The deadlock between Agile and Waterfall processes has continued in venture administration discourse for many years. Software program growth groups thrive in Agile environments, however an absence of administration assist is among the main obstacles to Agile transformation. A venture supervisor working within the software program trade for any size of time has in all probability encountered a C-suite that wishes them to “do Waterfall.” However what precisely does that imply in follow?

For years, research have proven a constructive relationship between using Agile frameworks and venture success, and it might be tempting for a venture supervisor to imagine they simply must promote their company officers on Agile’s outcomes. Nevertheless it’s equally vital to know what higher administration likes concerning the Waterfall methodology. For those who perceive the monetary safeguards that Waterfall affords the C-suite, you’ll be able to craft a hybrid framework that may bridge the hole between Agile practices and enterprise Waterfall as soon as and for all. The start of that understanding lies in Waterfall’s principally untold origin story.

The Murky Origins of Waterfall Methodology

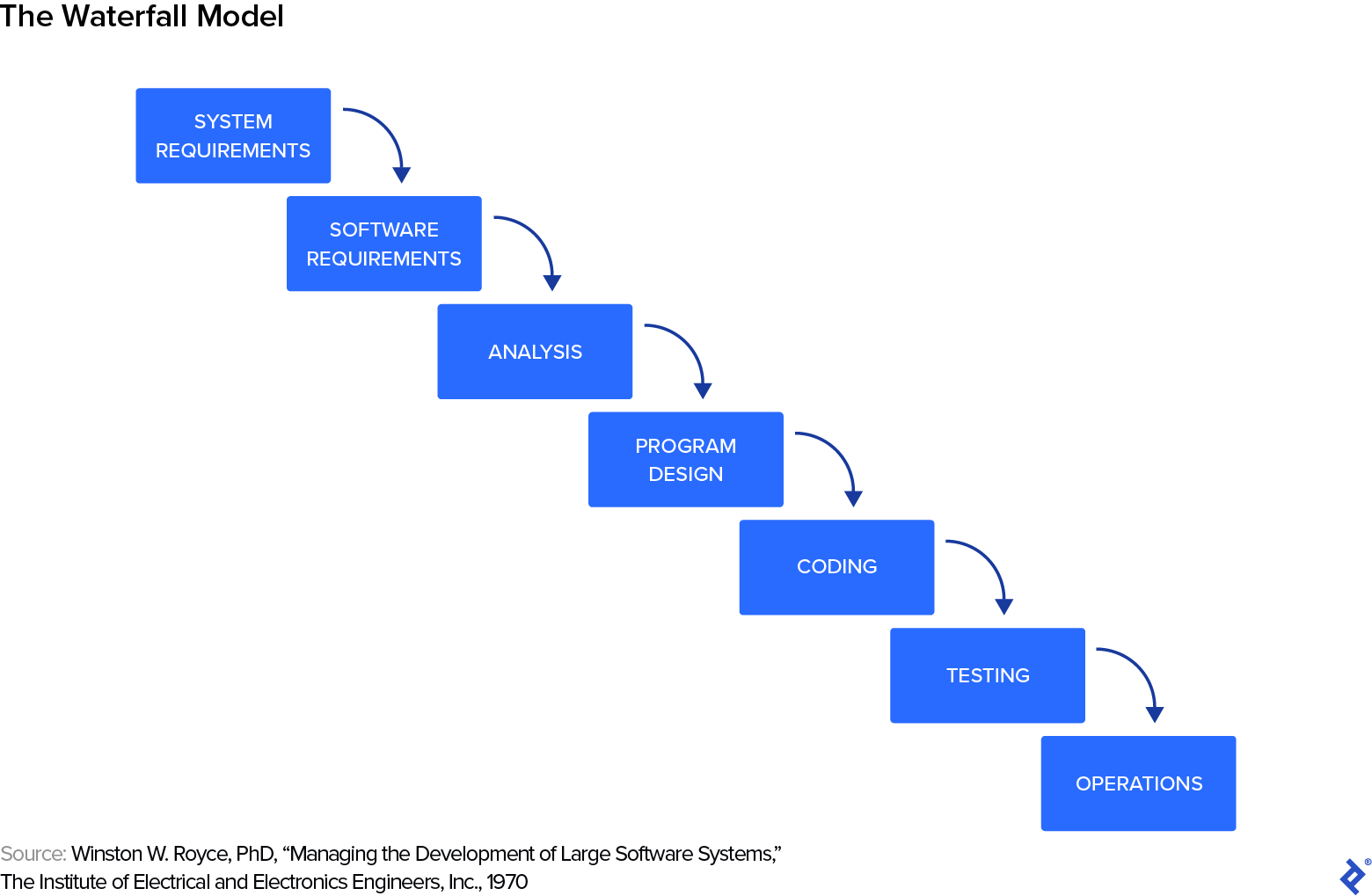

Most individuals in organizational administration affiliate the time period “Waterfall” with the chart under, which comes from “Managing the Growth of Massive Software program Programs,” an influential tutorial paper written by Winston W. Royce, PhD, in 1970. Royce’s illustration is broadly credited as the primary expression of Waterfall growth.

The crediting of Waterfall growth to Royce’s analysis is among the unusual ironies of the software program trade. In his paper, Royce by no means makes use of the phrase “waterfall” or advocates it as an efficient system; he truly presents what would come to be generally known as Waterfall as a cautionary story—an instance of a course of that’s “dangerous and invitations failure” as a result of it doesn’t account for the mandatory iteration wanted amongst software program growth phases.

Royce was not alone: 18 years later, Barry W. Boehm, PhD (who would quickly develop into director of DARPA), used a really related illustration, once more for instance of a problematic software program growth life cycle, and proposed iterative growth as a positive various. In 1996, nearly your complete software program trade endorsed an iterative growth cycle known as the Rational Unified Course of (RUP), which was itself a synthesis of greatest practices universally acknowledged by software program engineers.

This raises a giant query: Why would anybody in administration push again towards using Agile over Waterfall, a framework that since its inception has been seen by trade consultants and professionals to be at odds with environment friendly growth practices?

OpEx vs. CapEx: The Monetary Case for Waterfall

The rationale Waterfall stays in favor requires just a little information a few enterprise perform that growth groups seldom take into consideration: accounting.

In double-entry accounting, there are two sorts of bills: operational bills and capital bills (additionally generally known as OpEx and CapEx). Any expense lowers the online earnings of an organization, however an operational expense—corresponding to hire, payroll, or insurance coverage—lowers it extra. The cash is spent, and is subsequently now not on the books. A capital expense—corresponding to actual property, manufacturing unit gear, or workplace furnishings—lowers earnings much less due to an accounting approach known as depreciation, which distributes the expense over a number of years. Additionally, as soon as an asset has been bought, it’s thought-about a part of the corporate’s internet value.

Between 2000 and 2002—even because the Agile Manifesto was being developed—the company world was rocked by a pair of main accounting scandals, beginning with the US vitality firm Enron. Put merely, Enron (with the alleged complicity of accounting agency Arthur Andersen) hid main losses from buyers by deliberately mismanaging operational bills and capital bills. This was half of a bigger scheme to fraudulently inflate its earnings, and subsequently enhance its inventory market worth, by billions of {dollars}.

Shortly thereafter, a related scandal occurred at US telecommunications firm WorldCom. WorldCom additionally hid losses by purposefully miscategorizing operational bills as capital bills, and the 2002 session of Congress reacted by passing the Sarbanes-Oxley Act. Included on this invoice’s provisions had been new guidelines that made firm officers, such because the CEO and CFO, personally accountable for shareholder losses that occurred due to an absence of due diligence.

With regards to software program growth, CapEx versus OpEx is an particularly complicated concern: CapEx seems to be good on a steadiness sheet, permitting firms to report a greater working revenue and borrow bigger quantities.The draw back, nonetheless, is that capitalization standards have advanced and require documentation, critiques, and approvals—all of which may enormously hinder the software program growth course of.

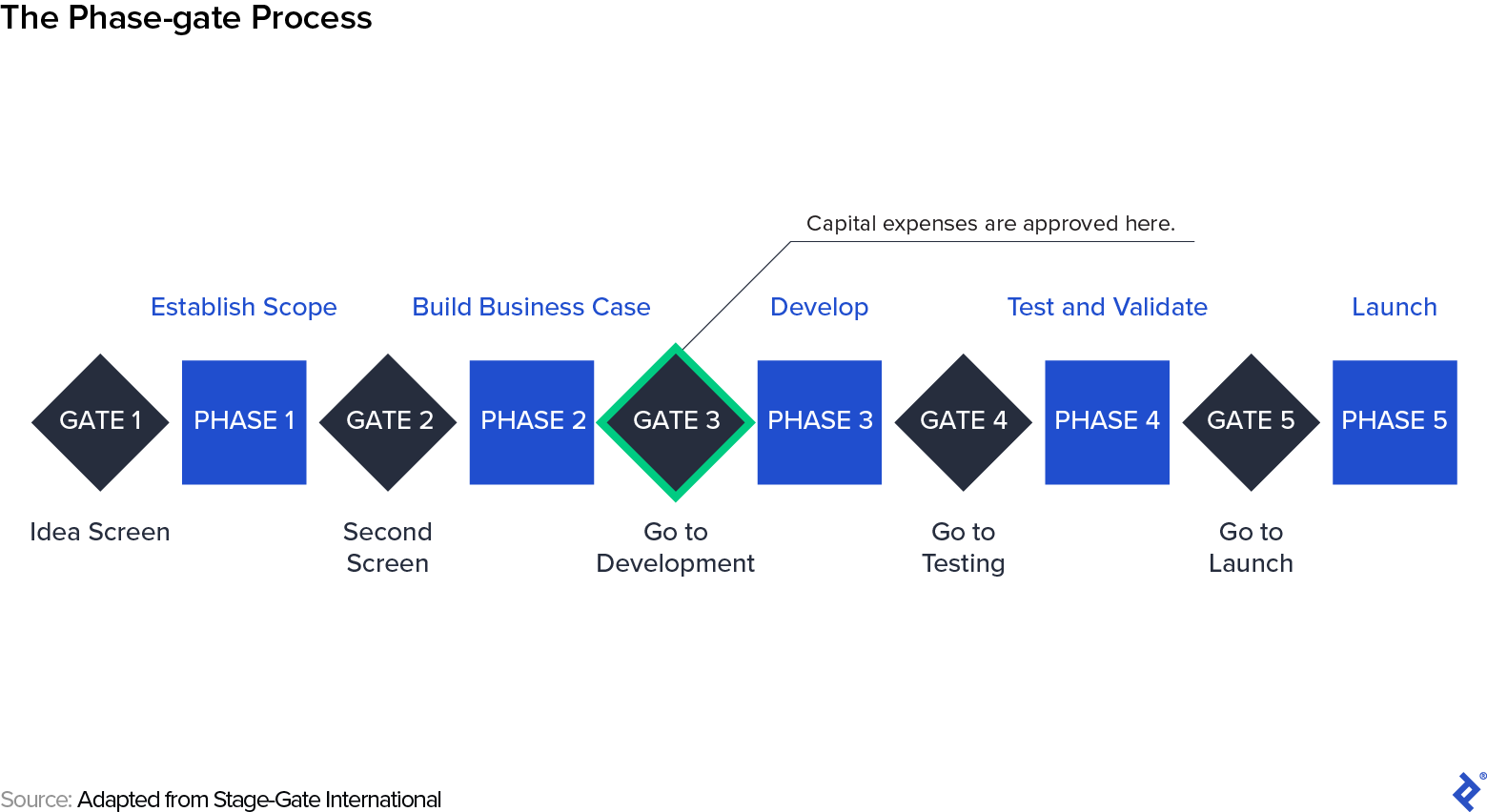

That is the place venture administration performs a central function. Within the wake of this laws, CFOs wanted a security mechanism that they may level to: a administration model that would show that they had met the necessities of the Sarbanes-Oxley Act. The Challenge Administration Institute had an answer: the phase-gate course of (often known as stage-gate). This Waterfall approach makes use of a collection of “gates”—pauses the place government approval could be wanted for growth to advance. By defining a stage that contained solely CapEx-eligible exercise, and isolating it from all different phases, CFOs might show that that they had exercised due diligence when itemizing an expenditure as a capital expense.

Quick-forward to the current day, and phase-gate administration has been the de facto normal for growth tasks at public firms for 20 years—Stage-Gate Worldwide estimates that 80% of the Fortune 1000 makes use of some variation of this framework. For an Agile developer or venture supervisor, this will likely appear baffling. Doesn’t your CFO know the advantages of Agile? They might or could not, however both approach, a very powerful factor for a venture supervisor to recollect is: They don’t care.

When the CFO desires you to “do Waterfall,” it’s not primarily based on a perception that Waterfall is the best solution to ship software program. It hardly ever issues to them if programmers use RUP, Scrum, XP, Crystal, FDD, DSDM, Kanban boards, or another growth approach or administration framework; what they care about is capitalizing the venture with out violating the phrases of the Sarbanes-Oxley Act.

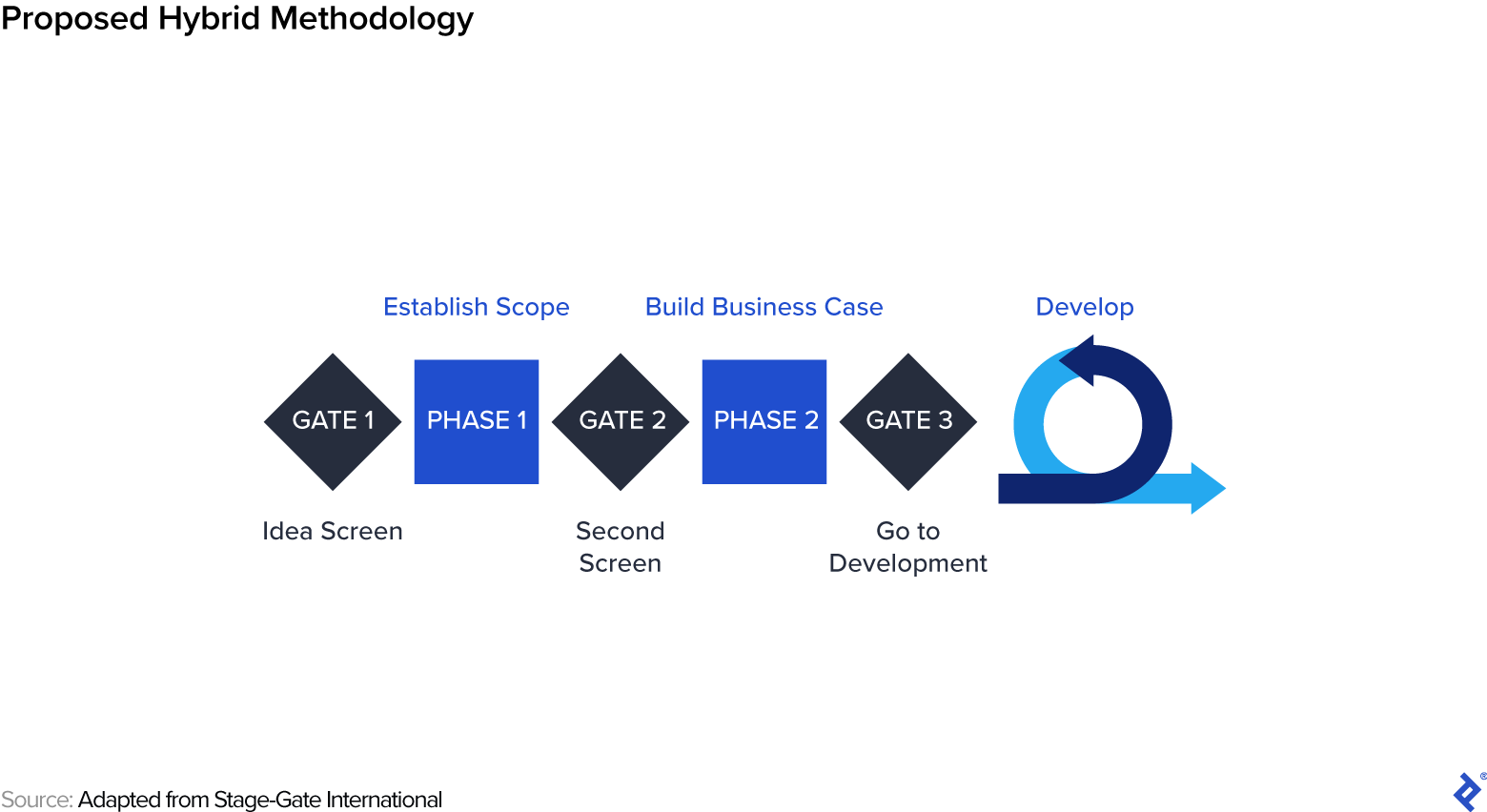

The excellent news is that every little thing it’s good to do to guarantee the CFO that the venture will cross an audit takes place outdoors of the particular growth course of. For those who can guarantee the C-suite that their wants shall be met, they need to be amenable to a hybrid methodology during which monetary issues are dealt with through Waterfall within the strategy planning stage and growth is completed in an Agile framework:

Navigating the Falls

If a venture supervisor understands what their CFO desires and may guarantee them of the operational oversight offered by a phase-gate framework, there’s no motive to make use of Waterfall over Agile in growth. Simply strategy the necessities of phase-gate administration with the understanding that its goal is monetary and authorized and doesn’t need to affect your crew’s growth work. Right here’s how one can get began:

Deal with Budgeting as Iterative … Till It Isn’t

Yearly, the company price range allocates a hard and fast quantity to capital expenditures. One small piece of that’s allotted to software program growth tasks, and enterprise leaders negotiate for the most important slice potential for his or her tasks. This negotiation course of often goes on for the primary two or three months of the fiscal yr.

Negotiation is extraordinarily iterative, so venture budgets fluctuate always all through this course of. Empower your small business sponsor by offering them with adjustable estimates. The purpose right here is to determine a price range envelope, so broad choices for a number of contingencies shall be extraordinarily useful. For instance, alongside a baseline estimate, you may present a less expensive possibility that will be possible if cost-saving situations are met, like doing knowledge migration through guide entry, or a dearer possibility if further options are included, like a cellular app. This may assist your small business sponsor alter their price range request as treasury committee negotiations get underway.

These estimates must be offered forward of price range negotiations, as a result of as soon as the treasury committee approves the tasks for the yr, there isn’t any going again. Within the phase-gate system, gate 3 is the place the venture is given treasury approval. Flexibility in budgeting exists, however solely on the entrance finish of the method, earlier than this gate happens.

Perceive Materiality

Your venture management workplace (or, should you don’t have one, your monetary controller) may also help you perceive firm thresholds for materiality—the purpose at which monetary variation is vital sufficient to be recorded: The acquisition of a field of pens could also be thought-about immaterial, however shopping for new computer systems for the crew isn’t. The road the place immaterial turns into materials varies by firm. Understanding your organization’s threshold, and documenting accordingly, will endear you to anybody making accounting selections.

Share your area information along with your counterpart in finance; for instance, understanding the idea of swapping person tales and reaching consensus on how one can deal with the follow will keep away from the looks of impropriety. Guarantee them that if any extra expense from a swap threatens to exceed the materiality threshold, you’ll escalate it so it may be correctly documented.

Communicate the Language of Finance

If you’re not already accustomed to weekly standing reviews and danger logs, get acquainted. Learn them. Love them. Fill them out commonly and precisely. Give them to your venture administration workplace and they’ll love you in flip.

Most significantly, should you present venture price range reviews or updates, make sure that your line merchandise titles and descriptions precisely match those you used when the price range was first authorised. If the authorised price range refers to “Epic: Authentication UI,” then that’s what it’s best to put in your report—not “Epic Login Display screen” or another variation. Ignore this recommendation and you might be assured to create friction and frustration throughout your complete monetary arm of the group.

Worth Delivered

For those who meet the monetary necessities above, congratulations! You’re fulfilling the C-suite’s must “do Waterfall.” The capital bills are correctly recorded, and no a part of the method has required any change in how code is definitely written or how updates are delivered. Any compromises you’ve needed to make in planning have gained you allies in different departments and the C-suite. The method has additionally given you a greater understanding of how your crew can work with different elements of the group, slightly than toiling in isolation—or worse, working in opposition to those that are alleged to be in your facet.

An Agile purist may contemplate these monetary issues to be “contract negotiations.” Nevertheless, it’s simply as legitimate to consider your monetary colleagues as inside enterprise clients. Assembly their wants on issues of finance is simply one other type of buyer collaboration. And in Agile, the shopper’s notion of worth delivered at all times wins.

Additional Studying on the Toptal Initiatives Weblog:

What Is an Agile Coach and How Can You Develop into One?

SAFe Case Research: Transformation Notes From the Discipline

Scrum Grasp vs. Agile Coach: Why Profitable Transformations Want Each