Financial institution and know-how platform Kapital continues to rake in enterprise capital, grabbing one other $40 million in Collection B {dollars} and $125 million in debt financing. Tribe Capital led the Collection B and was joined by backers, together with Cervin Ventures, Tru Arrow, MS&AD Ventures and Alumni Ventures.

This marks the second funding for the Mexico Metropolis–primarily based firm this 12 months. We beforehand lined Kapital’s $20 million Collection A in Could that included $45 million in debt.

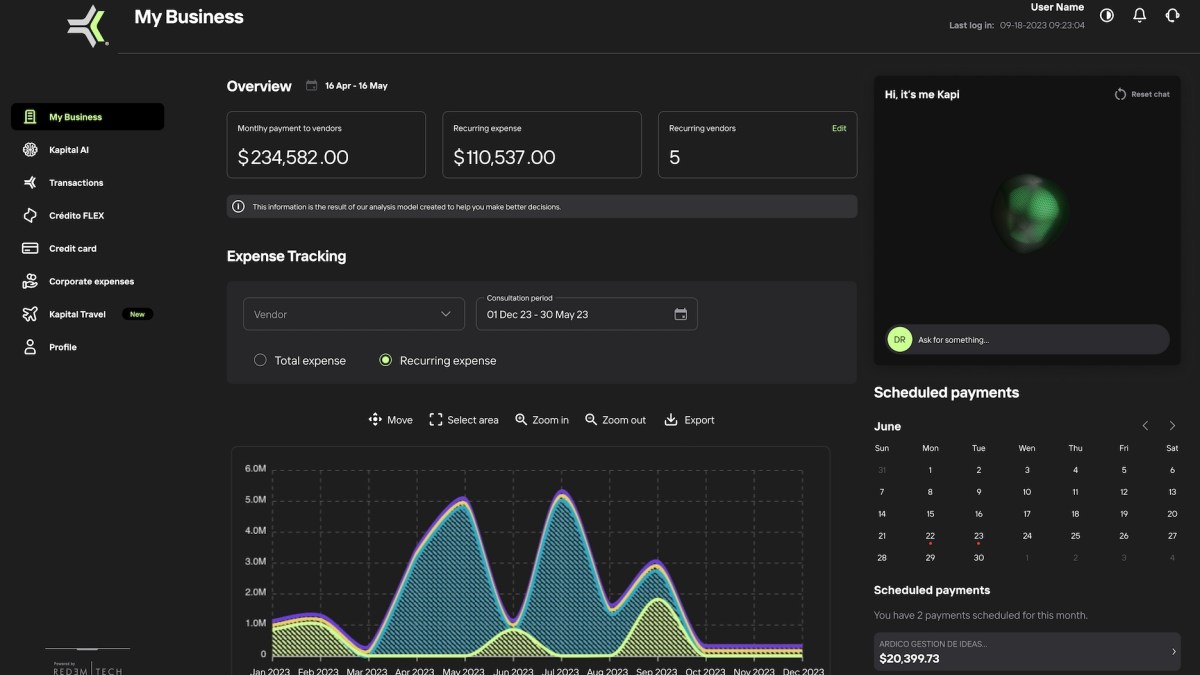

Rene Saul and Fernando Sandoval co-founded Kapital in 2020 to offer comparable monetary visibility to small companies, utilizing information and synthetic intelligence, that giant enterprises have. This allows clients to entry and handle their enterprise operations and money move in actual time. The corporate additionally makes use of AI to underwrite small enterprise loans.

“Small companies symbolize 90% of the world’s companies; nonetheless, in Mexico, solely 10.5% of these small companies have entry to complete financial institution credit score,” Saul mentioned. “That’s what we’re fixing — we give them visibility of their funds.”

In 2023, Kapital’s buyer base grew to 80,000 small companies in Mexico, Colombia and Peru. It additionally acquired Banco Autofin Mexico S.A. in September, which already had 65,000 clients, CEO Saul instructed TechCrunch. Kapital is worthwhile and grew income 6x prior to now 12 months.

Saul intends to deploy the brand new funding into R&D and know-how improvement, notably to bolster its cross-border providing and develop its product suite to offer insights for its clients. One of many areas Kapital wish to speed up is predictive analytics know-how in order that enterprise clients know how you can enhance margins by deciding on completely different distributors.

“Now we now have a financial institution and we are able to create embedded finance choices,” Saul mentioned. “We additionally management the funds and might hook up with every thing round clients seamlessly. Having operations in three completely different international locations in Latin America additionally means our clients can transfer the cash sooner. Our purpose is to construct a worldwide financial institution to ultimately join everyone on this planet.”