U.S. mortgage lender loanDepot has suffered a cyberattack that brought on the corporate to take IT techniques offline, stopping on-line funds towards loans.

loanDepot is without doubt one of the largest nonbank retail mortgage lenders within the USA, using roughly 6,000 folks and servicing loans of over $140 billion.

Yesterday, clients started experiencing points when making an attempt to log in to the corporate’s cost portal to pay loans or contact them by cellphone.

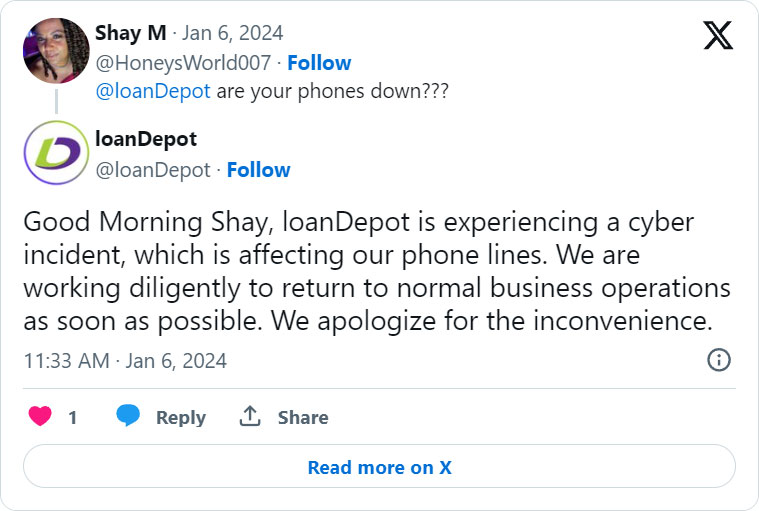

Some clients took to X to seek out out what was responsible for the outages, and loanDepot responded that they had been struggling a cyber incident.

“loanDepot is experiencing a cyber incident, which is affecting our cellphone traces. We’re working diligently to return to regular enterprise operations as quickly as attainable. We apologize for the inconvenience,” the corporate said on X.

After contacting loanDepot concerning the cyber incident, the corporate confirmed they suffered a cyber assault and are working with regulation enforcement and forensics specialists to research the incident.

“loanDepot is experiencing a cyber incident. We’ve got taken sure techniques offline and are working diligently to revive regular enterprise operations as rapidly as attainable.

“We’re working rapidly to grasp the extent of the incident and taking steps to attenuate its affect.

“The Firm has retained main forensics specialists to help in our investigation and is working with regulation enforcement.We sincerely apologize for any impacts to our clients and we’re targeted on resolving these issues as quickly as attainable.”

Do you might have details about the assault on loanDepot or one other cyberattack? If you wish to share the knowledge, you may contact us securely and confidentially on Sign at +1 (646) 961-3731, through e mail at lawrence.abrams@bleepingcomputer.com, or by utilizing our ideas type.

At the moment, loanDepot’s social media responses concerning the cyberattack have disappeared from X, however an identical message nonetheless seems when trying to log in to the corporate’s servicing portal.

This message additionally states that recurring automated funds will proceed to be processed, however there might be a delay in it showing within the cost historical past.

Nevertheless, utilizing the servicing portal to make a brand new cost won’t be attainable, and clients ought to as a substitute contact the corporate’s name middle.

“In case you are in search of to make a cost, it’s possible you’ll achieve this by our contact middle by talking with an agent at 866-258-6572 from 7 am CT to 7 pm CT Monday by Friday, and eight am CT to five pm CT on Saturday,” advises loanDepot’s servicing portal.

Presently, it’s not recognized what sort of assault the corporate is responding to, however it’s possible a ransomware assault.

If it was ransomware, the menace actors would have stolen company and buyer information throughout the assault, which they might use as leverage to scare the corporate into paying a ransom.

As loanDepot holds delicate details about its clients, resembling monetary and checking account data, clients must be looking out for potential phishing assaults and id theft.

In Could, loanDepot disclosed a knowledge breach ensuing from a cyberattack in August 2022 that uncovered buyer information.

Mortgage lending large Mr. Cooper additionally just lately suffered a cyberattack in November 2023.

A month later, Mr. Cooper disclosed a knowledge breach, confirming the assault uncovered the non-public information of 14.7 million clients.