Cybersecurity researchers have found an up to date model of an Android banking malware known as Chameleon that has expanded its focusing on to incorporate customers within the U.Okay. and Italy.

“Representing a restructured and enhanced iteration of its predecessor, this advanced Chameleon variant excels in executing Machine Takeover (DTO) utilizing the accessibility service, all whereas increasing its focused area,” Dutch cell safety agency ThreatFabric mentioned in a report shared with The Hacker Information.

Chameleon was beforehand documented by Cyble in April 2023, noting that it had been used to single out customers in Australia and Poland since a minimum of January. Like different banking malware, it is recognized to abuse its permissions to Android’s accessibility service to reap delicate information and conduct overlay assaults.

The rogue apps containing the sooner model had been hosted on phishing pages and located to impersonate real establishments within the international locations, such because the Australian Taxation Workplace (ATO) and a cryptocurrency buying and selling platform known as CoinSpot, in an try and lend them a veil of credibility.

The newest findings from ThreatFabric present that the banking trojan is now being delivered through Zombinder, an off-the-shelf dropper-as-a-service (DaaS) that is offered to different risk actors and which can be utilized to “bind” malicious payloads to authentic apps.

Beat AI-Powered Threats with Zero Belief – Webinar for Safety Professionals

Conventional safety measures will not reduce it in in the present day’s world. It is time for Zero Belief Safety. Safe your information like by no means earlier than.

Though the providing was suspected to have been shut down earlier this 12 months, it resurfaced final month, promoting capabilities to bypass the ‘Restricted Settings’ characteristic in Android to put in malware on gadgets and acquire entry to the accessibility service.

Each the malicious artifacts distributing Chameleon masquerade because the Google Chrome internet browser. Their bundle names are listed beneath –

- Z72645c414ce232f45.Z35aad4dde2ff09b48

- com.busy.woman

A notable characteristic of the improved variant is its potential to conduct Machine Takeover (DTO) fraud, which leverages the accessibility service to carry out unauthorized actions on the sufferer’s behalf.

However with the intention to trick customers into enabling the setting, the malware checks the Android model on the put in machine and if it is discovered to be Android 13 or later, prompts the person to show it on.

“Upon receiving affirmation of Android 13 Restricted Settings being current on the contaminated machine, the banking trojan initiates the loading of an HTML web page,” ThreatFabric defined. “The web page is guiding customers by means of a guide step-by-step course of to allow the accessibility service on Android 13 and better.”

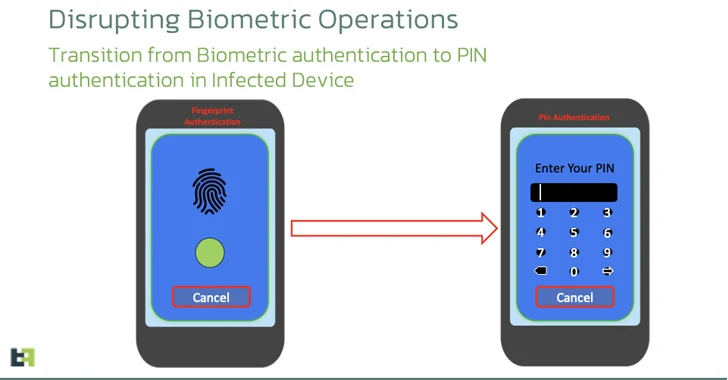

One other new addition is using Android APIs to disrupt the biometric operations of the focused machine by covertly transitioning the lock display authentication mechanism to a PIN in order to permit the malware to “unlock the machine at will” utilizing the accessibility service.

“The emergence of the brand new Chameleon banking trojan is one other instance of the delicate and adaptive risk panorama inside the Android ecosystem,” the corporate mentioned. “Evolving from its earlier iteration, this variant demonstrates elevated resilience and superior new options.”

The event comes as Zimperium revealed that 29 malware households – 10 of them new – focused 1,800 banking functions throughout 61 international locations over the previous 12 months. The brand new lively households embrace Nexus, Godfather, PixPirate, Saderat, Hook, PixBankBot, Xenomorph v3, Vultur, BrasDex, and GoatRAT.

The U.S. prime international locations focused comprise the U.S. (109 financial institution apps), the U.Okay. (48), Italy (44), Australia (34), Turkey (32), France (30), Spain (29), Portugal (27), Germany (23), Canada (17), and Brazil (11). Probably the most focused monetary companies apps are PhonePe (India), WeChat, Financial institution of America, Effectively Fargo, (U.S.), Binance (Malta), Barclays (U.Okay.), QNB Finansbank (Turkey), and CaixaBank (Spain).

“Conventional banking functions stay the prime goal, with a staggering 1103 apps – accounting for 61% of the targets – whereas the rising FinTech and Buying and selling apps are actually within the crosshairs, making up the remaining 39%,” the corporate mentioned.