In a cashless society, monetary transactions are processed electronically, a pattern which has accelerated in recent times.

A number of years in the past, a cashless society was one thing we’d solely examine in fantasy books. Nonetheless, residing in a cashless society might develop into a actuality with at the moment’s developments. Digital funds at the moment are an integral half of digital experiences.

Some international locations are already transferring to do away with money, particularly since each the shoppers and authorities our bodies are eager on that pattern. Sweden is predicted to develop into the primary cashless nation on the planet.

The Swedish economic system is about to develop into 100% digital by 2023. In accordance with the European Funds Council, conventional money transactions accounted for 1% of Sweden’s GDP in 2019. Money withdrawals have been steadily declining by about 10% per yr.

On this submit, you’ll study the variations between cashless funds and prepared money. You’ll additionally study the benefits of going cashless and the problems that have to be addressed earlier than a society may give up on money completely.

Conventional v/s Digital Funds

Conventional funds are made immediately with money, by means of a chip and pin card, or through a financial institution switch. Money and the chip and pin is the usual transaction methodology for many enterprise to client firms.

Money within the type of notes and cash is one thing that most individuals belief. Nonetheless, there are points. For starters, it’s a ache getting the best change. Then, there are points with bodily storing and transferring the cash. Banks, for instance, cost a charge for taking cash in from outlets, and thieves clearly would possibly steal your cash.

With chip and pin units and now contactless funds, companies scale back the chance of theft and the trouble of depositing cash within the financial institution. Firms do take a transaction charge for managing the fee course of, although.

The opposite good thing about the transfer to digital funds is the convenience of monitoring every thing. Digital funds make accounting rather a lot simpler and in addition profit the federal government because it reduces the chance for tax avoidance and accounting fraud.

The Way forward for the Funds Trade After COVID-19

Any enterprise that wishes to attain success needs to be watching advertising developments inside its area of interest. The identical goes for monetary providers. To maintain your organization forward of the sport, you need to watch how the market adjustments and make the mandatory changes.

COVID-19 has modified the pattern of cashless fee methods. As commerce moved from bodily areas to on-line shops, the best way we pay took the identical route. Usually contactless commerce was the one attainable option to reduce bodily contact.

So, the pandemic was undoubtedly a switching level for the adoption of digital fee applied sciences. Most area of interest market companies needed to rethink how they function and permit cashless funds.

The pandemic accelerated this pattern, expediting the transfer from money funds by over three years. This transfer was initially projected for 2023, however the world context superior it to 2020. The World Funds Report 2021 revealed that money was used for simply over 20% of the worldwide level of sale transaction quantity in 2020. That was a 32% discount from 2019.

Using money in 2020 fell all around the world. Aside from Sweden, different international locations are proving to be very near representing cashless societies. Money funds signify solely 5.4% of the purpose of sale quantity in Canada, 4.5% in Norway, and 11.9% within the US.

The Distinction Between Contactless Funds and Cell Funds

Contactless and cellular fee choices are attainable by means of digital means and don’t contain bodily contact with money or playing cards. Though contactless transactions and cellular fee know-how have issues in frequent, in addition they are very completely different.

Contactless Fee Techniques

Contactless fee transactions are finalized electronically by means of a wi-fi know-how referred to as NFC (Close to Discipline Communication). The very best examples of fee strategies utilizing NFC are contactless debit and bank cards. You must get the cardboard close to the reader or give a slight faucet to determine a connection and begin a transaction.

Cell Fee Know-how for Prospects

With cellular funds, prospects pays utilizing cellular banking apps and cellular wallets. General, cellular fee know-how works equally to contactless fee methods. As a substitute of utilizing playing cards, you employ a cellular machine, like a smartphone or smartwatch to provoke the transaction.

Most banks have a Cell App for his or her shoppers to make banking transactions. On this case, all you want is a Wi-Fi connection or broadband wi-fi web connection to deal with the transaction.

Utilizing a Cell Pockets System, prospects use an app or an e-wallet the place their bank card particulars are saved. Apple Pay and Android Pay are the 2 mostly recognized types of digital wallets globally, although native favorites like AliPay in China additionally lead some markets. The cellular pockets system makes use of the identical NFC know-how because the contactless strategies. Open the e-wallet and place the machine close to the reader to provoke the connection.

Cell Fee Know-how for Retailers

Accepting cellular wallets has develop into an expectation for retailers. If you’re a enterprise proprietor on the go, you want to have the ability to settle for funds anyplace you might be. Utilizing cellular terminals means you will be freed from a bodily POS terminal that must be carried with you.

Cell terminals are fee portals out there on a smartphone or linked tablets. To have the ability to settle for a fee, you should log right into a digital terminal and manually enter bank card particulars.

With cellular browser funds, prospects can use their cellphones to pay in your services. That is important, contemplating that so many eCommerce gross sales are accomplished through cellular units. So, when constructing web sites for what you are promoting, be sure you present an eCommerce resolution, like a fee gateway or hosted checkout, that’s mobile-friendly. To pay, prospects have to enter their fee particulars into the web site’s checkout part.

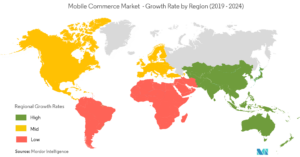

That is essential as M-commerce is regarded as the subsequent large part in know-how involvement.

Nonetheless, its adoption and degree of progress differ relying on the situation. The M-commerce market wants growing adoption of good units, higher broadband connectivity, cheaper providers, and social adoption of providers to develop.

It has develop into increasingly fashionable to browse for favourite merchandise, add to a cart and make on-line funds through cellular apps. Retailers developed their apps for patrons with an eCommerce fee processing resolution. The fee processing resolution permits companies to simply accept card funds throughout the app. Shoppers have to register their credit score or debit card particulars into the app earlier than buying.

What Are the Execs and Cons of Contactless Funds

An apparent good thing about contactless funds is comfort. All you want is your telephone, and you may make cashless funds from in every single place. It requires no bodily contact. It’s easy and fast. Listed below are another execs of going contactless.

No Money for Thieves to Steal

Anybody carrying money is a simple goal for criminals. If a thief takes money from you, it turns into very tough to trace and show that it was yours.

A research by American and German researchers revealed that crime in Missouri dropped by 9.8% as soon as the state changed money welfare advantages with Digital Profit Switch (EBT) playing cards.

So, theoretically, pickpocketing ought to dry up in a cashless society.

Automated Paper Trails

Cash laundering, unlawful playing, or drug operations, usually contain money in order that there isn’t any document of the transaction. Unlawful transactions are tougher if the supply of funds is simple to determine. It’s tough to cover earnings and keep away from taxes when there’s a fee historical past out there at any time.

Money Administration Prices Cash

Many companies have to retailer the money, withdraw extra in the event that they run out, and deposit the cash after they have an excessive amount of available. Some companies have to rent firms to move money safely.

Let’s not overlook that banks rent professionals to safe branches towards financial institution robberies.

The necessity to spend money and time on printing payments and minting cash after which dealing with and defending cash might disappear in a cashless future.

Worldwide Funds Turn into A lot Simpler

Touring overseas requires exchanging cash to the native foreign money. Going into a rustic that accepts cashless funds makes touring simpler. You can also make funds by means of your card or cellular machine.

Individuals can buy from firms overseas and simply anticipate the cargo to reach. You can also make purchases from anyplace on the planet, offered that the vendor can be keen to ship it for you.

The Way forward for the Funds Trade

There are some the reason why money remains to be necessary however by the seems of it, it can develop into extra of a distinct segment possibility. In accordance with PwC, a number of macrotrends will have an effect on the way forward for funds within the years to come back. These are:

- Inclusion and belief: The pattern is to give attention to digital wallets and cellular cash to allow client accessibility

- Digital currencies: Central banks at the moment are exploring the usage of any such foreign money, with 14% performing their very own pilot exams.

- Digital wallets: Using cellular funds will proceed to extend, with an estimated compound annual progress fee between 2019 and 2024 of 23%.

- Battle of the rails: As a consequence of elevated competitors within the monetary providers trade, card firms and processors are repositioning themselves available on the market. Digital pockets suppliers will proceed to hunt extra interoperability because of the fierce competitors.

- Cross-border funds: A rise in cross-border funds is anticipated, which is additional strengthened by the adoption of ISO 20022. ISO 20022 goals to make sure a standardized digital knowledge change between monetary establishments.

The belief based mostly on these macrotrends is that we’re transferring in the direction of a cashless society. That is additionally evident within the rise of industries that primarily depend on cashless transactions. The subscription economic system, as an example, has been rising with the digitalization of economies. In accordance with UBS Wealth Administration and Bernstein, to date, the digital subscription economic system is a $650-billion market and is about to succeed in a market measurement of $1.5 trillion by 2025. That’s a formidable annual progress fee of 18%.

With the growing relevance of digital funds within the years to come back, companies ought to discover methods to adapt in the event that they wish to keep within the sport.

On the similar time, they might want to implement cybersecurity measures to make sure the safety of shoppers utilizing these digital fee strategies. In spite of everything, with the rise in monetary digitalization is the inevitable improve in monetary crimes. To stop fraud, cash laundering, and different crimes, better collaboration amongst companies, fee suppliers, conventional banks, and even governing our bodies is finally required.

Wrapping Up

Offering the choice to purchase or promote on-line has develop into so frequent that it makes individuals surprise if money remains to be wanted in any respect. From eating places to grocery shops and any enterprise, cashless funds are accepted in most locations. We had been compelled to place money again into our pockets through the pandemic.

The factor is, the developments do nonetheless level to money being largely out of date, maybe even in our lifetime. We’re transferring in the direction of a cashless society, the place on-line funds and digital currencies would be the norm and not simply choices. That will imply an more and more financially interconnected world that may open up huge alternatives for each companies and shoppers. In a cashless society, the world will actually be everybody’s (monetary) playground.

About Creator

Matt Diggity is a SEO skilled and the founder and CEO of Diggity Advertising, The Search Initiative, Authority Builders, and LeadSpring LLC. He’s additionally the host of the Chiang Mai website positioning Convention.