Julian Robertson’s hedge fund buyers didn’t wish to take heed to him when, in 1999, he questioned the sanity of the costs being paid for shares in nascent web firms. So months after being berated for quarter-hour at an annual shareholders assembly on the Plaza Resort in New York in October 1999, he started the method of closing up his store. “There isn’t any level in subjecting our buyers to threat in a market which I frankly don’t perceive,” Robertson reportedly wrote to them in March of 2000. “After thorough consideration, I’ve determined to return all capital to our buyers, successfully bringing down the curtain on the Tiger funds.”

In April 2000, the tech market started to implode.

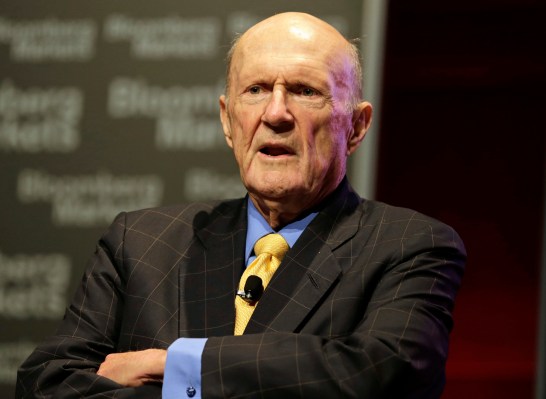

His good timing solely cemented the legend of Robertson, who simply handed away at age 90 of cardiac problems, based on his spokesman, however who, till he was 67, led Tiger Administration, one of many best-known funds within the 70-year-old hedge fund trade.

One needn’t look far to understand his lasting affect. Whereas Tiger Administration reportedly boasted common annual positive factors of greater than 25% for the 20 years it was up and operating, the extensive spate of funding managers who lower their enamel as a part of Robertson’s 200-person group has grow to be practically as legendary. Among the many many hedge funds run by individuals who labored with Robertson — they’re famously referred to as “Tiger Cubs” — are Tiger International, Lone Pine, Coatue Administration, Viking International, D1 Capital and Pantera Capital, and that’s only a sampling.

“In a bizarre manner, Julian Robertson touches trillions of {dollars} of belongings below administration as a result of there are such a lot of individuals who labored for him instantly [or] not directly,” Daniel Strachman, writer of Julian Robertson: A Tiger within the Land of Bulls and Bears, informed the Monetary Instances final yr.

Unsurprisingly, Robertson’s mentees communicate glowingly of him, as an investor, in addition to a philanthropist. Along with Robertson’s personal household basis and Tiger Basis, a nonprofit that claims it has offered greater than $250 million in grants to organizations working to interrupt the cycle of poverty in New York Metropolis, Robertson in 2017 signed the Giving Pledge, which asks members to present at the least half of their wealth away.

A kind of appreciative protégés is Coatue founder Philippe Laffont, who spent three years working for Robertson earlier than placing out on his personal in 1999 with a reported $45 million and who, in contrast to Robertson, had a penchant for tech firms. (Laffont misplaced cash on the downturn the next yr, however navigated his manner via it.)

Coatue — a crossover fund named after a seashore off the coast of Nantucket — has gotten squeezed once more this yr by the downturn in each private and non-private tech shares. Nonetheless, Coatue grew its belongings below administration to almost $60 billion by the tip of final yr, and Laffont credit Robertson for a few of that success.

“Julian was a legendary investor and a beneficiant mentor,” stated Laffont in a press release despatched to TechCrunch this morning. “He did a lot good on the earth, and so typically when no person was trying. All of us really feel lonelier with out him right here. He leaves an exquisite legacy that so many people will proceed to hunt to stay as much as. I think about myself lucky to have had his friendship and mentorship in my life.”

One other of Robertson’s well-known mentees is Chase Coleman, who labored as an funding analyst at Tiger Administration for practically 4 years earlier than the hedge fund wound down. Coleman, who launched Tiger International Administration the next yr, in 2001, additionally credit Robertson for a lot of the profession he has loved.

In a press release despatched to TechCrunch earlier in the present day, Coleman writes: “Julian was a pioneer and a large in our trade, revered as a lot for his talents as an investor as for the integrity, honesty, loyalty and competitiveness he demonstrated as a pacesetter. He made the time to be a real mentor, all the time main by instance and pushing all of us to grow to be one of the best variations of ourselves. For that and for his friendship, I’m endlessly grateful. He will probably be dearly missed, however his affect on me and numerous others, in addition to the numerous communities he touched via his philanthropic efforts, will endure.”

Like Coatue, Tiger International is a crossover fund that has more and more invested in personal tech firms in addition to publicly traded ones. Like Coatue, it has additionally had a relatively powerful 2022, owing to the market’s breathtaking zigs and zags. (In equity, the identical is true of many outfits, together with Viking International, whose founder, Andreas Halvorsen, as soon as traded equities at Tiger Administration and, like Laffont, struck out on his personal, with Viking, in 1999. His flagship fund is on observe for its worst yr ever, Bloomberg reported final month.)

Certainly, it’s straightforward to surprise what Robertson — whose success was tied to purchasing underpriced shares with good earnings prospects — considered a few of the funding methods being employed in recent times. Particularly, one wonders what he might need product of sure cubs’ aggressive strikes into late-stage privately held tech firms, the place costs had been being pushed sky excessive, generally by the identical individuals who discovered from Robertson.

If Robertson did ever query their varied approaches, he by no means stated so publicly. Even when Archegos Capital Administration — the household workplace of one other protégé, Invoice Hwang — all of the sudden collapsed in spectacular trend final yr (Hwang was charged with huge fraud by the SEC in April), Robertson got here to Hwang’s protection in a uncommon interview with the FT, telling the outlet final summer time: “Invoice is an effective pal, and I do know Invoice effectively. I feel he made a mistake and I anticipate that he’s popping out of it and he’ll go proper on.”