FirstCry, India’s greatest e-commerce platform for mom and child merchandise, is aiming to lift $218 million by means of the sale of recent shares in its preliminary public providing, virtually a 3rd of the $700m it had initially focused.

Brainbees Options, the father or mother agency of on-line child product market FirstCry, wrote in a draft prospectus filed with the native market regulator that some buyers together with SoftBank, NewQuest and TPG plan to promote some shares as a part of the IPO.

The startup is eyeing a valuation of about $4 billion, down from its earlier $6 billion goal final yr, based on an individual aware of the matter. FirstCry stated it hadn’t set the worth in its draft prospectus. The e book operating lead managers appointed for the IPO embrace Kotak Mahindra Capital, Morgan Stanley, BofA Securities India, and JM Monetary.

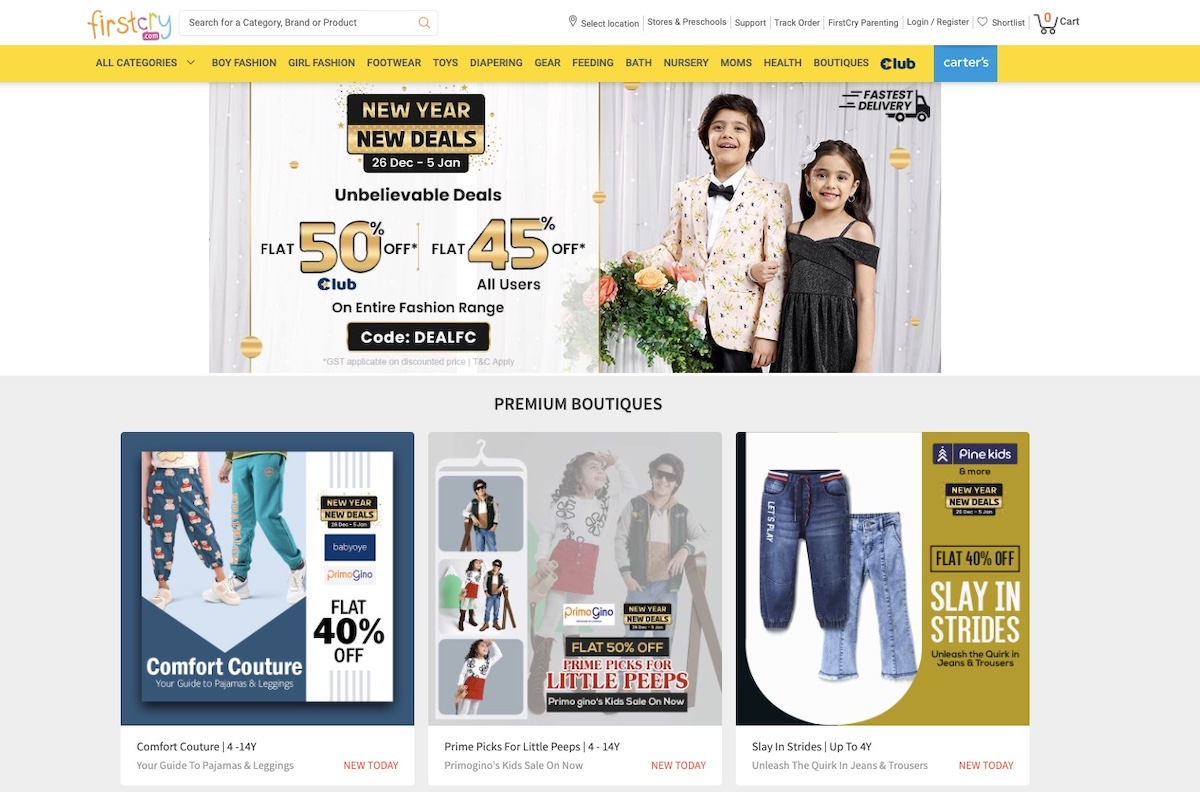

Based in 2010, FirstCry plans to make use of the IPO proceeds in direction of expenditure for establishing new shops and warehouses, gross sales and advertising initiatives, investments in abroad and home growth, expertise prices, and inorganic development by means of acquisitions. FirstCry affords over 1 million SKUs from over 6,800 manufacturers. This contains main third-party Indian and worldwide manufacturers in addition to FirstCry’s own residence manufacturers similar to BabyHug, Babyoye and others.

The startup additionally operates 180 pre-schools underneath the model FirstCry Intellitots throughout India. Brainbees has additionally expanded abroad by launching FirstCry on-line platforms in UAE and Saudi Arabia. It additionally acquired a majority stake in GlobalBees Manufacturers in 2021 to make investments in digital-first manufacturers throughout classes past MBK.

FirstCry reported greater than doubling its whole revenue to $688.4 million within the monetary yr ending March 2023, up from $302 million from the identical interval a yr in the past. Within the monetary yr ending March this yr, its losses had ballooned to $58.3 million, from $9.4 million from a yr in the past.