A self-proclaimed cryptocurrency millionaire has been charged with a number of felonies for his alleged position in a rip-off that presupposed to promote a high-powered cryptomining machine known as the “Bitex Blockbuster” that didn’t really exist.

James Wolfgramm (also called Semisi Niu or James Vaka Niu) of Spanish Fork, Utah, has been charged by a federal grand jury with wire fraud and cash laundering. The fees are in relation to a rip-off that’s stated to have collected almost US $1.7 million from two victims.

Based on the indictment, Wolfgramm introduced himself on-line as a cryptocurrency tycoon who had made his fortune in cryptocurrency.

It’s alleged that Wolfgramm posted photographs on social media of pricy sports activities automobiles he claimed to personal, suitcases full of money, and screenshots of cryptocurrency wallets containing tens of millions of {dollars}’ price of digital foreign money.

Nonetheless, the indictment alleges, among the photographs are thought to have been copied from the web sites and social media accounts of others.

Moreover, Wolfgramm and his firm Bitex are alleged to have promoted a non-existent cryptomining machine they known as the “Bitex Blockbuster”.

Based on the Division of Justice, victims have been proven a purported “Bitex Blockbuster” at Bitex’s workplace, which gave the look of real-time cryptomining however was in actual fact exhibiting a pre-recorded video loop.

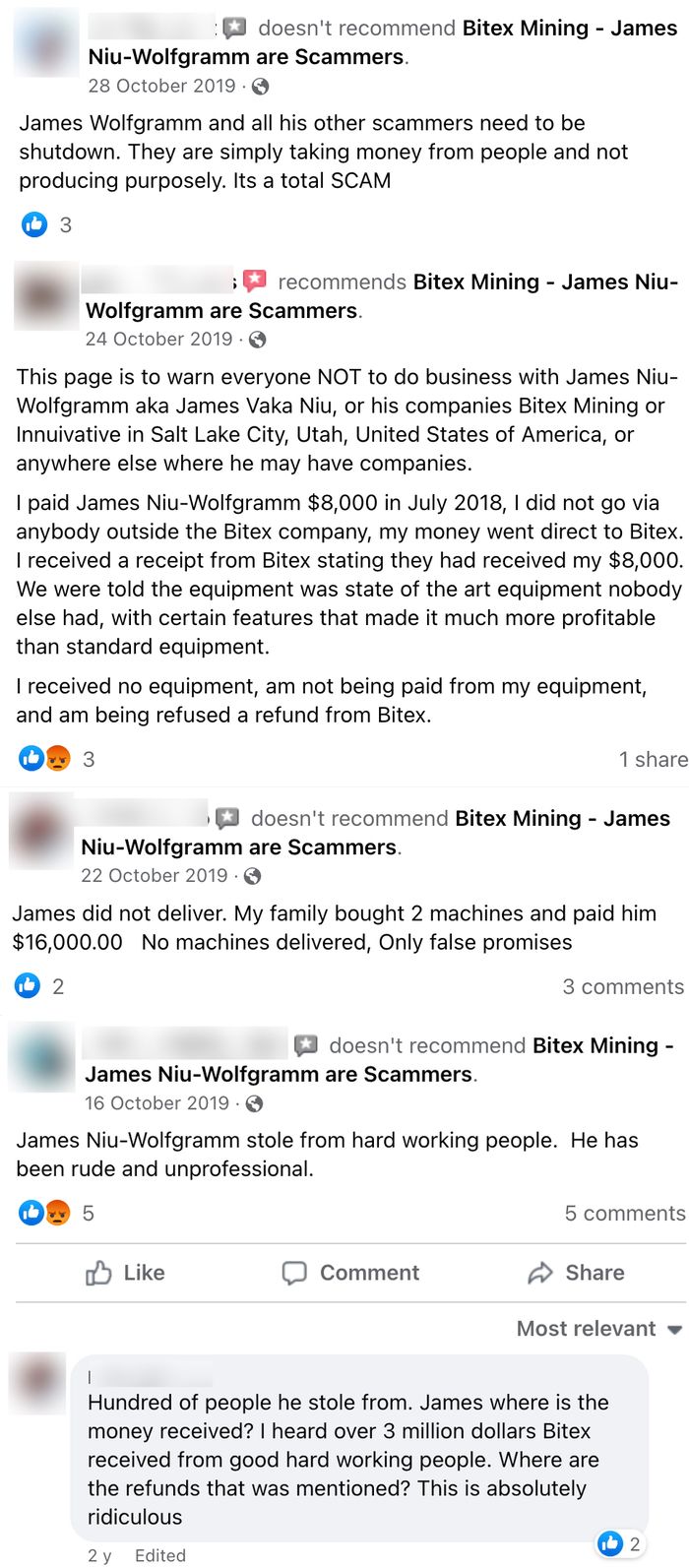

A few of Wolfgramm’s alleged victims turned to social media to share their tales of how that they had been scammed.

One other of Wolfgrammm’s firms – Ohana Capital Monetary, Inc. (OCF) – is alleged to have supplied monetary companies to these ineligible for conventional financial institution accounts, with the motto “Banking the Unbankable.”

OCF clients are stated to have obtained tens of millions of {dollars} from shoppers who believed that their cash can be stored on deposit, not realizing that their funds have been being spent by Wolfgramm and OCF on “unrelated enterprise bills.”

Wolfgramm faces two counts of cash laundering and 5 counts of wire fraud.