EduFi, a fintech startup that allows financially strapped college students to safe loans for his or her schooling, has raised $6.1 million in a pre-seed spherical led by Zayn VC with participation from Palm Drive Capital, Deem Ventures, Q Enterprise and angel buyers.

The Singapore-based startup has launched a synthetic intelligence-powered research now, pay later (SNPL) lending platform and its cellular app in Pakistan, a rustic that doesn’t have pupil mortgage merchandise as a class; as an alternative, customers take private loans with excessive curiosity and prolonged course of, Aleena Nadeem, founder and CEO of EduFi, instructed TechCrunch.

EduFi needs to handle the nation’s two points — excessive poverty ranges and low literacy charges — by way of its fintech platform. In Pakistan, about 40% of scholars attend non-public colleges as a consequence of public colleges’ poor high quality, leading to spending greater than $14 billion on their schooling yearly. Furthermore, over 50% of the grownup inhabitants in Pakistan doesn’t have entry to monetary companies comparable to financial institution accounts and insurance coverage.

Nadeem, an MIT graduate who beforehand labored at Goldman Sachs and Ventura Capital, had seen first-hand many kids battle with monetary obstacles to get a top quality schooling whereas working at Progressive Training Community (PEN) in Pakistan. PEN is a nonprofit group that offers free and high quality schooling to kids who can’t afford it.

“Many kids in Pakistan make it to highschool, however there’s a sharp drop in those that are in a position to obtain a better faculty schooling,” Nadeem mentioned. “This drop is the place EduFi is attempting to inject capital into the hole between highschool commencement and first-year college admission.”

The 2-year-old firm has already had partnerships with 15 universities, permitting the app to be out there to about 200,000 college students who should pay their charges for undergrad, Grasp’s and PhD throughout Pakistan.

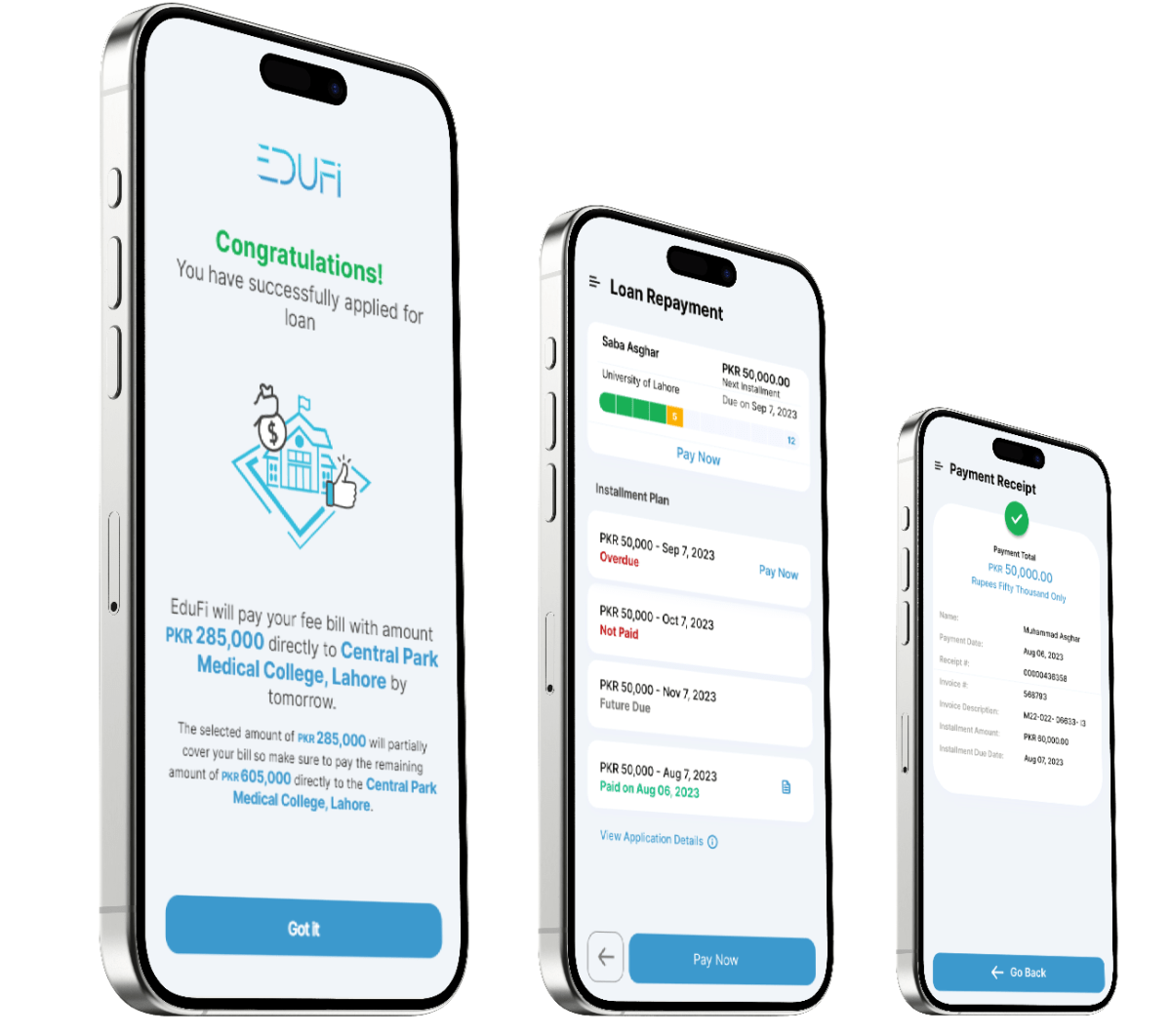

When a pupil (or a mother or father) applies for loans by way of the app, EduFi requires the applicant’s (pupil or mother or father) monetary standing. For instance, the earlier 12 months’ financial institution statements or a supply of revenue that may assist their mortgage repayments, comparable to a salaried job, a small enterprise, or freelance work. As soon as a pupil mortgage facility is accredited, EduFi sends the cash on to the faculty’s financial institution.

Throughout its beta section for the final 18 months, EduFi examined its credit score mannequin in opposition to 80,000 client finance loans banks had made. The startup claims that its credit score scoring system permits for the dispersal of pupil loans inside 48 hours of software and the fast disbursal of the mortgage. EduFi, which has obtained approval for a license to make loans from the Securities and Alternate Fee Pakistan (SECP), is ready for the license to be granted, which is predicted in November. Nadeem mentioned it’s at the moment validating its product and repair with potential clients and accumulating suggestions and information to enhance its service.

The corporate says it upended the standard financial institution strategy, which entails high-interest charges and an advanced software course of, in addition to takes not less than three to 4 weeks to approve. EduFi’s digital lending app gives customers a handy, simple course of and versatile mortgage phrases and circumstances.

“Training gives hope and may change the lives of individuals. I’m one instance of tens of millions on the market. EduFi gives this hope and will likely be a set off for change within the lives of individuals as we raise one of many largest burdens on aspiring households,” Nadeem mentioned. “For instance, college students in dental or medical colleges must pay upwards of $8,000 upfront, which isn’t sustainable for a lot of in Pakistan. Each pupil we’ve helped is a testomony to the ambition, alternative and empowerment we’re striving for at EduFi.”

The corporate will use the pre-seed capital to achieve extra clients, optimize its platform, broaden to neighboring international locations and launch different fintech merchandise, together with pupil bank cards.

“It is a important step in the direction of attaining monetary inclusion for center and low-income households. In Pakistan, households spend greater than 50% of their revenue on their kids’s schooling, which has grow to be more and more difficult as a consequence of inflationary pressures. EduFi’s revolutionary strategy will assist alleviate this burden and empower households to put money into their kids’s future,” Faisal Aftab, basic accomplice and founder at Zayn VC, mentioned in an announcement.