Insurance coverage large American Household Insurance coverage has confirmed it suffered a cyberattack and shut down parts of its IT programs after prospects reported web site outages all week.

American Household Insurance coverage (AmFam) is an insurance coverage firm specializing in industrial and private property, casualty, auto, and life insurance coverage, in addition to providing funding and retirement planning The corporate employs 13,000 folks and has a 2022 income of $14.4 billion.

In an electronic mail to BleepingComputer, American Household Insurance coverage confirmed that they detected uncommon exercise on their community and shut off IT programs to stop the unfold of the cyberattack.

“This week, the know-how groups at American Household Insurance coverage detected uncommon exercise in a portion of our community. We shortly took precautionary measures to guard information and assets and shut down a number of enterprise programs,” an AmFam spokesperson instructed BleepingComputer.

“We acknowledge the system outages are impacting prospects, brokers and workers and we admire their endurance and understanding.”

“Our investigation into the exercise is ongoing and consists of inner and third-party consultants. Thus far, now we have not detected any compromises to essential enterprise, buyer information processing or storage programs, and a number of other elements of our enterprise proceed to function with out interruption.”

The corporate hopes to deliver programs again on-line because it continues investigating the breach and figuring out it’s protected.

When you have any data relating to the American Household Insurance coverage cyberattack, you’ll be able to contact us confidentially through Sign at 646-961-3731

IT programs shut down after cyberattack

Since this previous weekend, American Household Insurance coverage has suffered IT outages impacting the corporate’s cellphone service, constructing connectivity, and on-line providers.

BleepingComputer has additionally been instructed by a number of sources that web connectivity was shut down by American Household Insurance coverage after the assault, impacting different tenants of the identical constructing.

Prospects have reported being unable to pay payments or file claims on-line, solely to be met with messages stating that the net web site is down and to contact them through cellphone as an alternative.

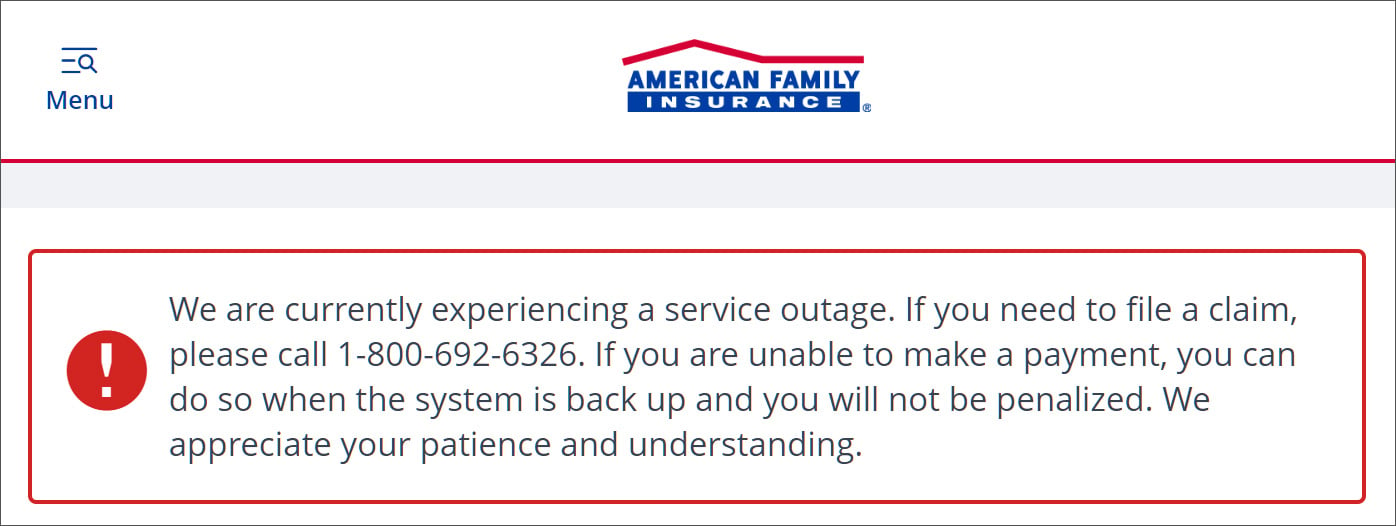

“We’re at present experiencing a service outage. If it’s good to file a declare, please name 1-800-692-6326,” reads a message on AmFam’s web site.

“If you’re unable to make a cost, you are able to do so when the system is again up and you’ll not be penalized. We admire your endurance and understanding.”

Supply: Reddit

Equally, trying to pay a invoice as a visitor shows an error message stating, “The server is quickly unable to service your request because of upkeep downtime or capability issues. Please attempt once more later.”

It’s unclear what sort of assault American Household Insurance coverage suffered, however it shares indicators much like ransomware assaults plaguing the enterprise.

Many of those assaults happen over the weekend when fewer workers monitoring the community or utilizing their computer systems and noticing suspicious exercise.

As a part of the assaults, the risk actors generally unfold all through the community, stealing information and encrypting units.

When the assault is accomplished, victims are left with ransom notes warning that the info might be leaked publicly if a ransom demand will not be paid.

Sadly, these techniques have been very profitable, with blockchain evaluation firm Chainalysis reporting that ransomware gangs have earned at the least $449.1 million in 2023.