November greetings from Cedar Rapids and Kansas Metropolis. The image might be a well-known sight for these within the fiber trade. Sure, we’re getting a second fiber to the house (FTTH) supplier for our 28-home neighborhood. The market is getting crowded in some locations (the returns for the second supplier in our neighborhood might be subpar) whereas others go unbuilt. Too many desktop analyses and never sufficient discipline verification.

After a full market commenary, we are going to present some temporary ideas on the influence of the current elections on telecommunications coverage after which dive into the second a part of our earnings evaluation. This week, we analyze who has momentum with fiber deployments and wireline broadband.

We’ve had a number of dozen new additions to the Temporary readership during the last month, and drastically recognize any and all referrals. Given our concentrate on the working efficiency of CellSite Options, the schedule doesn’t allow consulting or talking alternatives for the forseeable future, apart from these straight associated to telecom shelter remanufacturing or related civil development companies. There’s lots occurring in vital infrastructure as latency necessities prolong to secondary and tertiary markets, and CellSite is in the midst of a lot of these discussions. For now, time solely permits expressing our ideas by means of this column.

Whereas we won’t be publishing a full Temporary in two weeks (our interim on-line Temporary in two weeks can have hyperlinks to a few long-form items of content material), we are going to proceed our commonplace bi-weekly cadence by means of the tip of the 12 months. We’re going to be focusing our December Briefs on 4 foundational traits shaping the trade. These are extra in-depth than 2000 phrases permits, so we might be reviving the “Deeper” part of the web Temporary for folk to entry extra publicly accessible info. We can even intersperse every December Temporary with some ideas on capital priorities for every of the main telecommunications suppliers.

The fortnight that was

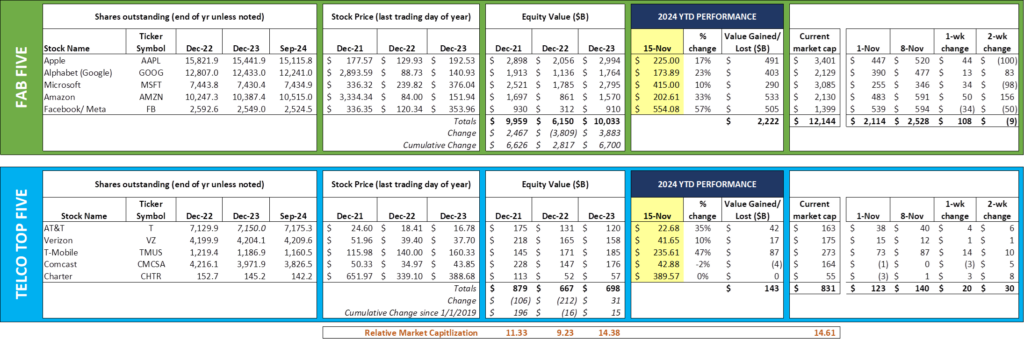

This was a surprisingly good week for the Fab 5 (+$108 billion) and the Telco Prime 5 (+$20 billion). The theme of “small features throughout the board, with one laggard” holds for each teams. It’s exhausting to really feel too unhealthy for Meta (the Fab 5 laggard this week), nonetheless, as they’re having fun with one other stellar inventory run (+57% year-to-date). As a gaggle, the Fab 5 have gained $2.22 trillion in worth this 12 months and $6+ trillion during the last two years – exceptional efficiency given growing world regulatory scrutiny and their sheer dimension.

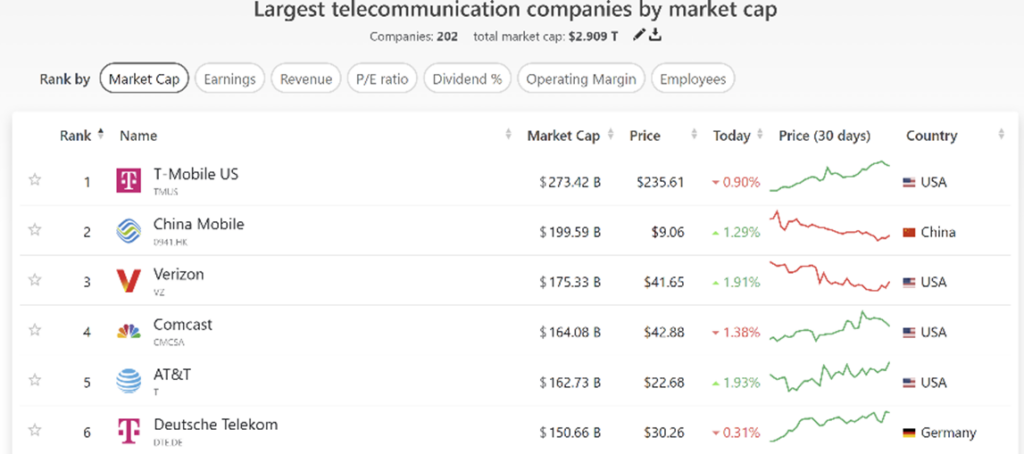

What could be very attention-grabbing are the worth migrations occurring within the Telco Prime 5. T-Cell’s inventory continues to outperform many of the Fab 5 on a share foundation (+47% year-to-date). They’re now probably the most worthwhile telecommunications firm on this planet by a really wholesome margin (extra right here and within the close by chart). Curiously, T-Cell is shortly approaching 10% of the whole world telecom market capitalization. And, as we all know from their Capital Markets Day, there are elevated buybacks on the horizon.

Whereas T-Cell’s breakout is notable, so is the ascent of AT&T (extra on why beneath). They’re a mere $1.25 billion in market capitalization from overtaking Comcast, and $13 billion from besting Verizon. Many people gave Ma Bell up for useless in 2020 as they grappled with poorly executed acquisitions, and whereas we didn’t toss them in the identical trash heap as Lumen (who can be lately displaying indicators of life) and Frontier (who managed to get acquired by Verizon – shareholders accredited the provide), we noticed a sophisticated and tough turnaround. Slightly over 4 years later, they’re contending for third place on the league desk – a noteworthy feat that we’ll elaborate on beneath.

Put up-election implications for telecom

A lot of you requested for our ideas on the election (which, imagine it or not, occurred lower than two weeks in the past). To cite the late Donald Rumsfeld, listed here are the “recognized knowns”

- The Federal Commerce Fee (FTC) and Federal Communications Fee (FCC) management goes to vary, enabling a friendlier M&A atmosphere. Whether or not this is applicable to Comcast (present proprietor of MSNBC, a relentless critic of something Trump) is a query, however the subsequent 4 years current a novel window to get offers executed. Did Comcast CEO Brian Roberts and the Comcast board reveal astute foresight once they introduced on October 31st that they’re considering a by-product of their cable networks? At a minimal, extra re-clustering may happen (the New York metropolitan space, together with Connecticut, may gain advantage, in addition to the Washington DC and SoCal markets). This brings Cox and Altice into the equation. If Altice is in play, the long-awaited Mediacom/ Suddenlink deal may lastly recover from the wall, making a rural-focused cable system that may be an efficient competitor to mounted wi-fi.

- The NTIA will change, and most of the NTIA pointers that chased away would-be Broadband Fairness Entry and Deployment (BEAD) bidders might be loosened. That is good for competitors, serving to firms like Constitution, who’re already bringing broadband to many rural areas due to their Rural Digital Alternative Fund grants, develop their footprints with extra wise guidelines. Extra on how this can change within the dialogue of Senator Thune’s election as Senate Majority Chief beneath.

- Scrutiny over web neutrality will lower, however governmental editorial investigations beneath the guise of “censorship” will improve. As gigabit speeds to the house improve, the federal government’s focus will shift from blocking or prioritizing packets to evaluating algorithms. Whereas we aren’t positive if octogenarian Senators may even perceive how these algorithms work, this won’t cease them from pontificating on the place Google or Meta are at fault. Part 230 of the 1996 Telecom Act (that reduces authorized legal responsibility to social media firms on account of revealed content material) will seemingly get revised – how a lot relies on the potential influence to President-elect Trump’s Reality Social enterprise.

There are various extra implications (China coverage, CHIPS Act revisions, Division of Authorities Effectivity potential actions, and so on.) for different Briefs. Backside line: M&A will get a lifeline, as does BEAD competitors. Every little thing else relies on the Congressional urge for food for change, which seems for the time being to be nice, however would possibly wane as 2025 approaches.

Senator Thune turns into majority chief

Final Wednesday, Senate Republicans chosen South Dakota Senator John Thune as their subsequent majority chief. We view his election as a optimistic for rural broadband deployment (a duplicate of his June 2022 feedback on rural broadband is right here). One of many alternatives that the Senate may deal with is streamlining the broadband mortgage/ grant course of. With the rise of state broadband places of work, we predict the time is correct for reengineering and consolidating federal applications. Given the entire mapping evaluation and related planning underway for BEAD, the states are finest suited to meet broadband targets.

This theme additionally applies to matters like Davis-Bacon (labor price) administration and compliance, low-cost broadband necessities (together with pricing), and environmental mandates. The Senate ought to strongly encourage the Division of Commerce (the place the NTIA is housed) to make clear every rule – shortly. Higher flexibility will improve the variety of bidders and decrease prices to realize every state’s broadband objectives.

This flexibility ought to embody the power to fund/ subsidize wi-fi options when options are pricey (and arm-twisting efforts have failed). Maine lately introduced the Working Web ASAP program which can present Starlink terminals to as many as 9,000 houses and companies (CNET article right here). At present retail charges, this might whole a $2.7 million upfront funding, a fraction of the price of FTTH. Discovering options for the final 2-5% of houses which have terribly excessive various value tags needs to be inspired, and the method to meet targets needs to be reengineered and streamlined.

Who’s bought momentum (Half 2)

In Half 1 (hyperlink right here), we started our earnings evaluation with a broad overview of the state of the trade. Somewhat than rehash that part, we are going to add some particulars that can assist make the case for our choice because the momentum chief within the wireline/ broadband trade.

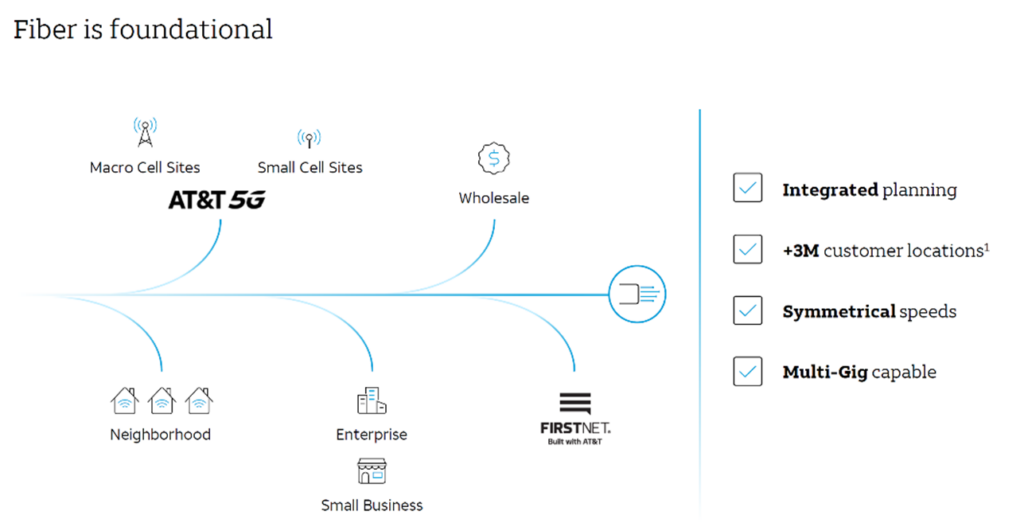

Behind all residential or business broadband deployments (wi-fi or wireline) is a fiber-based structure. Behind that structure is a forecast, in addition to a eager understanding of community development step perform prices (e.g., what’s the price of dropping in a second, empty conduit alongside sure routes to have capability for development).

Most fiber/ bandwidth suppliers are keenly eager about offering bandwidth to all clients alongside the route (see image from AT&T’s 2021 Investor Day close by). In some instances, they might even work with a 3rd supplier who has higher community monitoring or safety capabilities to serve main enterprises or wi-fi carriers. Extra customers of the identical fiber de-risk the capital funding and enhance discounted money stream paybacks.

As soon as a wi-fi service has both a) self-provided fiber; b) third-party leased fiber; or c) a long-term bandwidth circuit settlement that will or could not flip to a darkish fiber lease, they will plan for tower/ cell website development. This might embody mounted wi-fi companies for residential or enterprise clients. Within the case of some rural cities, mounted wi-fi is usually probably the most cost-effective resolution.

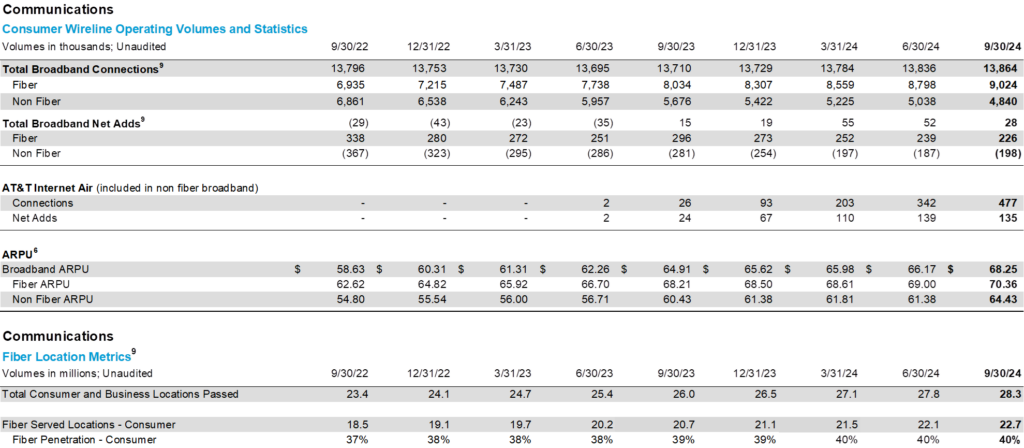

This setup leads us to our wireline/ broadband winner – AT&T. Right here is their most up-to-date client fiber pattern schedule (earnings package deal right here):

AT&T ended the quarter with roughly 9 million client fiber clients, up barely lower than one million from the third quarter of 2023 and up greater than 2 million from the third quarter of 2022. The corporate is now including 600K new passings per quarter in 2024, up from 400-500K in 2023. At this tempo, they may attain their 30 million goal in 2Q 2025, six months forward of their objective.

When AT&T provides passings, they’re shortly reaching the 40% hurdle. That is attributable to their bundling low cost provided to present wi-fi clients, in addition to a “full transfer to AT&T” bundle marketed to present un/ under-satisfied broadband clients. AT&T, at the very least for now, seems to be centered on ensuring new fiber deployments obtain the 40% threshold reasonably than going again to push the case to 45 or 50% (we anticipate that the financial equation to do this will are available in 2025, nonetheless).

Not like their cable counterparts, AT&T shouldn’t be deeply discounting their fiber service to draw new clients. They’ve shortly tapped into a worth combine that has allowed them to develop common month-to-month fiber income per family to $70.36. Our gross margin estimate is 90% on every fiber connection (offered it was put in accurately) because of the decrease upkeep prices on the brand new plant. We predict that the corporate might be articulating these and additional insights at their December 3rd analyst day in Dallas.

Labor prices related to putting in new fiber proceed to rise, however many of the supplies price will increase have peaked from post-COVID highs. As well as, AT&T can now make extra assured assumptions about mounted wi-fi (Web Air) penetration to the area surrounding the fibered city. As we now have talked about in earlier Briefs, we imagine that AT&T was stunned on the demand for Web Air from enterprise clients, and that the standard of the connection has led a lot of them to place 50% or extra of their whole site visitors by means of the wi-fi connection (for extra particulars on yield and prices, see their pricing right here). We predict an $80/ month price with the primary 250 GB at the next precedence is nice for now, however that the product might want to develop to incorporate 500 GB and better tiers (and we predict that enterprise clients will readily pay for these connections).

This leaves AT&T with a single, new fiber-fed structure that’s simple to keep up and extremely worthwhile to clients. Due to their divestiture of DirecTV, they will present a number of streaming choices to clients, a few of which could embody reside/ native broadcasts. Clients obtain bundled reductions and, with extra penetration, wi-fi scale improves.

To enhance their returns, AT&T has to return to the already cash-flowing neighborhood (40% usually considered on the degree that can produce wholesome money flows for fiber suppliers) and entice extra clients. Like wi-fi deployments, this “densification” course of is lots cheaper and simpler to implement than the preliminary “protection” development.

Better of all, AT&T shouldn’t be distracted by merger approvals (and related concessions to sure states like New York and California) and fearful about synergy achievement. They should concentrate on wi-fi and broadband saturation of the roughly 30 million extra houses of their footprint (we’re assuming that 18-25 million are already served by cable, and that considerably all of those are served by Starlink). That’s a neater dialog to have with states as they’re dispersing BEAD monies (cf: Texas and California characterize $5.2 billion of the whole $42.5 billion in allocations, and eight of the highest 9 states receiving BEAD monies are in conventional AT&T territories).

We predict AT&T has the clearest path to reaching excessive returns with their present fiber deployments and anticipate that at the very least 10 million extra houses handed might be introduced in December. The corporate can be sensible to droop any dividend will increase and focus any more money flows on densification. We additionally reiterate our expectation that AT&T will take full benefit of the diaspora occurring from North to South, and East to West (our earlier Temporary on that subject is right here).

Backside line: It’s exhausting to see how AT&T can screw it up with John Stankey on the helm and Jeff McElfresh because the COO. Something is feasible, however we see decrease execution danger with AT&T’s plan than with Verizon or cable. If solely AT&T may go sooner…

That’s it for this week. Solely an interim (on-line) Temporary over the Thanksgiving weekend, after which we dig deep into macro traits impacting the trade as we exit 2024. Till then, in case you have associates who want to be on the e-mail distribution, please have them ship an e mail to [email protected] and we are going to embody them on the record (or they will enroll straight by means of the web site).

Lastly – go Davidson Faculty Basketball and Kansas Metropolis Chiefs!

Vital disclosure: The opinions expressed in The Sunday Temporary are these of Jim Patterson and Patterson Advisory Group, LLC, and don’t replicate these of CellSite Options, LLC, or Fort Level Capital.