The worldwide value of cybercrime in 2023 was set to hit 8 trillion U.S. {dollars}. The monetary trade is a main goal as the speed of ransomware assaults has practically doubled (64%) since 2021. Monetary establishments are defending towards cybersecurity assaults by having a robust infrastructure that is ready to implement a zero belief coverage. This cornerstone of a zero belief coverage relies on having an concept of who or what the top system is that’s requesting entry.

Conventional password techniques, whereas easy, are out of date. Human elements on password reuse and complexity, coupled with intensive password breaches, have neutralized their safety effectiveness. Having a multi-factor system, and understanding context of the request (location, time, and so forth.) is vital to laying the groundwork for with the ability to belief. To make sure good safety hygiene, quite a few regulatory our bodies have instituted rules that implement monetary establishments adoption of multi-factor techniques to guard not solely the top consumer of their monetary merchandise, but in addition to guard the core of the monetary system. In locations the place federal rules weren’t sturdy sufficient, states have taken the lead, with New York and California passing related state mandates that monetary establishments or firms that “considerably interact in monetary actions” should use Multi-Issue Authentication (MFA) to guard their information.

Cisco Duo helps monetary establishments safe their clients information and meet these regulatory necessities. Hundreds of economic establishments are presently utilizing Duo as a MFA resolution to maintain their most trusted sources, their clients wealth, protected.

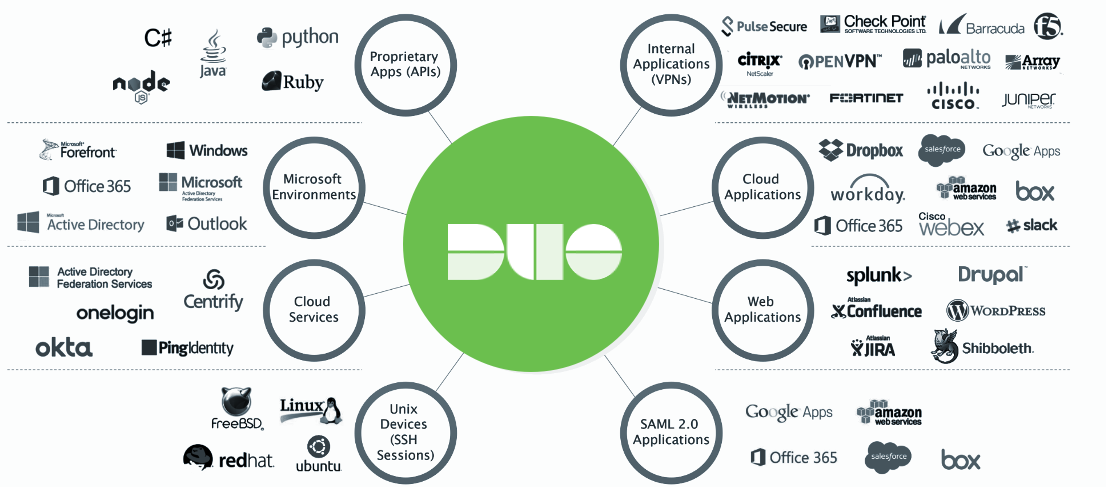

A key benefit of Duo is it helps with the frequent safety problem, lots of safety controls don’t get applied due to complexity for the top consumer or lack of scalability. Duo stands out as a result of it’s each extraordinarily user-friendly and extremely scalable, confirmed by its widespread adoption in academic settings and by directors managing among the trade’s largest multi-tenant cloud environments. Its effectiveness is obvious—it merely works. Moreover, Duo’s intensive integrations make the most of standards-based protocols, making the answer simple and accessible for builders to work with as properly.

An instance of the intensive capabilities and integrations of the Duo platform is proven beneath within the graphic.

Among the rules that may be happy by Cisco Duo embody:

- Fee Card Trade Knowledge Safety Commonplace (PCI DSS): Requires MFA to be applied as outlined in Requirement 8.3 and its sub-requirements. (PCI, 2017)

- FFIEC: Supplies steering on utilization of MFA for purchasers.

- Funds Service Directive2 (PSD2): Robust buyer authentication requires use of MFA.

Lately Cisco Duo offered focused suggestions on how clients will help apply CISA’s steering across the scattered spider cybersecurity group. Making a protection in-depth and 0 belief structure requires a safe resolution that is still user-friendly for the top consumer. Cisco Duo helps monetary establishments obtain their safety compliance and defend themselves as a part of a protection in-depth technique.

Listed here are extra hyperlinks on regulatory steering round MFA.

Share: