At first of the 12 months, I predicted “transition finance” can be a high theme to comply with in 2024, after it dominated sustainable finance discussions throughout the latest COP 28 proceedings in Dubai.

Two issues are clear: Transition finance represents a multi-trillion-dollar alternative for buyers, and Wall Avenue already sees the case for these automobiles to offer enticing risk-adjusted returns.

Many interpretations

Transition finance refers to investments meant to decarbonize high-emitting and hard-to-abate industries similar to metal, aviation and delivery. This capital can also be geared toward addressing potential social impacts related to decarbonization, together with unemployment and lack of tax income for native governments.

For instance, industrial conglomerate Mitsubishi Heavy Industries issued its first transition bond Sept. 8, 2022 to boost $71 million for company investments in hydrogen gasoline generators, high-efficiency gasoline generators fueled by liquid pure gasoline, and carbon seize and storage know-how, amongst different issues.

Japan Airways was the primary airline to difficulty transition bonds, with a $6.7 million difficulty in March 2022 and a second for a similar quantity 15 months later. Proceeds from each bonds will go in direction of upgrading the airline’s fleet to fuel-efficient plane.

One vital barrier to scaling transition finance is an absence of a normal framework and taxonomy for discussions, decision-making and documentation. An RMI evaluation of 17 transition finance frameworks discovered 17 definitions. The widespread theme was a deal with “the decarbonization of high-emitting entities and/or hard-to-abate sectors.”

Listed below are three high-profile examples:

Personal capital has entered the chat

The non-public sector and funding group has seen the chance sustainability-related finance presents. There was $2.74 trillion in funds that declare to deal with sustainability, impression or ESG elements as of September, in response to Morningstar, and it seems like Wall Avenue has its eyes set on transition finance as its subsequent trillion-dollar alternative.

Personal fairness giants Apollo and Brookfield have each launched multi-billion greenback transition funds and are aiming for $100 billion and $200 billion for his or her respective clear vitality and local weather capital platforms.

KKR is seeking to increase $7 billion for its first international local weather fund that may spend money on each inexperienced applied sciences and in decarbonizing current property similar to infrastructure.

The world’s largest asset supervisor and the one most related to ESG investing in the USA, BlackRock, already has a $100 billion transition-investing platform.

Banks are getting in on transition finance, too. Barclays is organising an vitality transition group to advise vitality and energy purchasers on their vitality transition methods, and it’s aiming to facilitate $1 trillion in transition financing by the tip of 2030. Citi created an identical group in 2021.

A linchpin: Public-private partnerships

Financing the transition to a net-zero emissions financial system would require unprecedented sums of cash that no particular person entity is ready to fund itself. For transition finance to work, governments and buyers might want to pool their capital in new methods.

The United Arab Emirates’ local weather finance fund introduced at COP28 final 12 months is one mannequin for the way public-private partnerships might mobilize capital to finance the transition to a net-zero financial system. The nation’s $30 billion dedication consists of $5 billion designated for initiatives within the International South. The UAE will cap its returns for that portion of the fund at 5 p.c. Any returns above that threshold can be redistributed to the opposite buyers as a part of a derisking clause meant to draw non-public capital to co-invest in these initiatives.

By limiting its personal returns to five p.c, the UAE is making the fund a way more enticing alternative for personal buyers who will obtain UAE’s returns over 5 p.c, Bloomberg reported. Beneath this construction, buyers might see their returns improve by as a lot as half a p.c.

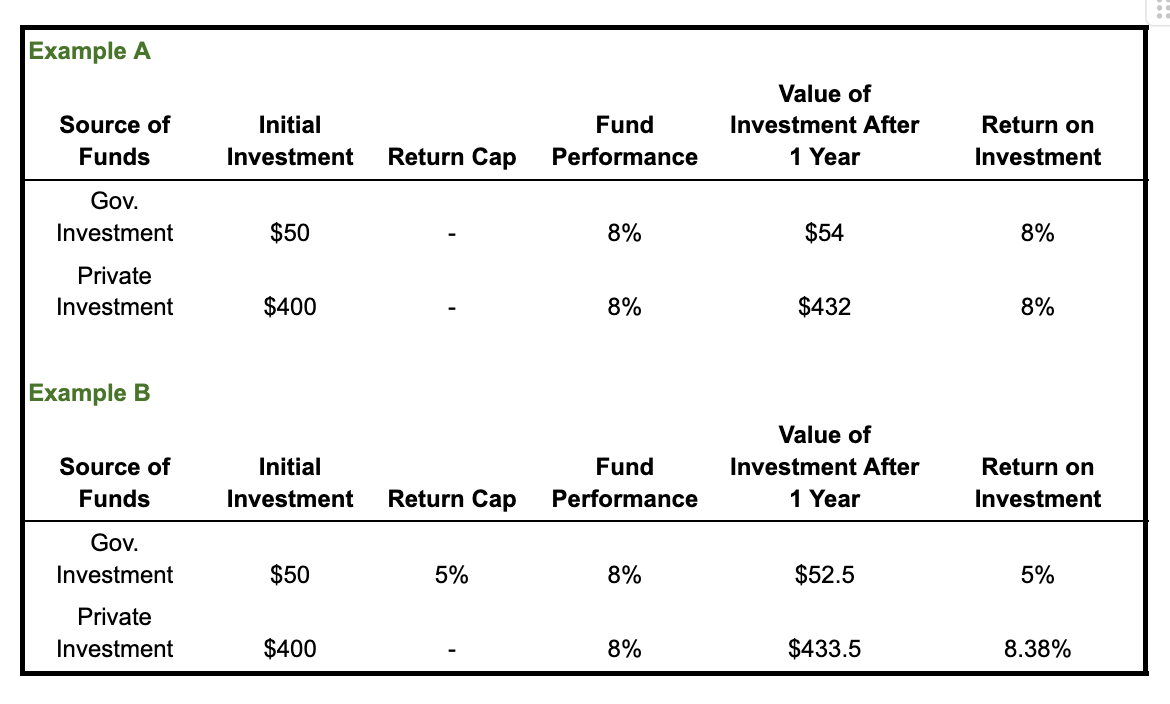

For example the fund invested $50 of presidency cash alongside $400 of personal capital. The chart under exhibits two variations of a state of affairs through which the fund returns 8 p.c on investments. Instance A depicts the returns allotted to every investor group with none caps on returns. Instance B exhibits what would occur if the returns of the federal government’s funding are capped at 5 p.c. Briefly: If the funding had an 8 p.c return in its first 12 months, the non-public buyers in Instance B would see their return on funding improve by 38 foundation factors.

The UAE hopes that its capped returns will assist appeal to non-public capital and develop the fund to $250 billion by 2050.

Nonetheless, that is only a drop within the bucket of what’s going to be wanted to transition the worldwide financial system. For instance, the Local weather Bonds Initiative estimates that China’s metal trade would require $3.14 trillion to realize carbon neutrality.

You may anticipate to listen to extra about transition finance all year long as GFANZ anticipates greater than 250 monetary establishments will publish transition plans utilizing its framework in 2024.