The worth of main cryptocurrencies rose Monday within the wake of U.S. authorities plans to guard Silicon Valley Financial institution and Signature Financial institution depositors.

The Federal Reserve issued a pair of statements on Sunday with one clear message: Silicon Valley Financial institution’s depositors, each insured and uninsured, will obtain assist in a way that may “absolutely defend” their deposits.

The chance of a banking contagion was decrease at the beginning of the week than final Friday, however not zero.

Following a rally within the worth of bitcoin and different crypto belongings, the general crypto market surpassed $1 trillion in worth on Monday, up about 14% day over day.

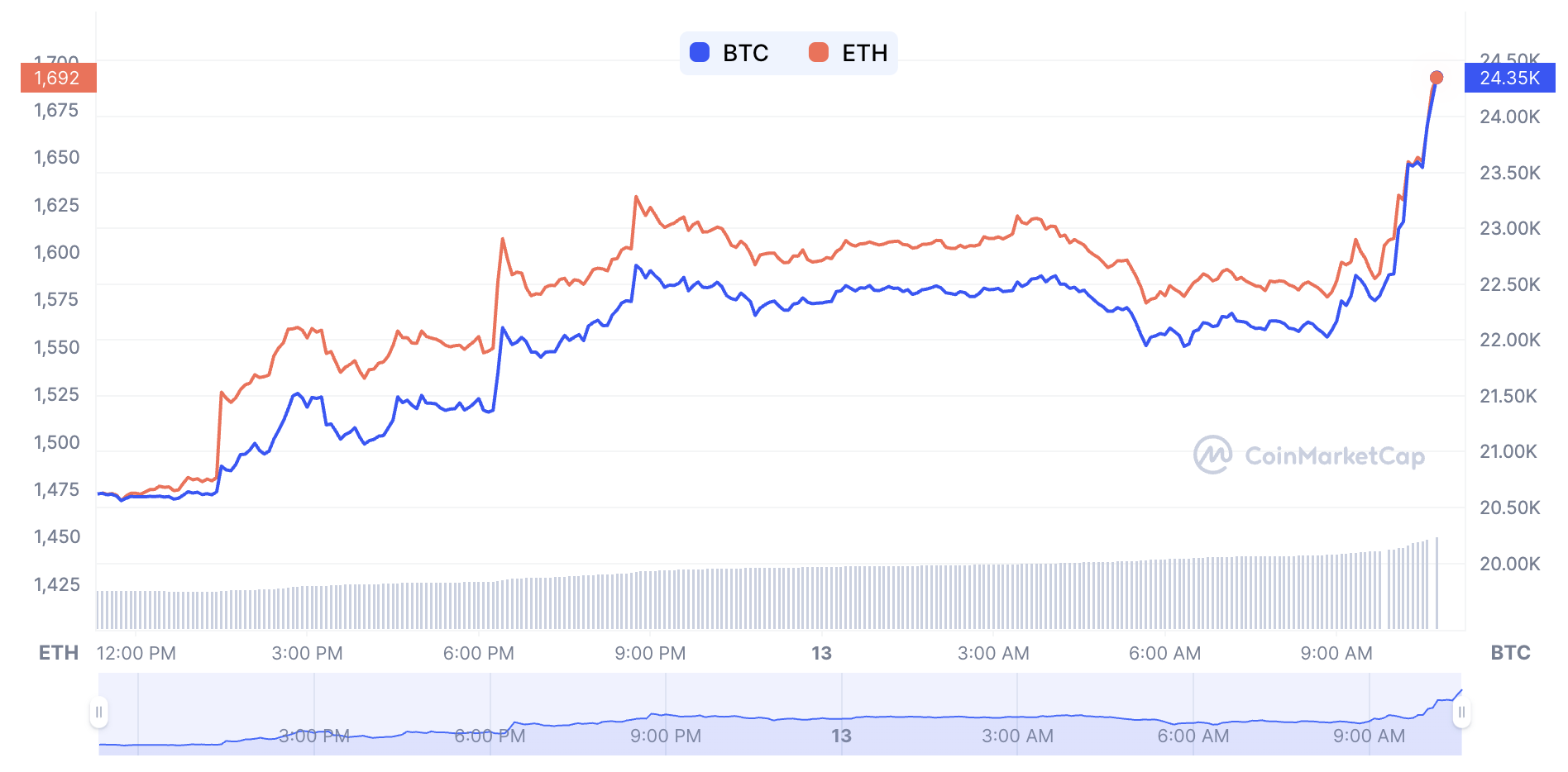

Up to now 24 hours, bitcoin rose 18.4% to over $24,000, whereas ether rose 15% to about $1,700, CoinMarketCap information confirmed. The 2 cryptocurrencies, that are the biggest by market capitalization, are buying and selling in parallel with each other.

Picture Credit: CoinMarketCap (opens in a brand new window)

USDC, the second largest stablecoin, additionally recovered about 4% up to now 24 hours following the information that deposits can be protected, CoinMarketCap information confirmed.

The alleged stablecoin depegged from its $1 peg for 3 days, going as little as 88 cents, after uncertainty circulated across the $40 billion USDC empire and the corporate shared that $3.3 billion, or about 8.2%, of its whole provide of reserves had been held in SVB.

Circle introduced the reserve danger was “eliminated” for the reason that funds grew to become accessible on Monday morning.

“Belief, security and 1:1 redeemability of all USDC in circulation is of paramount significance to Circle, even within the face of financial institution contagion affecting crypto markets,” Jeremy Allaire, co-founder and CEO of Circle, stated in an announcement. “We’re heartened to see the U.S. authorities and monetary regulators take essential steps to mitigate dangers extending from the banking system.”

USDC’s market capitalization is about $40.5 billion, with $10.9 billion in every day traded quantity, down 1% up to now 24 hours, in response to CoinMarketCap information. On the time of publication, USDC was millicents away from its $1 peg at $0.993, up 3.9% up to now 24 hours.

The crypto market, alongside different main industries, had a unstable week after Silvergate Capital, one of many largest banks to offer companies to crypto firms, shared it was winding down operations and liquidating its banking division.

Shortly after, Silicon Valley Financial institution collapsed on Friday, and Signature Financial institution, a serious crypto lender, was shut down by regulators on Sunday.

This market turmoil has seemingly propped up the crypto market, nevertheless, as merchants responded positively to the information and the general market cap rose on Monday.