Shares have been urgent decrease of late because the bond charges proceed to rise. This had the S&P 500 (SPY) dangerously near the 200 day transferring common. But hidden within the Friday Authorities Employment report was a clue that sparked a rally and possibly places an finish to current market weak spot. Learn on under for full particulars….

Proper now an important factor on investor’s minds is the dramatic rise in bond charges, and the way that makes shares much less engaging. I tackled that topic fairly totally in my earlier commentary this week. Make certain it learn now if you have not already:

When is the Inventory Bouncing Coming?

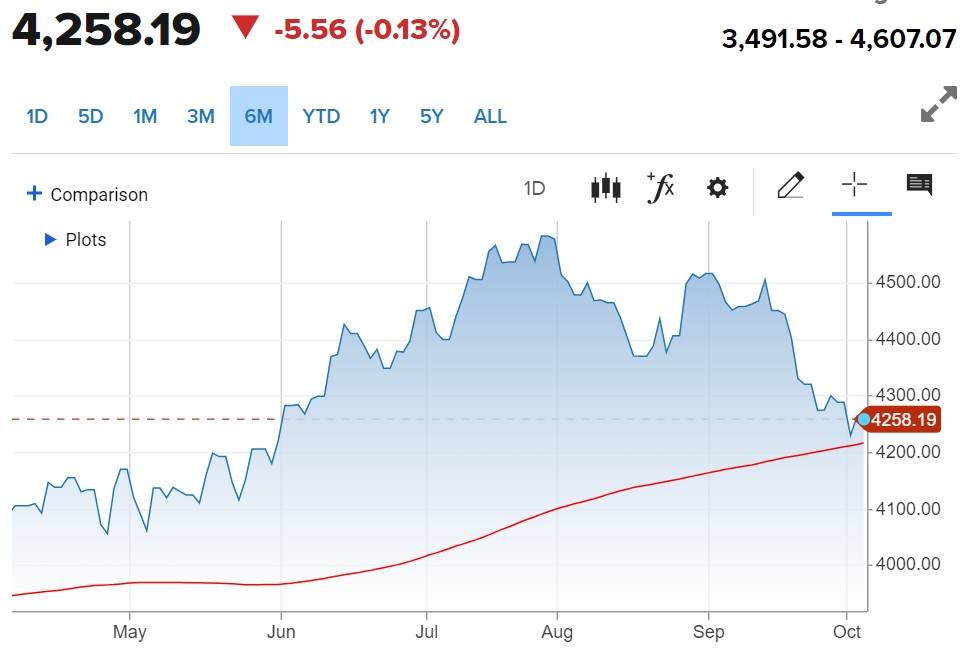

The fast reply to the above query, is that the bounce may very well be forming now as inventory flirt with the 200 day transferring common at 4,206 for the S&P 500 (SPY). That’s the crimson line within the chart under.

On the basic entrance, if charges preserve ripping larger, then it is going to solely put extra strain on inventory costs. I sense that 5% is a logical high for 10 12 months charges…however who says that the market is logical?

Additionally observe on the basic finish of issues that the financial experiences proceed to come back in optimistic. Even 20 months into essentially the most aggressive Fed price mountain climbing regime in historical past, GDP estimates proceed to be sturdy.

GDP Now has it their Q3 estimate all the best way as much as +4.9% bolstered by the latest ISM Manufacturing report. Additional, the Blue Chip Economist panel sees +2.9% because the extra logical progress trajectory.

If I have been to put a wager in Vegas I’d say the Economists are a lot nearer to the ultimate quantity. Regardless, it’s onerous to take a look at these outcomes and see a recession coming…and subsequently it’s onerous to be actually bearish.

On high of that the Authorities Employment State of affairs report got here out Friday morning a lot hotter than anticipated. Since a lot of the preliminary market response is predicated on simply studying the headline…then sure shares offered off early within the session.

Gladly, as prudent traders dug into the small print they found a hidden gem within the report. That being month over month wage inflation all the way down to solely 0.2% which suggests we’re ebbing ever nearer to the two% inflation goal for the Fed as this “sticky” type of inflation turns into unstuck at such excessive ranges.

As this new unfold…so too did the inventory beneficial properties. As I put this commentary to relaxation with 90 minutes left within the Friday session we’ve got a +1.4% consequence for the S&P 500 and properly above just lately resistance at 4,300.

Again to the massive image dialog about larger charges….

Sure, inventory costs are down of late as “charges normalize” to extra conventional historic ranges. Which means we’re not having fun with the artificially low charges we which were in hand the previous 15 years.

As soon as everybody makes this adjustment to the brand new world view of charges…and notice the world isn’t falling aside…they are going to be compelled to place their cash into the most effective shares. And possibly Friday’s rally is an early signal of that going down.

So, that are these greatest shares, you ask?

Learn on under for the reply…

What To Do Subsequent?

Uncover my model new “2024 Inventory Market Outlook” masking:

- Bear Case vs. Bull Case

- Buying and selling Plan to Outperform

- What Industries Are Scorching…Which Are Not?

- High 11 Picks for the Yr Forward

- And A lot Extra!

Acquire entry to this very important presentation now by clicking under:

2024 Inventory Market Outlook >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Complete Return

SPY shares have been buying and selling at $430.05 per share on Friday afternoon, up $5.55 (+1.31%). Yr-to-date, SPY has gained 13.70%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Writer: Steve Reitmeister

Steve is healthier identified to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Complete Return portfolio. Be taught extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The put up Investor Alert: Hidden Gem for Shares Present in Friday Report appeared first on StockNews.com