Beginning a enterprise is an thrilling second in life. Increasing a enterprise is just too, as a result of it means your preliminary concept is paying off. However one of many largest hurdles to each is cash — having the capital to launch or develop. The excellent news is, with a little bit digging, yow will discover grants and mortgage alternatives for small companies primarily based within the U.S.

You simply want a little bit assist understanding the place to look. And for that, you’ve come to the suitable place.

What are small enterprise grants and loans?

A small enterprise grant is actually free cash. It means you don’t should pay it again, ever. Nevertheless, most grants include stipulations and restrictions concerning who can win the grant, and the way the cash might be used. Additionally they normally have a cumbersome software course of, and the IRS usually considers a grant to be enterprise revenue, which signifies that it’s taxable.

A small enterprise mortgage, or financing, is cash given to you that you need to ultimately pay again, identical to a home or automotive mortgage. Some small enterprise loans cost curiosity, whereas others cost a flat charge.

Varieties of small enterprise financing

Primarily, there are three forms of small enterprise financing:

- Debt financing means an establishment provides you cash and you must pay it again, normally with curiosity on a set schedule. Typically in addition they desire a type of collateral so in the event you default on the mortgage, they seize the asset you assigned to it.

- Fairness financing is when one other accomplice or enterprise entity provides you a mortgage in alternate for partial possession of the enterprise. Normally you’ll pay them a proportion of your income going ahead, and also you lose some autonomy since you now have a enterprise accomplice. However the mortgage is often interest-free.

- Income-based financing is once you get a mortgage, however you pay it again as a share of your income, not a hard and fast month-to-month fee. We’ll say extra about this later once we speak about WooCommerce Funds + Stripe Capital.

However inside these classes, yow will discover some variations. Most loans come from banks, however some could be given by way of the federal government, and others from specialised personal companies.

Fundera gives a terrific useful resource for studying all about small enterprise financing. They even checklist particular banks and the credit score scores they require. Some banks and lenders supply loans for sure conditions that could be related to you. Yow will discover out extra about every of those financing choices at Fundera:

- Tools financing: a mortgage that pays for a bit of kit

- Brief-term enterprise mortgage: an choice for fast turnaround and pressing wants

- Service provider money advance: a variation of revenue-based financing

- Startup loans: financing given particularly for brand new companies

- Enterprise line of credit score: a versatile mortgage that makes cash out there as you want it

- SBA loans: financing from the Small Enterprise Administration, together with microloans

Components to contemplate when pursuing small enterprise financing

The three major elements you need to take into consideration earlier than making use of or accepting a suggestion for a small enterprise mortgage are possession, management, and danger.

With equity-based loans, for instance, you surrender some quantity of possession in your corporation, and also you lose some management over the decision-making. However, these loans normally haven’t any curiosity, in order that they’re low danger.

A typical debt-based enterprise mortgage with month-to-month curiosity funds comes with extra danger, as a result of what occurs in the event you can’t make the funds? However, it allows you to retain possession. See extra info concerning the execs and cons of various small enterprise financing choices.

A mortgage for current small companies: introducing WooCommerce + Stripe Capital

Entry to financing can fortify and gas your rising enterprise, serving to you develop and scale extra shortly. With quick, versatile financing, WooCommerce + Stripe Capital permits U.S.-based corporations to spend money on progress and stabilize money stream.

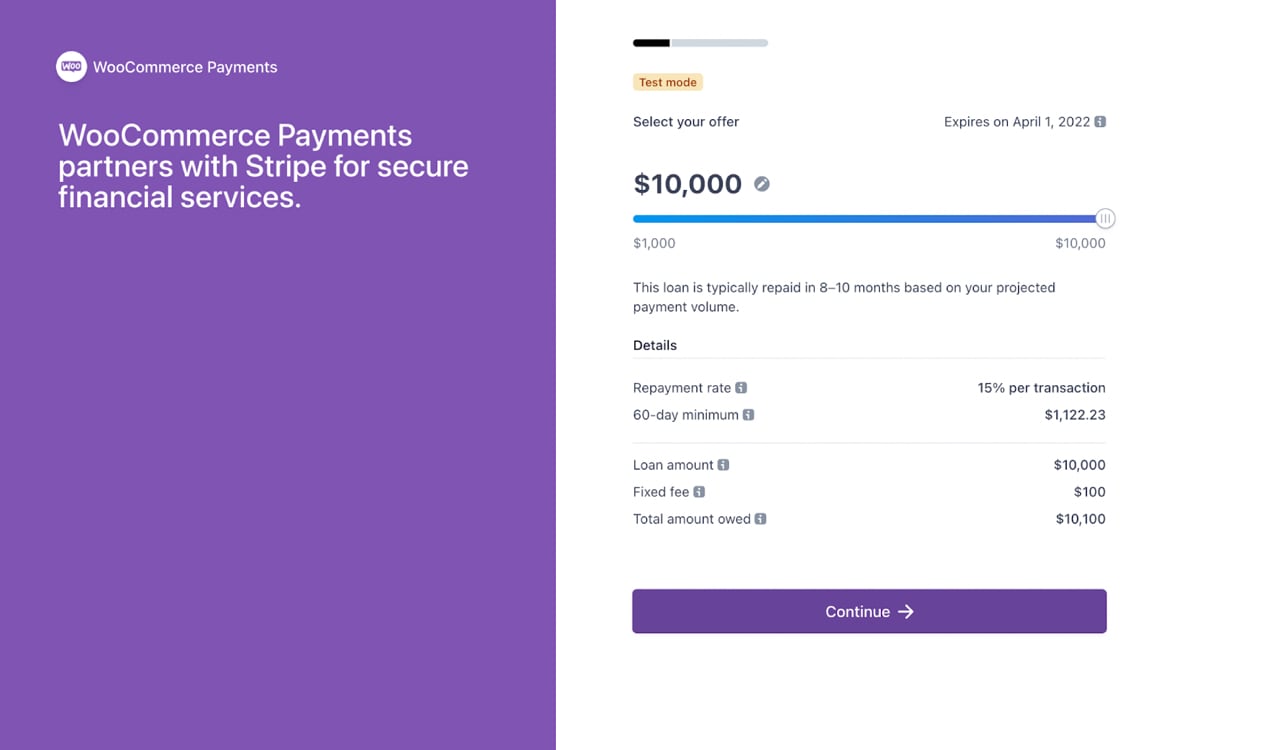

With WooCommerce and Stripe, mortgage gives are prolonged by Stripe’s banking accomplice, Celtic Financial institution, primarily based on elements equivalent to your retailer’s gross sales and historical past with WooCommerce Funds. There’s no prolonged software course of and no client credit score verify.

When you obtain a suggestion by way of e mail or in your dashboard messages, you may choose the dimensions that’s best for you and apply in minutes. For authorized corporations, funds usually arrive in as little as one enterprise day.

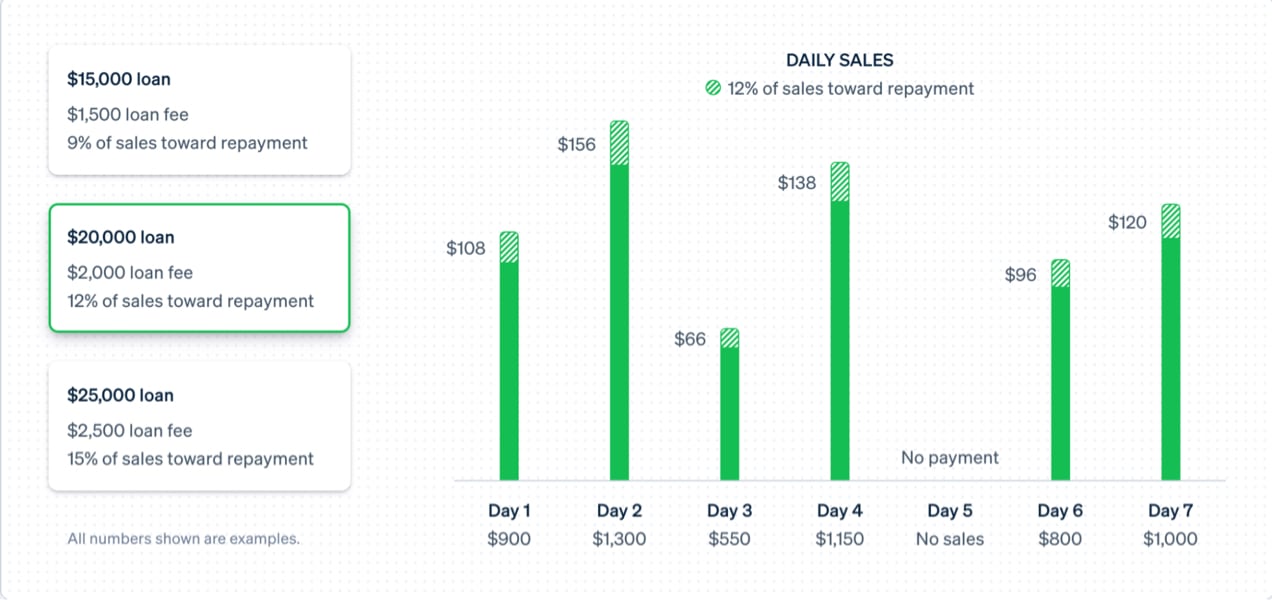

Not like many loans provided by way of conventional banks, WooCommerce + Stripe Capital expenses one fastened charge, and that charge by no means adjustments. Which means there aren’t any curiosity expenses or late charges so that you can fear about. Reimbursement additionally occurs robotically, by way of a hard and fast proportion of your transactions, and adjusts to your day by day gross sales. A set proportion will proceed to be deducted till the full owed is repaid.

For instance, suppose you get a $20,000 mortgage from Stripe Capital, provided at a ten% charge. Which means your complete mortgage debt is $22,000, which is a mortgage quantity of $20,000 and a mortgage charge of $2,000.

In our instance, Stripe Capital has established a payback charge of 12%. Which means daily, Stripe Capital will robotically deduct 12% of income out of your WooCommerce account for that month till the mortgage is paid off. That is advantageous to you as a result of it means your fee will rise and fall primarily based in your income, so your funds won’t ever exceed your revenue. Should you make no income in a given month, there’s no fee.

Suppose someday you make $900 in income, and the following day you make $1,300. Your fee on the primary day (assuming a 12% fee) could be $108, and on the second day, it will be $156.

Be taught extra about WooCommerce + Stripe Capital.

Varieties of small enterprise grants

Not like loans, that are pretty easy to know, grants could be troublesome to find and navigate by way of all the necessities and restrictions.

Usually, there are two forms of grants: authorities grants and personal grants. Personal grants normally come from companies or foundations.

There are grants for every kind of very particular conditions and enterprise sorts, together with:

- Awards for contest winners

- Scientific analysis corporations

- Companies owned by girls, minorities, or veterans

- Agricultural and rural companies

- Health and beauty companies

- And plenty of extra…

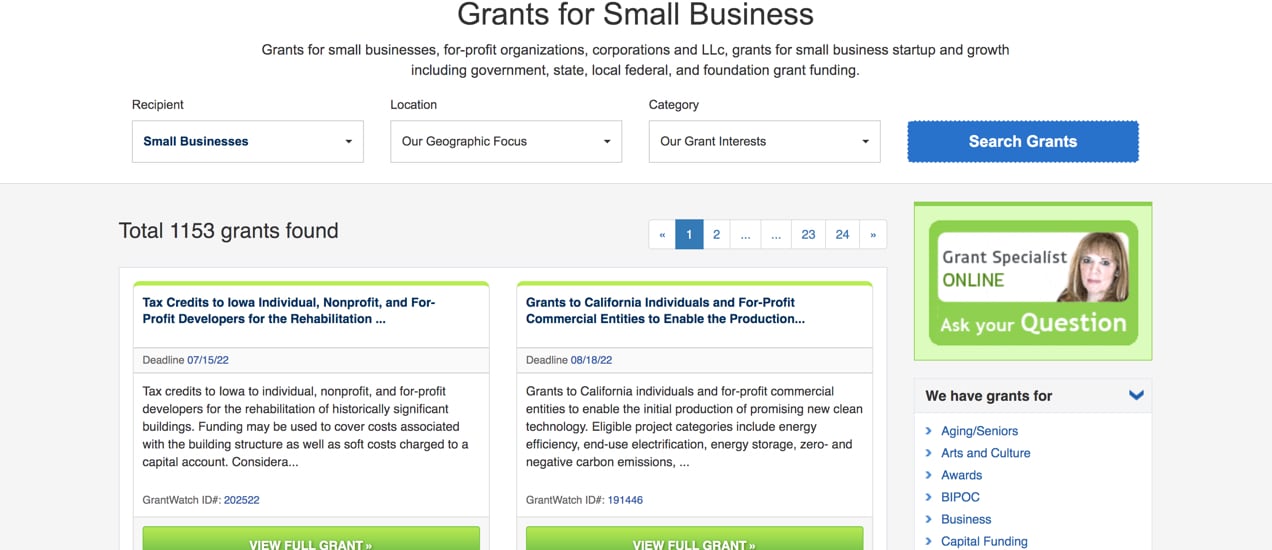

So once you go to a website like Grantwatch, which expenses a charge if you would like all the main points of a grant, you’ll see 1000’s of choices, up to date steadily. However earlier than your mouth begins watering, do not forget that you received’t qualify for a lot of of these grants, as a result of they are often for very particular conditions like these listed above.

We’ll present you some sources for extra grants in a bit.

Making use of for small enterprise grants

Earlier than you apply for a small enterprise grant, the primary job is to slim down your search round grants that your corporation really qualifies for. There’s no use filling out an extended software for a small enterprise grant you don’t have any probability of successful since you don’t meet the necessities.

For instance, in the event you’re a part of a minority group, you’ll be capable to apply for plenty of minority small enterprise grants. You’ll have a greater shot at these than the final grants, as a result of there might be much less competitors, and since these grants have been created particularly for companies like yours.

Subsequent, even for current companies, you’re going to need to have a well-written marketing strategy, as a result of most grant purposes ask very particular questions.

They need to know why you want this grant.

They need to know their cash is funding a worthwhile enterprise enterprise or enlargement with robust potential and that meets their causes for providing the grant. Should you haven’t up to date your marketing strategy in a very long time, it’s possible you’ll need to try this first.

If in case you have an current enterprise, you’ll additionally need up to date info in your annual income, variety of staff, your Employer Identification Quantity (EIN), and different fundamental information.

Then, nail down your pitch, and put aside time to reply all the particular questions on every grant software.

Making use of for small enterprise loans

The method for making use of for a enterprise mortgage relies upon closely on which kind of mortgage you’re pursuing.

Should you’re going for a federal small enterprise mortgage like a 7a mortgage, that can entail a really totally different course of than going by way of a financial institution. Normally, there are extra hoops to leap by way of for presidency financing, and navigating the maze on-line could be irritating. However, federal loans could be simpler to qualify for, so it could be a great various to a financial institution mortgage.

As you noticed earlier, there are fairly just a few variations of small enterprise loans, and the Fundera website lists particular banks and entities that supply every kind.

Earlier than making use of for small enterprise loans, you need to know:

- Your credit score rating

- Why you want the mortgage

- Your common month-to-month income

- The quantity you’re looking for

- Your plan for paying it again

Locations to seek out small enterprise grants and loans

Prepare, as a result of there’s a deluge of sources for this. They fluctuate in ease of use and navigation.

- Nav small enterprise grant contest. Nav awards a $10,000 grant for small companies each quarter, plus a runner-up grant prize, to any enterprise sorts that apply and win their contest. This grant has virtually no limitations.

- FedEx grant contest. FedEx runs their contest a number of instances per 12 months, and the winners additionally obtain a print companies credit score, a web site audit, and different perks. The highest prize is $50,000.

- Visa international innovation grant. Visa’s grant contest comes with just a few extra stipulations than the primary two, however they select 4 winners yearly.

- Grantwatch and Opengrants. These are fee-based grant-finding companies which are nice locations to search for the smaller, niche-based grants that might in any other case be very onerous to seek out. You may search by location, kind of grant, enterprise kind, and different parameters.

- US Chamber of Commerce grants. That is one other nice supply with every kind of grants. And it features a good checklist of common small enterprise grants which are out there to most forms of corporations, along with ones with narrower {qualifications}.

- Self-employed enterprise grants. Should you’re self-employed and are a member of NASE, you could possibly apply for a small enterprise grant each month, for as much as $4000.

And there are different lists of grants from Nav, Bench, and the federal authorities. Authorities grants have a decrease chance of qualification, as a result of they have an inclination to fund solely very explicit forms of companies.

What concerning the Small Enterprise Affiliation?

The SBA is a federal company, and with a reputation like that, you’d assume they’d supply grants to… small companies. However most of their cash funds state and native packages for small companies.

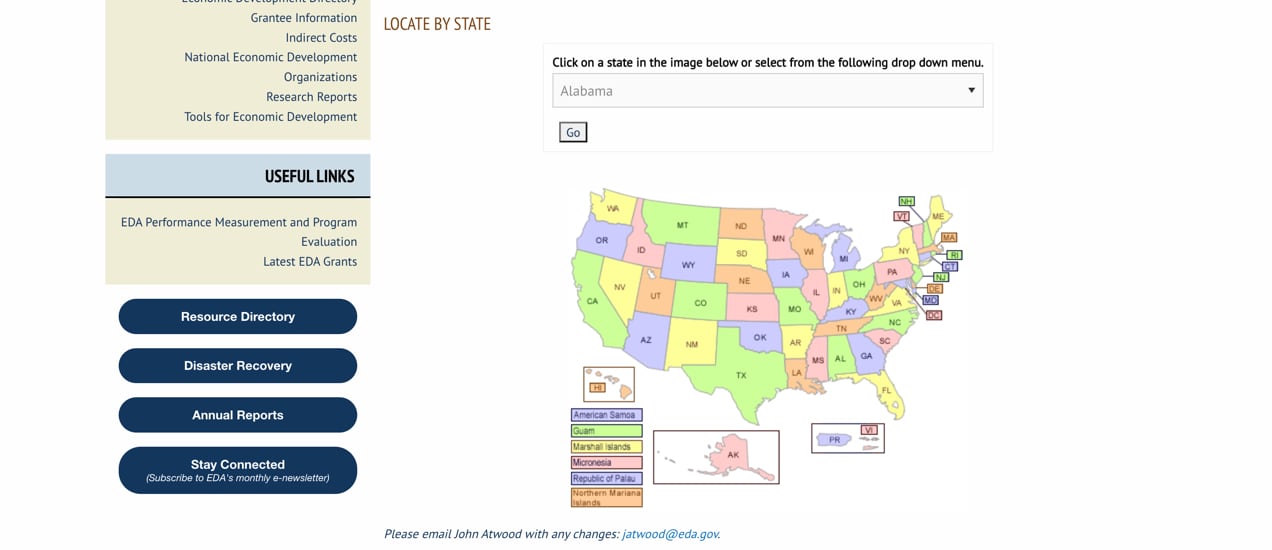

So for presidency grants, you might have higher luck trying on the state and native stage. The Financial Improvement Listing web page received’t lead you to grants immediately, but it surely does have a searchable and clickable map, by state, that can join you with plenty of native sources.

Small enterprise mortgage sources

The federal small enterprise mortgage program contains a number of decisions that received’t be helpful to most companies. However the 7a program is the most typical one, and that one is price trying into if you would like small enterprise financing.

And as talked about already, you should use Fundera for an enormous number of financial institution and institutional loans, principally of the debt-based selection. Moreover, it’s possible you’ll obtain a suggestion robotically from WooCommerce if your corporation qualifies for a WooCommerce + Stripe Capital mortgage.

Go get ‘em!

Should you’re on the lookout for a technique to give your new or current enterprise a monetary increase, hopefully you’re now feeling a bit extra impressed, motivated, and knowledgeable.

Right here’s your plan of motion:

- Replace your marketing strategy.

- Discover the sources that appear to suit your enterprise and scenario.

- Discover the small enterprise grants and financing choices that you’ve an opportunity at successful.

- Discuss to trusted advisors and mentors if in case you have them.

- Begin filling out purposes or act on a suggestion from WooCommerce + Stripe Capital right this moment!

Notice that with WooCommerce + Stripe Capital, all loans are issued by Celtic Financial institution, a Utah-Chartered Industrial Financial institution, Member FDIC. All loans topic to credit score approval.