Will Peng graduated from Princeton with about $35,000 in debt.

He requested his immigrant dad and mom what they thought one of the best strategy could be for him to pay it off.

“There have been corporations telling me that I ought to refinance my pupil loans,” recollects Peng, who’s the oldest of six kids born in Taiwan. “I used to be additionally unsure how I ought to steadiness paying off my pupil loans whereas constructing an emergency fund and placing cash into my 401(okay).”

So he searched Google and “learn lots of NerdWallet articles” however nonetheless “made a ton of errors.”

It was at that time that Peng realized that he was possible not alone in his struggles and so the thought for his startup, Northstar, was born.

Realizing that receiving monetary advisory providers is commonly a luxurious reserved for the higher center class or prosperous, Peng determined one of the best ways to make such providers extra accessible was to associate with employers to supply a monetary wellness profit to their workers.

“We need to construct monetary wellness for the 100%, not simply the 1%,” he mentioned.

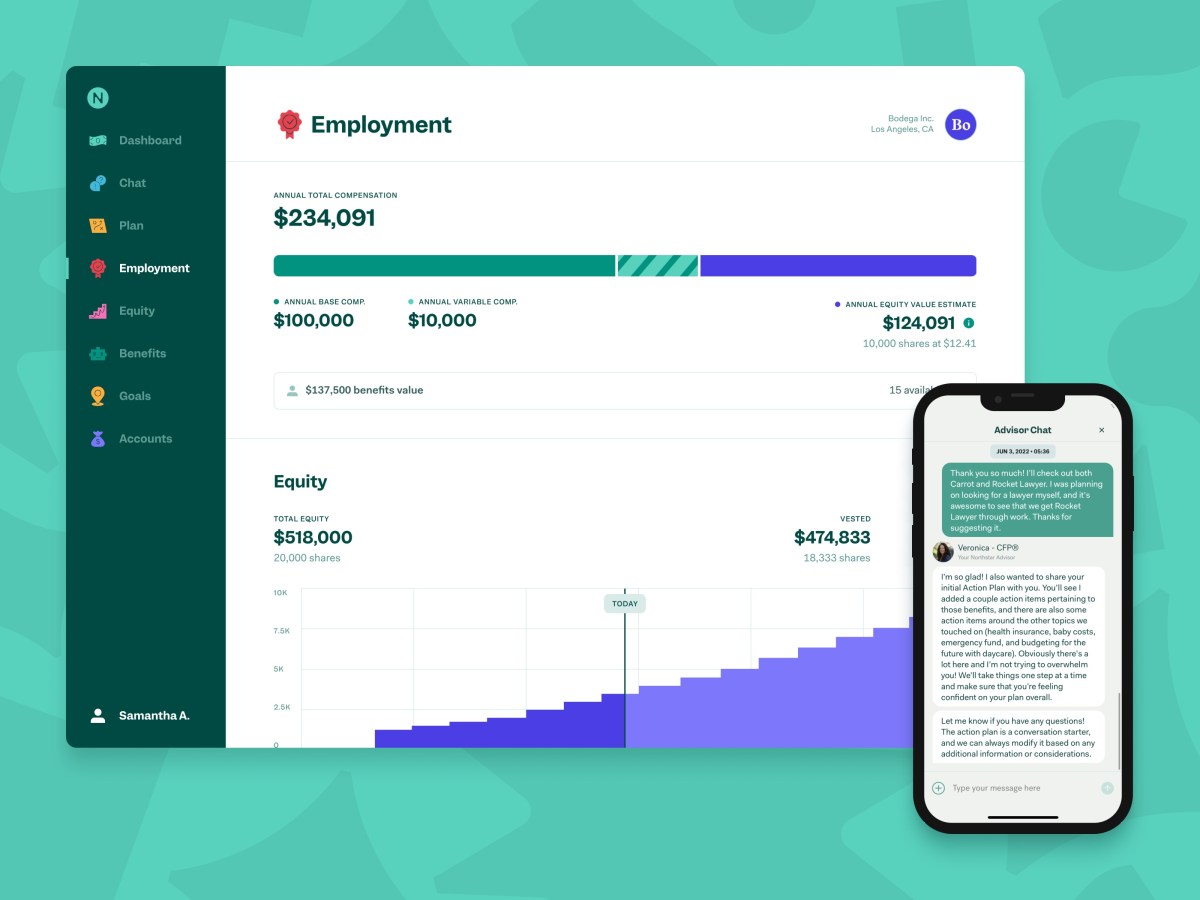

Particularly, Los Angeles-based Northstar has developed a set of non-public monetary administration instruments to assist information workers by numerous monetary and life conditions with the goal of serving to them perceive “the complete worth of their compensation, fairness, and advantages.”

Whereas lots of its shoppers are within the tech house, they “vary in measurement and business” and embody non-public and public corporations, in accordance with Peng. For instance, Northstar’s clients embody the likes of Zoom, Snap, 23andMe, Virgin Orbit and, mockingly, NerdWallet. The corporate fees employers a month-to-month subscription based mostly on headcount to give workers one-on-one entry to a full-time monetary advisor employed by Northstar. Staff pay nothing and there’s no fee concerned.

Northstar pairs workers with the identical advisor to allow them to really feel consolation and familiarity moderately than have an worker speak to a distinct particular person each time they’ve a query. And because the firm has constructed out its monetary advisor workforce, the corporate has been intentional about hiring various workers in order that workers usually tend to speak with individuals with related backgrounds as their very own.

It seems that Northstar’s providers are in additional demand than ever within the present difficult macro atmosphere, in accordance with Peng, who was beforehand a basic associate at Purple Swan Ventures for practically a decade and an early investor in Coinbase, Guideline, Even and Oscar.

Whereas the CEO declined to disclose onerous income figures, he did inform TechCrunch that Northstar’s income has grown “over 5x” year-over-year and that the expectation is that it’ll develop 3x year-over-year subsequent 12 months. Since December 2020, the corporate has grown its buyer base by greater than 600%.

“We’ve discovered that monetary wellness is only a broad subject, no matter distribution channel or the way it’s really executed,” mentioned Peng. “It’s wanted in good occasions, however particularly in dangerous occasions.”

And right now, Northstar is asserting that it has simply raised $24.4 million in a brand new funding spherical led by GGV Capital that in accordance with Peng, took a remarkably quick time to shut in a really difficult fundraising atmosphere.

“The time from the primary assembly to the time period sheet was a couple of month,” he advised TechCrunch.

New traders PayPal Ventures, Thomson Reuters Ventures and Canvas Ventures joined current backers M13, Workday Ventures, Parade Ventures, Basis Capital, Designer Fund and RRE in collaborating within the spherical, which brings Northstar’s complete raised to $40 million since its 2016 inception.

Whereas he declined to disclose valuation, Peng famous that the brand new financing was a “important up spherical.”

The necessity for its providing is larger than ever as a result of, in Peng’s view, whereas shoppers have entry to extra “nice” instruments than ever, they nonetheless lack the information to know what to do with them.

“It’s really exacerbated the issue — this unfair expectation that people really know what to do with their funds,” mentioned Peng.

“Monetary recommendation is one thing that basically all people wants. It’s not simply those that have fairness compensation, for instance,” he added. “In the event you get a paycheck, for those who get advantages, then you definitely deserve monetary recommendation.”

Picture Credit: Northstar co-founders Matt Matteson (CTO) and Will Peng, CEO

Northstar, for instance, may help workers with issues like understanding life insurance coverage or whether or not or not a excessive deductible well being plan is one of the best match for those who’re getting ready to have kids.

“It’s this actually holistic strategy that mixes every little thing that you simply obtain from the employer below one roof,” Peng mentioned.

Presently, Northstar has about 50 workers. It’s trying to double or triple its headcount with its new spherical of financing. The corporate additionally has contractors that function monetary advisors to workers within the 18 international locations — reminiscent of Canada, United Kingdom, Germany and France — through which Northstar is working. The corporate hopes to be in 30 international locations by the tip of 2023.

GGV Capital managing associate and Northstar board member Hans Tung tells TechCrunch that his agency invested in Northstar as a result of it shares “the imaginative and prescient that monetary wellness must be common for all workers.”

“Monetary recommendation has been round for a few years, but most shoppers would not have entry to monetary advisors at inexpensive charges and enabled by tech, creating an enormous market,” he added. “As a worldwide investor, we search for corporations that democratize expertise for underserved markets and need to ‘go world.’”

My weekly fintech e-newsletter, The Interchange, launched on Could 1! Enroll right here to get it in your inbox.