As telecom analysts, my TeleGeography colleagues and I have been busy attending conferences and gathering market intelligence from most of the most distinguished telecom firms around the globe.

Lately, our travels took us to São Paulo and Mexico Metropolis for the Futurecom and Mexico Join 2022 conferences.

There’s quite a bit occurring in each the Brazilian and Mexican markets, so let’s recap among the dialogue themes that stood out.

IP Transit Is Nonetheless Low-cost

In keeping with TeleGeography’s World Web Geography database, Brazil and Mexico stay the highest two international locations in Latin America for worldwide web bandwidth.

Brazil and Mexico stay the highest two international locations in Latin America for worldwide web bandwidth.

In 2022, that meant over 38 Tbps of worldwide bandwidth for Brazil and greater than 26 Tbps for Mexico.

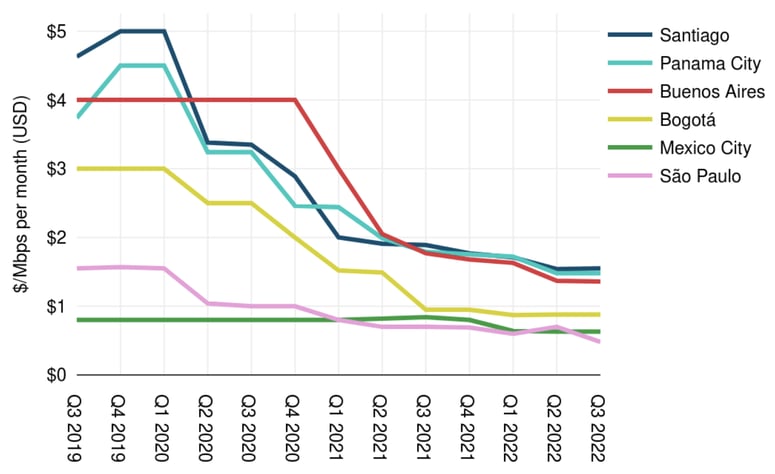

On the similar time, we see that IP transit costs in each international locations are among the many lowest within the area. That is largely as a consequence of elements like low transport prices and excessive competitors.

Our newest findings counsel that these costs will proceed to tumble.

Weighted Median 10 GigE IP Transit Costs in Latin America

Supply: TeleGeography

Our most up-to-date knowledge exhibits weighted median costs of $0.63 and $0.48, respectively, for a ten GigE port in Mexico Metropolis and São Paulo. And lots of transactions are occurring at even cheaper price factors in each markets.

Outdated Cable Programs Want Changing

Worldwide connectivity to Mexico is basically outlined by terrestrial routes between Mexico Metropolis and Dallas, however subsea cables additionally play an essential position.

The wave of latest cable tasks coming to Mexico was one of many important speaking factors at Mexico Join. That is notable as a result of two older methods—Maya-1, prepared for service (RFS) in 2000 and ARCOS, RFS 2001—have lengthy dominated the Cancún-Florida route.

Along with AMX-1, owned by incumbent América Móvil and put into operation in 2014, three new cable methods are on the way in which to japanese Mexico:

- GigNet-1: Scheduled to be RFS by the top of 2022, this technique would join Cancún to Boca Raton, Florida.

- Caribbean Specific: Scheduled to be RFS in 2025, this technique would join Cancún to Boca Raton, Florida with additional connectivity to Central and South America.

- Gold Knowledge-1: Scheduled to be RFS in 2025, this technique would join Veracruz and Cancún to Naples, Florida.

Service variety has traditionally been restricted on subsea routes between Cancún and america, however new cables may disrupt the market with elevated competitors and corresponding value erosion.

Connectivity to the U.S. Is Nonetheless Essential

Latest cable launches like that of Malbec in 2021 display that there’s urge for food for intra-regional connectivity in Latin America.

Nevertheless, necessities for capability to the U.S. proceed to dominate markets like Brazil. For carriers, this has grow to be obvious as demand from Brazilian ISPs for transport to the U.S. has grown.

That is additionally evident in our World Bandwidth Analysis Service the place we estimate that worldwide bandwidth to the U.S. has accounted for, on common, 84% of whole Latin American capability since 2017.

We estimate that worldwide bandwidth to the U.S. has accounted for, on common, 84% of whole Latin American capability since 2017.

Home Market Growth is on Individuals’s Minds

Worldwide bandwidth demand is steadily rising all through Latin America. In bigger markets like Brazil and Mexico, extra focus goes towards filling community gaps to higher join extra of the inhabitants to these worldwide routes.

A number of firms at each Futurecom and Mexico Join commented that areas with historically much less connectivity to the worldwide web—reminiscent of Amazonia—are actually seeing extra infrastructure funding. And terrestrial connectivity on routes like Mexico Metropolis (a dense metro space) to Querétaro (an information heart hub) have grow to be priorities because the telecom ecosystem swells in Mexico.