Working an ecommerce enterprise takes extra than simply nice concepts, merchandise, advertising, and stock. You additionally want an ecommerce accounting system to comply with the cash. How a lot are you spending? What are your earnings? Are you inside your anticipated enterprise price range? Is the federal government pleased with your corporation? Ecommerce accounting makes use of well-known processes for protecting monitor of your monetary information and enterprise transactions, and staying updated on taxes, payroll, and earnings.

Whether or not you’re simply beginning your ecommerce retailer or have been at it for a short time and are realizing that you simply need assistance monitoring your corporation funds, this ecommerce accounting information will get you getting into the proper path.

Ecommerce accounting empowers you to evaluate the monetary well being of your corporation and make extra correct monetary projections as your corporation grows.

What does ecommerce accounting contain?

Ecommerce companies are constructed on transactions and stock. You make gross sales. You ship items. You buy and refill stock.

The fundamentals of ecommerce accounting start with a system for recording and reporting your transactions, which incorporates buy orders, invoices, bills, and taxes.

But it surely goes a lot additional than that. Accounting corporations will then take that information and use it to arrange monetary statements to allow them to analyze and report on the monetary well being of your corporation.Ecommerce firms additionally require some specialised consideration as a result of fundamentals of the enterprise mannequin.

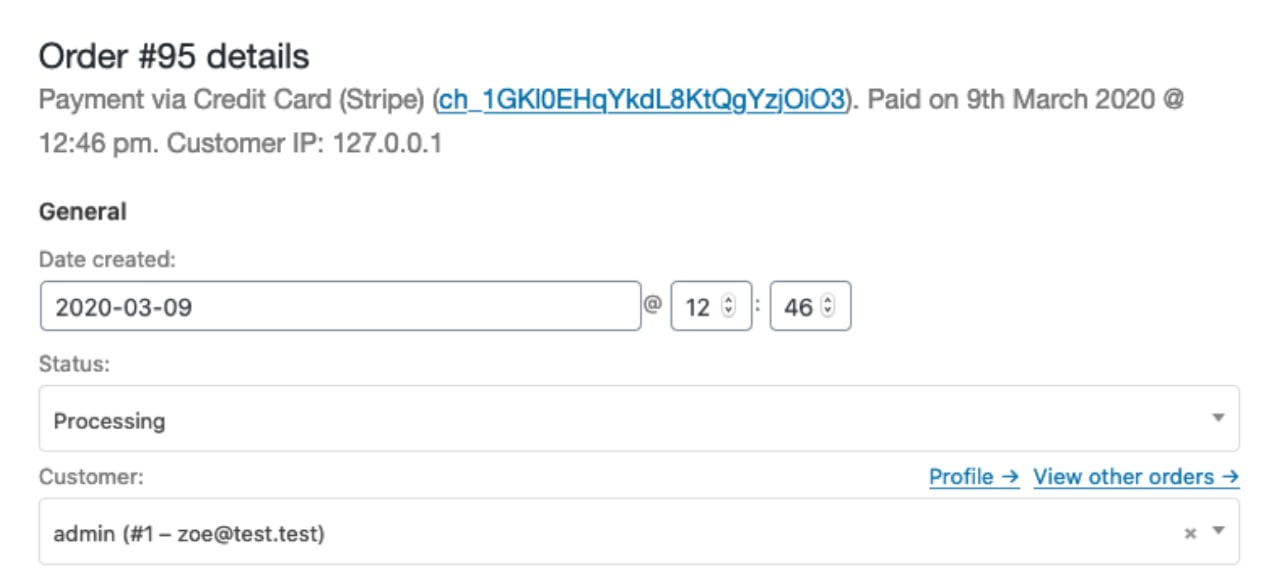

Take into consideration what occurs if you make a sale in your ecommerce retailer. Which means the client makes use of their bank card and submits cost to your cost processor. What are all of the ways in which sale impacts your funds?

- Your cost processor has obtained cash, nevertheless it’s not in your checking account but

- Gross sales taxes are incurred, presumably from a distinct state or nation

- Stock declines

- Bank card and/or cost processor charges are charged

- Precise revenue from the sale differs from the gross sales worth

- The order should be shipped, and could be returned — who’s paying for delivery in each situations?

Regardless of the gross sales channel, making even a single sale touches on many points of your monetary data — and the aftereffects of that one sale will present up in your monetary data over the subsequent couple months. And if the order does get returned, many of those transactions should now be reversed or modified.

And, that’s only one sale.

Monitoring a few of that is the job of a bookkeeper, and we’ll speak in regards to the variations between ecommerce bookkeeping and accounting a bit later.

First, let’s start with some fundamental accounting terminology.

Primary accounting phrases

Listed here are an important phrases to know for ecommerce accounting:

Transactions

In accounting terminology, a transaction occurs any time cash is spent, obtained, or requested for by a enterprise or vendor.

A transaction could possibly be any of the next:

- Cash the enterprise proprietor invests within the enterprise

- Income from gross sales

- Invoices

- Bills like wages, advertising, journey, and constructing prices

- Property bought, comparable to automobiles, workplace gear, property, or supplies

A single transaction can have a number of elements. While you pay an hourly worker, for instance, you must know the period of time they labored, their gross wages, tax deductions, and web pay. The very best accounting software program can carry out all of those duties.

Transactions for ecommerce firms can get sophisticated on account of sure elements, significantly gross sales taxes and timing delays brought on by the separation between enterprise and client.

For instance, do you cost gross sales tax proper on the time of buy? If that’s the case, what occurs to that cash if the product will get returned a month later?

Ecommerce accounting makes an attempt to handle your transactions and processes so these types of issues don’t cloud the monetary image of your corporation.

Debits and credit

All transactions are tracked by a system of debits and credit. First, let’s outline some key phrases:

Debit: A file of the cash taken out of your checking account. You’ll see debits present up in your assertion if you make a purchase order.

Credit score: A file of the cash added to your account.

Property: Property (actual or mental) owned by a company.

Liabilities: Enterprise obligations which have but to be fulfilled. A legal responsibility is a declare in opposition to the belongings proven on a steadiness sheet.

Fairness: The sum of belongings after debits have been subtracted from them.

Now, we will have a look at how these phrases play into what’s generally known as the primary accounting equation:

Property = Liabilities + Fairness (Proprietor’s or Company’s)

A debit is added to the left facet of the equation, as an asset. A credit score is added to the proper.As a easy instance, when you make a sale for $500, that $500 will get debited and added to your corporation belongings. And it additionally will get credited as Proprietor’s Fairness within the type of revenue. At any time when one thing will get debited, one thing else should be credited, as a result of this retains the equation balanced.

That’s a vastly simplified rationalization, nevertheless it offers you a fundamental concept of what your accounting software program is doing if you enter transactions.

Value of products bought (COGS)

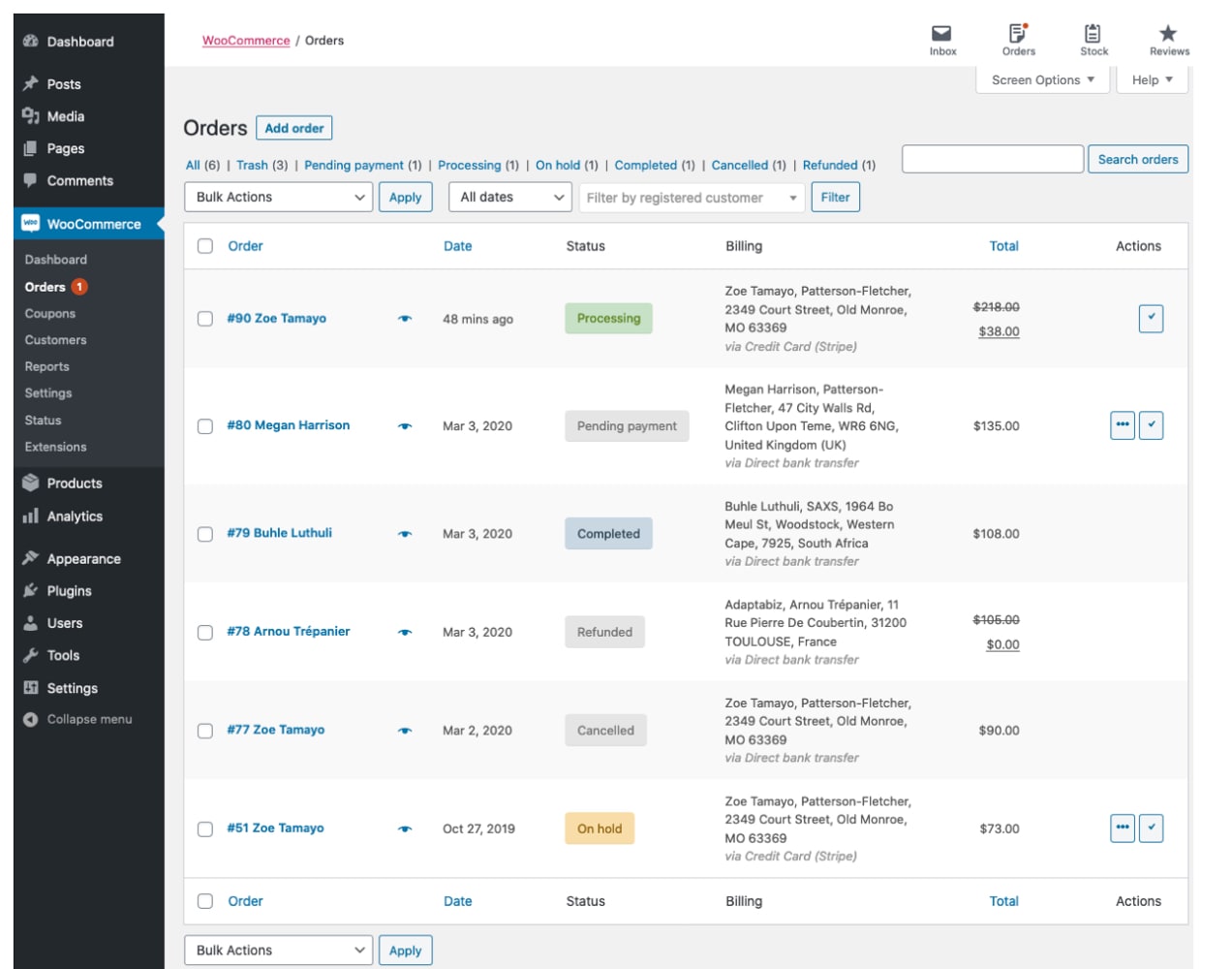

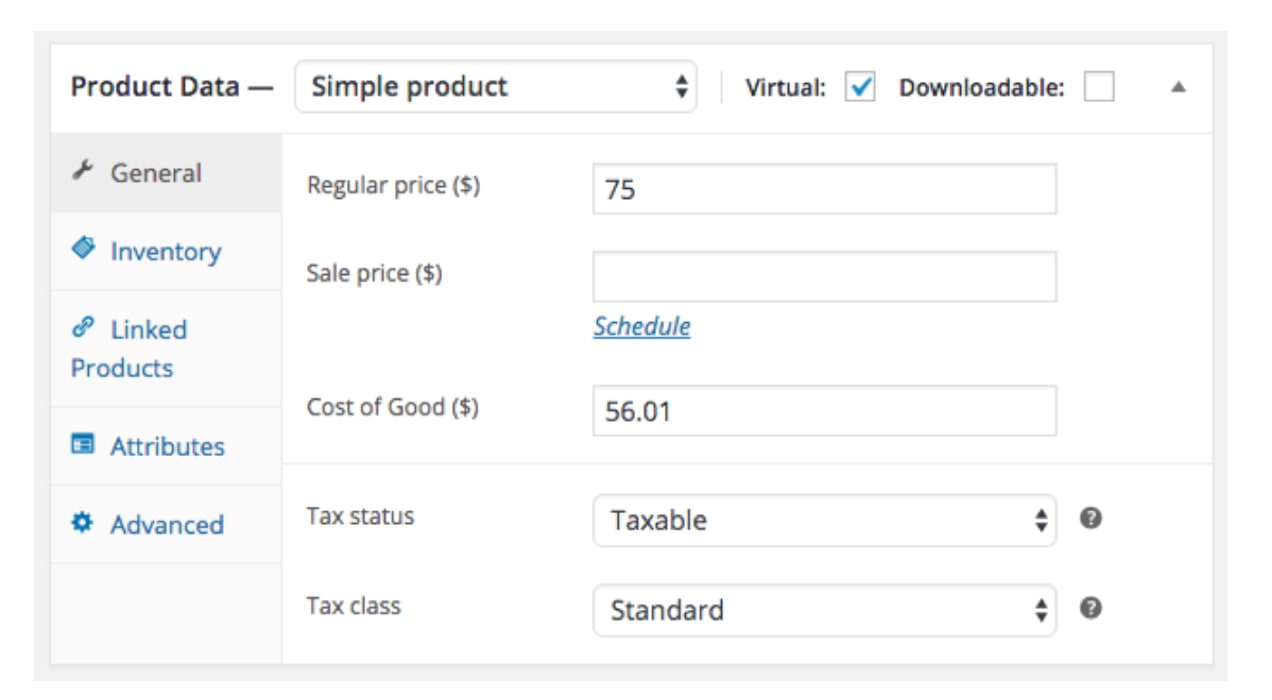

Ecommerce accounting should pay specific consideration to the price of items bought. This refers to all the prices required to promote a product, not counting issues like payroll or advertising.

COGS covers all stock prices, together with buying, storing, managing, and delivery. Stock is your largest expense as an ecommerce vendor, so when you don’t have an correct accounting image of the prices of products bought, your revenue margin and taxable revenue can even be inaccurate.

An inaccurate COGS additionally makes it tougher to know what to spend on advertising, what costs to set, how a lot stock to order, when you ought to rent staff, and the way a lot warehouse house to amass.

Revenue margins

Margins characterize the precise revenue your corporation acquires after a sale has been made. You calculate margins with this equation:

Margin = (Income – Value of Items) / Income

Basically, it’s your web earnings expressed as a share. If you happen to promote $10,000 price of merchandise in per week and your COGS for these merchandise is $3000, your margins could be 70%.

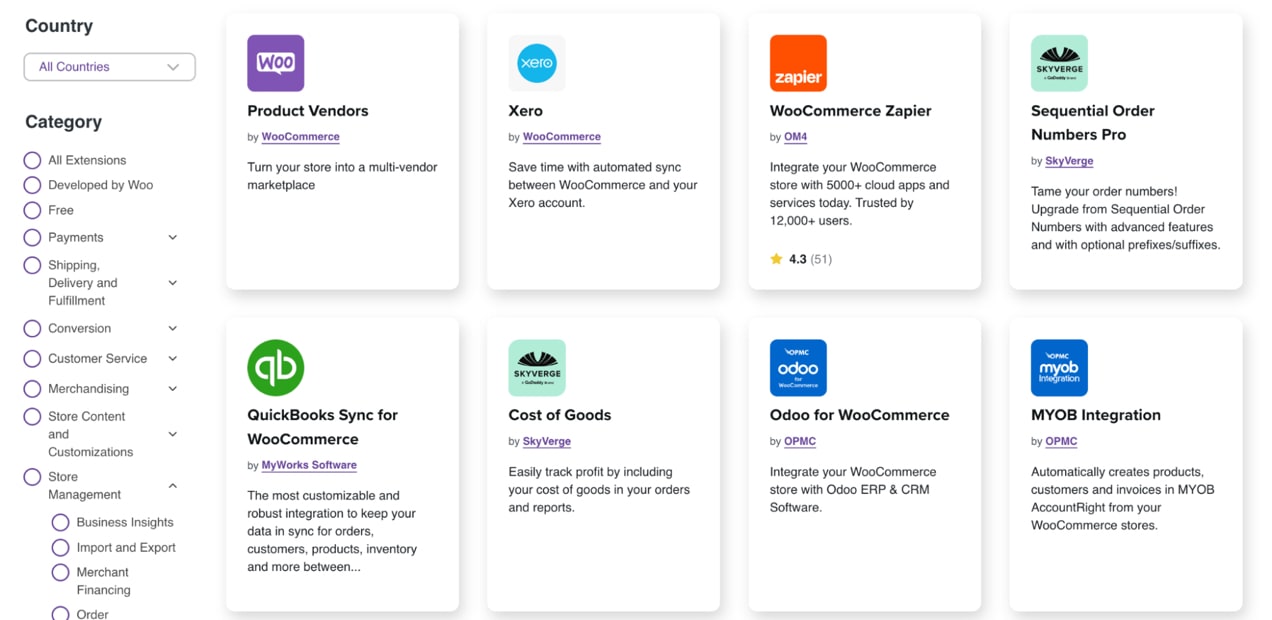

To simplify this course of, WooCommerce has an extension that calculates your value of products so you possibly can compute the price of every particular product you promote, a class of merchandise, or your whole merchandise for any time interval you choose.

Accounts receivable and accounts payable

These phrases discuss with cash that has not but modified palms, however is slated to.

Accounts receivable consists of any cash that is because of arrive in your checking account. For instance, when you ship out an bill, that goes in accounts receivable till the client really pays you.

Accounts payable works the identical means in reverse. If your corporation makes a purchase order from a vendor, and that vendor sends you a purchase order order, it goes in accounts payable till you really make the cost.

Ecommerce accounting vs bookkeeping — what’s the distinction?

There’s some overlap between ecommerce bookkeeping and accounting. However normally, the distinction is that bookkeepers course of occasions, and accountants compile and analyze these occasions to create an correct and helpful image of your corporation price range.

If a sports activities analogy helps, bookkeepers are just like the play-by-play announcer, and accountants are just like the analyst or shade commentator. The bookkeeper tracks what occurred. The accountant tells you what it means.

What does an ecommerce bookkeeper do?

Bookkeeping duties focus totally on transactions, data, and monetary establishments. You probably have staff, the bookkeeper handles the payroll. In addition they do issues like:

- Course of invoices

- Ship receipts

- Report what is available in and goes out from your corporation checking account

- Report stock purchases

- Reconcile your financial institution accounts each month

- Generate month-to-month monetary statements

- Create year-end statements and tax paperwork

Correct ecommerce bookkeeping will allow you to construct a financially secure and dependable enterprise mannequin.

What does an ecommerce accountant do?

Along with what the bookkeeper does, the accountant seeks to offer a full and correct image of the true monetary standing of your ecommerce enterprise. Regardless of the ecommerce platform you employ, they incorporate your stock, value of products bought, and different complicating elements comparable to gross sales taxes, returns, chargebacks, pre-orders, subscription income, and alternate cost strategies like Purchase Now Pay Later (BNPL).

An ecommerce accountant will do issues like:

- Analyze and monitor operational prices and enterprise efficiency

- Conduct monetary forecasting

- Research monetary statements — together with these out of your bookkeeper

- Carry out tax planning, together with submitting returns

- Report in your money circulate administration

The accountant’s objective is to assist ecommerce enterprise house owners make knowledgeable monetary selections.

Are you able to afford to rent a brand new worker? Do you have to broaden into a brand new state or nation? What’s the minimal you need to cost for a brand new product?

Ecommerce accounting at its greatest will be capable of reply these questions.

Accounting strategies for ecommerce sellers

There are two fundamental strategies of ecommerce accounting — the money technique and the accrual technique. The accrual technique is the extra widespread one, and relying on the dimensions and nature of your corporation, could also be required by regulation.

The essential distinction between the strategies is when a transaction is acknowledged.

Money foundation accounting

In money foundation accounting, a transaction is acknowledged when precise cash has modified palms. While you pay an bill, money foundation accounting marks that as an expense. If you happen to obtain an bill in January however you pay it in March, money accounting marks that as an expense in March.

Earnings operates the identical means. Suppose you make a sale, and the client indicators up for a cost plan that may unfold out their funds over 4 months. With money accounting, you depend this as revenue every month the cash is available in.

Accrual technique accounting

In accrual accounting, the transaction is acknowledged when the work has been accomplished and the bill despatched. Suppose you place an order for a contemporary provide of workplace paper in January and put it on your corporation bank card. You obtain the workplace paper instantly, however you don’t really pay for it till February, when the statements on your bank card accounts arrive.

In accrual accounting, the transaction occurs the second you obtain the paper. You are taking the receipt, retailer it in your file system, and file the expense. It’s an expense for January, regardless that you don’t pay for it till February.

Utilizing the identical instance, accrual accounting would file the whole buy worth as revenue the day the sale is made, regardless that you received’t really obtain all the cash till 4 months have handed.

Which accounting technique is healthier for ecommerce companies?

Accrual accounting offers you a clearer image of your value of products bought every month. If you happen to purchase paper in August, that paper was a part of the price of working your corporation — in August, not if you really get round to paying the invoice. If you happen to make a sale in Might, then you definately made the sale in Might, not in July when the client lastly sends the cash.

It additionally works higher with stock administration.

Suppose you make $30,000 in new stock purchases in September, and also you promote it over the subsequent 4 months main as much as the vacation season. In money accounting, you’ll mark the whole stock buy as an expense in September. In accrual accounting, you’ll mark it as an expense as you promote the product.

With the money strategy, you’d have a giant expense in September, after which artificially excessive revenue margins in October, November, and December, as a result of it is going to seem as you probably have no prices of products bought.

Accrual accounting allows you to reconcile the prices of doing enterprise every month, so you possibly can see which months produced the best margins.

Three main monetary statements

Even when you plan to outsource your ecommerce accounting and bookkeeping, you want to have the ability to learn and perceive your monetary experiences. If you happen to’re doing it your self, utilizing your ecommerce bookkeeping software program to enter transaction information will allow you to arrange the three fundamental monetary statements: revenue statements (also referred to as the “revenue and loss assertion” or P&L), steadiness sheets, and money circulate statements.

Earnings assertion

The revenue assertion experiences revenue earned over a specified time period, comparable to a month. This revenue is what folks discuss with after they use the time period “backside line.” Your revenue is your web revenue. Or, when you misplaced cash throughout that point interval, your web loss.

Steadiness sheet

Steadiness sheets report your belongings, liabilities, and fairness at a particular time limit, sometimes on the finish of a month, quarter, or yr. It’s a snapshot of your monetary well being.

Property are issues owned which have worth. Liabilities, together with accounts payable, are stuff you owe.

If you happen to look again on the fundamental accounting equation listed earlier, you’ll see that fairness is solely the distinction between belongings and liabilities. Subtract liabilities from belongings, and you’ve got what’s known as the “guide worth,” or fairness, of your corporation.

Money circulate assertion

The money circulate assertion experiences on how your money readily available has modified throughout a given time interval.

All three of those statements may be shortly produced by your accounting software program, so long as you’ve been diligent about coming into your monetary information. If you happen to don’t have time for that, that is one purpose to rent an ecommerce bookkeeper.

Important monetary metrics for ecommerce accounting

TaxJar put out an excellent article about ecommerce accounting metrics. Bear in mind, accounting isn’t nearly protecting monetary data. Accounting additionally tells the story in regards to the monetary standing and progress (or decline) of your ecommerce enterprise.

Listed here are their most important accounting metrics:

Income

Income refers to your gross receipts earlier than any bills have been deducted. Income is pretty straightforward to trace. However by itself, it offers you an incomplete image.

Contribution margin

That is the promoting worth minus the associated fee to promote that product. It’s type of just like the COGS determine from earlier than, however for every particular person product you promote. It doesn’t embody working bills.

Revenue

Revenue is what outcomes after you are taking away all of your bills out of your income, together with advertising and working bills. In case your income is excessive however your earnings are low, you both want to extend income, or cut back prices.

Ecommerce conversion price

That is the share of holiday makers to your ecommerce retailer who purchase one thing.

Buyer acquisition value

Usually, it prices rather a lot much less to make extra gross sales to your present clients than to amass a brand new buyer.

So, in case your CAC is excessive, and also you don’t need to cease any of your advertising, you could have two choices:

- Attempt to enhance or optimize your advertising

- Begin advertising extra to your present clients

Buyer lifetime worth

If you happen to’re a comparatively new ecommerce vendor, you’ll have a tricky time figuring out this one on your first few years. However with good accounting software program, you’ll be capable of begin estimating this as time goes on.

This quantity helps you justify your advertising bills. In different phrases, in case your CAC is excessive, however your buyer lifetime worth is way larger, then it’s price the associated fee to amass these clients.

Common order worth

Particularly for newer ecommerce companies, it is a extra helpful metric than lifetime worth. If you happen to spend $10 to get a buyer, however they spend a median of $25 per order, that’s a great deal so long as your different bills aren’t too excessive. If you happen to can scale that up as you attain extra clients, you’ll do nice.

Cart abandonment price

This quantity is shockingly excessive for ecommerce shops. In line with TaxJar, about 70% of ecommerce customers put merchandise in carts however don’t purchase them.

Your single greatest technique for lowering cart abandonment is to ship deserted cart emails, which is straightforward to automate with the proper electronic mail platform, comparable to MailPoet.

If you happen to can decrease that cart abandonment price right down to 60% or 50%, that may produce a large improve in income. And if all it takes is a couple of automated emails, that’s a no brainer.

Buyer refund and return price

Do lots of clients return merchandise for a refund? That’s an indicator that one thing is fallacious. Hold monitor of this and do all the pieces you possibly can to maintain it low.

5 vital ecommerce accounting duties to deal with

If you happen to’re within the early phases as an ecommerce enterprise proprietor, it is advisable get a deal with in your fundamental accounting duties quickly so that you don’t find yourself in scorching water later. And simply so we’re clear, ‘scorching water’ can imply lots of issues, comparable to:

- Unpaid taxes — revenue tax, gross sales tax, or state and native taxes

- Incorrect tax filings

- Overspending on stock

- Hiring staff you possibly can’t afford

- Withdrawing an excessive amount of fairness

Listed here are some steps you possibly can take to get your ecommerce accounting system off to a great begin:

1. Create a separate enterprise checking account

Ecommerce small enterprise house owners typically don’t take into consideration this as they’re busy with all the opposite enterprise startup duties.

However enterprise accounting turns into very tough when you’re mixing private with enterprise transactions. Your corporation account is what you’ll use for all your corporation bills, and it’s the place you’ll deposit revenue from gross sales.

To open a enterprise checking account, you’ll want a enterprise tax ID quantity.

2. Put together for workers and contractors

If you happen to plan to have staff, you’ll must arrange procedures for withholding taxes. Even when you plan to run the enterprise by yourself for now, you’ll in all probability nonetheless rent contractors for specific tasks. Contractors who’re paid above a specific amount per yr within the U.S. should be despatched a 1099, so remember to:

- Monitor who you’ve paid and the way a lot you’ve paid them

- Get a W-9 kind from every contractor

- Hold present addresses on file for everybody you rent

3. Get accounting software program

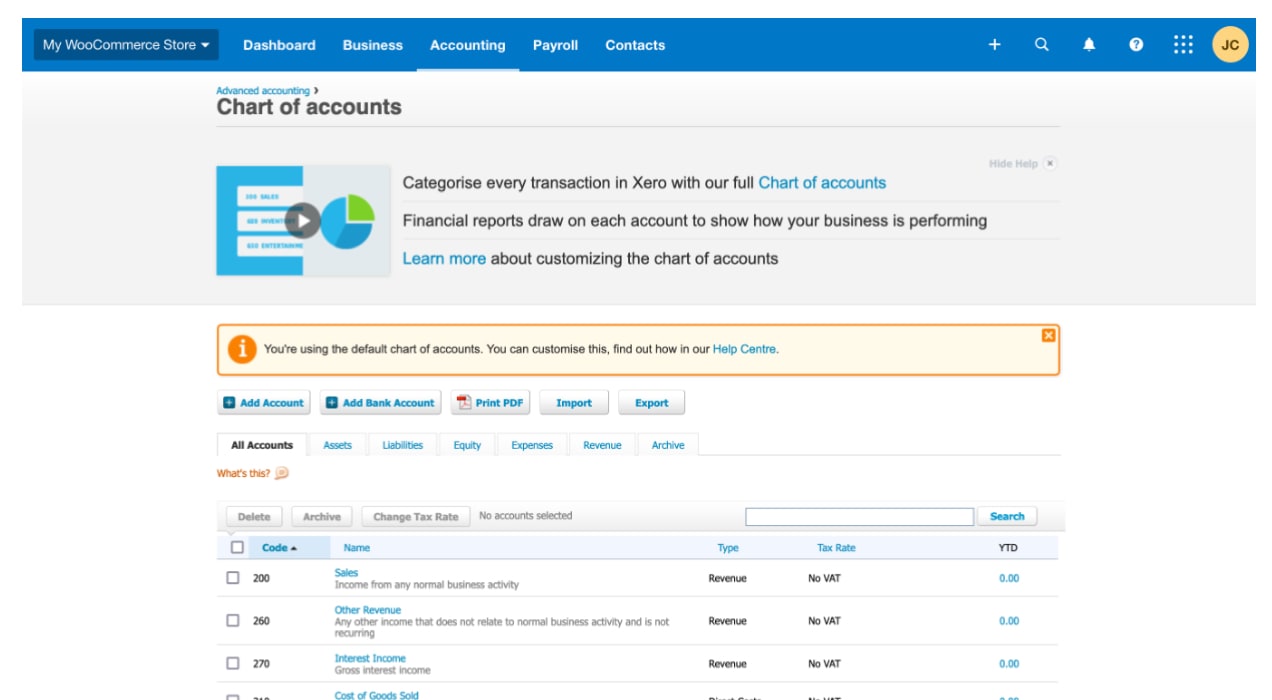

If you happen to count on to have tons of or hundreds of transactions per 30 days, you’re going to need accounting software program like QuickBooks On-line, Xero, or FreshBooks. Companies with fewer transactions can get away with utilizing an Excel spreadsheet, however a high-transaction enterprise received’t be capable of sustain with guide entries.

Ecommerce accounting software program automates many of the important accounting duties and simplifies your life. It data, shops, and retrieves monetary information and makes use of it to provide monetary experiences and statements.

If you happen to resolve to make use of accounting software program, you possibly can sync your retailer information with QuickBooks Sync for WooCommerce, Xero for WooCommerce, or WooCommerce FreshBooks.

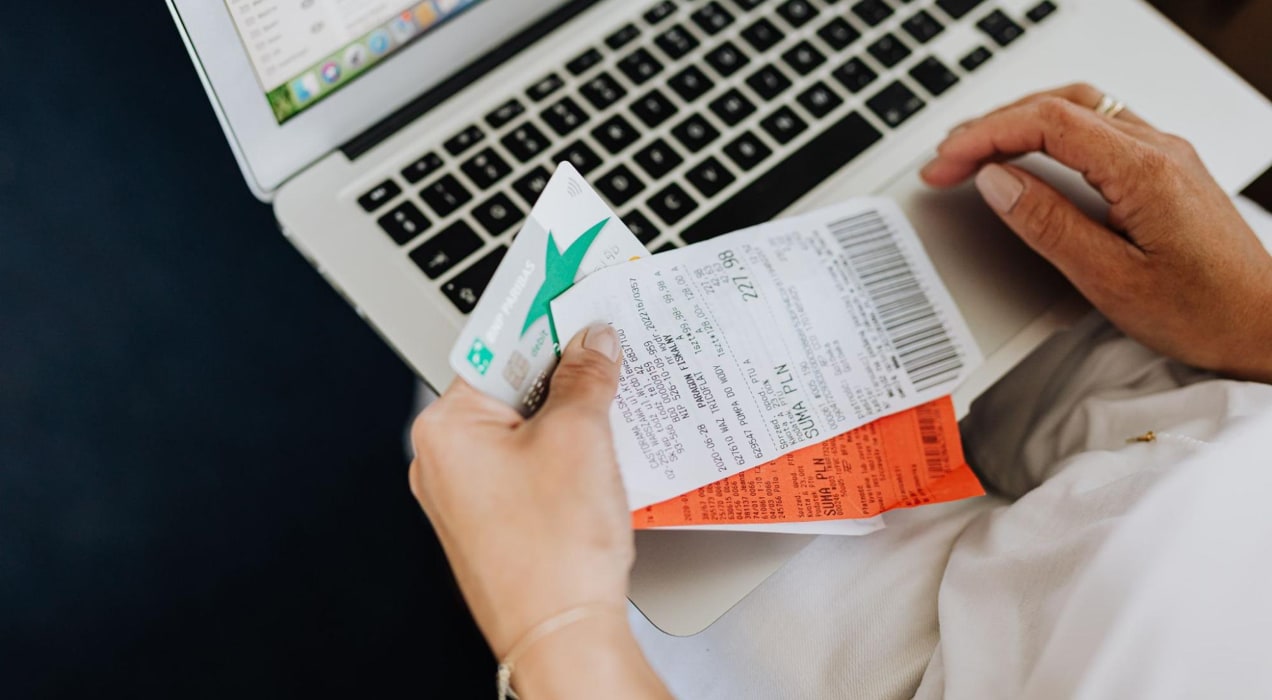

4. Hold all receipts, invoices, and cost data

The Reliability Precept of Accounting says that solely transactions with supporting documentation must be recorded. If you happen to don’t have data of a transaction, you possibly can’t depend it as revenue or an expense. If you happen to tried to say a tax deduction for an expense you don’t have any proof you ever paid for, that could possibly be known as tax fraud.

Hold bodily receipts. Or take images of them and retailer them digitally. Hold all emailed invoices and receipts in a separate electronic mail folder too, not simply your common inbox.

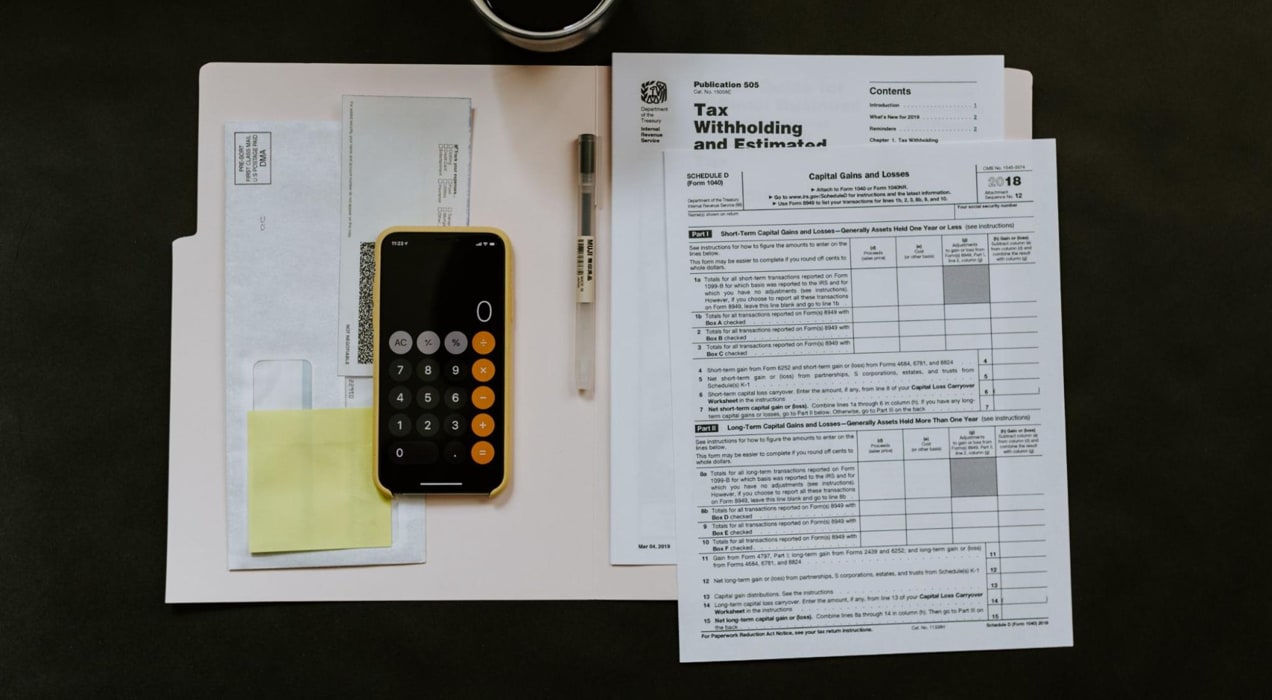

5. Begin being attentive to tax necessities

Tax necessities range dramatically relying on the kind of enterprise and the place it operates. That you must find out about gross sales tax compliance, import tax you probably have any worldwide transactions, tax withholding, quarterly taxes, and some other taxes particular to your nation, state, province, metropolis, or area.

These taxes will determine into your accounting software program and monetary reporting. It’s all the time really helpful to seek the advice of with a tax skilled to make sure you’re following the proper procedures.There’s much more to say about ecommerce tax administration. Listed here are two huge tax points you’ll should take care of:

Monitoring and paying gross sales taxes

Ecommerce gross sales taxes have turn into very sophisticated. Almost each US state now prices a web-based gross sales tax, and the EU additionally has a gross sales tax system.

Within the U.S., every state prices completely different charges, and has completely different necessities for when gross sales tax applies.

Paying estimated quarterly enterprise taxes

Enterprise revenue is pre-tax. Similar to a 1099 worker, your ecommerce enterprise makes cash earlier than any taxes are paid on that revenue.

And like a 1099 worker, it is advisable pay quarterly revenue taxes. If you happen to don’t, the federal government will penalize you for being late in your tax invoice.

How do you handle this? The thought is to keep away from falling means behind in your taxes. One of the simplest ways to handle quarterly taxes is to put aside a share of your revenue every month after which use that to pay estimated taxes every quarter.

Your accounting software program can simply handle all of this, in addition to the gross sales tax necessities. And talking of software program…

Why your ecommerce enterprise wants accounting software program

It’s price a while to revisit this query and ensure you understand the advantages of utilizing software program to assist handle your ecommerce accounting duties.

First, as you’ve simply seen, tax administration has turn into exceptionally difficult, particularly gross sales tax and income from a number of gross sales channels. In case your ecommerce enterprise sells merchandise throughout the US or in numerous states, you’ll not get pleasure from making an attempt to maintain up with this all by yourself. You could have a enterprise to run.

Your software program can even handle the quarterly tax allotment you’ll must pay revenue taxes, and can assist velocity up preparation of your year-end tax statements. And if you’re additionally topic to state and native taxes, that complexity mounts much more. The very best accounting software program can deal with all of those necessities.

Second, accounting software program makes it a lot simpler to trace your revenue and bills by creating monetary statements, so you recognize your month-to-month revenue margin and may see your corporation fairness.

Third, accounting software program helps handle payroll, together with contract staff. If you happen to don’t need to pay for ecommerce bookkeeping and accounting, you’ll undoubtedly want accounting software program.

Do you have to rent bookkeepers and accountants or DIY?

If you happen to don’t get accounting software program, or when you do get it however don’t need to be accountable for utilizing it, you’ll want a bookkeeper. However as your corporation grows, you’ll finally additionally want to take a look at a number of the many accounting corporations that perceive the nuances of ecommerce companies.

Many ecommerce enterprise house owners like the thought of working their very own present, together with performing because the Chief Monetary Officer, and so long as your corporation stays small, you would possibly be capable of get away with it. However let’s outline “small.”

With an ecommerce firm making even one thing like $100,000 per yr in web earnings, that’s already going to begin getting out of hand when it comes to your accounting system when you’re promoting merchandise in a number of states or nations. The gross sales taxes alone simply get too complicated.

You additionally should take care of delivery, returns, chargebacks, and all the remainder. Most ecommerce platforms promote lower-priced merchandise, and deal in quantity. Except yours is an exception to that, meaning you should have lots of transactions.

The extra transactions, the extra time it takes to trace and file all of it. And even a “small” ecommerce enterprise making simply $100,000 in web earnings per yr promoting merchandise that vary from $5 to $20 can have lots of transactions.

Now, if your corporation solely sells in a single area, state, province, or nation, your stage of tax complexity goes means down. In that state of affairs, you would possibly be capable of get away with doing it your self — if you need the additional work.

Check out your choice and see the way it goes. You’ll be able to all the time change your thoughts later.

WooCommerce has accounting coated

WooCommerce understands the accountability enterprise house owners have every day. Manually inputting transactions and creating monetary experiences may be time consuming and tax planning may give you a headache, however accounting is an important a part of working a profitable enterprise.

To take the burden off of retailer house owners, the world’s main ecommerce platform has quite a lot of extensions that automate key accounting processes. Go to this web page for a full checklist of accounting extensions for WooCommerce shops.