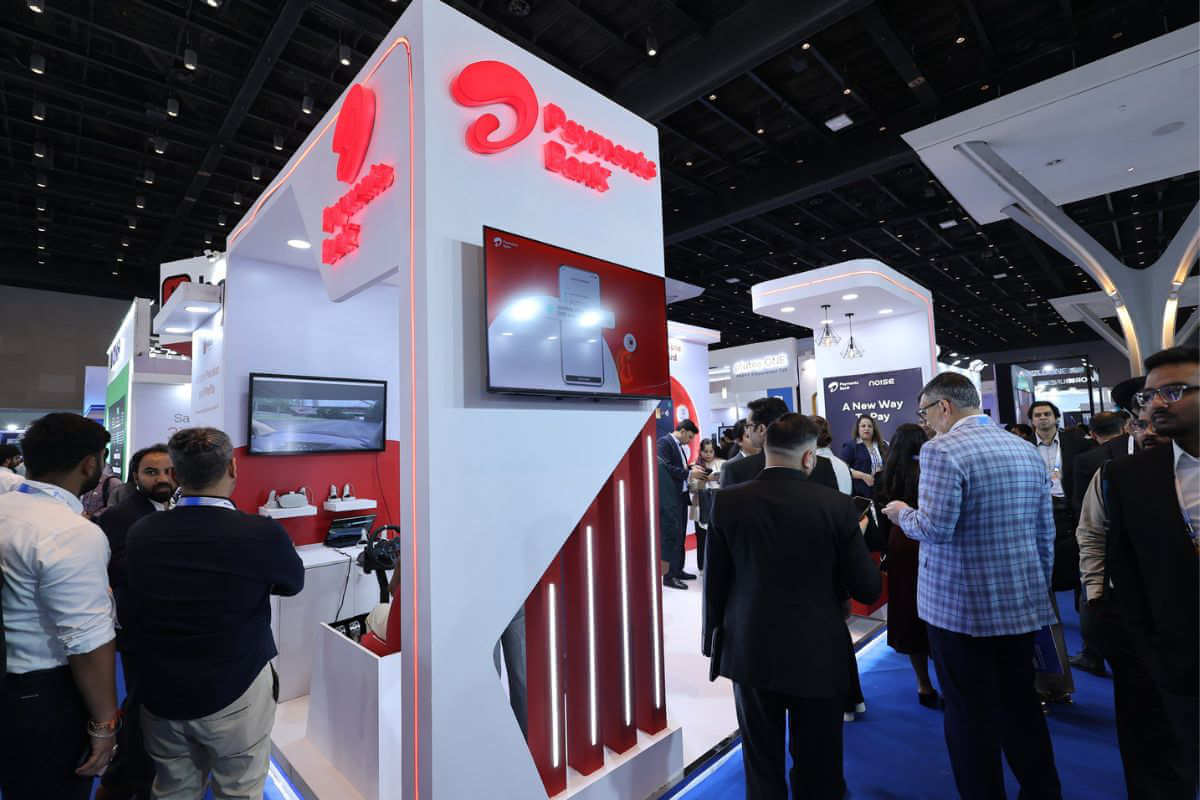

Airtel Funds Financial institution, the fintech arm of Bharti Airtel, participated within the World Fintech Fest 2024, which occurred from August 28 to August 30 in Mumbai. Throughout the occasion, Airtel Funds Financial institution (APB) showcased a number of improvements aimed toward advancing fintech in India. Let’s check out the bulletins APB made in the course of the occasion:

Additionally Learn: Airtel Funds Financial institution Launches NCMC-Enabled Smartwatch in Collaboration with Noise

1. Showcases Self-Reliant Person Journey

Airtel Funds Financial institution, in partnership with the Nationwide Funds Company of India (NPCI), demonstrated a self-reliant person journey for NCMC-enabled playing cards, protecting the whole lot from issuance to card top-up and utilization. NCMC stands for the Nationwide Frequent Mobility Card, an initiative by the Authorities of India to create a seamless and interoperable cost answer for numerous modes of transportation and different utilities. Together with NPCI and Razorpay, the financial institution additionally demonstrated personalised experiences on UPI on the occasion.

2. Introduced NCMC-Enabled Smartwatch

Airtel Funds Financial institution, in collaboration with Noise and NPCI, introduced the launch of its upcoming NCMC-enabled smartwatch, built-in with the RuPay chip. The financial institution showcased a prototype of this smartwatch on the World Fintech Fest 2024.

With NCMC integration, customers will benefit from the comfort of Faucet and Pay transactions at service provider areas and NCMC-enabled transit funds throughout metro programs, buses, parking amenities, and extra nationwide. Moreover, it helps the issuance of transport concessions and month-to-month passes, the place relevant, by transport operators, making day by day commutes hassle-free.

With this smartwatch, shoppers can enter the metro with only a faucet, making funds seamlessly, the financial institution highlighted in the course of the occasion.

Learn extra in regards to the announcement by the hyperlink.

3. India’s Most well-liked Protected Second Account

Chatting with the media on the occasion, the CEO of Airtel Funds Financial institution mentioned that Airtel Funds Financial institution is the primary selection for India’s protected second account. “Now we have seen a big uptake in individuals making use of for a digital second account. We’re the most important financial institution in processing transit funds, with practically a 48 % market share throughout the nation, particularly in metros like Delhi, Mumbai, Ahmedabad, and Gujarat,” the CEO mentioned.

The financial institution expects that kind elements for mobility funds will change and believes that mobility would be the subsequent massive theme. The financial institution famous that its prospects recognize the simplicity of with the ability to carry out banking transactions simply on a single display.

4. Two New Options in Airtel Funds Financial institution

The financial institution introduced the launch of two new options on its funds platform, which it claims are firsts in India. These options are the Fraud Alarm and the Clear Banking part.

The Fraud Alarm:

The Fraud Alarm is designed to supply speedy help in case of a fraudulent transaction, with only a single swipe. If prospects suspect fraud, they will report the transaction with one swipe. The financial institution said {that a} course of that normally takes 4-5 steps to report fraud now occurs with only one slide.

Upon sliding to report, the account will get quickly blocked, the present mPIN expires, an SMS is distributed to reset the mPIN, a ticket is raised with the financial institution’s fraud administration crew, and Airtel Funds Financial institution will name the shopper inside minutes for assist.

Clear Banking part:

And the second function, The Clear Banking part is designed to supply easy, simple, and sincere banking with readability in each transaction, the financial institution mentioned.

By means of this part, prospects can see precisely what they’re paying for, perceive the phrases and circumstances, know what knowledge is saved and why, learn the way safe the info is, and perceive the permissions and the explanations for them.

“Expertise Belief, Security, and Transparency with Airtel Funds Financial institution,” the financial institution marketed this function.

Additionally Learn: Airtel Funds Financial institution Launches Sensible Look ahead to Contactless Funds

5. Extra Developments

Airtel Funds Financial institution additionally enabled stability top-ups for NCMC playing cards in collaboration with NPCI and ISG. Moreover, the financial institution unveiled the brand new look of the NETC FASTag in partnership with NPCI and IHMCL.

These are the most recent developments from Airtel Funds Financial institution within the digital fintech area, showcased on the World Fintech Fest 2024.