Generally, when operating a web-based retailer, you make a sale however later obtain a fee dispute discover. These often occur weeks – and even months – after the preliminary transaction. Now you’ve bought administrative work to maintain, the chance of shedding the income from the sale, and fewer time to concentrate on operating your online business.

Whereas that is often an rare occasion, if it occurs regularly, necessary companions like bank card corporations might begin to levy fines, impose stricter guidelines, or lower ties with your online business.

The excellent news is {that a} proactive plan to forestall disputes and handle them once they do happen will maintain your retailer clear from complications. Even higher information? You’ll be able to study the whole lot you want to know on this article.

What are chargebacks or disputes?

A fee dispute occurs anytime a cardholder contacts their bank card firm to contest a cost on their invoice. Bank card corporations take these complaints critically, and in the event that they decide that the explanation for the dispute is legitimate, they’ll present a provisional credit score to the shopper’s account whereas the dispute is resolved. That is also called a chargeback.

Why do chargebacks and disputes occur?

There are two major causes of fee disputes:

- Dissatisfied clients

- Fraudulent card exercise

We’ll dive deeper into each a bit later.

At first look, you’ll suppose you’d have rather more management over the primary one than the second. The reality is, you’ve gotten some management over each, as you’re about to see.

Why retailers want to reply to disputes

Fee disputes aren’t one thing you’ll be able to simply ignore and hope they go away. They received’t. Ignoring them will simply trigger issues to escalate that may impression the long-term viability of your retailer.

Card networks monitor your dispute charge (the ratio of confirmed transactions to disputed ones) and should cost increased charges or subject penalties if yours is unfavorable.

What to do once you obtain a fee dispute

Right here’s what to do once you obtain a fee dispute discover:

Reply instantly

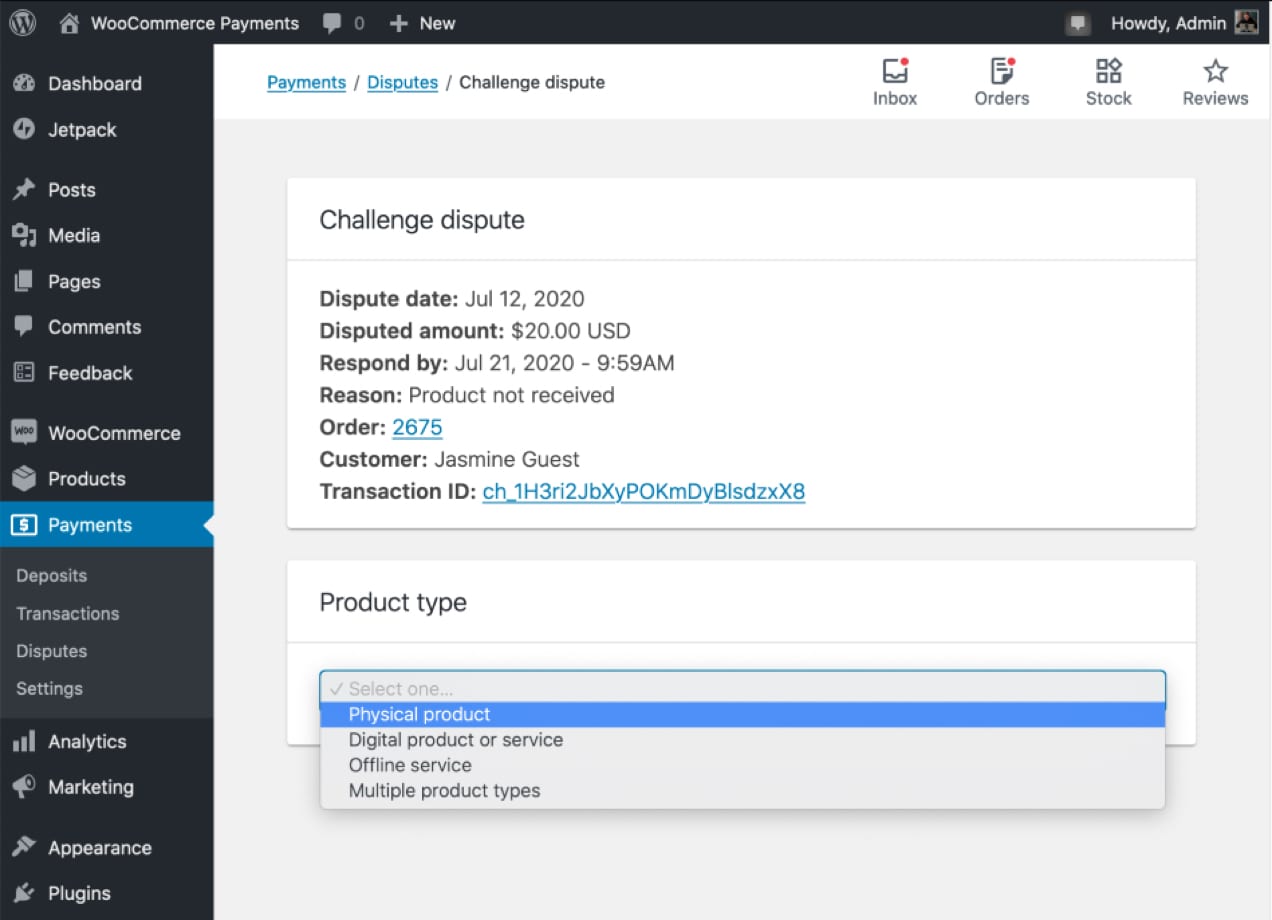

If the cardboard community begins with an inquiry, you need to reply instantly. For those who use WooCommerce Funds, you’ll be notified of any disputes through e mail and an inbox notification in your dashboard.

An absence of response inside a reasonably brief period of time leads them to presume you’re not planning to contest the dispute. Every card community has their very own timeframe for a way lengthy a dispute inquiry stays open, however you’ll wish to fastidiously collect proof whereas submitting mentioned proof earlier than the timeframe expires.

For those who’re utilizing WooCommerce Funds, you’ll be able to simply log into your retailer’s dashboard to reply to the dispute.

Present documentation

Subsequent, present clear and compelling proof in regards to the transaction in query. This could embody the bank card quantity (or the truncated model), the date and quantity of the transaction, and any order particulars or proof of supply you’ve gotten on file.

This data permits them to rule out the opportunity of fraud, and ensures that everybody has the identical understanding of the scenario.

Submit requested proof

Along with the essential documentation, the cardboard community could ask for extra data relating to the transaction. And even when they don’t, you need to ship it anyway. Taking the time to assemble all the requested documentation is time effectively spent, however be sure to’ve gathered and submitted the whole lot earlier than the deadline.

The kind of proof you ship will depend upon the kind of fee dispute you’re going through. There are at the least seven kinds of fee disputes:

- Refund wasn’t processed

- A number of prices

- Fraudulent prices

- Unrecognized prices

- Product not obtained

- Product unacceptable

- Subscription canceled

As you’ll be able to see, the proof required to contest every of those will likely be completely different. See this text for particulars on the kind of proof you’ll want in every of those conditions. Whatever the scenario, we strongly advocate that retailers reply to every dispute with as a lot details about the transaction as potential.

What occurs for those who don’t reply to chargebacks?

Chargebacks may appear intimidating or tough to take care of. Nevertheless, it’s an necessary a part of operating a retailer and following some easy steps can prevent lots of stress. Bank card corporations nonetheless need you to achieve success whereas defending their customers, so work inside the course of to take care of a strong status.

For those who select to completely ignore chargebacks, nevertheless, issues can turn into tough. Right here’s the development of ignored or unchecked chargebacks:

First, you lose the revenue and the income from the sale and must pay a charge on high of that loss.

After that, in case your disputes begin to accumulate and also you don’t maintain them underneath management, your card community might levy extra fines and better charges till you deliver your chargeback charge down. If the issue persists, you could be restricted from accessing parts of your gross sales income. Lastly, they’ll ultimately stop permitting you to simply accept funds, and mark your account as excessive threat.

This might maintain different card networks from desirous to do enterprise with you. And for those who can’t settle for funds on-line, you’ll be able to’t actually run your online business.

This, after all, is an excessive case. It’s completely preventable for those who take the fitting steps.

What’s a dispute threshold?

The dispute threshold, or chargeback threshold, is what card networks use to assist them resolve when to extend monitoring and penalties on a service provider or enterprise to get them to cut back their dispute charge.

What’s a dispute charge?

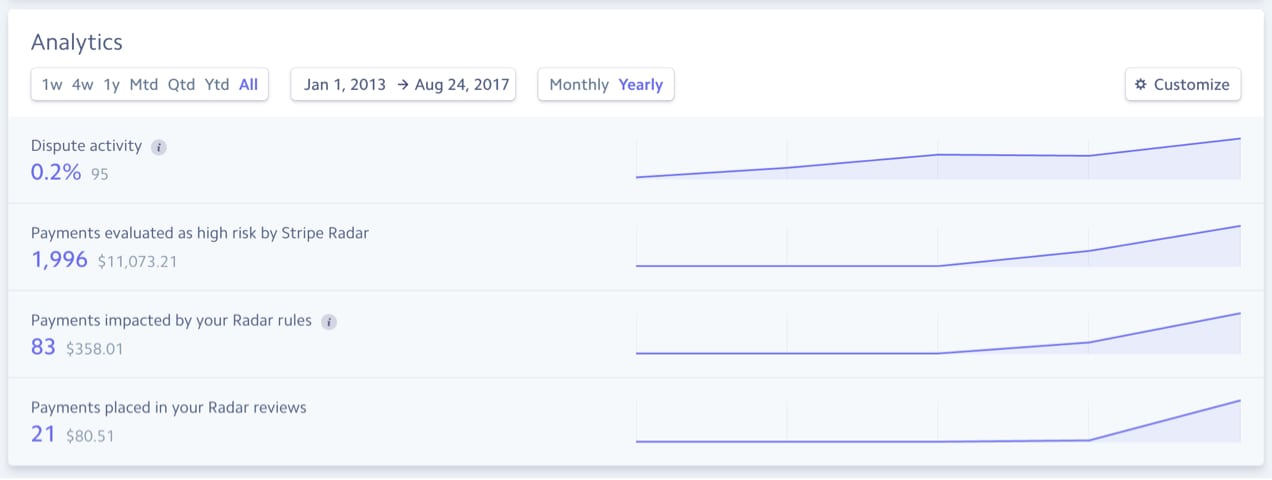

The ‘dispute charge’ measures the variety of disputes per whole processed transactions in a given time interval, corresponding to one week. So, for those who had 500 funds processed in every week and 5 of these bought disputed, you’ll have a 1% dispute charge for that week.

That is distinct from ‘dispute exercise,’ which measures the % of disputes in a given time interval, no matter processing date.

The distinction is that some disputes don’t occur till weeks or months after the acquisition. That is what dispute exercise incorporates. You may get 5 disputes in a single week, but when three of these relate to purchases made previous to that week, then your dispute charge would solely embody the 2 from that week, however your dispute exercise would come with all 5. Right here is extra from Stripe on measuring disputes.

Bank card networks usually use dispute exercise for his or her dispute thresholds. And once more, every card community has its personal threshold. The brink might be based mostly on dispute exercise, dispute quantity, or extra generally, each.

For example, Visa will improve their penalties in opposition to a enterprise with at the least 100 chargebacks in a month and 0.9% dispute exercise. However Mastercard’s dispute threshold begins at 1.5%.

The quantity quantity is useful for small companies, as a result of for those who solely obtain 50 funds in a given month, and simply one in every of them will get disputed, you’re already at a 2% charge. So the amount threshold retains smaller companies away from the upper penalties.

For those who’re utilizing WooCommerce Funds and have questions on find out how to greatest deal with disputes, you’ll be able to all the time attain out to the WooCommerce assist group for help.

How can I scale back my on-line retailer’s dispute charge?

Now that you simply perceive how disputes work, listed here are some methods to assist scale back your dispute charge.

You’ll be able to study extra about a few of these right here.

1. Use a transparent financial institution assertion descriptor

That is the brief phrase that seems on bank card statements for every buy. Ideally, it ought to say your organization’s title, state/area/province, and even perhaps embody a telephone quantity. Descriptors are restricted to a most of twenty-two characters, so that you’ll must be inventive and punctiliously select what will likely be most recognizable to your clients. Why?

A transparent assertion descriptor informs your patrons of the place they bought an merchandise. It might instantly scale back disputes brought on by unrecognized prices. They’ll see your data and do not forget that, sure, it’s a official buy they supposed to make.

And if a buyer sees this on their assertion and wonders in regards to the cost, they could name you straight relatively than file a dispute with their bank card firm, and you may resolve it with them.

2. Put firm data on transaction receipts

For a similar motive because the financial institution descriptor, giving the shopper easy-to-read, correct firm data on their receipt will increase the possibility that they’ll name you if there’s an issue, relatively than their bank card firm.

Embrace your organization title, location, contact data, web site, emblem, and a message about customer support. And ensure this doesn’t intrude with the transaction particulars on the receipt.

3. Reply to buyer complaints promptly and search for options

Keep in mind, there are at the least seven causes of chargebacks. A number of will be resolved earlier than reaching the dispute stage just by offering good customer support.

If a buyer complains a few product, its high quality, injury throughout supply, or different elements, take heed to them and work with them to resolve the issue and keep away from a chargeback.

4. Provoke contact earlier than fulfilling suspicious orders

That is one in every of your greatest instruments to make use of in opposition to fraud. As a savvy enterprise proprietor, it’s necessary to evaluation your orders for any indication of fraud or threat.

WooCommerce Funds features a threat degree column in your dashboard. It grades each transaction for fraud threat. For those who see a transaction with any label apart from ‘regular,’ don’t fulfill the order earlier than calling the cardholder to see in the event that they actually made this buy.

For those who obtain no response, particularly with repeated makes an attempt, or if the telephone quantity seems to be invalid, take into account refunding the order with out delivery it.

Most different fee processors provide some form of fraud detection metric, however they’re not all the time as straightforward to make use of. With WooCommerce Funds, it’s proper there subsequent to every transaction. There’s no want to sit down on maintain along with your bank card firm for half the day.

5. Get proof of supply

Every time potential, it is a strong piece of proof you should use in instances the place a buyer claims the order by no means arrived. Examples embody, cargo monitoring particulars, requiring a signature upon supply, taking a photograph of the ultimate delivered merchandise, and so on…

6. Clearly state insurance policies

Your insurance policies about refunds, returns, and cancellations matter to your clients. Put these in your invoices or receipts. Characteristic them on key web site pages, corresponding to your checkout web page. Embrace them on retailer shows. It’s even higher if you may get the cardholder to signal or acknowledge that they comply with your phrases.

7. Use correct product descriptions

Product descriptions have to match the product. When a cardholder receives one thing that appears completely different from what they thought they ordered, they could contest the cost as a result of they’ll assume you despatched them the flawed product.

Particulars matter. Don’t skimp.

8. Take away discontinued or out-of-stock gadgets

Take away gadgets out of your on-line retailer which might be not accessible so clients can’t order one thing they received’t obtain. You may take into account doing the identical for gadgets out of inventory, until you’ll be able to simply and precisely embody an ‘out of inventory’ graphic on the related product pages, and sustain with it because the standing adjustments.

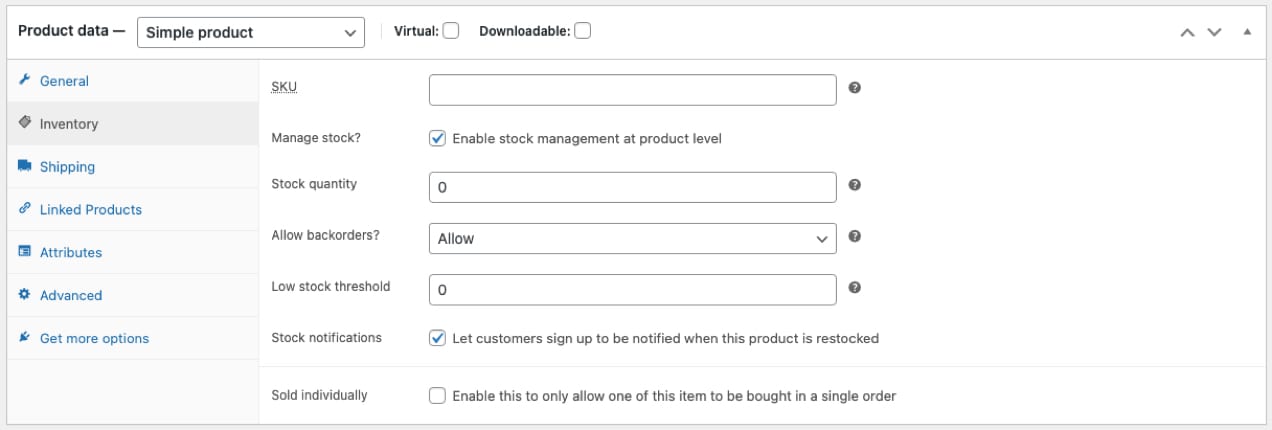

That is executed routinely for those who reap the benefits of the built-in stock administration on WooCommerce. You’ll be able to select to enable backorders or cease gross sales of out of inventory gadgets. Most retailers will wish to toggle settings to, “Don’t enable,” or “Permit, however notify buyer.”

9. Be cautious with worldwide orders

Sure kinds of fraud are an unlucky actuality nowadays, and orders from some areas could pose a better threat. It helps to decide on a fee answer that features fraud detection to assist mitigate this threat, corresponding to WooCommerce Funds.

10. Acquire as a lot buyer data as potential

Not each enterprise wants to gather delivery data, however get it anyway. This helps confirm {that a} cardholder is who they declare to be.

For each transaction, you need the next data:

- Buyer title

- Buyer e mail

- CVC quantity on their bank card

- Full billing deal with and postcode

- Delivery deal with, if completely different from billing

11. Ship cargo monitoring data

Be immediate with this. After a buyer orders, they need to obtain an e mail with monitoring data as quickly as potential. After that, they need to get periodic updates. This serves as extra proof if a buyer claims the product by no means arrived.

Strengthen your defenses in opposition to fraudulent prices

Need to enhance your fraud threat detection? That’s only one advantage of utilizing WooCommerce Funds, which helps on-line companies settle for funds, protect their status, and maximize earnings.