Join day by day information updates from CleanTechnica on electronic mail. Or comply with us on Google Information!

After the subsidies-derived gross sales rush of December, Germany’s plugin car (PEV) market was sure to have a hangover month in January. And it did, by scoring some 37,000 registrations. Whereas that could be a 40%-plus improve over the January 2023 consequence, you will need to keep in mind that a yr in the past, the German EV market was experiencing one other hangover month, associated to the top of PHEV subsidies in December 2022. So, evaluating January 2024 with January 2022, this yr there was a 9% drop. So, one can say that the elimination of incentives, each to BEVs (finish of 2023) and PHEVs (finish of 2022), pulled the market backwards by two years. January 2024 seems to be extra like January of 2022 than January of 2023.

One instance of that’s the restoration of plugin hybrids (PHEVs), which jumped this yr by 63% YoY. In the meantime, full electrics (BEVs) had been up “simply” 24%, to 22,474 items. Pure electrics thus began the yr shedding a good portion of their benefit in comparison with plugin hybrids (61% vs 39% in 2024, in opposition to 67% vs 33% in 2023).

Having mentioned that, the BEV vs PHEV ratio isn’t as balanced because the lead to January 2022 (53% vs 47%) and 2022 as a complete (56% vs 44%). It appears evident that with BEVs shedding entry to subsidies in 2024, PHEVs will recuperate a part of their significance in Germany.

This efficiency allowed the plugin car (PEV) share to start out the yr at 17%, with BEVs alone hitting 11%. That’s under the January 2022 market share (22% PEV, 11% BEV), however anticipate these numbers to climb all year long, finally surpassing final yr’s consequence (25% PEV, 18% BEV), and perhaps even that of 2022 (31% PEV, 18% BEV), which is the present excessive mark. We should always see a couple of 40%-plus months in Germany in 2024, particularly in the direction of the top of the yr.

Trying on the January greatest sellers, we must always make a disclosure first: with a number of manufacturers taking part in the “pre-registration” sport on the finish of 2023, don’t give an excessive amount of worth to those preliminary outcomes, as they might be impacted by the earlier pre-registrations.

Nonetheless, there are a couple of traits which are already seen, considered one of them being the race between Tesla and Volkswagen Group. However whereas on paper all appears the identical as final yr, trying nearer, there are a couple of variations.

The Tesla Mannequin Y as soon as once more began the yr on high, however whereas it had an incredible 4,108 registrations final January, this time it “solely” bought 2,393 registrations. And whereas final yr’s consequence might need already settled the dialogue relating to the 2023 greatest vendor title (in January), this yr, the advance that Tesla’s crossover has is a few 900 items. Whereas already vital sufficient to position it as the primary candidate for this yr’s title, this nonetheless permits some hope for the competitors….

… Particularly, January’s silver medalist, the Skoda Enyaq. With 1,457 registrations, it doubled the variety of registrations it had in the identical interval final yr. The posh Audi This autumn e-tron additionally began its profession in 2024 on the fitting foot, by delivering 1,424 registrations. That’s twice as many as twelve months in the past, and it allowed Audi to complete January within the final place on the rostrum.

As for the anticipated Volkswagen Group greatest sellers, the VW ID.3 and ID.4, properly … it was a gradual month. The hatchback began the yr in #17 with 507 items, its worst lead to nearly two years. Its crossover sibling, which was 18th in January, had 504 registrations, additionally underperforming.

Plugin hybrids had been again within the high spots, with the Ford Kuga PHEV main the pack in 4th with 1,067 registrations, adopted by a pack of Mercedes PHEV fashions (GLC in fifth, E-Class in ninth, GLE in thirteenth, C-Class in fifteenth). This brings one other 2022 flashback, as a result of whereas in January 2023 there have been solely 4 PHEVs within the high 20, and solely considered one of them was a Mercedes, in January 2022, there have been six PHEVs, with three of them being Mercedes (GLC, GLE, A-Class). So, now we now have seven PHEVs and 4 Mercedes fashions….

The German model appears to be the one one taking full revenue from the PHEV know-how, helped by the truth that its PHEV fashions have usable electrical vary (over 100 km of WLTP electrical vary), which is because of 25 to 30-ish kWh batteries and fast-charging capabilities. Whereas nonetheless under the specs of the very best Chinese language EREVs, they stand one degree above their legacy OEM competitors, which have their PHEVs nonetheless within the 15-ish kWh ranges.

However it wasn’t solely within the PHEV class that Mercedes had month, as a result of the compact EQA electrical crossover ended the month in seventh, with 803 registrations, twice as many because it had a yr in the past when it began 2023 in nineteenth.

Heck, even the large Mercedes EQE had a robust begin, ending January in 14th with 656 gross sales, permitting it to be 4th within the full dimension class.

And that is one other early pattern that we are able to see. As a result of the BEV subsidies had a worth cap that excluded a lot of the full dimension fashions, there was no end-of-year gross sales rush in that class, which meant that gross sales stored on getting into January like nothing had occurred. Add this to the gross sales hangover in decrease classes, and this month we see full dimension fashions over-represented, with 4 full dimension fashions within the high 20, three of them coming from Mercedes (#9 E-Class, #13 GLE, #14 EQE). The 4th consultant was the longtime class chief, the Audi Q8 e-tron, which as soon as once more began the yr within the lead, in eighth, with 759 registrations.

Within the second half of the desk, the #16 Cupra Formentor PHEV continued to promote fairly properly in Germany, scoring 518 registrations in January. Within the final positions on the desk, two fashions made a shock look, with the Volvo XC60 PHEV exhibiting up in #19, with 501 registrations, whereas a place under, the Opel Astra confirmed up for the primary time with 498 registrations, divided between 389 PHEVs and 109 BEVs.

Simply outdoors the highest 20, in #21, we now have the Porsche Cayenne PHEV, with 495 registrations, the mannequin’s greatest rating since December 2021. Just one unit behind, we discover the #22 Volvo EX30. In its first quantity month, the EX30 had 494 registrations. A lot is predicted from the compact Volvo, and a high 20 place in Germany appears properly inside attain.

Lastly, the Renault Megane EV had a strong 471 gross sales in January. The compact hatchback appears to be doing its job of holding down the (Renault) fort, not less than till the upcoming (and tentative worth for cash king) Scenic land. Relating to the Renault 5’s profession in Germany, it’s a huge unknown, as a result of whereas the Zoe was greatest vendor materials in its heyday, having been the #1 EV in Germany from 2018 till 2020, the market has moved on since then, and one wonders how a lot of an impression the French EV could have in 2024. Focus on.

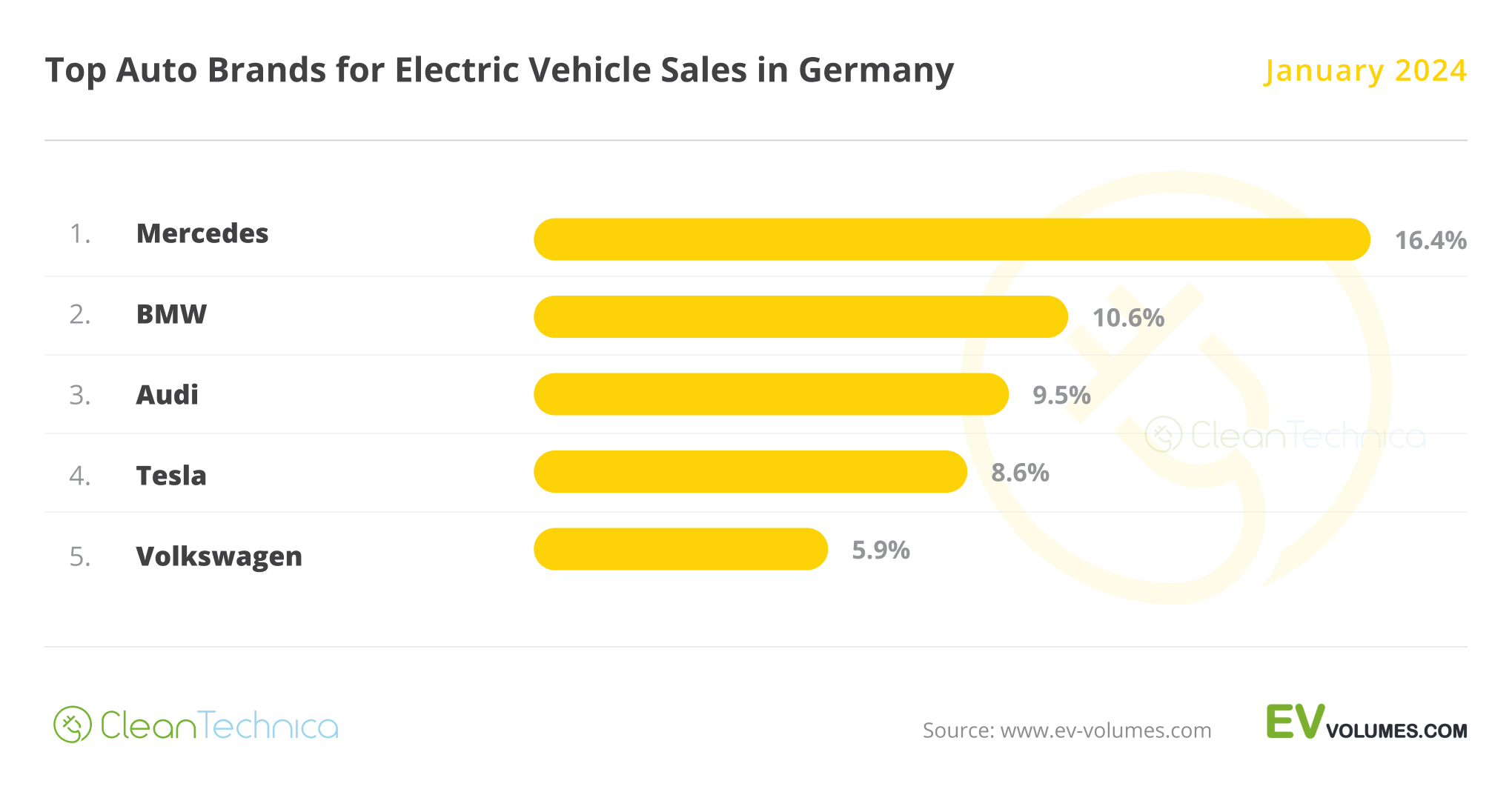

Within the model rating, high-voltage Mercedes (16.4%) shocked the competitors, beginning the yr within the lead with a big benefit over BMW (10.6%). Does this imply that the three-pointed-star make will lastly win the model title? As for BMW, regardless of ending January in 2nd, it was nonetheless a constructive begin for the Bavarian make, particularly contemplating {that a} yr in the past it was in fifth with 5.2% share.

Audi (9.5%) profited from sturdy outcomes from the This autumn e-tron and Q8 e-tron to start out the yr within the final place on the rostrum, adopted by Tesla in #4 (8.6%). The US make’s efficiency this January pales subsequent to what it had a yr in the past, when it began in #1 with 17.1% share, however the yr remains to be younger and it’ll have loads of time to recuperate.

The identical may be mentioned about Volkswagen, which began the yr in an atypically low fifth place, with simply 5.9% share, removed from the 13.4% share it had twelve months in the past.

These final two manufacturers could have loads of time to recuperate all year long, however this serves additionally to spotlight that right here, too, it’s a return of some kind to 2022. Whereas the present #1 and #2, Mercedes and BMW, began 2023 in third and fifth, respectively, on this identical interval in 2022, they had been really in the identical positions as they’re in 2024, with Mercedes main on the time with 13.1% share, adopted by BMW with 10.1%. (this was the final “Nice Scott!” second, I promise)

Outdoors the highest 5, a point out goes out to the great second Volvo (5.1%) had. It may benefit from the longer term success of the EX30 to have a go at reaching the #5 spot.

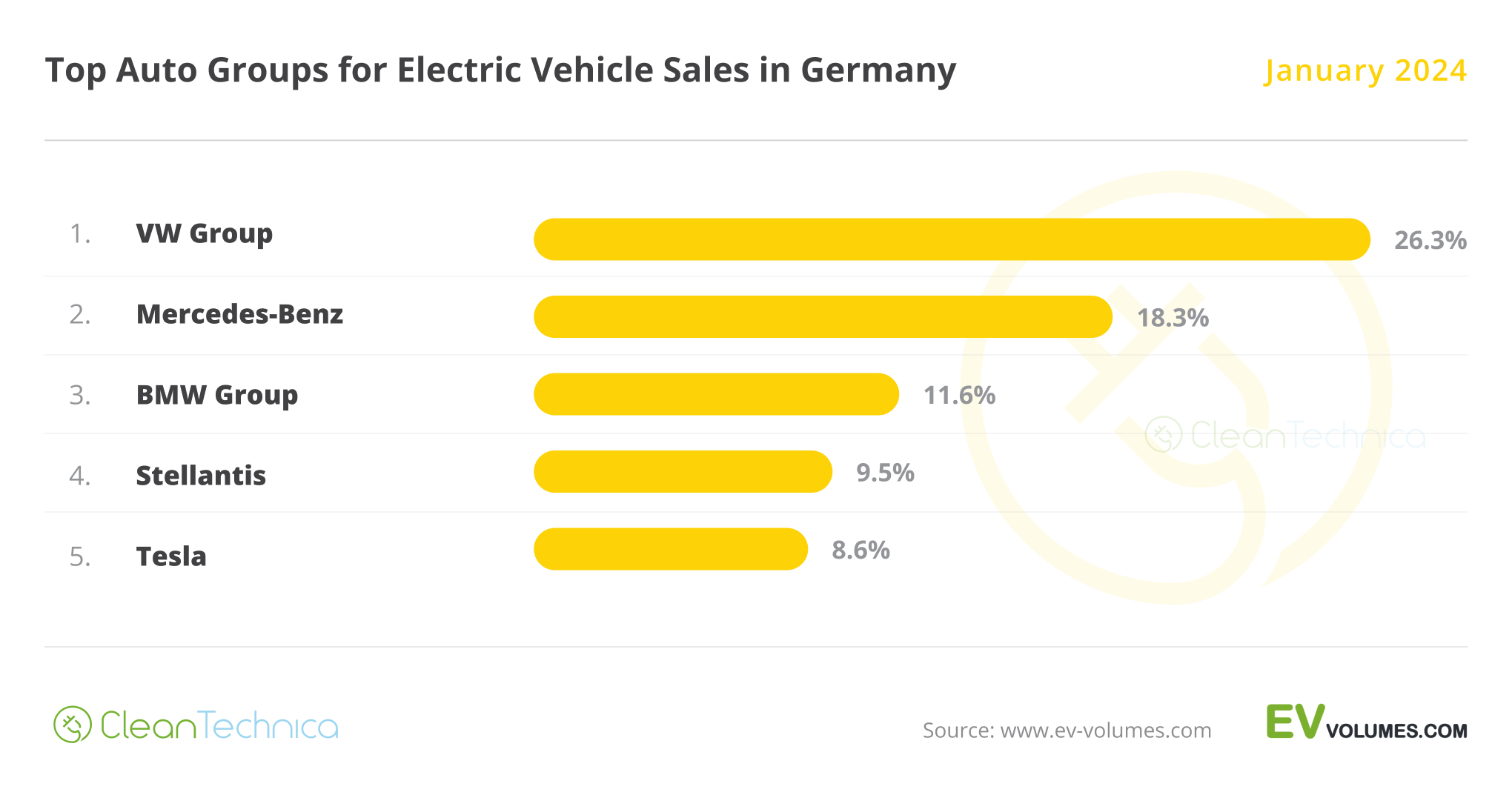

OEMs, Volkswagen Group (26.3%) began the yr in its ordinary place. Nevertheless, the rise of #2 Mercedes–Benz, at 18.3% share, surged it into 2nd place. Volkswagen Group shouldn’t be complacent with its Stuttgart rival competing for the OEM title in Germany.

BMW Group was third, with 11.6% share, with the German OEM enhancing its rating considerably over the identical interval final yr (6.4%).

In 4th we now have Stellantis (9.5%), adopted by Tesla (8.6%), with the Korean Hyundai-Kia Group at present sixth, with 6.6% share.

Have a tip for CleanTechnica? Wish to promote? Wish to recommend a visitor for our CleanTech Speak podcast? Contact us right here.

Newest CleanTechnica TV Video

I do not like paywalls. You do not like paywalls. Who likes paywalls? Right here at CleanTechnica, we applied a restricted paywall for some time, however it all the time felt fallacious — and it was all the time robust to resolve what we must always put behind there. In idea, your most unique and greatest content material goes behind a paywall. However then fewer individuals learn it!! So, we have determined to utterly nix paywalls right here at CleanTechnica. However…

Thanks!

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.