In the summertime of 2022, KrebsOnSecurity documented the plight of a number of readers who had their accounts at big-three shopper credit score reporting bureau Experian hijacked after identification thieves merely re-registered the accounts utilizing a special e-mail tackle. Sixteen months later, Experian clearly has not addressed this gaping lack of safety. I do know that as a result of my account at Experian was lately hacked, and the one manner I might get better entry was by recreating the account.

Coming into my SSN and birthday at Experian confirmed my identification was tied to an e-mail tackle I didn’t authorize.

I lately ordered a replica of my credit score file from Experian through annualcreditreport.com, however as typical Experian declined to supply it, saying they couldn’t confirm my identification. Makes an attempt to log in to my account instantly at Experian.com additionally failed; the location stated it didn’t acknowledge my username and/or password.

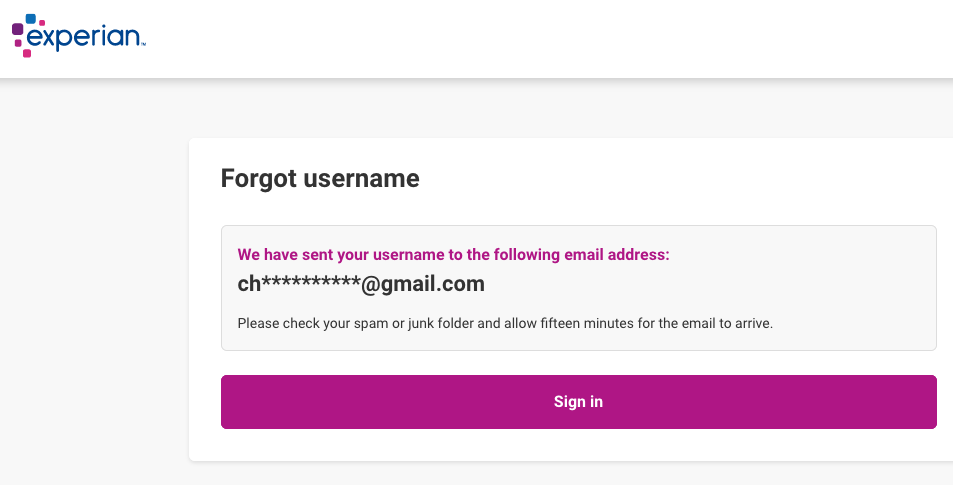

A request for my Experian account username required my full Social Safety quantity and date of delivery, after which the web site displayed parts of an e-mail tackle I by no means approved and didn’t acknowledge (the complete tackle was redacted by Experian).

I instantly suspected that Experian was nonetheless permitting anybody to recreate their credit score file account utilizing the identical private data however a special e-mail tackle, a serious authentication failure that was explored in final yr’s story, Experian, You Have Some Explaining to Do. So as soon as once more I sought to re-register as myself at Experian.

The homepage stated I wanted to supply a Social Safety quantity and cell phone quantity, and that I’d quickly obtain a hyperlink that I ought to click on to confirm myself. The positioning claims that the cellphone quantity you present will likely be used to assist validate your identification. However it seems you can provide any cellphone quantity in the USA at this stage within the course of, and Experian’s web site wouldn’t balk. Regardless, customers can merely skip this step by deciding on the choice to “Proceed one other manner.”

Experian then asks to your full identify, tackle, date of delivery, Social Safety quantity, e-mail tackle and chosen password. After that, they require you to efficiently reply between three to 5 multiple-choice safety questions whose solutions are fairly often primarily based on public data. Once I recreated my account this week, solely two of the 5 questions pertained to my actual data, and each of these questions involved road addresses we’ve beforehand lived at — data that’s only a Google search away.

Assuming you sail by means of the multiple-choice questions, you’re prompted to create a 4-digit PIN and supply a solution to certainly one of a number of pre-selected problem questions. After that, your new account is created and also you’re directed to the Experian dashboard, which lets you view your full credit score file, and freeze or unfreeze it.

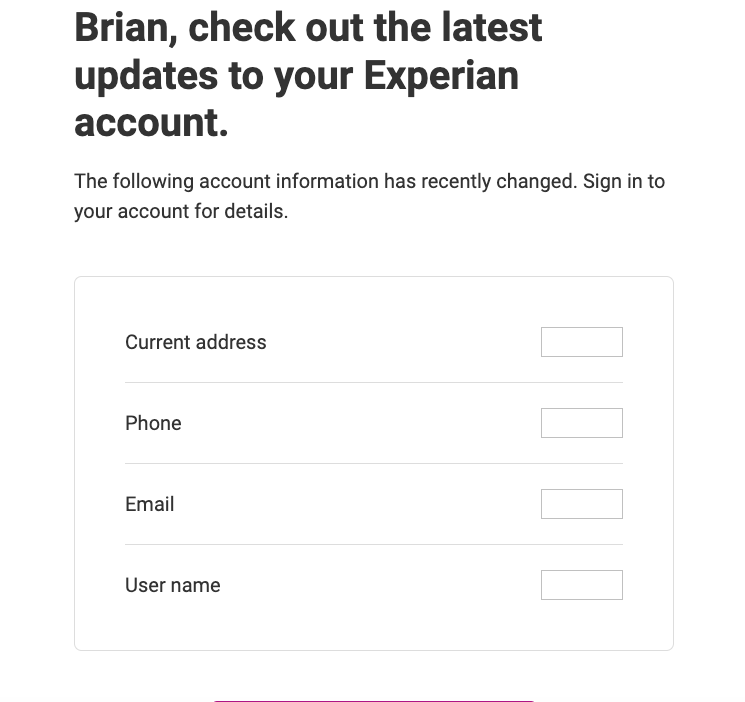

At this level, Experian will ship a message to the outdated e-mail tackle tied to the account, saying sure elements of the consumer profile have modified. However this message isn’t a request searching for verification: It’s only a notification from Experian that the account’s consumer information has modified, and the unique consumer is obtainable zero recourse right here apart from to a click on a hyperlink to log in at Experian.com.

For those who don’t have an Experian account, it’s a good suggestion to create one. As a result of not less than then you’ll obtain certainly one of these emails when somebody hijacks your credit score file at Experian.

And naturally, a consumer who receives certainly one of these notices will discover that the credentials to their Experian account now not work. Nor do their PIN or account restoration query, as a result of these have been modified additionally. Your solely possibility at this level is recreate your account at Experian and steal it again from the ID thieves!

In distinction, should you attempt to modify an current account at both of the opposite two main shopper credit score reporting bureaus — Equifax or TransUnion — they’ll ask you to enter a code despatched to the e-mail tackle or cellphone quantity on file earlier than any modifications could be made.

Reached for remark, Experian declined to share the complete e-mail tackle that was added with out authorization to my credit score file.

“To make sure the safety of shoppers’ identities and knowledge, we have now carried out a multi-layered safety strategy, which incorporates passive and energetic measures, and are always evolving,” Experian spokesperson Scott Anderson stated in an emailed assertion. “This contains knowledge-based questions and solutions, and machine possession and possession verification processes.”

Anderson stated all shoppers have the choice to activate a multi-factor authentication methodology that’s requested every time they log in to their account. However what good is multi-factor authentication if somebody can merely recreate your account with a brand new cellphone quantity and e-mail tackle?

A number of readers who noticed my rant about Experian on Mastodon earlier this week responded to a request to validate my findings. The Mastodon consumer @Jackerbee is a reader from Michican who works within the biotechnology business. @Jackerbee stated when prompted by Experian to supply his cellphone quantity and the final 4 digits of his SSN, he selected the choice to “manually enter my data.”

“I put my second cellphone quantity and the brand new e-mail tackle,” he defined. “I obtained a single e-mail in my unique account inbox that stated they’ve up to date my data after I ‘signed up.’ No verification required from the unique e-mail tackle at any level. I additionally didn’t obtain any textual content alerts on the unique cellphone quantity. The particularly attention-grabbing and egregious half is that after I register, it does 2FA with the brand new cellphone quantity.”

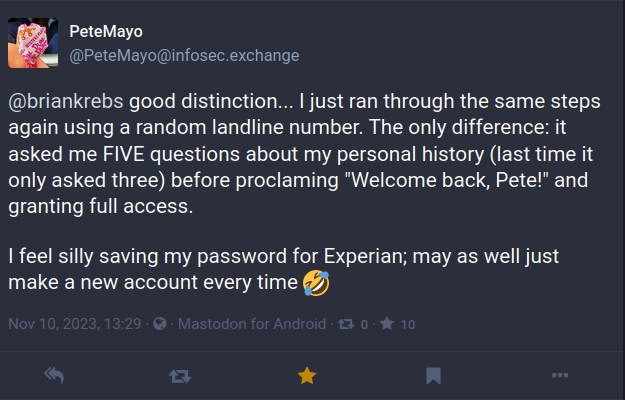

The Mastodon consumer PeteMayo stated they recreated their Experian account twice this week, the second time by supplying a random landline quantity.

“The one distinction: it requested me FIVE questions on my private historical past (final time it solely requested three) earlier than proclaiming, ‘Welcome again, Pete!,’ and granting full entry,” @PeteMayo wrote. “I really feel foolish saving my password for Experian; might as effectively simply make a brand new account each time.”

I used to be lucky in that whoever hijacked my account didn’t additionally thaw my credit score freeze. Or in the event that they did, they politely froze it once more once they had been carried out. However I absolutely anticipate my Experian account will likely be hijacked but once more until Experian makes some necessary modifications to its authentication course of.

It boggles the thoughts that these elementary authentication weaknesses have been allowed to persist for therefore lengthy at Experian, which already has a horrible observe file on this regard.

In December 2022, KrebsOnSecurity alerted Experian that identification thieves had labored out a remarkably easy approach to bypass its safety and entry any shopper’s full credit score report — armed with nothing greater than an individual’s identify, tackle, date of delivery, and Social Safety quantity. Experian mounted the glitch, and acknowledged that it endured for practically seven weeks, between Nov. 9, 2022 and Dec. 26, 2022.

In April 2021, KrebsOnSecurity revealed how identification thieves had been exploiting lax authentication on Experian’s PIN retrieval web page to unfreeze shopper credit score recordsdata. In these instances, Experian didn’t ship any discover through e-mail when a freeze PIN was retrieved, nor did it require the PIN to be despatched to an e-mail tackle already related to the buyer’s account.

A couple of days after that April 2021 story, KrebsOnSecurity broke the information that an Experian API was exposing the credit score scores of most People.

Extra best hits from Experian:

2022: Class Motion Targets Experian Over Account Safety

2017: Experian Website Can Give Anybody Your Credit score Freeze PIN

2015: Experian Breach Impacts 15 Million Clients

2015: Experian Breach Tied to NY-NJ ID Theft Ring

2015: At Experian, Safety Attrition Amid Acquisitions

2015: Experian Hit With Class Motion Over ID Theft Service

2014: Experian Lapse Allowed ID Theft Service Entry to 200 Million Shopper Information

2013: Experian Offered Shopper Knowledge to ID Theft Service