Excessive-flying enterprise buyers in India managing a whole bunch of tens of millions of {dollars} are tempering expectations, making early-stage startup bets that in best-case eventualities they hope will return 3 to five occasions invested capital.

A number of main India buyers together with Peak XV Companions, Elevation Capital, Lightspeed, Nexus and Accel have raised $500 million-plus up to now two years, emboldened by earlier house runs and huge market potential.

Nonetheless, the prevailing temper has shifted this 12 months. Traders more and more warning they battle to identify actually fund-returning prospects — the most recent headache confronting the world’s most populous nation. (A VC with a not too long ago raised fund beneath $250 million asserted that funding companies wielding $500 million or extra in capital reserves face higher issue deploying these belongings profitably.)

VC companies typically make between 20 to 30 investments per fund, betting on a choose few startups that may doubtlessly generate outsized returns to compensate for different losses. These companies goal to have 2-3 of their portfolio corporations drive the vast majority of a fund’s capital good points. This technique of pursuing high-risk, high-reward offers is particularly widespread amongst early-stage buyers who allocate most of their fund capital into younger startups in hopes of getting in early on the following huge factor.

The glut of capital has led India buyers to show abnormally cautious and picky, founders and buyers stated. Companies are scrutinizing offers at Collection A and B levels for as much as 6 months now, stated an funding banker, when such offers as soon as took far much less diligence. India’s sovereign fund has been evaluating an funding in agritech startup WayCool for greater than six months at this level, in keeping with two folks accustomed to the matter. Gaming startup Loco has additionally held talks with buyers to lift about $80 million, however greater than six months later no deal has materialized.

Bessemer Enterprise Companions’ India crew has inked only one new web deal this 12 months, in keeping with folks accustomed to the matter. One investor remarked that Bessemer is taking months and months in due diligence and sustaining a excessive stage of skepticism.

Anant Vidur Puri, a associate at Bessemer Enterprise Associate, confirmed the agency has solely accomplished one web new funding in India this 12 months, saying the fund is “roadmap targeted” that appears to construct a concentrated portfolio of high-quality investments and sometimes likes to double down on current backings.

“We’re additionally stage agnostic so can are available in at Seed, Collection A, B or C and look to proceed to again our investments over levels, in keeping with the concentrated portfolio technique. Some years we do 6-7 new offers and a few years we do 0 as properly which may rely upon after we see enticing and compelling investments out there, however on a mean we don’t do greater than a handful of latest investments every year,” he advised me in a textual content message.

Mirroring the sluggish funding tempo in startup ecosystems globally, Indian startups have secured roughly $7 billion in capital in 2023, in keeping with market intelligence platform Tracxn, down from about $25 billion in 2022 and $37 billion in 2021. In truth, it’s the bottom since 2016. (Just one Indian startup — Zepto — entered the unicorn membership this 12 months.)

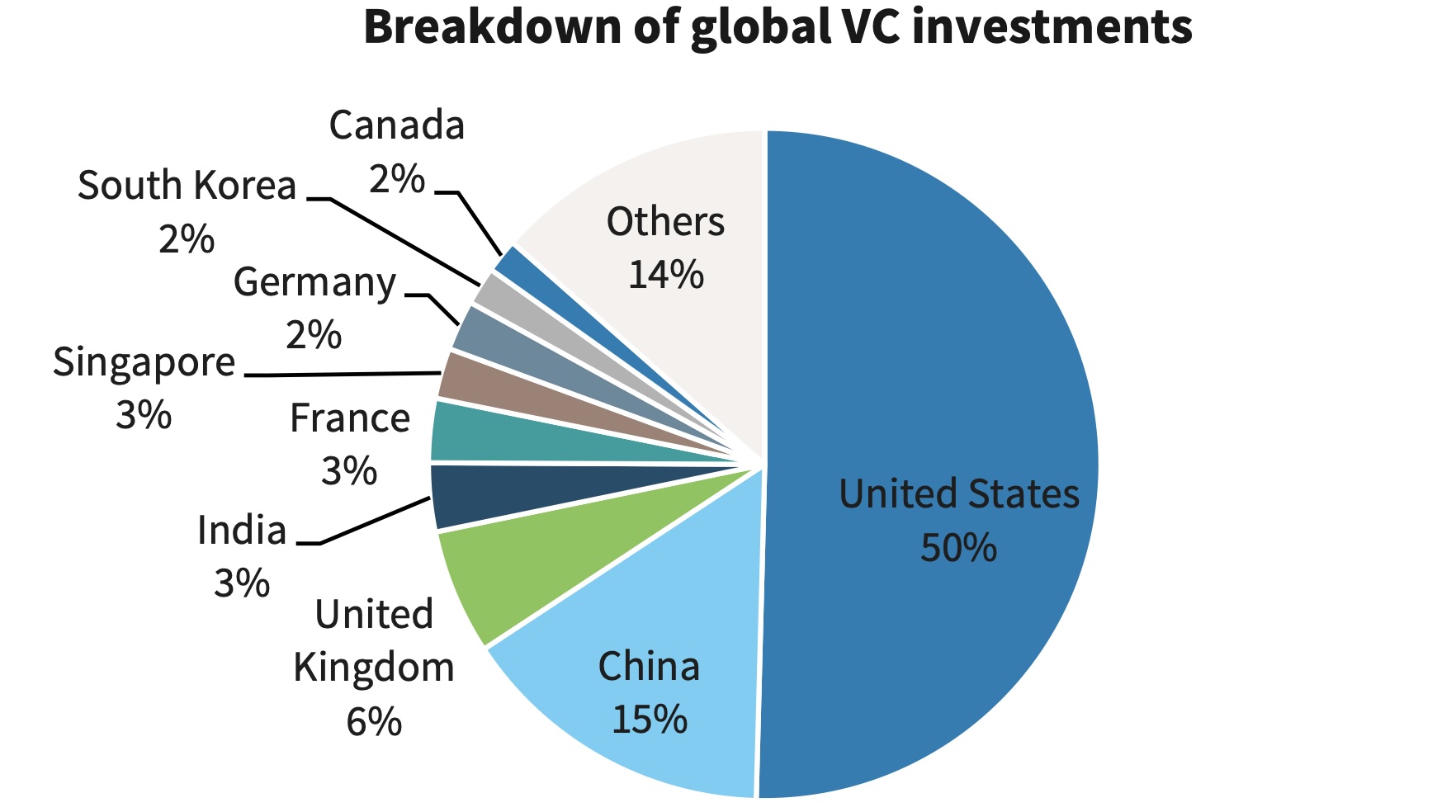

Prime VC markets, by quantity of funding in 2023. (Knowledge: Pitchbook and Barclays)

Some buyers stated they’re taking extra precautions due to the dwindling worth of lots of the high Indian startups, one thing they are saying has pressured them to rebuild their market thesis for India.

Prosus not too long ago slashed the valuation of Byju’s to beneath $3 billion. (Byju’s, which has raised over $5 billion up to now, was valued at $22 billion early final 12 months.) Pharmeasy, as soon as valued at $5.4 billion, not too long ago raised capital at a 90% low cost. Vanguard has minimize the valuation of ride-hailing big Ola by greater than 60%. Meals supply big Swiggy, service provider funds platform Pine Labs, and SaaS Gupshup have all additionally confronted write-downs this 12 months. Reliance and Google-backed Dunzo, which has raised greater than $500 million, is struggling to make payroll, and BNPL startup ZestMoney, which raised over $130 million, is shutting down.

India-focused buyers are additionally more and more rising bearish on Southeast Asia. In recent times, companies like Peak XV and Lightspeed expanded into the area, backing many early-stage startups, a few of which grew to become huge winners.

Nonetheless, some massive buyers now harbor apprehensions, saying an excessive amount of capital chases too few viable Southeast Asia offers, inflating valuations and diminishing potential returns. (In a current interview, Peak XV stated it stays very bullish on Southeast Asia.)

Traders additionally query whether or not they have overestimated India’s SaaS alternative. “Everybody underwrote product threat, corporations had been capable of construct merchandise. Nobody has been capable of promote/scale income past a significant level,” a U.S.-based early-stage India investor stated, including that only a few corporations have been capable of break into American networks to promote to U.S. corporations.

Dev Khare of Lightspeed Enterprise Companions India stated there have been fewer than 100 transactions for Indian enterprise software program startups throughout seed by means of progress in 2023. The market stays very targeted on seed transactions, and the Collection A spherical is the “chokepoint.”

“Lots of of seeds accomplished in India in 2021/2022 are discovering it arduous to interrupt into enterprise budgets given contraction in budgets and/or many are me-too’s/gentle options,” he wrote.