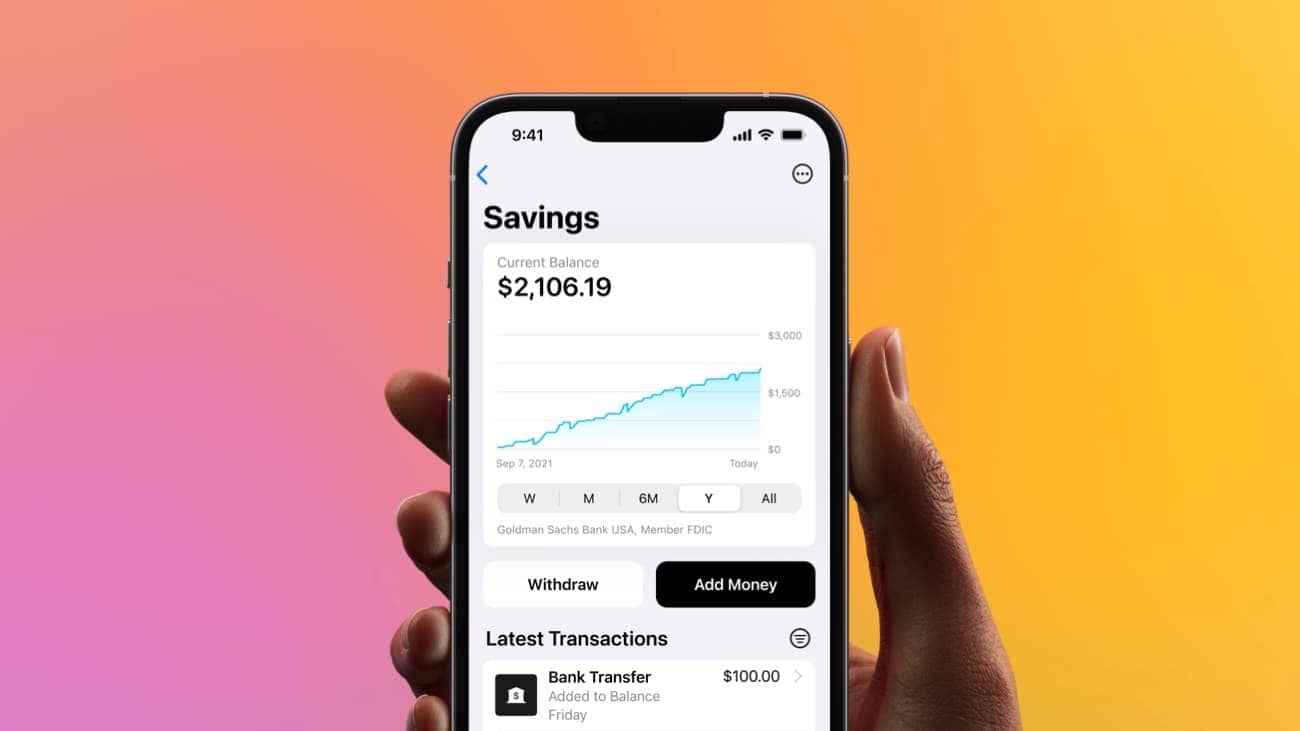

Photograph: Apple

Apple’s partnership with Goldman Sachs for the Apple Card is coming to an finish. The Cupertino large has reportedly despatched a proposal to the financial institution to exit from the settlement within the subsequent 12 to fifteen months.

For the time being, it’s unclear if Apple has zeroed in on one other banking companion for Apple Card.

Goldman Sachs has misplaced billions of {dollars} on this partnership

Apparently, the transfer will come only a yr after Apple and Goldman Sachs prolonged their partnership by means of 2029, reviews the Wall Avenue Journal.

Apple depends on Goldman Sachs to deal with the banking necessities of Apple Card and its financial savings account. The 2 corporations have been working collectively since 2019. The collaboration has labored in Apple’s favor. Nevertheless, Goldman Sachs has suffered billions of {dollars} in losses, so it desires to exit the partnership and in the reduction of on its client finance enterprise.

Rumors of Goldman Sachs seeking to exit the Apple Card partnership have been swirling since June this yr.

A earlier report had detailed that Goldman Sachs needed to vary when Apple Card payments prospects. The invoice is generated in the beginning of the month. This causes Goldman Sachs’ customer support division to be flooded with calls. After which, they sit idle for the remainder of the month.

Apple Card wants a brand new banking companion

The Cupertino large didn’t verify the WSJ report, however its consultant issued the beneath assertion to CNBC:

“Apple and Goldman Sachs are centered on offering an unbelievable expertise for our prospects to assist them lead more healthy monetary lives. The award-winning Apple Card has seen a fantastic reception from shoppers, and we are going to proceed to innovate and ship the perfect instruments and providers for them.”

Apple would possibly reportedly swap to American Specific as its banking companion. Nevertheless, the deal has not but been finalized. The latter has raised issues about this system’s loss charges and different elements. Synchrony Monetary may also take over the Apple Card program from Goldman Sachs. It already works intently with Amazon and PayPal to challenge their bank cards.

If you’re an Apple Card buyer, nothing modifications for you instantly. As soon as Goldman Sachs exits the partnership and Apple finds a brand new banking companion, it may need to make some tweaks to its bank card and financial savings account.