Regardless of quite a few acquisitions, the cellular robotic market is in truth not consolidating, and extra firms pop up every year.

|

Hearken to this text |

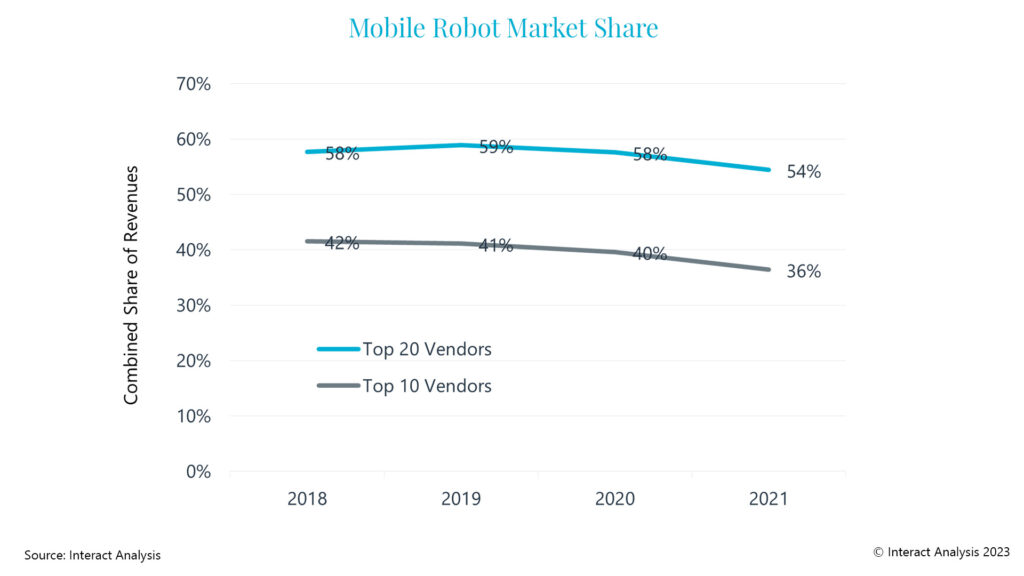

Regardless of quite a few acquisitions, the cellular robotic market is in truth not consolidating. Extra distributors emerge every year and extra industrial firms are launching AMRs. The mixed market share of the highest 10 and prime 20 main distributors barely modified between 2018 and 2020 and certainly dropped in 2021. Over the previous six years of researching this trade, we constantly establish new gamers (each start-ups and current firms from adjoining markets that now supply AMRs).

Fragmentation

Given the dramatic development charges and big variance in regional and vertical trade efficiency, additional fragmentation of the provider base seems to be probably – particularly when contemplating the big variety of present distributors and the continuous emergence of latest ones. As proven within the determine under, the highest 10 distributors of cellular robots, captured simply 36% of complete trade revenues in 2021. Evaluate this to the extra mature industrial robotic market and there the highest 10 distributors take pleasure in a 73% mixed market share. The identical determine for collaborative robotic arms is even increased, at practically 85%.

Begin-Ups Develop Up

Most of the AMR start-ups from yester-year are actually producing vital revenues (>$20m) having efficiently expanded on pilots performed in earlier years. US-based Locus Robotics grew to become the trade’s first “unicorn” being valued at over $1bn following its $150m fund-raising spherical shut to 2 years in the past. Chinese language rival, Geek+ has lengthy been rumored to be planning its IPO (maybe when trade and macro situations enhance), additional highlighting how far these once-start-ups have come.

The marginally extra established gamers have additionally seen their companies develop to the subsequent degree. Having significantly expanded their buyer and distribution bases, they’re benefiting from prospects putting in bigger numbers of AMRs because the know-how turns into extra confirmed.

Vendor Efficiency Varies Vastly

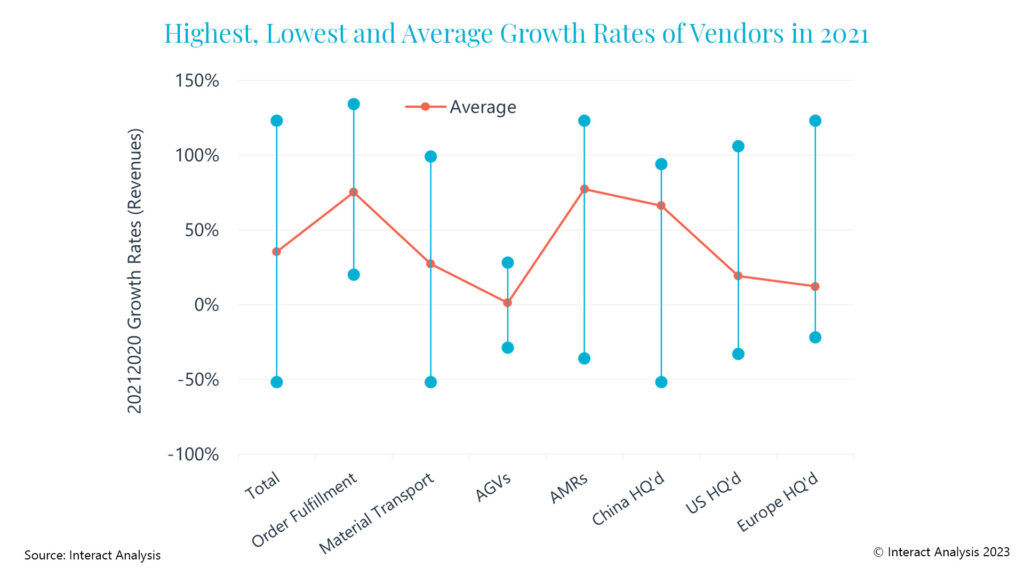

A part of the rationale that the trade isn’t but consolidating is the truth that “cellular automation” captures a mess of robotic sorts, industries and purposes. From automated tugger trains on automotive manufacturing strains, via to cellular manipulators selecting particular person gadgets in a achievement middle. As such, vendor efficiency varies massively, and sometimes has little to do with their technique, product or efficiency however extra to do with driving the waves of their trade sector.

General income development charges for distributors ranged from ~150% to adverse 50% in 2021. How a vendor carried out was largely linked to the principle finish industries and areas they have been uncovered to in addition to the kind(s) of cellular robotic they provide.

What does the Future Maintain?

Main trade consolidation seems unlikely within the subsequent 2-3 years. Nevertheless, given the present financial atmosphere and curiosity in cellular automation, it’s probably a number of the smaller gamers will attempt to ‘money of their chips’. On the similar time, we’re additionally more likely to see much more distributors emerge over the approaching years. The web consequence will probably be neither consolidation nor additional fragmentation.

Some excessive profile and main AMR distributors have been acquired previously two years (notably Fetch Robotics and ASTI Cell Robotics). Nevertheless, each have been acquired by firms with out an current cellular robotic portfolio, so this didn’t assist consolidate or focus market revenues. There have been examples of cellular robotic firms buying each other. In September 2021, Locus Robotics acquired Waypoint Robotics. And late final yr Teradyne introduced the merger of its two cellular robotic acquisitions (MiR and AutoGuide). At first look, this will point out market consolidation, however on nearer inspection, it reveals this M&A exercise was considerably insignificant as AutoGuide and Waypoint mixed accounted for lower than 1% of complete trade revenues on the level of acquisition.

Future acquisitions look probably, significantly from industrial firms wishing to capitalize on the excessive development and margins seen within the cellular automation sector. Nevertheless, our expectation is that this is able to come from firms not already lively throughout the sector.

Different potential consumers may very well be retailers or logistics firms (a lá Amazon/Kiva) or bigger warehouse automation system integrators (the likes of Dematic or Honeywell Intelligrated). However in our opinion that appears unlikely and unwise presently. With so many alternative cellular robotic distributors and applied sciences on the market, buying a single AMR firm in the present day brings little worth and places all their eggs in a single basket. As an alternative, it will be much better for a retailer or logistics firm to have the ability to purchase from a number of robotic firms, selecting the best-in-breed for the duty at hand. Comparable for a system integrator, it will be way more compelling to have the ability to supply its prospects the know-how from a number of robotic distributors (assuming they will get distribution agreements) reasonably than from a single one it had acquired.

After all, with the ability to benefit from utilizing AMR applied sciences from a number of distributors does include its personal challenges – most notably combined fleet orchestration. However that’s one other subject solely!

Editor’s Observe: This story was initially printed by Work together Evaluation and was reprinted with permission.