How excessive can the S&P 500 (SPY) go with out the Fed reducing charges? Steve Reitmeister says that 5,000 is a lid on inventory costs with possible pullback, buying and selling vary and sector rotation to observe. Why is that? Learn on under for extra.

Final week’s headline exclaimed “5,000 or Bust!”. I nonetheless imagine that is true as its simply inside attain from at this time’s shut at 4,954 (SPY).

The issue is that I do not count on rather more upside from there till the Fed begins reducing charges. If that is not coming in March…then how lengthy do we have to wait???

That dialogue will likely be on the coronary heart of at this time’s Reitmeister Complete Return commentary. Plus, we are going to plot a course to income even when the general market is lackluster for some time.

Market Commentary

Chairman Powell threw buyers for a loop final Wednesday when he made it clear that fee cuts are extremely unlikely to start out on the March 21st assembly. Since then, shares have been extra risky and fewer bullish.

I’ve even seen some market commentators calling for a nasty correction or worse. That does not appear needed. Type of like once you pull your automobile as much as a pink mild that you already know in some unspecified time in the future goes to show inexperienced.

You aren’t getting out of your automobile and sit on the curb. As an alternative, you retain your eyes straight forward and able to step on the fuel pedal as soon as once more.

When will that mild for shares flip inexperienced once more?

Sadly, the mix of Powell’s speech and three sturdy financial experiences (Authorities Jobs, ISM Mfg, ISM Providers) pushes it out to the Might 1st assembly at a minimal. Proper now, buyers put 65% odds of that occuring. And 97% probability of cuts by the point of the June 28th assembly.

These outcomes are most definitely attainable. Nevertheless, I sense estimates of the speed cuts are a tad too optimistic given the details in hand. And let’s not overlook the immense endurance the Fed has flaunted to date main buyers to greater than as soon as push out the date of the primary minimize.

Till that first minimize is in hand looks as if the proper setting for a buying and selling vary state of affairs the place 5,000 will present a fairly tight lid on inventory costs. The draw back is probably going 4,800 which was a earlier level of cussed resistance earlier than the current break above on January 18th.

Shares by no means actually idle in these buying and selling ranges. Extra possible it’s a risky time with fixed sector rotations and adjustments in market management.

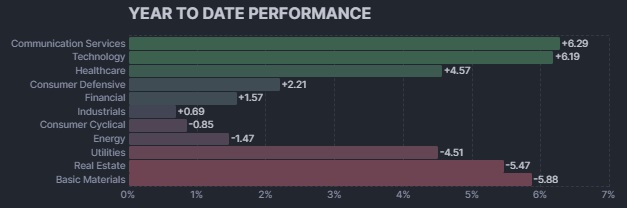

Usually the strongest teams turns into the weakest and the weakest turns into the strongest. If that’s the case, then let’s take a look at what sectors are sizzling and never thus far in 2024:

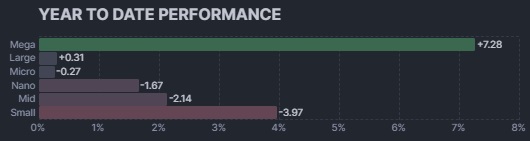

Additionally clever to test in with the yr thus far view based mostly upon market cap:

To nobody’s shock mega cap tech shares are absorbing a lot of the positive factors with different teams languishing. This was the image for the inventory marketplace for a lot of 2023 till the script bought flipped within the latter levels of the yr.

I sense the same change of management goes to happen in some unspecified time in the future this yr. Buying and selling ranges provide pretty much as good of a possibility of any for that altering of the guard. Which means this all could also be quickly at hand.

So sure, in my Reitmeister Complete Return portfolio I proceed to have a small inventory bias. However not simply any small caps will do. They should present operational excellence as finest expressed via a beat and lift earnings report this quarter.

On prime of that pullbacks and sector rotation intervals often have a higher eye in the direction of worth than through the massive bull runs. Add this altogether and its prime time for POWR Score shares.

That being constant development corporations exhibiting operational excellence whereas buying and selling at cheap costs. This has all the time been essentially the most constant path to inventory market income and no cause for that to not be the case in 2024.

What are my favourite POWR Scores shares now?

Discover 12 of them within the subsequent part…

What To Do Subsequent?

Uncover my present portfolio of 12 shares packed to the brim with the outperforming advantages present in our unique POWR Scores mannequin. (Practically 4X higher than the S&P 500 going again to 1999)

This consists of 5 below the radar small caps just lately added with great upside potential.

Plus I’ve 1 particular ETF that’s extremely effectively positioned to outpace the market within the weeks and months forward.

That is all based mostly on my 43 years of investing expertise seeing bull markets…bear markets…and the whole lot between.

In case you are curious to study extra, and need to see these fortunate 13 hand chosen trades, then please click on the hyperlink under to get began now.

Steve Reitmeister’s Buying and selling Plan & Prime Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Complete Return

SPY shares have been unchanged in after-hours buying and selling Tuesday. 12 months-to-date, SPY has gained 3.93%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Creator: Steve Reitmeister

Steve is best recognized to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Complete Return portfolio. Study extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The put up Are Shares Caught til Summer season? appeared first on StockNews.com