Earlier this week, I joined Ciena and Telstra for a reside webinar highlighting Asia-Pacific market drivers, developments, and new cable builds.

Throughout my session, which targeted on Trans-Pacific submarine cable developments, content material suppliers got here up fairly a bit.

These corporations prioritize the necessity to hyperlink their information facilities and main interconnection factors. As such, they typically deploy large quantities of capability on core routes.

The Trans-Pacific and Intra-Asia routes are two nice examples.

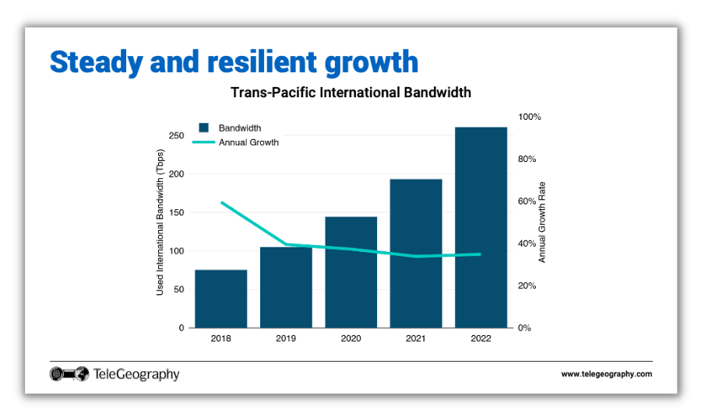

I started my presentation by displaying Trans-Pacific worldwide bandwidth from 2018 to 2022.

This chart exhibits that bandwidth demand progress throughout the Pacific has remained resilient and somewhat regular through the years. Trans-Pacific bandwidth grew 35% year-over-year in 2022 alone, reaching simply over 250 Tbps of capability.

Though the turquoise line exhibits a dip in annual progress earlier than stabilizing in 2019, the extra essential takeaway is absolutely the improve in wholesome bandwidth progress through the years.

And who’s consuming all of this bandwidth?

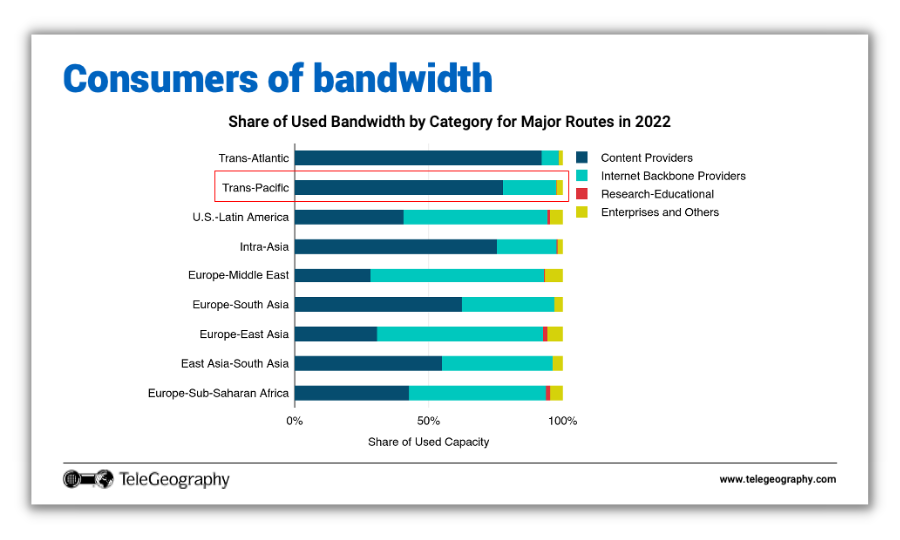

The slide under breaks down 4 completely different classes of bandwidth customers—Content material Suppliers, Web Spine Suppliers, Analysis-Instructional, and Enterprises and Others—throughout a number of main routes.

We will see that bandwidth utilization will not be evenly distributed throughout these classes.

Content material suppliers, proven in navy blue, take up enormous shares of capability throughout the Pacific and Intra-Asia (roughly greater than 78% and 75% of bandwidth, respectively).

On the flip facet, web spine suppliers (turquoise), nonetheless eat bigger volumes of bandwidth on sure routes, like U.S.-Latin America, Europe-Center East, and many others.

With that being stated, we anticipate a basic improve in content material supplier share of bandwidth throughout most of those routes within the years to come back. Demand from different forms of customers can be rising, simply not as quick as content material supplier demand.

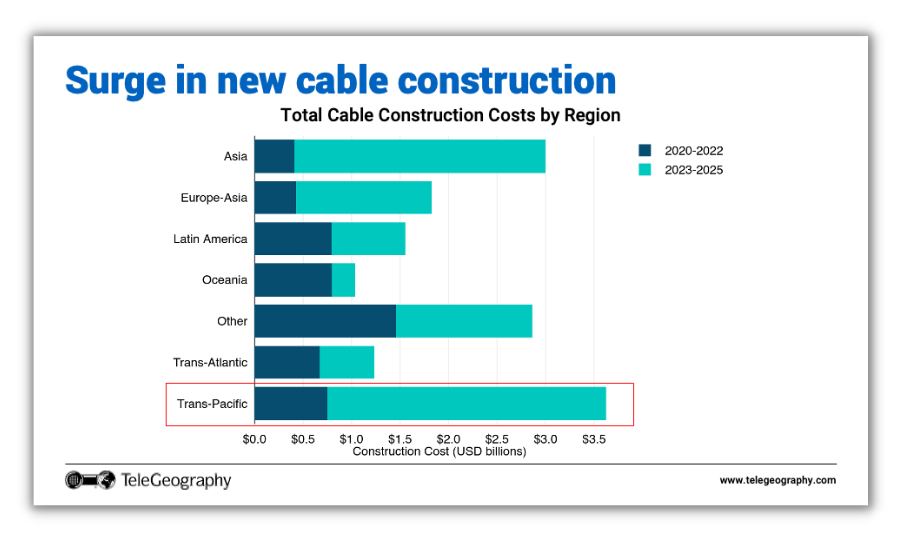

Unsurprisingly, the rise in bandwidth demand has led to a surge in new cable funding.

Unsurprisingly, the rise in bandwidth demand has led to a surge in new cable funding. As we will see within the determine under, there are a whole lot of cables getting into service within the subsequent three years.

Specializing in the Trans-Pacific alone, the development worth for cables getting into service from 2023-2025 is considerably greater in comparison with 2020-2022.

We additionally witness equally excessive ranges of cable funding in Asia—often known as Intra-Asia—as there’s a have to distribute this capability inside the area. Be aware that there could also be extra, unannounced cables on the horizon, which can additional inflate these values.

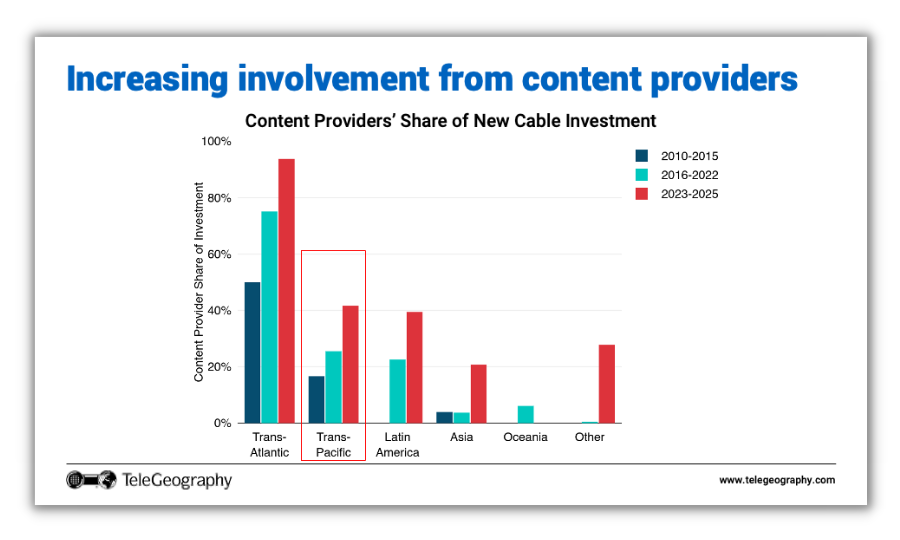

Earlier in my presentation, I established that content material suppliers eat extra bandwidth on sure routes.

If we break down content material supplier funding in new cables by time interval, we see will increase throughout the board.

Almost half of all Trans-Pacific cable investments getting into service between 2023-2025 are backed and funded by content material suppliers.

Almost half of all Trans-Pacific cable investments getting into service between 2023-2025 are backed and funded by content material suppliers.

And we consider that this development is prone to improve sooner or later.

Subsequent, my presentation lined why international worth erosion is slowing, the truth of U.S. and China decoupling, and an summary of all previous and new cable methods throughout the Pacific.

If you want to discover these subjects, you’ll be able to obtain my slides over right here. An on-demand recording of the total webinar can be obtainable to look at right here.