Join each day information updates from CleanTechnica on e mail. Or comply with us on Google Information!

There’s one thing that’s typically misplaced in discussions about tech adoption developments, and particularly in terms of one thing we cowl quite a bit, electrical automobile gross sales developments: it’s not a straight, constant line upward. There are ups and downs. When adoption jumps up quick, these of us bullish on the transition get additional excited and bullish. When the adoption development slows, individuals who choose a extra conservative “nothing is admittedly ever going to vary” story get to say, “See, the revolution ain’t happenin’!”

These ups and downs within the adoption developments are sometimes pushed, not less than partly, by the fact of how a market truly evolves. As shopper demand rises, manufacturing capability has to rise. When demand has risen fairly a bit and manufacturing capability development hasn’t stored up, there’s a provide crunch that results in increased costs. When manufacturing capability ramps up quite a bit, however, durations can comply with the place there’s extra manufacturing capability than demand, or not less than the place provide catches as much as demand, main to cost drops.

A core of the EV market, after all, is the battery market. So, apart from auto manufacturing capability, EV manufacturing capability is a vital aspect on this entire leapfrog development or chutes and ladders development.

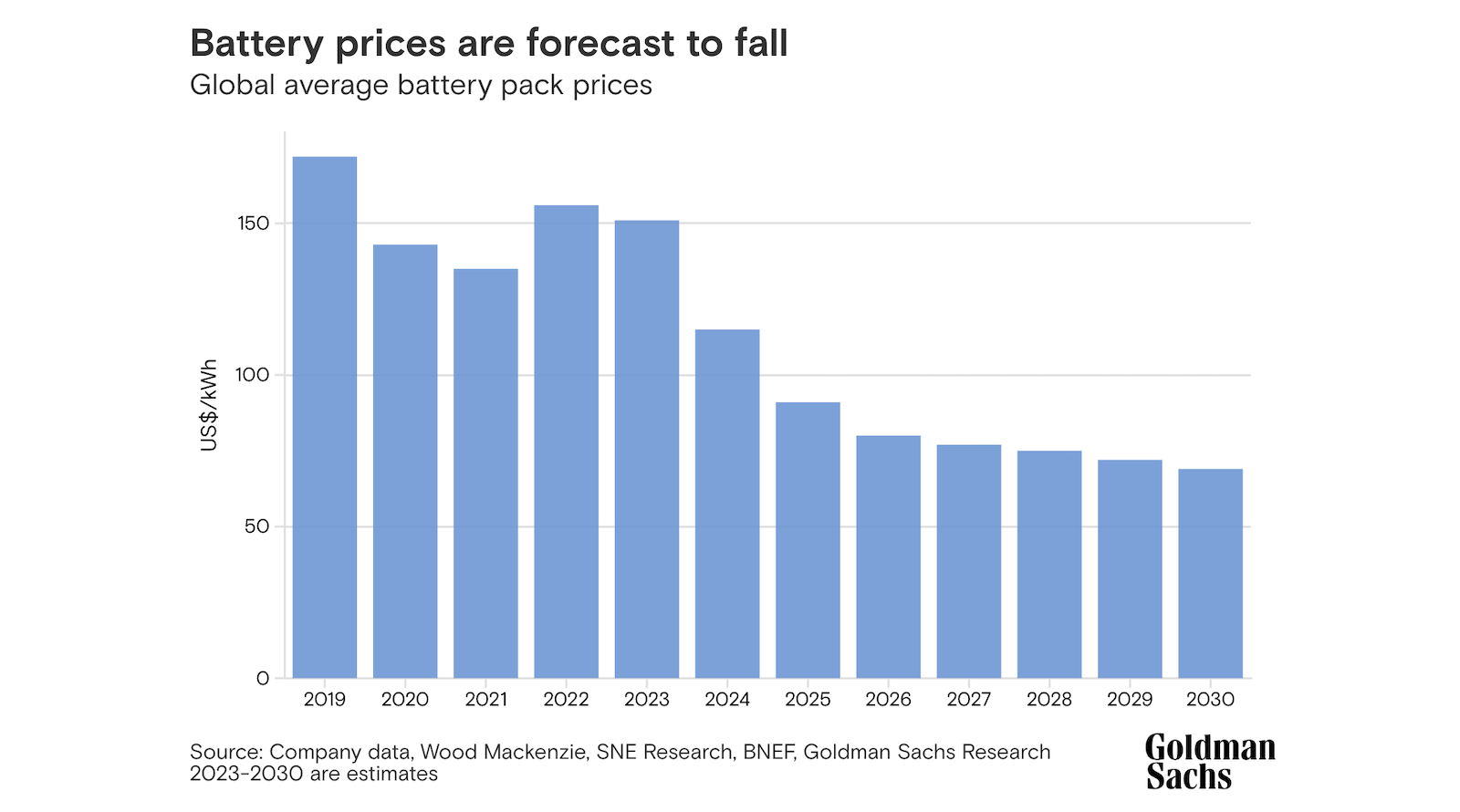

The excellent news in the meanwhile is that EV battery costs are anticipated to drop quite a bit in 2024 and 2025. That’s based on a latest evaluation from Goldman Sachs. When EV battery costs do come down quite a bit, we are able to then count on electrical automobile costs to come back down quite a bit, which is able to increase EV gross sales additional.

“In a number of months, decrease steel costs ought to begin to movement by means of to EV makers. ‘The excellent news is battery costs are actually falling quickly,’ Bhandari says,” Goldman Sachs writes. “Goldman Sachs Analysis expects an almost 40% decline in battery costs between 2023 and 2025, and for EVs to succeed in breakthrough ranges when it comes to value parity (with out subsidies) with inside combustion engine vehicles in some markets subsequent 12 months. Long term, our analysts challenge EVs to take a significantly increased share of automobile gross sales, reaching 50% within the US and 68% within the EU by 2030.”

The EV battery worth value development seems dramatic, and really useful. With Goldman Sachs’ wealth of information throughout most likely each sector on the planet, one would assume the monetary firm is on level in terms of EV battery worth developments this 12 months and subsequent. Forecasting EV gross sales a number of years out is a a lot tricker enterprise, and one would hope that the forecast of simply 50% EV market share within the US and 68% within the EU is pessimistic and incorrect.

So far as why EV battery costs will drop, Goldman Sachs argues that it’s due to a combination of EV battery materials prices dropping and EV battery producers persevering with to innovate nicely. “The bear marketplace for metals is one motive battery costs are forecast to say no. The opposite is that battery innovation remains to be ongoing, Bhandari says. Producers are discovering methods to simplify the manufacturing of batteries (by means of structure-related improvements that enable higher, less complicated packaging), and to make use of supplies, like silicon, which will scale back charging time and enhance vitality density.” Unsurprisingly, however maybe rather less convincingly, additionally they raised the age-old dream of some solid-state battery breakthrough. (I’ve been listening to about this for the previous decade plus, nevertheless it’s at all times extra of a dream or hope than a transparent actuality on the horizon. I suppose you might say that it’s form of just like the fake pool of water you see on the horizon within the desert.) “Main improvements like solid-state batteries (versus utilizing liquid electrolyte as in batteries as we speak) may, within the coming years, be a game-changer for the business, as solid-state batteries are anticipated to permit carmakers to pack in much more vitality, for a similar quantity of weight, than a standard battery.” One can dream.

Chip in a number of {dollars} a month to assist assist unbiased cleantech protection that helps to speed up the cleantech revolution!

Goldman Sachs additionally brings up the Inflation Discount Act handed by Democrats once they managed Congress and the White Home, in addition to sturdy EV-supportive insurance policies in Europe. “The US Inflation Discount Act’s subsidies may bolster the sector within the home US market. EU coverage — together with the bloc’s carbon emission targets for vehicles and its plans to ban gross sales of inside combustion engine vehicles by 2035 — is anticipated to assist demand for EVs. The UK’s zero-emission automobile mandate, in the meantime, requires 22% of vehicles to be electrical from 2024 (although with some flexibility), and EV subsidies are being prolonged in Spain and launched in France.” Certainly — the policymakers have been making a distinction, serving to to convey a brighter future for humanity. After all, that’s what they’re purported to do — they’re purported to be leaders. However I might not fault anybody for arguing that it’s typically not what you count on from a politician.

For now, we must always thank the policymakers who’ve enabled a sooner transition to electrical transport, and we must always take into account strongly what is required as a way to preserve sturdy insurance policies going. “The regulatory tailwinds are nonetheless in place,” Bhandari notes, however the wind can at all times shift, particularly in politics.

Circling again, this can be a huge quote that I believe ought to get extra consideration: “Goldman Sachs Analysis expects an almost 40% decline in battery costs between 2023 and 2025, and for EVs to succeed in breakthrough ranges when it comes to value parity (with out subsidies) with inside combustion engine vehicles in some markets subsequent 12 months.” (Emphasis added.) If electrical vehicles attain upfront worth parity in core automobile segments with gasoline-powered vehicles, issues may get very attention-grabbing. Then, the entire advantages of handy house or office (and even vacation spot) charging, a smoother drive, higher torque, higher security, and cleaner air can actually come to life. With out the hurdle of a decrease upfront value for vehicles in the identical class, the mass market would possibly lastly divulge heart’s contents to the entire different causes to go electrical. (Word: It appears clear to me that Tesla’s automobiles are already at upfront worth parity with different automobiles of their lessons, which is why they promote so nicely, however the factors above principally concern electrical vehicles from legacy automakers versus different vehicles with their dimension and options from those self same automakers.)

The EV market may get very attention-grabbing within the subsequent 24 months.

Have a tip for CleanTechnica? Wish to promote? Wish to counsel a visitor for our CleanTech Speak podcast? Contact us right here.

Newest CleanTechnica TV Video

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.