It’s all the time essential to know your clients’ perspective, particularly at key conversion factors like checkout. A essential a part of an efficient checkout expertise is offering a protected, simple methodology for purchasers to take a look at with the fee methodology of their selecting.

Deciding to simply accept cryptocurrency on WooCommerce is a superb step that may enable you meet this want and enchantment to a wider viewers. And relying on which cryptocurrency fee answer you select, your processes as a service provider may not look a lot completely different than conventional fee strategies. Nevertheless, clients paying with crypto will have a distinct expertise, and studying what that appears like may also help you turn into a greater retailer supervisor.

On this article, we’ll enable you perceive a fee transaction out of your clients’ perspective. With this data, you’ll be properly geared up to identify alternatives to extend your conversion charge, supply direct assist, and educate your clients and prospects.

Crypto vocab examine

You may dig into every of those phrases a bit additional right here. However right here’s a abstract of a very powerful phrases:

Public key: Primarily, the data somebody wants with a purpose to ship you cryptocurrency.

Public tackle: A hashed (mainly, shorter) model of a public key. That is what you may share with somebody who desires to ship you cash. Consider it as a Venmo username or PayPal.me hyperlink. (e.g., 0x12B0aD31f483Cdf4741de8f5679A472E5fe3345G)

Personal key: Permits a person to entry funds despatched to a public key. This could by no means be shared with one other social gathering.

Web3: Outlined by AP Stylebook, Web3 is a catchall time period for the prospect of a brand new stage of the web pushed by the cryptocurrency-related expertise, blockchain.

Web3 pockets (crypto pockets): Shops private and non-private keys for blockchain transactions.

Seed phrase: A listing of 12-24 randomly-generated phrases that grant entry to a Wweb3 pockets. This can be utilized to get better entry to a cryptocurrency pockets. This could by no means be shared with one other social gathering.

Non-custodial pockets: Customers personal their personal keys and possess full entry to their Wweb3 pockets. (e.g., Metamask, Belief Pockets.)

Custodial pockets: Personal keys are possessed by third-party corporations. (e.g., Coinbase, OpenNode.)

Peer-to-peer funds

You is perhaps pondering, “Isn’t a serious level of cryptocurrencies the truth that they’re peer-to-peer and don’t depend on third events?”

Sure, it’s completely doable so that you can obtain funds from a buyer while not having to make use of any third-party service or device.

Nevertheless, this merely isn’t real looking for the typical shopper. They’re not going to run their very own node, generate transactions from a terminal command line, and memorize their personal keys. Likewise, most retailers are joyful to pay a small transaction price with a purpose to give clients a low-friction expertise, whereas saving themselves a variety of time and power reconciling funds to orders.

So, this text focuses on typical ecommerce transactions utilizing instruments and companies most definitely to be adopted by newbie and intermediate-level customers.

Overview of constructing a crypto fee

From a buyer’s perspective, there are three steps:

- Get entry to a funded crypto pockets.

- Join their pockets.

- Full the fee and obtain a affirmation.

The particular expertise will depend on the fee processor and wallets concerned. Let’s run via a few examples and discuss what’s occurring at every step to your buyer.

1. Get entry to a funded crypto pockets

There are many choices for folk who need a crypto pockets. Every possibility comes with its personal options, advantages, and assist for various cryptocurrencies, chains, and fee experiences.

‘Conventional’ digital pockets suppliers like PayPal and CashApp now assist crypto funds. Business-leading crypto exchanges like Coinbase, Crypto.com, and Binance supply their very own apps, which additionally function fee wallets. Then there are crypto-native wallets like MetaMask, Rainbow, and plenty of others. You must do your individual analysis to find out the best choice or choices for you.

After selecting a pockets and getting it arrange, the subsequent step is so as to add some cryptocurrency to it so that you’ve got an accessible steadiness to spend. That is often a fast course of as a result of most wallets supply in-app buy choices.

So how does a buyer know which cryptocurrency so as to add?

It is a good query! Usually, it doesn’t truly matter, apart from charges that may add up in the event that they need to change currencies. Some crypto fee processors will present computerized change choices in order that clients will pay you in a single foreign money and also you obtain it in one other.

The place that’s not doable, most crypto wallets supply in-wallet change/swap performance in order that if a buyer holds bitcoin (BTC) however desires to pay in ethereum (ETH), they’ll make that swap simply. Ideally you’ll load the pockets with no matter foreign money you need to pay in, however that’s not all the time doable prematurely of deciding to make a purchase order.

2. Join their pockets to your web site

There are two most important ways in which a buyer can join their pockets to your web site: QR code or browser pockets join. Crypto fee processors might supply one or each of those as choices.

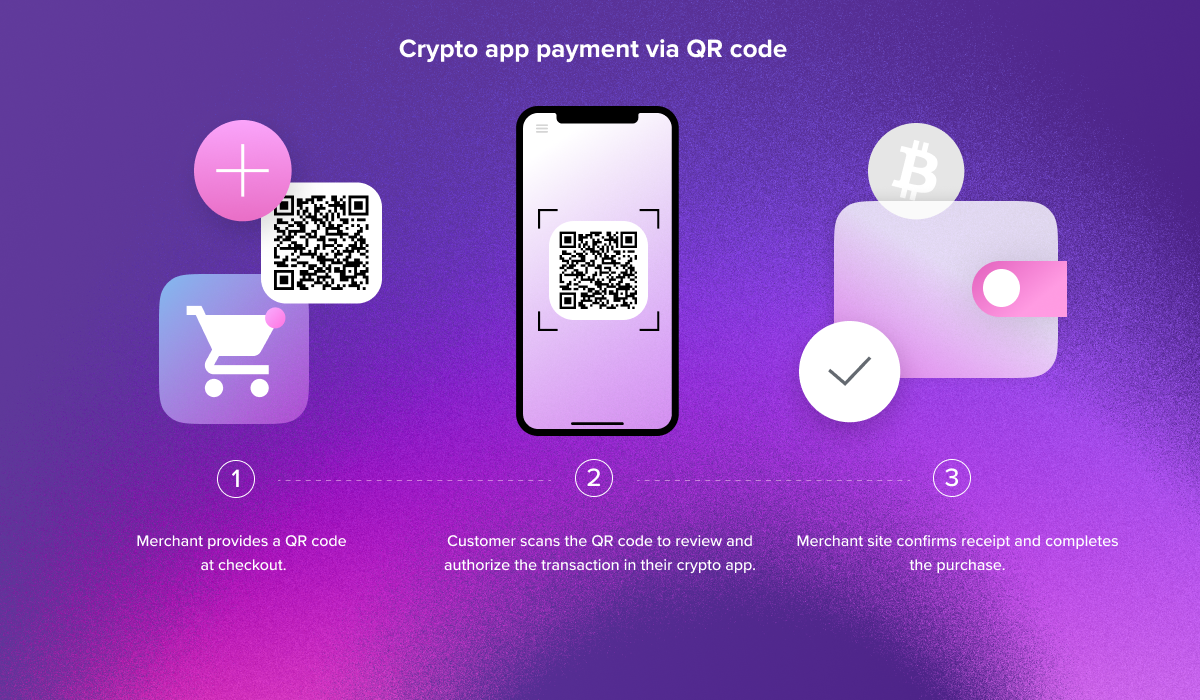

QR code

This route is greatest for purchasers who’ve their crypto pockets as an app on their cellphone. When somebody chooses to pay with crypto, they’re offered with a QR code that they’ll scan with a utility of their crypto pockets app.

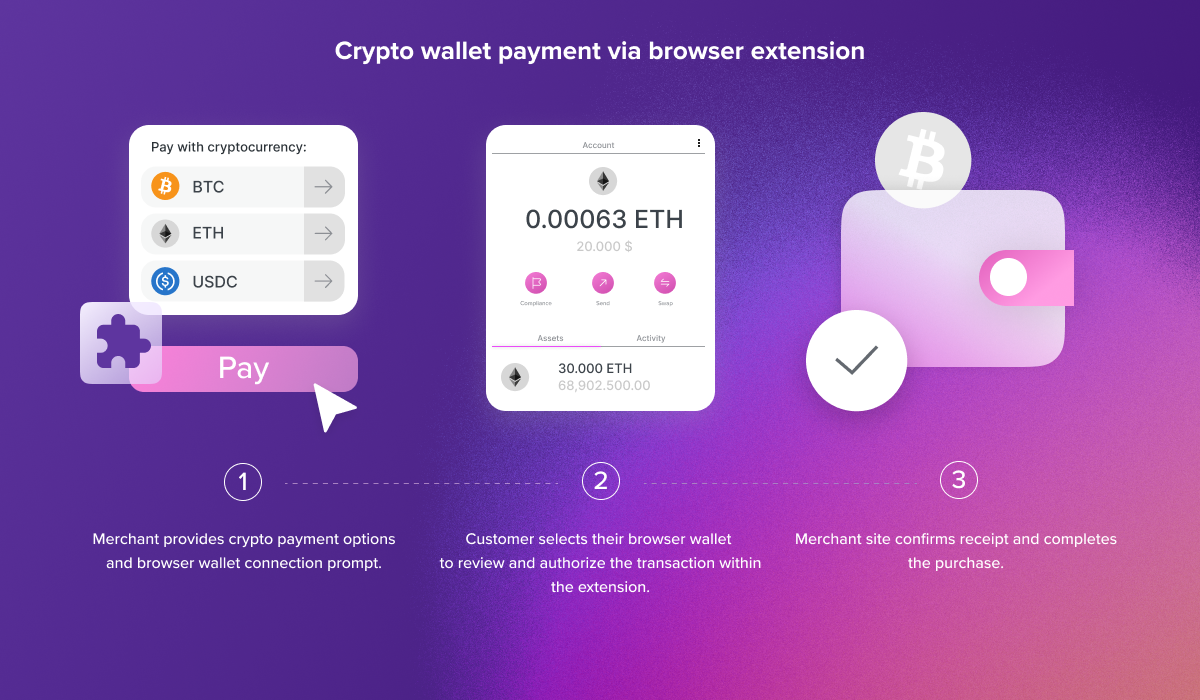

Browser pockets join

This route is greatest for purchasers who entry their crypto pockets by way of an online browser extension. When somebody chooses this route, they’re prompted to attach their Web3 pockets by clicking a button, which invokes the browser pockets and asks for authorization to attach.

3. Full the fee and obtain a affirmation.

Whichever route the client follows, the pockets will then present prompts that information them via making fee – both within the app or the browser.

As soon as fee is made, there is usually a delay (often solely seconds) earlier than fee is confirmed by the blockchain. At this level, you and your buyer will each obtain a affirmation. The place transactions are made straight on-chain, you could each additionally obtain a blockchain transaction ID.

And that’s it!

What do crypto funds processes imply for retailers?

There’s an enormous distinction between a buyer who’s already acquainted with crypto and is able to full a transaction and somebody who’s by no means used crypto earlier than. Getting arrange with a crypto pockets, funding it, and understanding the method to finish a transaction are all boundaries to entry.

At first, most crypto funds are prone to come from extra skilled crypto customers. Over time, this quantity is predicted to develop considerably. So, in case your followers and clients have indicated that they’re all for crypto, it could be worthwhile to direct them to respected sources to allow them to learn to pay you in the way in which they like.

Advantages of crypto fee choices to your clients

Within the first article on this collection, we explored causes that accepting crypto is sensible for a lot of retailers. However why would your clients need to pay in crypto?

- They maintain crypto and need to spend it! Maybe they had been an early investor, they’re a terrific dealer, or they receives a commission in crypto.

- It’s cheaper for them to spend crypto straight than to simply accept change and/or foreign exchange charges for conventional funds. This may be significantly true for worldwide clients.

- They might not have entry to different fee strategies.

- They might want to maintain sure transactions personal or separate from their different monetary actions.

- They really feel it’s extra handy and safe.

- They worth having the ability to transact with out paying charges to conventional monetary service suppliers (i.e., they’re ideologically-driven).

- There are not any limits to day by day fee quantities – this significantly applies to high-cost, luxurious gadgets that may exceed a person’s day by day banking limits.

- They’re paying for a digitally-native asset like an NFT.

Buyer issues to remember

As you’ll be able to see, there are a variety of choices with regards to crypto funds from a buyer expertise. Listed here are some issues which can be price taking into account when selecting and working crypto funds:

- How simple is it to your clients to pay, and with which cryptocurrencies?

- Do your clients get publicity to crypto community charges straight? This may make it costlier for them to pay if a crypto community may be very busy.

- Are you clear about dispute decision? That is significantly essential within the absence of conventional refund and chargeback choices. Annoyed or sad clients usually tend to complain and go away detrimental evaluations.

- How lengthy will clients want to attend on order affirmation? Relying on the way you’re permitting clients to pay, they might want to attend longer than regular. Once more, that is the place utilizing a funds accomplice may also help, as they’ll typically maintain each charges and affirmation instances very low.

- Do consumers want training? Clients might respect training about how they’ll pay with crypto, together with steering on safety and avoiding scams.

Confidently assist your clients embrace the way forward for funds

Retailers can select crypto fee processing choices which can be easy and acquainted. Clients, then again, could have a distinct fee expertise.

There are thousands and thousands of crypto customers who’re already prepared, prepared, and capable of pay with crypto. Whereas crypto fee choices have gotten simpler and less complicated, it’s nonetheless essential for retailers to know their clients’ experiences and the implications of their choices with a purpose to profit from this new progress alternative.

Able to get began? View crypto funds extensions.

Be taught extra about why it’s time to begin accepting cryptocurrencies and how to decide on a cryptocurrency funds supplier.