On Dec. 23, 2022, KrebsOnSecurity alerted big-three client credit score reporting bureau Experian that id thieves had labored out methods to bypass its safety and entry any client’s full credit score report — armed with nothing greater than an individual’s identify, tackle, date of start, and Social Safety quantity. Experian mounted the glitch, however remained silent in regards to the incident for a month. This week, nonetheless, Experian acknowledged that the safety failure endured for practically seven weeks, between Nov. 9, 2022 and Dec. 26, 2022.

The tip in regards to the Experian weak spot got here from Jenya Kushnir, a safety researcher residing in Ukraine who mentioned he found the strategy being utilized by id thieves after spending time on Telegram chat channels devoted to cybercrime.

Usually, Experian’s web site will ask a collection of multiple-choice questions on one’s monetary historical past, as a means of validating the id of the particular person requesting the credit score report. However Kushnir mentioned the crooks discovered they might bypass these questions and trick Experian into giving them entry to anybody’s credit score report, simply by enhancing the tackle displayed within the browser URL bar at a particular level in Experian’s id verification course of.

After I examined Kushnir’s directions alone id at Experian, I discovered I used to be in a position to see my report though Experian’s web site informed me it didn’t have sufficient info to validate my id. A safety researcher buddy who examined it at Experian discovered she additionally might bypass Experian’s 4 or 5 multiple-choice safety questions and go straight to her full credit score report at Experian.

Experian acknowledged receipt of my Dec. 23 report 4 days afterward Dec. 27, a day after Kushnir’s methodology stopped engaged on Experian’s web site (the exploit labored so long as you got here to Experian’s web site by way of annualcreditreport.com — the positioning mandated to offer a free copy of your credit score report from every of the foremost bureaus every year).

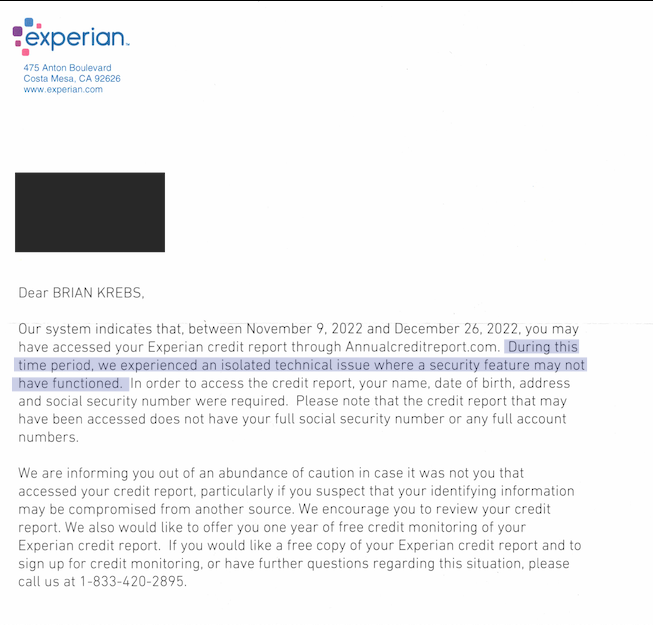

Experian by no means did reply to official requests for touch upon that story. However earlier this week, I acquired an in any other case unhelpful letter by way of snail mail from Experian (see picture above), which acknowledged that the weak spot we reported endured between Nov. 9, 2022 and Dec. 26, 2022.

“Throughout this time interval, we skilled an remoted technical subject the place a safety function might not have functioned,” Experian defined.

It’s not fully clear whether or not Experian despatched me this paper discover as a result of they legally needed to, or in the event that they felt I deserved a response in writing and thought perhaps they’d kill two birds with one stone. But it surely’s fairly loopy that it took them a full month to inform me in regards to the potential influence of a safety failure that I notified them about.

It’s additionally a little bit nuts that Experian didn’t merely embody a replica of my present credit score report together with this letter, which is confusingly worded and reads like they think somebody apart from me might have been granted entry to my credit score report with none form of screening or authorization.

In spite of everything, if I hadn’t licensed the request for my credit score file that apparently prompted this letter (I had), that might imply the thieves already had my report. Shouldn’t I be granted the identical visibility into my very own credit score file as them?

As a substitute, their woefully insufficient letter as soon as once more places the onus on me to attend endlessly on maintain for an Experian consultant over the cellphone, or join a free 12 months’s value of Experian monitoring my credit score report.

Because it stands, utilizing Kushnir’s exploit was the one time I’ve ever been in a position to get Experian’s web site to cough up a replica of my credit score report. To make issues worse, a majority of the knowledge in that credit score report is just not mine. So I’ve received that to stay up for.

If there’s a silver lining right here, I suppose that if I had been Experian, I in all probability wouldn’t need to present Brian Krebs his credit score file both. As a result of it’s clear this firm has no concept who I actually am. And in a bizarre, form of unhappy means I assume, that makes me completely satisfied.

For ideas on what you are able to do to reduce your victimization by and general value to the credit score bureaus, see this part of the latest Experian story.