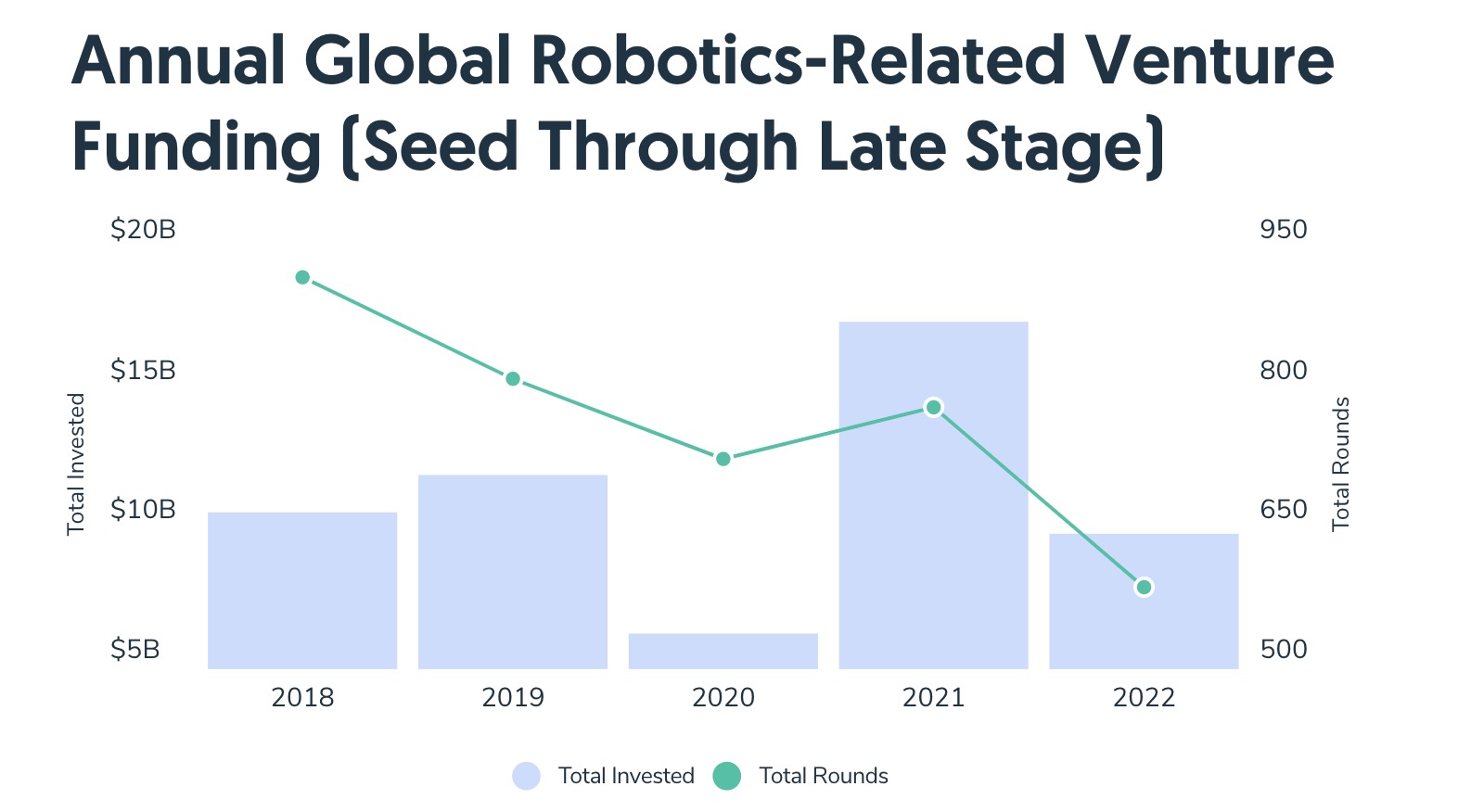

There was a short, lovely second for a couple of months in 2021 when it felt like robotic investments may be immune from broader market forces. All of us essentially and implicitly understood this to not be the case, but it surely was a pleasant second nonetheless.

Reality is, there was a little bit of insulation in there. There was nonetheless sufficient ahead momentum to maintain cruising for a bit, at the same time as headwinds grew. However the whole lot comes all the way down to Earth finally. Now that we’re roughly a month into 2023, we will start assessing the injury. Taking a look at these graphs collated by Crunchbase, issues appears pretty stark.

Picture Credit: Crunchbase

A few high line factors:

- 2022 was the second worst yr for robotics investments over the previous 5 years.

- The figures have been on a reasonably regular decline for the previous 5 quarters.

Per the primary level, 2020 was the bottom. It was additionally an anomaly, what with the worldwide pandemic. Uncertainty doesn’t breed investing confidence. The complete yr determine is much more placing given how investor confidence prolonged into early final yr. Issues actually began slowing down in Q2. A cursory take a look at the bar graph may counsel that 2021 is an anomaly. Sure and no. Sure, so far as acceleration. No, so far as the lengthy view. The query just isn’t if these bars will begin rising yr over yr, however when.

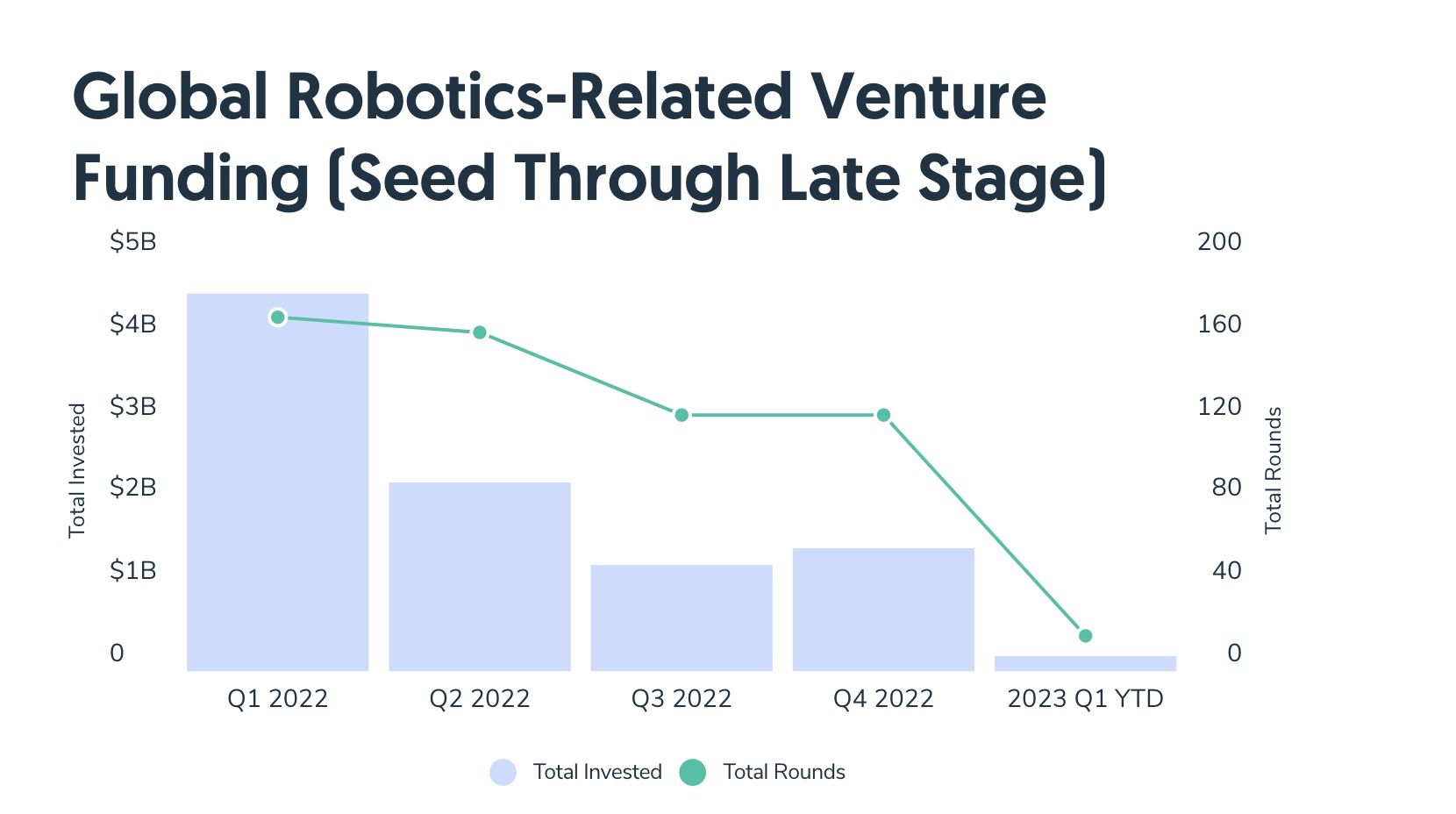

Picture Credit: Crunchbase

The identical factor that stalled investments in 2020 accelerated them the next yr. Whilst issues reopened, jobs have been more and more tough to fill and corporations throughout the board have been in a determined push to automate. As good because it may be, we’re not able to classify automation and robotics as “recession-proof” simply but. I do, nevertheless, suspect that those that management the purse strings essentially perceive that these downward tendencies are extra a product of the macroenvironment than something particular to robotics.

For some early-stage startups, nevertheless, that’s chilly consolation. Lots of runways shortened dramatically this yr. Comfort may come someplace down the highway, however in a whole lot of instances decisive motion must be taken for individuals who all of the sudden discover themselves unable to shut a spherical that may have felt like a foregone conclusion 12 months in the past.

Given the selection between getting acquired and shutting down that some will inevitably face, it appears probably that M&A exercise will spike. Positive there’s much less cash floating round, however few can flip down a great fireplace sale. In some instances, that can go a methods towards strengthening merchandise and portfolios.

Anecdotally, I’m seeing investments ramp up for the yr, however that seems a part of the pure cycle of corporations ready till after the vacations to announce. A correct bounce again, alternatively, appears inevitable, however solely these with high-powered crystal balls can say exactly when.