, monitoring, expense controls and journey expense administration. We additionally weighed different components such because the consumer interface design, studying curve and buyer help.