It’s been over 2 years since we revealed our final piece on Ammonia, whereas curiosity in Ammonia stays robust, we anticipate much more demand for inexperienced ammonia generated by rising pure gasoline costs and up to date geopolitical occasions which can lead to important adjustments within the business. Additional, because the market continues to develop so have the innovators seeking to handle the challenges and alternatives on this area. Ammonia stays an necessary industrial chemical with round 200 million tons per yr of manufacturing. Round 80% of the produced ammonia is utilized in chemical fertilizers (a market valued at over $100b) which maintain meals manufacturing for billions of individuals.

Gaseous at room temperature, ammonia will be liquefied below low strain or when cooled. As beforehand mentioned, the properties of ammonia makes it a pretty potential power service (long-distance) and transportation gasoline. One of many major potential future markets is the delivery business which is liable for round 2.5% of the world’s complete CO2 emissions. The Worldwide Maritime Organisation (IMO), which creates coverage for its 173 member states, adopted a GHG technique concentrating on carbon depth discount per transport exercise by 40% in 2030 and by 70% in 2050, in comparison with 2008. Though electrochemical storage options have gained some traction, low carbon fuels stay predominant in most projections, with ammonia one of many main future fuels alongside methanol, hydrogen, and others.

Ammonia is conventionally produced utilizing the Haber Bosch course of which requires nitrogen and hydrogen inputs. Traditionally almost all of the required hydrogen has been produced from the steam reforming of pure gasoline, or gasification of coal. Nitrogen is derived from an air separation course of. Present ammonia manufacturing ends in roughly 2% of worldwide emissions. Producers are more and more coming below shareholder and buyer strain to deal with these emissions. Insurance policies such because the EU Emissions Buying and selling Scheme and proposed Carbon Border Adjustment Mechanism (CBAM) are probably so as to add additional strain as carbon costs improve, ETS free allowances are eliminated, and ammonia imported into the EU might entice a charge relying on its carbon depth.

Massive scale low-carbon and inexperienced ammonia

The principle method to reducing the carbon depth of ammonia manufacturing is thru various hydrogen manufacturing. This contains hydrogen manufacturing with carbon seize (‘blue’), hydrogen from methane pyrolysis (‘turquoise’), and hydrogen generated by electrolysis (inexperienced). These approaches usually induce extra value.

Industrial-scale low-carbon blue ammonia manufacturing exists at present. For instance, Nutrien has round 1 million tonnes each year of capability. There are additionally a variety of deliberate tasks such because the 1 million tonne each year Barents Blue challenge in Norway which is getting ready for FEED research upfront of a last funding determination. Blue ammonia manufacturing is best in areas with decrease pure gasoline costs and developed infrastructure for CO2 transport and storage. In lots of instances, retrofit of carbon seize is feasible which allows leveraging of present infrastructure. Nonetheless, critics argue that this method prolongs fossil gasoline manufacturing, nonetheless ends in 5-15% of CO2 emissions through the seize course of, and continues to trigger emissions throughout pure gasoline manufacturing.

Methane pyrolysis additionally leverages pure gasoline feedstock to generate hydrogen. Methane pyrolysis innovators have attracted important funding in current months, together with a $1 billion DOE mortgage granted to Monolith Supplies to improve Monolith’s Olive Creek Facility to allow manufacturing of 275 thousand tonnes of unpolluted ammonia from 2025. As a result of the produced carbon through the methane pyrolysis course of is stable, this method will help keep away from fugitive emissions in carbon seize, although emissions in pure gasoline manufacturing stay.

An alternate method makes use of renewable power to generate hydrogen through electrolysis. There are quite a few tasks deliberate, together with a number of 10+ million tonnes each year hubs deliberate by Intercontinental Vitality. The method is best suited to areas with massive renewable power technology potential and fewer enticing choices for export of power, resembling Western Australia. It appears to be like more and more enticing when pure gasoline costs are excessive. Regardless of the rising curiosity, inexperienced ammonia is just not with out challenges. The capital necessities for giant scale tasks are important and the extent of market demand for ammonia in new markets (past fertilizer) stays unclear which may impression funding selections. The 20 million tonne each year Western Inexperienced Vitality Hub in Australia is predicted to value greater than $70 billion with the funding selections anticipated as late as 2028.

Innovation in ammonia synthesis

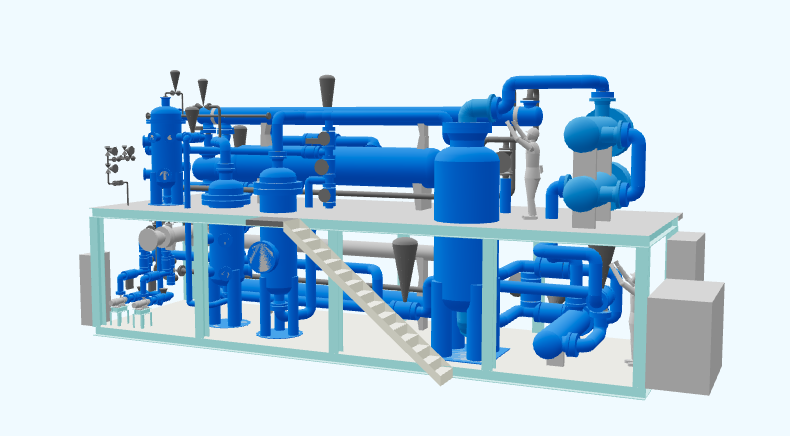

The Haber Bosch course of used for ammonia synthesis requires excessive temperate and strain. This ends in demanding (and expensive) gear necessities and implies that the method is poorly suited to cyclic operation required to match renewable power provide. Combined renewable power provide and/or hydrogen storage is taken into account to deal with intermittent manufacturing curves of renewables, whereas Seaborg and others are investigating ammonia manufacturing utilizing nuclear power.

A rising variety of innovators are creating new applied sciences with a give attention to the ammonia synthesis. We spoke with Frank Natali of Liquium, who has developed an economical expertise to create ammonia at low temperatures and in regular atmospheric situations, considerably lowering carbon emission. Frank defined that the expertise will help handle emissions of the present ammonia market in fertilizer and a rising future market in fuels. A key promoting level for the expertise is that it permits for the opportunity of small ammonia vegetation which may scale back transportation and storage prices. Liquium plans to pilot expertise within the present fertilizer market by 2025, and promote small, decentralized vegetation by 2030 earlier than addressing the marketplace for massive scale vegetation. Solely based in 2021, Liquium is at the moment elevating a seed funding spherical to help improvement.

One other innovator, Tsubame BHB is creating catalyst expertise which may function at low strain – appropriate for the usage of electrolytic hydrogen generated at regular strain. We spoke with Tomoyuki Koide who defined how “the expertise is related at smaller scale as a result of the decrease strain necessities keep away from the necessity for costly supplies used within the typical ammonia synthesis course of”. Additional, decrease temperatures allow greater conversion fee in ammonia synthesis. Traders embrace Ajimoto which makes use of ammonia to supply amino acids, and NYK which is creating ammonia prepared delivery vessels. Tsubame operates a smalls scale pilot and has plans to promote modular vegetation (and catalysts), with operation beginning in 2024. Tsubame introduced a $3.6 million funding spherical in June 2021 to introduce applied sciences on-site and conduct R&D on mass manufacturing of next-generation catalysts.

The previous yr has seen a mess of bulletins from ammonia innovators, largely concentrating on new catalyst applied sciences and decentralised ammonia manufacturing.

- Jupiter Ionics raised $1.8 million from Tenacious Ventures and is collaborating in a challenge to deploy pilot-scale models that manufacture inexperienced ammonia and ammonia-based fertilisers on farms.

- Nitricity raised $5 million from Vitality Influence Companions, Advantageous Construction Ventures, Lowercarbon Capital and MCJ Collective to speed up improvements to supply renewable nitrogen fertilizer at point-of-use.

- Starfire Vitality raised an undisclosed quantity from New Vitality Applied sciences, Chevron Expertise Ventures, Osaka Gasoline USA, and Mitsubishi Heavy Industries in April 2021 to advance commercialisation of catalysis expertise for the synthesis and cracking of carbon-free ammonia.

- Atmonia partnered with Fujitsu to analysis catalysts for clear ammonia manufacturing leveraging materials informatics.

Regulate

Regardless of the current traction out there, the profitable scale up of recent ammonia applied sciences will probably be influenced by a number of components. Within the present markets, fertilizer stays a key goal and demand for environment friendly meals manufacturing is powerful. Nonetheless, ammonia-based fertilizers may face competitors from options resembling these below improvement by Kula Bio, Enko Chem, N2-applied and others.

Demand for ammonia as transportation gasoline is considerably depending on the deployment of ammonia-ready engines and/or delivery vessels resembling these below improvement by Amazon/Amogy and Man Vitality Options, and the profitable implementation of greens delivery corridors which allow bunkering for ammonia fuels resembling these between the ports of LA and Shanghai, or these proposed in Australia and Chile.

Lastly, the appliance of ammonia as an power service for long-distance export might compete with methanol (additionally related as a chemical intermediate) or liquid hydrogen carriers programs resembling these produced by Hydrogenious. If the intent is to make use of hydrogen, e.g. DRI-EAF steelmaking, or in gasoline cells, then efficient cracking applied sciences resembling these below improvement by Starfire Vitality will develop in significance.