October 13, 2022

PRESS RELEASE

Apple Card will quickly let customers develop Every day Money rewards whereas saving for the longer term

Apple Card customers will be capable of develop their rewards in Apple Pockets by mechanically depositing their Every day Money into a brand new high-yield Financial savings account from Goldman Sachs

CUPERTINO, CALIFORNIA Apple in the present day introduced a brand new Financial savings account for Apple Card that can enable customers to save lots of their Every day Money and develop their rewards in a high-yield Financial savings account from Goldman Sachs.1 Within the coming months, Apple Card customers will be capable of open the brand new high-yield Financial savings account and have their Every day Money mechanically deposited into it — with no charges, no minimal deposits, and no minimal steadiness necessities.2 Quickly, customers can spend, ship, and save Every day Money instantly from Pockets.

“Financial savings allows Apple Card customers to develop their Every day Money rewards over time, whereas additionally saving for the longer term,” mentioned Jennifer Bailey, Apple’s vp of Apple Pay and Apple Pockets. “Financial savings delivers much more worth to customers’ favourite Apple Card profit — Every day Money — whereas providing one other easy-to-use software designed to assist customers lead more healthy monetary lives.”

Apple Card customers will be capable of simply arrange and handle Financial savings instantly of their Apple Card in Pockets. As soon as customers arrange their Financial savings account, all future Every day Money acquired can be mechanically deposited into it, or they will select to proceed to have it added to an Apple Money card in Pockets. Customers can change their Every day Money vacation spot at any time.

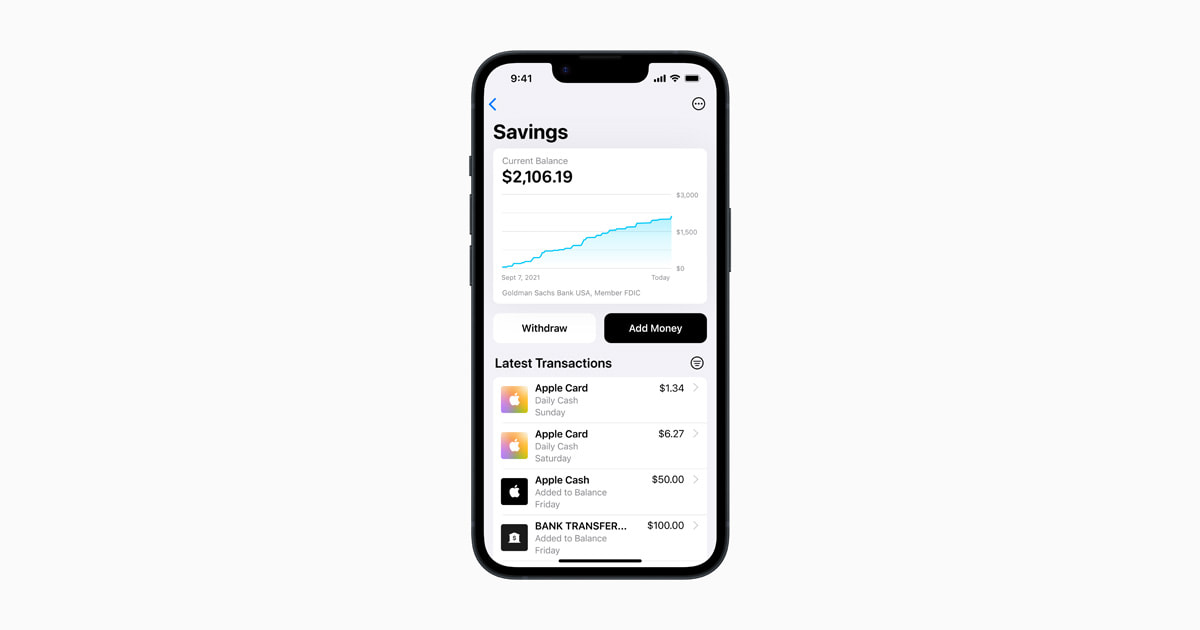

To increase Financial savings even additional, customers may deposit further funds into their Financial savings account by means of a linked checking account, or from their Apple Money steadiness. Customers may withdraw funds at any time by transferring them to a linked checking account or to their Apple Money card, with no charges. As soon as arrange, Apple Card customers can watch their rewards develop in Pockets by means of an easy-to-use Financial savings dashboard, which reveals their account steadiness and curiosity accrued over time.

Apple Card customers get 3 p.c Every day Money on Apple Card purchases made utilizing Apple Pay with Apple and choose retailers, together with Uber and Uber Eats, Walgreens, Nike, Panera Bread, T-Cell, ExxonMobil, and Ace {Hardware}, in addition to 2 p.c Every day Money after they use Apple Pay at different retailers, and 1 p.c on all different purchases. There isn’t a restrict to the quantity of Every day Money customers can obtain.

The brand new Financial savings account from Goldman Sachs expands upon the monetary well being advantages and beneficial Every day Money that Apple Card already provides. Constructed into Pockets on iPhone, Apple Card has remodeled the bank card expertise by simplifying the applying course of, eliminating all charges, encouraging customers to pay much less curiosity, providing the privateness and safety customers count on from Apple, and providing Every day Money on each buy.3

About Apple

Apple revolutionized private know-how with the introduction of the Macintosh in 1984. Right this moment, Apple leads the world in innovation with iPhone, iPad, Mac, Apple Watch, and Apple TV. Apple’s 5 software program platforms — iOS, iPadOS, macOS, watchOS, and tvOS — present seamless experiences throughout all Apple units and empower individuals with breakthrough companies together with the App Retailer, Apple Music, Apple Pay, and iCloud. Apple’s greater than 100,000 staff are devoted to creating the perfect merchandise on earth, and to leaving the world higher than we discovered it.

- Financial savings accounts are supplied by Goldman Sachs Financial institution USA, Salt Lake Metropolis Department. Member FDIC.

- Financial savings is on the market to Apple Card House owners and Co-House owners, topic to eligibility necessities.

- Variable APRs vary from 13.99 p.c to 24.99 p.c based mostly on creditworthiness. Charges as of October 1, 2022.

Press Contacts

Kimberly Mai

Apple

Heather Norton

Apple

Apple Media Helpline

(408) 974-2042