Let’s begin from the center: on the eve of 2025, the worth of private finance instruments, particularly in banking and monetary companies, is super. Private monetary software program has immensely influenced our on a regular basis routines.

Provided that the app is positioned in your smartphone, customers can simply observe and management their spending proper on the spot, plan their finances, and have reminders about essential funds or buying items.

In addition to, private finance instruments supply far more: customers can management bills, handle dangers, elevate funds, expose credit and loans, and safe insurance coverage—on paper and digital instruments.

On this article, we’ll uncover the technical intricacies of the private finance app improvement course of, and clear up the prices and challenges on the best way.

Hop on our suggestions and further info to information you alongside the best way. Whether or not you select the skilled software program developer staff or sort out this problem by yourself, with all the mandatory info in your pocket the duty gained’t be exhausting. Good luck on the best way!

What’s a Private Finance App?

Private finance apps are like private caregivers that contribute to customers’ monetary and psychological well being. These are functions that permit you to throw out all of the old-school gadgets and help you with budgeting, spending, and funding information on paper and digital gadgets.

In our extremely technological period, when each step is definitely processed within the digital area and assisted by AI and machine studying, the choice to develop a private finance app for your enterprise appears clear and logical.

Since there’s an enormous demand for private finance apps, let’s have a look at some stats to achieve a greater perspective on private finance app improvement.

In keeping with the TEM journal examine ‘Private Finance Administration Utility’ of August 2024, trendy households more and more want assist in helping them observe their earnings and each day bills, investing funds, planning budgets, and constructing and structuring their monetary methods.

The distant answer for taking full management over a consumer’s cash is a big step in the direction of monetary independence. It affords new alternatives for progress, each in private and enterprise domains, displaying up as a significant increase in enterprise enlargement and conquering the market.

As for the Future Knowledge Stats, the projection of the worldwide private finance administration functions market is to develop from $1.23 billion in 2023 to $1.61 billion by 2030. Thus, creating private monetary software program will likely be an impressive enterprise impetus.

Private Cash Administration Software program: Technology Traits in Constructing Private Finance Apps

The scientific analysis on private finance app improvement within the Journal of Financial Training and Entrepreneurship Research reveals—there’s nice potential for scaling your private finance app improvement enterprise amongst Gen Y.

Using private finance apps to trace expenditures, type household budgets, and carry monetary offers permits customers, particularly Millenials, to craft their private experiences by performing tens of duties concurrently, based mostly on their lively wants and a number of monetary calls for.

Following the paper ‘Fintech Evaluation of Private Finance App Utilization amongst Millennials’, knowledge safety and private privateness are the Millennials’ key issues whereas utilizing fintech apps. Their essential precedence is private knowledge safety and consumer privateness. For developer groups, an amazing deal will likely be staking on enhancing and upgrading safety programs and privateness practices.

Who’re the following technology customers, Gen Z? For builders and companies, it’s helpful to see the stats on this gen’s motivation.

Contemplating the swift modifications within the monetary panorama in recent times, fintech firms and banks, together with private monetary planning software program and private finance app improvement, Zoomers are extra lively customers of cellular applied sciences.

In keeping with the ‘Digital finance and the angle of Gen_Z cohort: a assessment’ examine, Gen-Z performs a vital function within the success of private monetary software program and makes up a substantial share of the shopper base for banks and fintechs.

Within the array of their priorities are inclusion, safety, and accessibility of monetary companies. Hereby, for enterprise house owners, it means further issues to remember whereas creating the private finance app.

As you see, along with Gen Y, Zoomers are one of many prime client generations taking the lead in private finance app improvement globally down the highway.

Tech Characteristic Traits in Private Finance App Improvement

Now, to maintain observe of the wants and priorities of potential prospects of your private finance app, it is going to be level to see the tech traits round private monetary software program improvement. This can enable you to construct an answer that meets the calls for of future customers.

Because of the rise in optimizing work and free time, the private apps area can be reworking to adjust to new traits:

- AI and machine studying

- Digital help bots and chatbots

- Open banking options integration

- Blockchain applied sciences

- Gamification

- Consumer-centric consumer interface

Forms of Private Finance Apps

In the case of managing your funds, there’s no one-size-fits-all answer. Private finance apps come in numerous kinds, every designed to cater to particular wants and objectives.

On-line Fee Providers

Selecting to construct your app on this area brings alongside a substantial amount of competing firms. It’s clever for you customers to spend money on creating any such private finance software program. For the time being, banks nonetheless lack flexibility and mobility in processing funds, so you possibly can have a aggressive edge on this subject.

On-line Banking

Deciding to construct this sort of private finance app may very well be a helpful alternative, particularly now as banks and monetary enterprises ship their companies within the digital subject. It means private net and cellular finance apps will dominate the software program market.

Crypto Wallets and Crypto Platforms

As seen from the analysis, cryptocurrency is altering the monetary world on a worldwide scale. This manner, some firms and prospects choose making and having funds in cryptocurrencies. So, you gained’t make a mistake by selecting the crypto pockets to create your private cash administration software program.

Insurance coverage Tech

This know-how contains digital insurance coverage firms and a tech stack that includes AI, Blockchain, Large Knowledge, and extra to supply shoppers improved insurance coverage companies.

The Greatest Apps on the Market to Comply with

To catch a transparent visible understanding of what a private finance app is, have a look at a number of the top-notch gamers within the private finance software program subject and take into account adopting their performance.

- Mint: That is the most effective free app to trace your finances.

- Prism Finance: Pay Payments, Cash Tracker: This app extends the final private finance app performance. You’ll be able to sync your app with a lot of billing suppliers.

- Spendee: Taking observe of this software’s options is without doubt one of the finest choices to handle your loved ones’s shared bills, as within the case of a family.

- EveryDollar: It is without doubt one of the most complete apps for budgeting and monitoring your spending.

Listed below are extra private finance software program apps to maintain your eye on:

- PocketGuard: Funds Tracker

- NerdWallet: Handle Your Cash

- Each Greenback: Funds Tracker

- GoodBudget: Funds and Finance

- Mobills: Funds Planner

- Funds Planner: Expense Tracker

Steps to Constructing a Private Finance App

Now, given there are many features and income in your consumer or your software program firm when constructing private monetary software program, it’s time to get into the method of improvement. Let’s unlock the complete potential of the step-by-step strategy to creating a private finance app.

1. Visualize Your App’s Shopper

Getting proper to the center of your target market ensures you construct an efficient and user-centered private finance software. It’ll assist your shoppers attain their objectives whereas defending their private knowledge. So, analysis the subject and element up the demography.

Additionally, focus in your consumer’s wants, habits, geography, and many others. as quickly as you wish to rating the bullseye and get outcomes from the discharge.

2. Dive into the Rivals’ Space

Subsequent, dive into the competitors space. What firms are you competing with, and what private finance app options do they ship? This is a crucial survey into probably the most in-demand functionalities by your future customers, and likewise to assume on which options you possibly can enhance and attain new heights within the area.

3. Outline the Important Problem to Sort out

Then, analysis the optimum applied sciences to use in your private finance app. Contemplate the tech stack and databases making the UX extra regular and cozy.

4. Safety Precedence

As talked about, for probably the most lively private finance app customers—Gen Y and Gen Z—privateness and private knowledge safety are a prime precedence.

So, take into account selecting these practices to make your customers’ safety even higher:

- Apply two-factor authentication. It empowers consumer verification by way of two steps of identification, crafting a extra protected consumer expertise.

- Minimize every session’s longevity to a sure time restrict.

- Implement Fee Card Business Knowledge Safety Commonplace and Basic Knowledge Safety Regulation.

- Steer clear of making your customers’ private info clearly visualized, particularly in public spots. No brilliant coloration palette and no catchy fonts are beneficial.

5. Select Your Private Finance App Primary Options

Provoke the event course of with the essential private finance app parts. Contemplate the next:

- Consumer authorization to protect customers from info leaks.

- The consumer profile so as to add and revise fundamental private information.

- Earnings and expense administration to observe over cash transfers in actual time.

- Reminders and notifications about future and potential funds, statistics on funds and spending, and important updates.

- Consumer registration and onboarding to make the app accessible solely to approved customers by way of safe login registration.

Furthermore, you possibly can enrich your private finance app with add-up companies like AI chatbots, exterior financial institution accounts, calculations, barcode scanning, and far more.

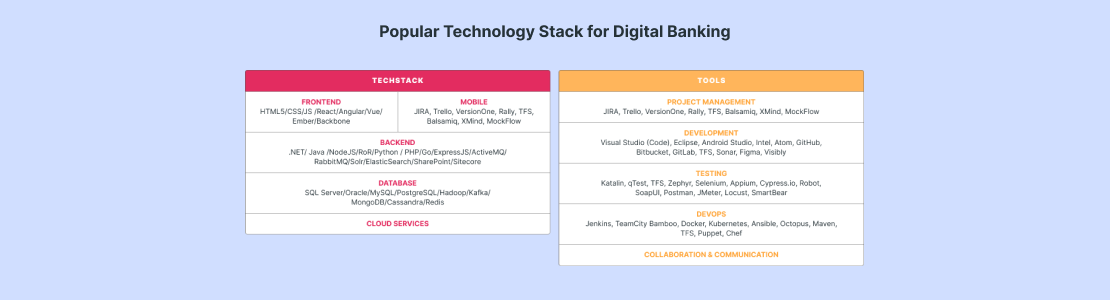

6. Decide Optimum Applied sciences and Databases

Speaking concerning the tech stack, take into account related programming languages, databases, and frameworks which might be suitable with particular programming languages utilized.

- Entrance-end utility applied sciences construct up a visible and tangible interplay with the consumer. Often, this stack contains HTML, CSS, and JavaScript.

- The backend kinds the core construction of your app and is accountable for optimum knowledge loading, knowledge safety, and the comfort of cash switch. It depends on languages like Ruby, C++, Python, Kotlin, or Node.js.

- Database options needs to be secure and reply promptly to consumer queries. Contemplate choices like MongoDB, Categorical.js, Node.js, or Angular.

- In case you are constructing a rich-in-features private finance app, take into consideration together with API integrations.

7. Straightforward-to-Use UX

Applied sciences for utilizing a private finance app conveniently and safely are extremely essential. So, a responsive and easy-to-understand consumer expertise (UX), along with a clean consumer interface (UI), will drive your app to the highest.

Nevertheless, bear in mind about safety and keep away from extraordinarily brilliant fonts and colours. The distinction in shades and colours needs to be your UI precedence.

In addition to, strive to not overwhelm your customers with an excessive amount of info on one display and distribute info in a uniform manner.

8. Testing and High quality Assurance

That is the stage undoubtedly to not skip. At any time when customers’ knowledge in your private finance app is misplaced or compromised, all of the earlier work goes in useless.

So, put your finest efforts into testing and assuring high quality checks on all the event phases: safety testing, knowledge integrity, usability, useful and efficiency testing. Alternatively, rent knowledgeable QA staff.

When you have got checked all of the bugs and shortcomings, the appliance will be printed within the app shops.

Should-Have Options for a Private Finance App

Let’s take a look at the most well-liked private finance functions: Mint (free, with optionally available paid improve), NerdWallet (free), Buxfer (free, paid plans), Goodbudget (free, paid plans), Each Greenback, Mobills (free, with optionally available paid updates), with private finance apps bragging free variations—Prims, Spendee, and Funds Planner.

A few of these apps supply free trial variations, some don’t. But, for scaling and selling your private finance app, the chance for present and potential prospects to obtain your software program product rapidly and with no additional bills has potential.

Take the highest private finance app, Mint, which is free and has conquered the world because of its no-expenses choice, simply with further non-binding updates. As with most private finance apps, it’s synchronized with the financial institution and is straightforward to make use of.

Beneath are probably the most in-demand private finance app options constructed into many of the well-liked apps:

- Consumer registration and onboarding that make the app accessible just for approved customers by way of safe login registration

- Account integration with a number of monetary companies

- Managing private finances

- Receiving a monetary standing report for a sure interval

- Insightful recommendation by way of AI chatbots

- Getting in depth bills and earnings reviews

- Forex converter

- Extraction of charts

- Moveable calculator

- Report technology and visualization by charts

- Barcode scanning preview

What’s extra, bear in mind concerning the safety and knowledge privateness instruments as these will stay the very best precedence in your customers. It’s a problem to remember for a enterprise proprietor.

Important Factors to Contemplate Whereas Constructing a Private Finance App

So, in creating a private monetary app, you must take into account the next factors to make sure your app’s success.

1. Venture Options

In case your buyer needs third-party APIs built-in, it’ll take longer to launch, and the tech stack will develop into far more advanced to guard customers’ private knowledge. It means a couple of programming language, enhanced synchronization, extra versatile screens, API integrations, and tailored UI.

2. Time to Market

The overall equation is that the longer the undertaking improvement time, the dearer it is going to be. Within the case you’re restricted in time, put your eye on ready-to-go software program options. As an illustration, to learn from code reuse and easy help, select the mixture of Python programming language and Django framework. Quite the opposite, if there’s loads of time forward to work in your private finance app, seize the chance to develop a extra features-packed app, utilizing the Java language and Spring framework.

3. Private Knowledge Safety

The purpose right here is to protect the private monetary software program system by protected libraries and frameworks immune to cyber threats and hacking assaults, that might even be suitable with business requirements like CBDP, and PCI DSS.

4. Product Structure

Now, for those who or your consumer needs to take care of scalability and third-party integration capabilities on this private monetary instrument, it is going to be extra worthwhile to guess on microservices structure. So, a programming language like Ruby is required to include into your private monetary software program stack—to deal with giant numbers of simultaneous customers.

Tech Stack and APIs for Private Finance Apps: Scalability Potential

As we embark on deciding on the related software program applied sciences in your private finance app improvement, take into accout probably the most essential challenges in —safety and efficiency.

From this angle, right here’s the listing of probably the most related applied sciences in your private accounting app undertaking:

1. Entrance-end Applied sciences for Your Private Finance App

- React Native: Allows cross-platform app improvement, permitting the identical code to run on each iOS and Android gadgets. It reduces improvement time and prices whereas sustaining excessive efficiency and a local feel and look.

- Databases: MongoDB, Categorical.js, Node.js, Angular. For shoppers wanting a scalable cross-platform monetary app, they might be an amazing alternative.

2. Again-Finish Applied sciences

- Python programming language is a well-liked know-how for simplicity and open-source frameworks like Django and Flask. This alternative supplies your private finance app undertaking with flexibility and strong measures. The language can be well-adapted to funding and AI trades.

- Java language comes up as a related alternative for those who want an enhanced surroundings for the app. Its Spring framework backs up enterprise-level initiatives with scalability choices.

- Kotlin and Node.js are decide for creating real-time private finance apps (e.g., banking apps) leaving the chance for a lot of simultaneous connections.

3. Database Applied sciences

- SQL Databases (MySQL or PostgreSQL) will give your utility knowledge integrity and reliability, and empower the app with the chance to construction knowledge and transactions.

- NoSQL Databases. Quite the opposite, Cassandra and MongoDB databases permit you to scale the performance of your private finance utility horizontally and alter it as wanted.

4. Cellular Improvement

- React Native: A go-to framework for constructing apps that work on each Androids and iPhones with one codebase.

- Flutter: Google’s toolkit for creating high-performance apps for cellular, net, and desktop, all from a single codebase with interesting designs.

- Ionic: A versatile, open-source framework utilizing net applied sciences (HTML, CSS, JavaScript) to make smooth, cross-platform apps.

5. APIs

As for the listing of APIs to construct your private finance software program, it is going to be based mostly on the geographic location of your companion financial institution and the technical complexity of your private finance utility.

Usually, the app’s customers are accountable for unclosing their private info, which helps your finance app look at the consumer’s knowledge and improve the productiveness of the software.

Value of Constructing a Private Finance App

Once you perceive the know-how behind creating private monetary planning software program, the following step is to learn the way lengthy it takes to develop a private finance app.

The reply can’t be simple as there are a lot of components to keep in mind. The bills for the event of a private finance app often begin from $37,500. This finances line can fluctuate between $25,000 and $50,000. The ultimate value of a private finance app depends upon:

- App performance and complexity of options

- What cellular platforms and gadgets your app will operate on

- Third-party integration factors

- UI/UX integration

- Smartphone {hardware} options: GPS navigation, AR and NFC applied sciences, and extra

- Upkeep plan

Apps improvement fluctuates relying on the staff location, your private finance app tech stack concerned, its performance, and superior options integrated within the product on private monetary software program planning.

So, let’s see the charges per hour in numerous areas: USA – $70-150, Canada – $60-120, Western Europe – $65-130, United Kingdom – $45-100, Jap Europe – $30-65, India – $20-50.

Additionally, take into accout the potential of an MVP creation, if you wish to take a look at solely the essential options of your private monetary software program product on first customers and get worthwhile suggestions with out losing sources on enriched app performance. The price of this product could differ from $22,500 to $27,500.

Superior options to incorporate:

- Tailor-made alerts to fit your consumer or your undertaking wants ($30-100)

- Integrating the app with banks and monetary establishments ($200-300)

- Calculating money owed payoff ($50-150)

- Tax management ($100-150)

- Planning retirement instruments ($100-300)

- Funding evaluation instruments ($100-300)

As a rule, software program improvement firms embrace contingency prices of their undertaking finances. Additionally, bear in mind concerning the fixed upkeep and updating of the launched app within the lengthy view.

How Lengthy Does It Take to Construct a Private Finance App?

It’s clear sufficient that the time for constructing every function in a private finance app can differ relying on the consumer calls for for the app, the options’ complexity, and the applied sciences concerned, however a decrease certain line for fundamental options is the next:

- Budgeting – 50-150 hours

- Monitoring the spending – 50-100 hrs

- Reminders on payments – 30-100 hrs

- Safety – 100-300 hrs

- Purpose setting – 50-150 hrs

If we take a generalized time schedule, the pure app improvement course of takes round 470 hours. But, within the case of constructing an MVP or a extremely upgraded options stack, a private finance app price will shift from 470 to 800 hours.

How one can Guarantee App Safety: Optimised Rules for Private Finance Apps Safety

Conserving your private finance app safe is tremendous essential, particularly in the case of defending delicate monetary information. We will divide the most effective safety practices into blocks in line with performance:

- Consumer safety ideas: privateness and consumer consent, safe authentication and authorization.

- Safe design ideas.

- Practices of training on consumer safety: fixed safety training and coaching of customers. Compliance with regulatory requirements, ongoing updates and patch administration, testing, and auditing safety practices.

- Knowledge minimization and encryption, managing third-party dangers, protected storage, and transmission of information.

- Monitoring and log administration, common safety assessments, and evaluations.

Closing Phrase: SCAND’s Experience in Fintech App Improvement

Misplaced within the turbulent ocean of software program improvement? Don’t know what to choose? You could pay attention to the recommendation, and the private finance instruments and applied sciences offered within the article. This can assist clear up your thoughts concerning the technique of your private finance app improvement.

One other manner of creating a correct determination is to stay to long-standing professionals out there who adhere to high quality and consumer comfort. So, achieve worthwhile insights into SCAND’s full experience in private software program improvement.

With a must construct a private finance app tailor-made to your organization’s calls for, a digital banking service, or a fintech fee answer, the corporate holds on to the highest software program improvement requirements.

In a high-demand safety area like fintech software program improvement companies, SCAND stands out from the group. SCAND’s progressive turn-key and custom-made options convey people and company shoppers distinctive privateness safety and safety.

Furthermore, with 20+ years within the cellular and desktop improvement area, we flip the usage of SCAND merchandise into a cushty and well-protected consumer expertise.