Tech-savvy Nordic customers actively embrace change. This extends to on-line checkout too, with most of the area’s e-shoppers now preferring Various Funds Strategies (APMs) to conventional playing cards.

Let’s take a deep dive into the Nordic funds market and uncover what’s fueling this disruptive pattern.

Supply: Nordic Embassy

Supply: Nordic Embassy

The Nordic international locations – Denmark, Finland, Norway, Sweden, and Iceland – could also be comparatively small, however mixed, they symbolize the world’s 10th largest economic system. Its customers have huge shopping for energy too, with the biggest spend per capita on the continent, 78% increased than the EU common.

The area’s companies and customers are hungry for recent concepts and tech-innovation, constantly placing it within the international high ten for digital competitiveness.

This, along with excessive web and cell penetration, has helped make it one of many world’s most mature eCommerce markets. In 2021, Nordic eCommerce accounted for roughly one-fourth of Nordic companies’ complete revenues.

Nordic customers actively embrace fee change

The area is a hotbed of banking, cell, and fintech innovation. Whereas different international locations battle with monetary underserving, the Nordics have loved many years of far-reaching banking providers, with Norway boasting 100% inclusivity.

In contrast to many change-resistant Western markets, Nordic customers are extremely receptive to new methods to pay. In consequence, its customers adopted digital funds and contactless a lot quicker and extra extensively than in different mature markets. A lot so, that it leads the worldwide drive in direction of a totally cashless economy.

All of this has created an ecosystem that has seen explosive development in APMs

APMs are methods to pay that fall exterior money or international card schemes (Visa, MasterCard, American Categorical) and embody pay as you go playing cards, cell funds, e-wallets, financial institution transfers, and purchase now, pay later (BNPL) prompt financing.

For a few years, Nordic governments and banks have been selling digital and cell funds as options to money, collaborating on initiatives like debit card schemes, digital banking IDs, and customary funds infrastructure. Their success signifies that cell fee adoption now surpasses many of the EU, together with bigger economies equivalent to Germany and France.

Standard funds are being disrupted

Historically, fee playing cards have dominated Nordic client preferences. In Norway, adults maintain, on common, 4 playing cards (2.7 debit playing cards and 1.6 bank cards) – the best quantity in Europe.

Throughout the area, international card schemes have 22 million bank cards, with Mastercard as the principle participant. Excessive-interest charges, low loss ranges, and revolving balances assist bank card profitability in Norway. In Sweden, nonetheless, customers have many different choices for short-term borrowing, whereas elsewhere, interchange caps have meant issuers proceed to battle to boost margins.

In Finland, debit playing cards now command the most important share of card quantity. Each right here and in Denmark, dual-function debit/bank cards assist discourage customers from counting on credit score. Debit playing cards even have deep penetration, particularly with home schemes like BankAxept in Norway and Dankort in Denmark.

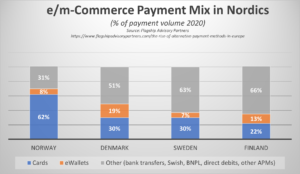

Transfer away from bodily retailing – to on-line and cell channels – and a brand new sample is rising. Card use is falling behind, and APMs are beginning to push out in entrance.

Nordics’ altering checkout combine

Nordic customers, accustomed to the convenience and comfort of banking and procuring on their telephones, are actually selecting new various fee choices that higher match their wants – for entry, comfort, price, and velocity.

In Denmark, Finland, and Sweden, APMs now dominate on-line checkout share. In lots of instances, volumes are transferred to credit score/debit-linked digital wallets. As well as, new strategies, together with interest-free credit score like BNPL, are beginning to pull a bigger slice of transactions on the checkout.

Supply: Flagship

In the meantime, in Norway, fee preferences are shifting away from money and bank cards to digital wallets and purchase now, pay later choices (BNPL). Its neighbor Denmark leads the best way in cell funds, with two in ten Danes now utilizing this technique to pay for his or her on-line procuring. Invoicing can be well-liked, particularly in international locations like Sweden, the place it’s utilized by round 30% of Swedes.

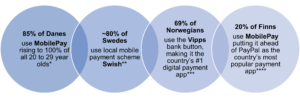

Cell apps are taking APMs to the lots

Nordic has many home-grown cell apps which have gained large traction within the area, serving to to fend off dominance by international gamers like PayPal. The massive three are Swish in Sweden, Vipps in Norway, and MobilePay in Denmark and Finland.

*Supply: Statista **Supply: Riksbank ***Supply:JP Morgan **** Supply: Statista

Digital and Cell Fee App Use

Supply: JP Morgan

How are exterior and different financial components influencing demand for APMs?

Though the Nordics had seen a giant shift from bodily shops to eCommerce previous to 2020, a report from PostNord reveals that COVID considerably superior the area’s mass migration to on-line procuring, with 1 / 4 extra customers utilizing it than earlier than the pandemic. By mid-2021, Nordic customers had been able to bounce again with an uplift in on-line spending on leisure and life-style.

Nevertheless, the current international financial disaster, fueled by skyrocketing inflation, rising vitality costs, and the battle in Ukraine, has considerably derailed this. One in 4 (25%) Nordic customers now not really feel their households are financially safe. In consequence, many want to scale back their spending.

Consequently, retailers are having to work more durable to develop their Nordic companies. Making adjustments to their checkouts – providing customers extra versatile sorts of fee strategies that give them higher visibility to finances and monitor cashflow – will help them get forward.

Many are turning to BNPL as a fast repair answer to the cost-of-living disaster. All Nordic markets are anticipated to see double-digit development in BNPL. From 2022-28 forecasts predict BNPL CAGR to extend by 33.8% in Sweden, 18.6% in Finland, 14.2% in Sweden, and 13.4% in Norway.

It’s not nearly alternative – it’s about the suitable alternative

One of the best fee choices for any service provider’s checkout are people who match their prospects’ preferences, experiences and shopping for selections.

For example, having the ability to provide deferred fee on massive seasonal baskets, installments on huge ticket luxurious gadgets, one-click cell funds for spontaneous social customers, and pay as you go for budget-conscious college students and risk-averse vacationers.

It’s additionally about enhancing the UX. Many APMs ship quicker checkout processes and extra seamless and various buyer experiences, serving to to make sure increased conversion and encourage better loyalty.

The correct APM can even present new-to-the-market retailers with better gross sales and enterprise safety by permitting them to construct extra belief round their model – by means of affiliation. For example, small and unfamiliar retailers can increase their credibility by providing a globally acknowledged and established BNPL model like Klarna or trusted financial institution options like MobilePay.

New initiatives will pave the best way for smoother cross-border APMs

The Nordics are taking a look at new methods to ship real-time funds throughout borders and at scale. P27 initiative, led by Danske Financial institution, Handelsbanken, Nordea, OP Monetary Group, SEB, and Swedbank goals to harmonize funds between member international locations by offering an open-access, ISO 20022 compliant infrastructure.

Powering real-time funds, domestically and cross-border in a number of currencies, P27 may also align with SEPA to easy funds with the remainder of the EU. It might additionally turn out to be a serious catalyst for APMs, permitting them to ship the sleek, seamless experiences Nordic customers need when shopping for on-line from abroad web sites and serving to to turbo-boost additional development and competitors within the area.

Navigating Nordic APM Success

Nordics eCommerce represents a serious marketplace for each native and worldwide manufacturers seeking to increase home and cross-border gross sales.

It’s clear that providing fundamental card funds at on-line and cell checkout is now not sufficient. Whereas debit/bank cards nonetheless dominate in-store, within the digital area it’s APMs which can be the rising stars – whether or not it’s Swish in Sweden, MobilePay in Denmark, Vipps in Norway, or Verkkopankki in Finland.

To achieve success, retailers should optimize their fee combine for Nordic markets. Not solely that, however additionally they should accommodate native, regional, and worldwide funds rules, necessities, and tax legal guidelines to remain compliant and defend Nordic prospects.

Having the suitable on-line fee companions, like 2Checkout (now Verifone), will help easy this course of. Tapping into their regional experience, collective business knowledge, and client information can maintain retailers with Nordic development ambitions on observe, making certain they’ve the suitable APM heroes to get and keep forward.