Apple’s third fiscal quarter outcomes will probably be issued on August 3, accompanied by the standard name with analysts. Here is what to anticipate from the outcomes, and what Wall Avenue thinks of the iPhone maker.

Apple confirmed its quarterly outcomes will probably be launched on August 3 again on July 10. As is typical for the occasion, it is going to be adopted by a name hosted by CEO Tim Cook dinner and CFO Luca Maestri, with the outcomes launched at round 4:30 PM ET and the decision itself ranging from 5:00 PM ET.

Some Apple steering

As has been typical of the monetary outcomes from Apple itself since early 2020, the corporate has declined to supply agency numbers in its forward-looking steering. Nevertheless, throughout the second quarter earnings name, Maestri did supply up some particulars to contemplate.

Based on Maestri, income for the quarter is predicted to development equally year-on-year to Q2, as long as the macroeconomic outlook does not worsen. Overseas change was additionally predicted to stay a headwind at 400 foundation factors, although Companies ought to proceed to see comparable development to the March quarter.

Maestri additionally stated the gross margin for the third quarter ought to relaxation at 44% to 44.5% with working prices starting from $13.6 billion to $13.8 billion. The energy of the Gross Margin can be attributed to the flat overseas change fee, the CFO added.

YoY: Q3 2022 figures

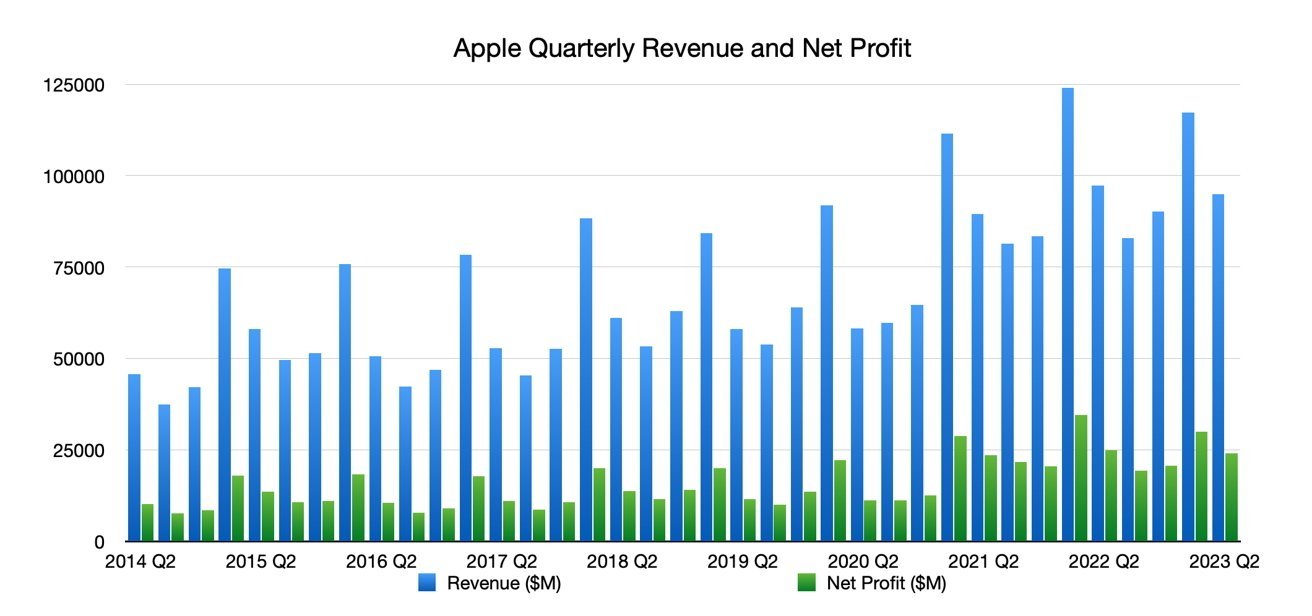

The third quarter is often the bottom of Apple’s annual cycle of outcomes, with it usually incomes much less income than all the different quarters within the yr. Even so, Apple does proceed to see enhancements within the quarter’s outcomes in comparison with the earlier yr’s report.

For Q3 2022, Apple noticed a 2% YoY improve in income to $83 billion, with iPhone income up barely at $40.6 billion, iPad income barely down at $7.22 billion, and Mac income additionally all the way down to $7.38 billion. Wearables, House, and Equipment noticed a slight discount to $8.08 billion, however Companies continued to see development to $19.6 billion.

Quarter releases

Surfacing late within the quarter are updates to the Mac Studio and Mac Professional, and the introduction of a 15-inch MacBook Air. None of those merchandise will make a cloth impression on the quarter, however ought to do properly for the This fall figures.

What Wall Avenue thinks

Utilizing figures sourced from Yahoo Finance,a consensus of analysts have put ahead the concept that Apple’s income will probably be $90.29 billion, primarily based on the stories of 25 analysts. The overall vary was from a low of $82.81 billion to a excessive of $97.17 billion.

The earnings per share is reckoned to be about $1.36, primarily based on opinions from 28 analysts. That features a low estimate of $1.17 and a excessive of $1.51.

Particular person analysts on Apple

Wedbush

On July 30, Wedbush stated Apple might “flex the muscle groups” throughout the outcomes, citing excessive demand for the iPhone 14 Professional in China. With a “clear uptick in demand” in China, the excessive iPhone income in China could possibly be a excessive level, particularly this late within the iPhone product cycle.

With roughly 25% of the present set up base not upgrading their iPhone for 4 years or extra, and the prospect of an “anniversary version” iPhone 15, Wedbush feels there could possibly be a “steadier transition” from iPhone 14 to iPhone 15 in comparison with earlier generational switches.

Companies can also be an “underappreciated asset” by Wall Avenue, with an acceleration in development again to double digits anticipated within the coming quarters.

Wedbush maintained an “Outperform” ranking for Apple, in addition to a $200 worth goal.

Morgan Stanley

In a July 25 be aware, Morgan Stanley believes Apple could have an as-expected June quarter, with income trending equally year-on-year to Q2. Which means an earnings per share of about $1.19 and $81.7 billion in gross sales.

These could change if the macroeconomic outlook does not worsen. Overseas change is predicted to remain as a headwind at 400 foundation factors.

Certainly, Morgan Stanley was extra enthusiastic in regards to the fourth quarter in September, insisting it could possibly be “5-10% above Consensus.” Yr-on-year income development can also be anticipated for the primary time in 4 quarters, the report claimed, with iPhone and Companies being the principle accelerators.

Morgan Stanley reiterated its worth goal of $220.

Goldman Sachs

Anticipating no surprises, the July 25 Goldman Sachs be aware is equally enthusiastic in regards to the September quarter, however stayed considerably on subject in regards to the June quarter.

An EPS of $1.21 is predicted, pushed by “outperformance in Mac and Companies.” Mac income of $9.4 billion is predicted, versus the year-ago quarter harmed by provide chain points, whereas Companies might attain $21.8 billion over App Retailer spending.

On September’s quarter, Goldman Sachs proposes the launch of the iPhone 15 is “promising” because the “comparatively weaker efficiency in iPhone 14 to-date suggests {that a} bigger share of the put in base could wish to improve.” The analysts mood expectations by warning of stories of manufacturing points that “could end in a delayed launch or restricted availability on the time of launch.”

Deutsche Financial institution

On July 24, Deutsche Financial institution raised its worth goal for Apple from $180 to $210, and reiterated its “Purchase” ranking for the inventory.

The Deutsche Financial institution be aware anticipates Q3 outcomes to be in line or barely higher than Wall Avenue estimates, with upsides on iPhone, Mac, and Companies. It additionally believes that, whereas the Avenue expects a 5% YoY decline on iPhone, Apple might nonetheless see development within the space.

Overseas change dynamics, which beforehand had a destructive impact on development and gross margins, might even see some enchancment, in flip rising the EPS.

Deutsche Financial institution views Apple “favorably given its prime quality of earnings and robust steadiness sheet.”