When U.S. shoppers have their on-line financial institution accounts hijacked and plundered by hackers, U.S. monetary establishments are legally obligated to reverse any unauthorized transactions so long as the sufferer experiences the fraud in a well timed method. However new knowledge launched this week means that for among the nation’s largest banks, reimbursing account takeover victims has change into extra the exception than the rule.

The findings got here in a report launched by Sen. Elizabeth Warren (D-Mass.), who in April 2022 opened an investigation into fraud tied to Zelle, the “peer-to-peer” digital fee service utilized by many monetary establishments that enables prospects to rapidly ship money to family and friends.

Zelle is run by Early Warning Companies LLC (EWS), a non-public monetary companies firm which is collectively owned by Financial institution of America, Capital One, JPMorgan Chase, PNC Financial institution, Truist, U.S. Financial institution, and Wells Fargo. Zelle is enabled by default for purchasers at over 1,000 completely different monetary establishments, even when an amazing many purchasers nonetheless don’t realize it’s there.

Sen. Warren stated a number of of the EWS proprietor banks — together with Capital One, JPMorgan and Wells Fargo — failed to offer all the requested knowledge. However Warren did get the requested info from PNC, Truist and U.S. Financial institution.

“General, the three banks that offered full knowledge units reported 35,848 circumstances of scams, involving over $25.9 million of funds in 2021 and the primary half of 2022,” the report summarized. “Within the overwhelming majority of those circumstances, the banks didn’t repay the purchasers that reported being scammed. General these three banks reported repaying prospects in solely 3,473 circumstances (representing practically 10% of rip-off claims) and repaid solely $2.9 million.”

Importantly, the report distinguishes between circumstances that contain straight up checking account takeovers and unauthorized transfers (fraud), and people losses that stem from “fraudulently induced funds,” the place the sufferer is tricked into authorizing the switch of funds to scammers (scams).

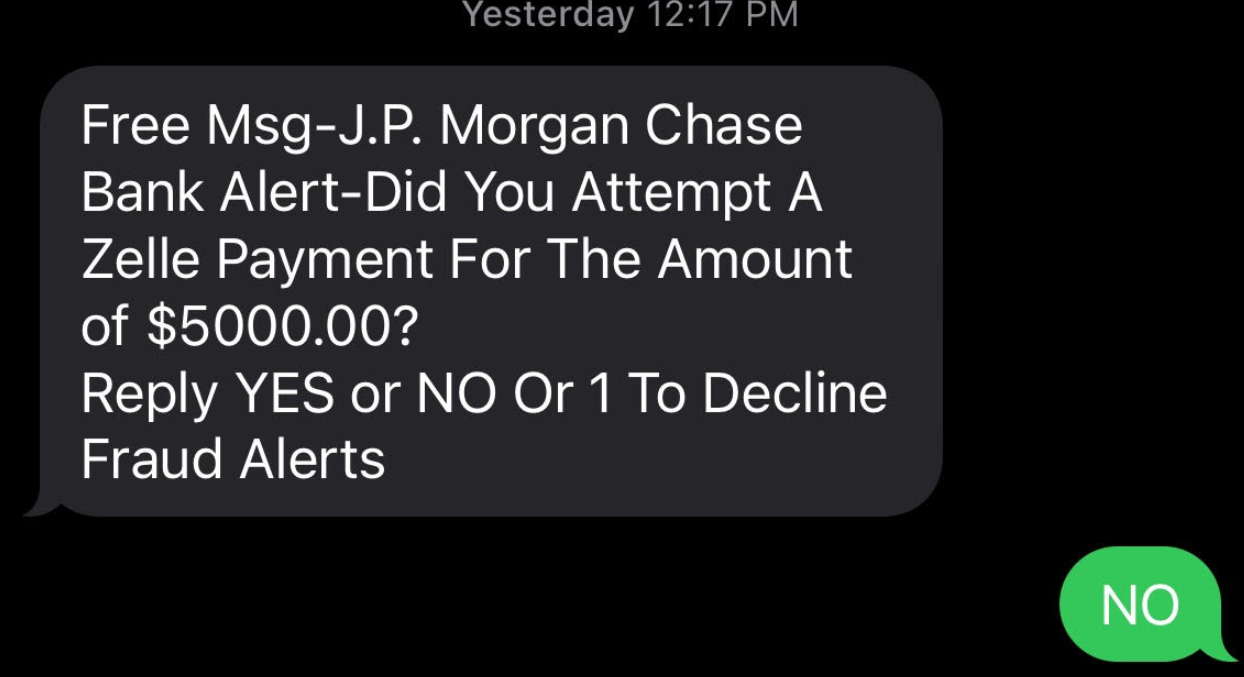

A typical instance of the latter is the Zelle Fraud Rip-off, which makes use of an ever-shifting set of come-ons to trick folks into transferring cash to fraudsters. The Zelle Fraud Rip-off usually employs textual content messages and telephone calls spoofed to seem like they got here out of your financial institution, and the rip-off often pertains to fooling the shopper into considering they’re sending cash to themselves after they’re actually sending it to the crooks.

Right here’s the rub: When a buyer points a fee order to their financial institution, the financial institution is obligated to honor that order as long as it passes a two-stage take a look at. The primary query asks, Did the request really come from a certified proprietor or signer on the account? Within the case of Zelle scams, the reply is sure.

Hint Fooshee, a strategic advisor within the anti cash laundering apply at Aite-Novarica, stated the second stage requires banks to present the shopper’s switch order a form of “sniff take a look at” utilizing “commercially cheap” fraud controls that typically will not be designed to detect patterns involving social engineering.

Fooshee stated the authorized phrase “commercially cheap” is the first motive why no financial institution has a lot — if something — in the way in which of controlling for rip-off detection.

“To ensure that them to deploy one thing that might detect a great chunk of fraud on one thing so arduous to detect they might generate egregiously excessive charges of false positives which might additionally make shoppers (and, then, regulators) very sad,” Fooshee stated. “This may tank the enterprise case for the service as an entire rendering it one thing that the financial institution can declare to NOT be commercially cheap.”

Sen. Warren’s report makes clear that banks typically don’t pay shoppers again if they’re fraudulently induced into making Zelle funds.

“In easy phrases, Zelle indicated that it will present redress for customers in circumstances of unauthorized transfers during which a consumer’s account is accessed by a foul actor and used to switch a fee,” the report continued. “Nevertheless, EWS’ response additionally indicated that neither Zelle nor its father or mother financial institution house owners would reimburse customers fraudulently induced by a foul actor into making a fee on the platform.”

Nonetheless, the info recommend banks did repay at the very least among the funds stolen from rip-off victims about 10 p.c of the time. Fooshee stated he’s stunned that quantity is so excessive.

“That banks are paying victims of licensed fee fraud scams something in any respect is noteworthy,” he stated. “That’s cash that they’re paying for out of pocket virtually solely for goodwill. You can argue that repaying all victims is a sound technique particularly within the local weather we’re in however to say that it must be what all banks do stays an opinion till Congress adjustments the regulation.”

UNAUTHORIZED FRAUD

Nevertheless, with regards to reimbursing victims of fraud and account takeovers, the report suggests banks are stiffing their prospects each time they will get away with it. “General, the 4 banks that offered full knowledge units indicated that they reimbursed solely 47% of the greenback quantity of fraud claims they obtained,” the report notes.

How did the banks behave individually? From the report:

-In 2021 and the primary six months of 2022, PNC Financial institution indicated that its prospects reported 10,683 circumstances of unauthorized funds totaling over $10.6 million, of which only one,495 circumstances totaling $1.46 have been refunded to shoppers. PNC Financial institution left 86% of its prospects that reported circumstances of fraud with out recourse for fraudulent exercise that occurred on Zelle.

-Over this identical time interval, U.S. Financial institution prospects reported a complete of 28,642 circumstances of unauthorized transactions totaling over $16.2 million, whereas solely refunding 8,242 circumstances totaling lower than $4.7 million.

-Within the interval between January 2021 and September 2022, Financial institution of America prospects reported 81,797 circumstances of unauthorized transactions, totaling $125 million. Financial institution of America refunded solely $56.1 million in fraud claims – lower than 45% of the general greenback worth of claims made in that point.

–Truist indicated that the financial institution had a a lot better document of reimbursing defrauded prospects over this identical time interval. Throughout 2021 and the primary half of 2022, Truist prospects filed 24,752 unauthorized transaction claims amounting to $24.4 million. Truist reimbursed 20,349 of these claims, totaling $20.8 million – 82% of Truist claims have been reimbursed over this era. General, nonetheless, the 4 banks that offered full knowledge units indicated that they reimbursed solely 47% of the greenback quantity of fraud claims they obtained.

Fooshee stated there has lengthy been quite a lot of inconsistency in how banks reimburse unauthorized fraud claims — even after the Shopper Monetary Safety Bureau (CPFB) got here out with steerage on what qualifies as an unauthorized fraud declare.

“Many banks reported that they have been nonetheless not residing as much as these requirements,” he stated. “Consequently, I think about that the CFPB will come down arduous on these with fines and we’ll see a correction.”

Fooshee stated many banks have just lately adjusted their reimbursement insurance policies to deliver them extra into line with the CFPB’s steerage from final yr.

“So that is on the right track however not with enough vigor and pace to fulfill critics,” he stated.

Seth Ruden is a funds fraud knowledgeable who serves as director of worldwide advisory for digital identification firm BioCatch. Ruden stated Zelle has just lately made “vital adjustments to its fraud program oversight due to client affect.”

“It’s clear to me that regardless of sensational headlines, progress has been made to enhance outcomes,” Ruden stated. “Presently, losses within the community on a volume-adjusted foundation are decrease than these typical of bank cards.”

However he stated any failure to reimburse victims of fraud and account takeovers solely provides to strain on Congress to do extra to assist victims of these scammed into authorizing Zelle funds.

“The underside line is that rules haven’t stored up with the pace of fee know-how in the US, and we’re not alone,” Ruden stated. “For the primary time within the UK, licensed fee rip-off losses have outpaced bank card losses and a regulatory response is now on the desk. Banks have the selection proper now to take motion and enhance controls or await regulators to impose a brand new regulatory setting.”

Sen. Warren’s report is out there right here (PDF).

There are, in fact, some variations of the Zelle fraud rip-off which may be complicated monetary establishments as to what constitutes “licensed” fee directions. For instance, the variant I wrote about earlier this yr started with a textual content message that spoofed the goal’s financial institution and warned of a pending suspicious switch.

Those that responded in any respect obtained a name from a quantity spoofed to make it seem like the sufferer’s financial institution calling, and have been requested to validate their identities by studying again a one-time password despatched by way of SMS. In actuality, the thieves had merely requested the financial institution’s web site to reset the sufferer’s password, and that one-time code despatched by way of textual content by the financial institution’s website was the one factor the crooks wanted to reset the goal’s password and drain the account utilizing Zelle.

Not one of the above dialogue includes the dangers affecting companies that financial institution on-line. Companies in the US don’t take pleasure in the identical fraud legal responsibility safety afforded to shoppers, and if a banking trojan or intelligent phishing website ends in a enterprise account getting drained, most banks is not going to reimburse that loss.

That is why I’ve all the time and can proceed to induce small enterprise house owners to conduct their on-line banking affairs solely from a devoted, entry restricted and security-hardened machine — and ideally a non-Home windows machine.

For shoppers, the identical outdated recommendation stays the most effective: Watch your financial institution statements like a hawk, and instantly report and contest any costs that seem fraudulent or unauthorized.