All of us recognize that we’re at present in a bull market with the S&P 500 (SPY) making new highs as soon as once more this week. Nevertheless, it’s prudent to ponder what might create a bear market as to be looking out. That’s the reason Steve Reitmeister shares insights on the two essential causes of bear markets. And the way a lot of a priority that needs to be to traders at the moment. Learn on beneath for extra.

A market that refuses to go down…will inevitably go up

And that easy logic is exactly what we see occurring at this stage. At the same time as the beginning date for Fed price cuts will get kicked additional down the street, traders simply do not need to lose their grip on the inventory market.

This helps clarify why the S&P 500 (SPY) pushed to new highs as soon as once more on Thursday at the same time as Fed officers are singing in unison concerning the risks of reducing charges too quickly. One has to imagine this constructive worth development will keep in place till there’s a dramatically damaging catalyst.

In order that results in the query…what might derail this bull market?

That will probably be on the heart of at the moment’s dialogue.

Market Commentary

One in all my favourite funding sayings is:

“It is a bull market til confirmed in any other case”

Which means that the pure gravity of the inventory market is to maneuver increased. That helps clarify why the common bull market lasts 63 months whereas the common bear market solely 13 months. That may be a 5 to 1 benefit in favor of being in a bull market.

Or to place it one other method…it’s more durable to create a bear market than most individuals notice. So, you really want some extraordinary occasions to shake shares off their bullish axis.

Whenever you boil it down there are actually simply 2 components that create a bear market. Let’s discover each beneath.

First, and most clearly, is the concept of a recession forming. This lowers the earnings outlook plus reduces threat taking resulting in decrease PE for every inventory. This mixture culminates in a median bear market drop of 34% for the S&P 500.

The second purpose stems from an fairness worth bubble that bursts (typically with a recession to comply with from all that lack of family internet value). The 2 apparent examples are 1929 and the tech bubble of 2000.

Sure, some would possibly level to the Nice Recession of 2008. However that was from an fairness bubble in actual property that led to banking failures. That’s an fascinating scenario for positive…however completely different than shares being overpriced resulting in their eventual fall.

On the recession entrance the economic system continues to clip alongside at a wholesome tempo with the GDP Now estimate for Q1 ticking as much as +2.5% development. That could be very near the long run common of +2.7% and definitely doesn’t trace at a recession forming.

Granted, there may be at all times the priority that the Fed overstays their welcome with excessive charges that begets a future recession. This worry comes from 12 of the final 15 price climbing cycles ending in recession. Nevertheless, it does look like Powell and firm are good college students of historical past and are on their strategy to managing a comfortable touchdown that enables them to chop charges earlier than a recession unfolds.

I not too long ago noticed that the present PE of the market (20.7) is within the prime 5% of all time. That does make one cease of their tracks and think about if we’re overvalued.

The counter argument to that’s that traders now higher perceive the chance and reward of the inventory market versus bonds and money. This has led to increased PE’s for shares over the past 20-30 years making the long run historic requirements a bit outdated.

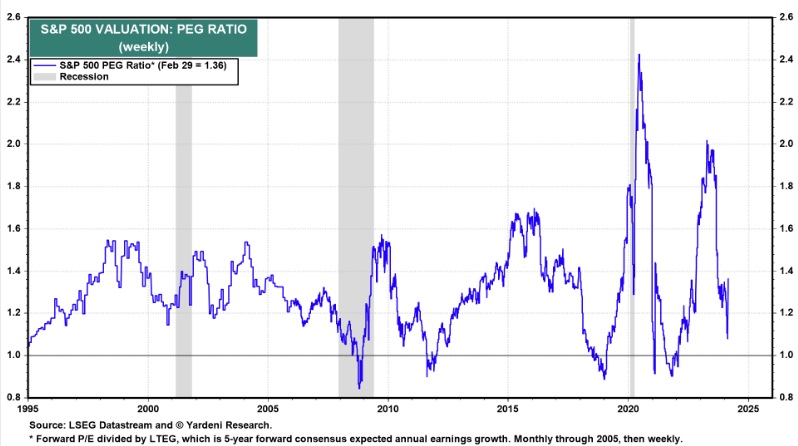

As a counter argument I need to share this PEG Ratio chart going again 30 years:

The PEG ratio is my favourite valuation metric because it says what you’re keen to pay for every unit of earnings development. Which means {that a} tech inventory rising earnings 20% a 12 months SHOULD have the next PE than a sleepy utility firm with meager 3% earnings development.

As you’ll be able to see that the present PEG degree for the market is sort of center of the pack for the previous three a long time and never a trigger for alarm on the valuation entrance.

But there most definitely are teams which are being a bit too richly valued just like the Magnificent 7 shares and a number of the “in style” AI firms. Apparently Tesla has already lastly fallen from their too lofty heights with shares 40% off their highs. I wish to see a few of that revenue taking roll to those different names with that cash flowing to different worthy firms with extra interesting valuations.

Taking it again to the highest, it is a bull market til confirmed in any other case. And since we simply reviewed what might presumably derail the market (recession and valuation) we’re on fairly protected footing on that entrance as properly.

Thus, proceed to be totally invested in shares. Simply have a better eye in direction of worth at the moment on condition that there are certainly some overripe shares due for a fall.

Are you curious about my favourite shares at the moment?

Learn on beneath to find them now…

What To Do Subsequent?

Uncover my present portfolio of 12 shares packed to the brim with the outperforming advantages present in our unique POWR Rankings mannequin. (Practically 4X higher than the S&P 500 going again to 1999)

This consists of 5 below the radar small caps not too long ago added with large upside potential.

Plus I’ve 1 particular ETF that’s extremely properly positioned to outpace the market within the weeks and months forward.

That is all primarily based on my 43 years of investing expertise seeing bull markets…bear markets…and every little thing between.

If you’re curious to study extra, and need to see these fortunate 13 hand chosen trades, then please click on the hyperlink beneath to get began now.

Steve Reitmeister’s Buying and selling Plan & High Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Whole Return

SPY shares have been buying and selling at $514.66 per share on Friday morning, down $0.15 (-0.03%). 12 months-to-date, SPY has gained 8.28%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Creator: Steve Reitmeister

Steve is healthier recognized to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Whole Return portfolio. Be taught extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The submit What Would Trigger a Bear Market Now? appeared first on StockNews.com