Obtain the Databricks Insurance coverage NLP Resolution Accelerator

Introduction

The present financial and social local weather has redefined buyer expectations and preferences. Society has been compelled to change into extra digital, and this extends to customer support in insurance coverage corporations.

Nonetheless, there’s a important problem in approaching this concern with a data-driven mindset. Traditionally, structured information has been the primary ingredient that permits corporations to research the previous to be able to perceive and predict the long run. By leveraging Pure Language Processing (NLP), corporations can analyze completely different sources of unstructured information generated by clients, similar to audio from telephone calls and free textual content from chat messages.

Pure Language Processing (NLP) refers to a set of applied sciences that allow computer systems to grasp, interpret, and generate human language. Within the insurance coverage business, NLP can be utilized to automate duties that require understanding and processing massive quantities of written or spoken language, notably in customer support, claims processing, and underwriting.

Right this moment, clients have completely different expectations relating to product customization and worth. They like insurance coverage built-in into their each day lives fairly than one thing they renew annually. A seamless buyer expertise is now anticipated, with 58% of customers stating that their customer support expectations are increased than they had been a 12 months in the past, based on TalkDesk. One other report from Bain & Firm reveals that globally, 59% of 28,765 customers in 14 nations need life insurers to reward them for wholesome dwelling.

From the angle of insurance coverage suppliers, maintaining with buyer calls for may be difficult. Forrester estimates that 53% of assist groups have seen a rise in assist queries because the pandemic began. Offering a digital, self-service expertise turns into paramount to be able to cut back strain on insurance coverage contact facilities.

Insurance coverage corporations have been utilizing chatbots and IVRs for years to answer buyer queries about widespread insurance coverage matters similar to checking the standing of a declare, reporting claims, and understanding insurance coverage protection. Nonetheless, the problem is to make sure that IVRs present an attractive person expertise with out overwhelming customer support brokers with an excessive amount of complexity and overhead. In line with Oliver Wyman, a lot of the ache factors leading to a less-than-ideal buyer expertise are as follows:

- Screening: Buyer chatbots usually battle to interpret extra complicated buyer requests. These chatbots could have restricted comprehension capabilities, making it troublesome for them to grasp the explanation behind a buyer’s name. Giant Language Fashions (LLMs) have proven improved capabilities in comparison with conventional Pure Language Processing (NLP) on this space.

- Routing: There’s restricted routing of consumers, because the chatbot could not absolutely perceive the character of the client request, ensuing within the buyer being routed to an individual, and probably ready on maintain once more.

- Decision: Customer support brokers lack important instruments to resolve inquiries rapidly. Chatbots could not precisely summarize buyer requests, retrieve insurance coverage paperwork to confirm protection, or present an inventory of related options for the agent. In consequence, brokers could have to ask the client to repeat the explanation for calling, inflicting additional delays as they retrieve the client’s coverage and related particulars, to not point out degradation of the customer support expertise.

To enhance the client expertise, insurance coverage corporations ought to contemplate leveraging extra superior applied sciences, similar to LLMs, to reinforce chatbot comprehension and routing capabilities. Offering brokers with complete instruments that permit fast entry to buyer data and related sources also can assist streamline the decision course of.

It may be daunting for insurers to outline the most effective technique for offering higher buyer expertise and care, whereas coping with the challenges of scaling and coaching their customer support workforce. Find out how to correctly steadiness the 2 sides of this coin? And most significantly, the place to begin?

Potential Outcomes of Making use of NLP to Buyer Service

Investing in a holistic digital transformation technique might help insurance coverage corporations seamlessly scale their operations whereas shifting budgets and human sources from operational processes to precise product and worth creation. Within the context of customer support, one of many key issues when formulating such a method is name deflection. By understanding widespread buyer ache factors and empowering them with self-service channels, insurance coverage corporations can scale extra simply whereas offering a sooner and extra related buyer expertise.

To use digital transformation to customer support within the insurance coverage area, we have to perceive why clients are getting in contact. For example, we would need to know:

- What are the highest 10 causes for buyer calls?

- What number of clients are calling for help with auto insurance coverage versus different forms of merchandise, similar to life insurance coverage or medical insurance?

- How are these distributions altering month-over-month or year-over-year?

These insights will permit us to formulate a correct technique for customer support, in addition to different areas similar to advertising and value. Moreover, we will analyze which merchandise or matters are probably problematic, similar to when there are too many contact re-occurrences from the identical buyer. Lastly, we have to examine whether or not our customer support staff is well-prepared to serve our clients.

Doing this type of evaluation requires organizations to transform uncooked textual content into well-understood statements (categorized textual content) and depends on structured information. Within the context of pure language processing, transformer fashions –similar to BERT, GPT, and ChatGPT– have made it attainable for corporations to extract precious, structured insights from this kind of information at an unprecedented scale. These fashions permit for simple classification of buyer utterances based mostly on particular buyer intents, in addition to gauging buyer sentiment.

Implementation Challenges & Motivation

As soon as an organization understands its clients, it might probably transfer to the appropriate facet of the Knowledge and AI Maturity Curve. Pure Language Processing (NLP) and Transformer fashions can help in automating buyer experiences, similar to utilizing chatbots for engagement, and personalization, similar to predicting buyer intents and their subsequent interactions based mostly on prior historical past. Regardless of the potential of NLP and Transformers, the present adoption panorama in most enterprises exhibits that there’s a important untapped alternative. In line with McKinsey, as of the tip of 2022, solely 11% of enterprises have or plan to incorporate Transformer fashions as a part of their AI merchandise.

Resolution

We’re happy to announce the launch of a brand new Resolution Accelerator specifically designed to set the technical finest practices and reusable capabilities across the creation and upkeep of NLP and Transformers fashions for insurance coverage name heart analytics. The answer accelerator is a set of artifacts (information, notebooks, code, visualizations) that provides corporations a head begin on growing and deploying a machine studying answer. Within the following sections, we’ll take a look at the completely different parts of this answer accelerator.

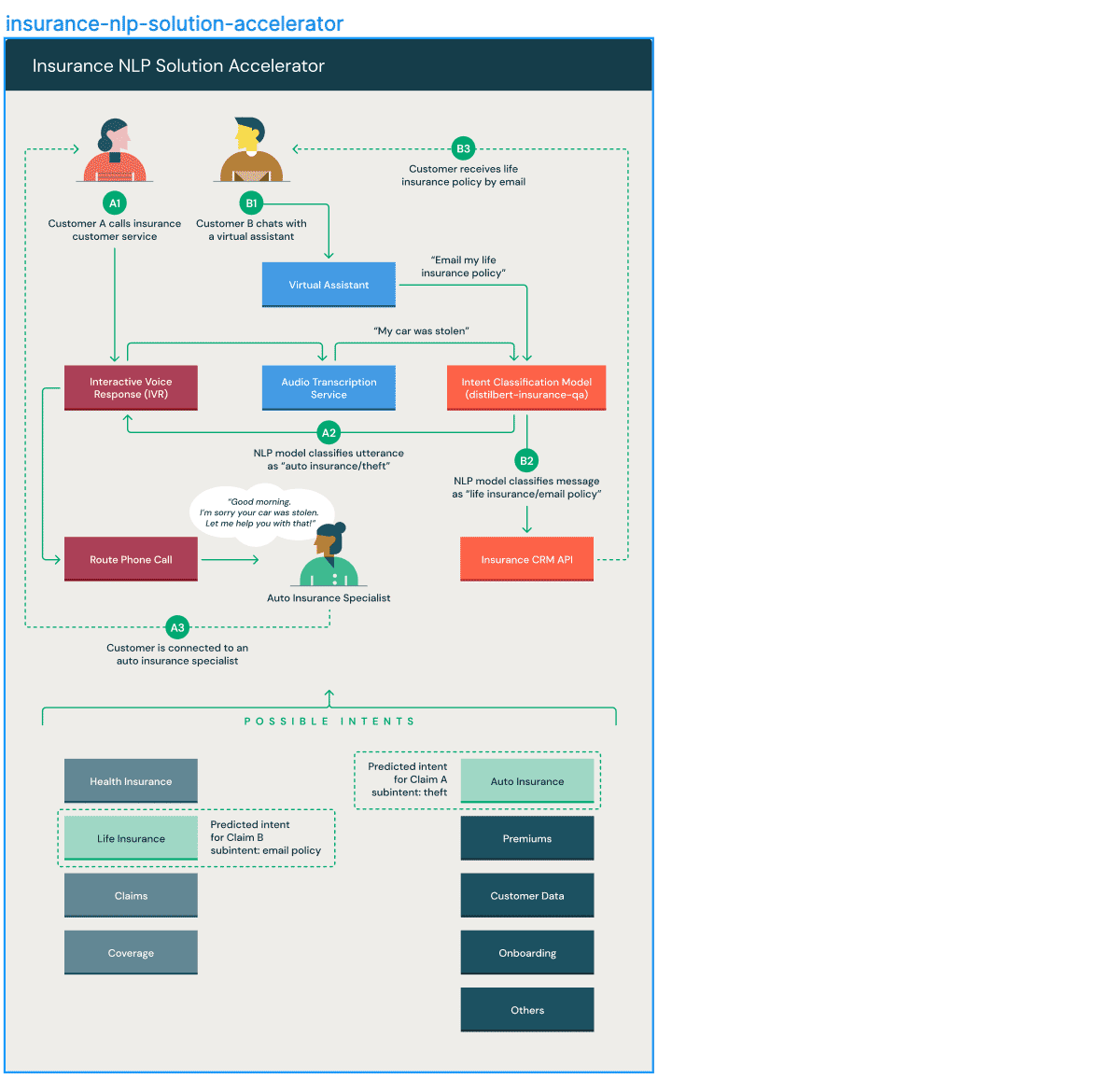

The aim of this answer accelerator is twofold:

- Detecting buyer intents at scale based mostly on textual information from an Interactive Voice Response (IVR) stream or preliminary interactions between a buyer and a service agent.

- Classifying opening sentences from clients to a customer support chatbot in real-time.

Conclusion

In conclusion, the capabilities of NLP, Transformers, and Giant Language Fashions (LLMs) will proceed to evolve. Nonetheless, it is essential to notice that no insurance coverage firm possesses excellent information. Current adjustments within the macroeconomic surroundings, similar to inflation, provide chain disruptions, evolving loss tendencies, and the affect of local weather change on catastrophes, together with workforce adjustments and updates in underwriting guidelines and protection eligibility standards, have drastically altered insurers’ enterprise combine. In consequence, historic information could not successfully generalize to future eventualities.

Insurers have two choices: they’ll both purchase exterior or third-party information to complement their structured information derived from operational methods (similar to insurance policies, exposures, premiums, protection, and claims), or they’ll improve their inside structured information with inside unstructured information, together with voice calls/audio, pictures, textual content, and movies.

Abstract

Our aim with this answer accelerator is to display how straightforward it may be to attain digitization capabilities by using buyer unstructured information and leveraging NLP, Transformers, and a Lakehouse platform.

To get began on growing and deploying a machine studying answer for detecting buyer intent based mostly on items of textual content from an Interactive Voice Response (IVR) stream or from a digital agent, obtain the Insurance coverage NLP Resolution Accelerator.