Insurance coverage corporations have seen an incredible shift in modernization. Historically recognized for the usage of legacy programs, main carriers are modernizing their infrastructure by shifting to the cloud and embracing new applied sciences, akin to AI, all with the purpose of sustaining worthwhile progress.

A typical main follow for these corporations which have yielded worth on innovation has been the flexibility to go to market with new digital merchandise shortly, automate guide processes, and join with clients, and their information, wherever they’re. The principle areas the place that is true are:

- Linked Insurance coverage & Mobility

The rise of IoT and telematics means insurers are altering product choices, and methods of doing enterprise. Take into consideration the aggressive benefit that main corporations (Progressive) had being the primary to launch a telematics product. It comes with the benefit of getting extra correct pricing and, in consequence, cultivating a buyer base that’s extra keen to share information if it leads to higher premiums for them. - Determination Help & Automation

Determination help and automatic processing can each decrease Complete Value of Possession (TCO), in addition to allow new digital merchandise, and ship real-time buyer experiences. This development is affecting among the most mature areas of the insurance coverage worth chain, akin to underwriting, the place corporations attempt to maximize Straight By way of Processing (STP) to triage insurance policies in order that underwriters solely have a look at probably the most advanced dangers to find out acceptability and eligibility. - New Merchandise, Higher Experiences

Digital platforms and companions join shoppers with declare adjusters and companions for elevated shopper perception. Linked vehicles, houses, and cellular units allow speedy and enriched FNOL (first discover of loss). Additionally, a greater buyer expertise breeds loyalty, with digital platforms turning into efficient portals to upsell and cross-sell new merchandise.

Challenges (Operation vs Analytics)

Private strains (auto, residence house owners, renters) are an space of insurance coverage the place insurers have a wealth of knowledge about their clients. In lots of instances, akin to with private auto these companies have gotten extra aggressive with many rivals within the area. Consequently, insurers wish to differentiate themselves in a commoditizing enterprise. With pricing stress, AI/ML is rising as a technique to maximize income by turning information into insights and actioning them to raised value insurance coverage, automate processes, and goal merchandise to clients. However incorporating AI/ML into the insurance coverage course of is difficult to do nicely.

One of many greatest challenges in bringing machine studying to current enterprise workflows is the talents required to span two forms of groups which can be historically in solely totally different organizations. You want information scientists and information engineers who know the information, and the place a mannequin may be pointed to for coaching, and also you want software program builders, individuals who know the place within the software panorama you possibly can intercept these guide choices, and who know how you can write the advanced code wanted to weave information and insights into an current software.

Moreover, to be information pushed, corporations should sew disparate programs and depend on AI-driven functions to get real-time information and make choices quicker. Nevertheless, these AI-driven functions have a number of challenges when they’re wanted to be taken into manufacturing:

- Operational and analytical wants

Purposes are sometimes constructed with a number of operational information platforms; analytics and AI typically require a number of analytical information platforms; AI-driven apps may be the worst of each worlds. - Actual-time necessities

Firms battle to get the most recent, freshest (real-time) information whereas minimizing curation and copying information for evaluation within the information warehouse. - Knowledge is difficult

Firms battle to effectively leverage real-world information each structured and unstructured – and infrequently require advanced processing.

Alternatives

Out of this complexity, there is a chance to simplify operation and analytics wants, handle real-time wants, and simplify information administration, by leveraging better of breed operational and analytics platforms for insurance coverage use instances.

When introduced collectively, MongoDB and Databricks convey the simplicity and real-time information and analytics administration insurers have to scale AI throughout the group.

Transactional/operational (MongoDB)

- MongoDB Atlas is the one multi-cloud developer information platform that simplifies the way you construct with information

- Construct higher apps – quicker, and with much less sources

- Combines all information sorts and software growth wants (question, search, vector search, cellular, and so forth.) into one developer information platform

Analytics (Databricks)

- Collaborative toolset for the Knowledge Scientist, Knowledge Practitioner, Knowledge Engineers

- Acquire higher perception – in actual time and with AI, leveraging all forms of information (structured, semi-structured, unstructured)

- Combines all Machine Studying, Analytics, BI, and Streaming use instances into the Lakehouse, e.g. one analytics information platform

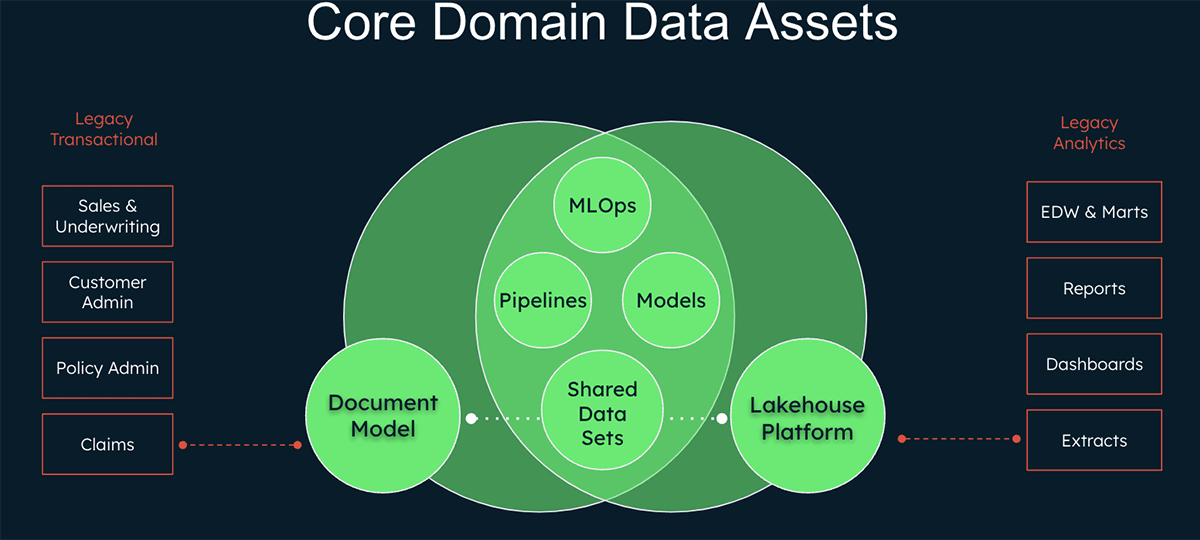

What occurs while you mix these two applied sciences, bringing collectively the transactional and analytical worlds?

- Simply construct real-time AI-driven functions

- Cut back prices and simplify structure with built-in platforms for operational and analytical information

- Work with information in any format, evolving functions and insights quickly

How will this work in follow (in an insurance coverage use case)?

Leveraging the structure, design, and construct work, insurers can take heed to occasions that stream in from their legacy programs, and into discrete microservice domains and their respective occasion buses. A company that is matured into an event-based structure is well-suited to start weaving in machine studying into key factors of their enterprise workflows.

MongoDB can seize occasions for operational functions and retailer them. MongoDB Atlas is a significant accelerator, as a result of it permits software program groups to maneuver shortly, with only a few folks. Not solely does the Doc Mannequin offer you agility and adaptability, however platform options like Triggers, Capabilities, and Charts, let customers implement what can basically be thought-about a “low-code” answer. This accelerates the constructing of knowledge transformation pipelines, to show uncooked mannequin output into data that might be extra simply consumed by people who want to make use of the information. Basically you’ll be able to construct functions to ship real-time in your information decisioning course of.

However the enterprise affect one may generate with information will solely be pretty much as good as the amount, high quality, and number of historic information accessible for machine studying. Telematics information, for example, might be aggregated into classes (i.e. journeys) on an operational platform like MongoDB and returned as-is for visualization functions, however would wish additional enrichment for use for behavioral modeling or dynamic pricing.

Enter the Databricks Lakehouse. With its native help for actual time information ingestion and AI, Databricks permits information practitioners to derive additional insights round driver behaviors (or change of behaviors) by combining extra threat components, car data or climate circumstances.

Pattern Use Case: Telematics Pricing

To show the worth realized from combining the transactional and analytical world, we are going to now take a deep dive into one of many foremost drivers of innovation talked about above, Linked Insurance coverage & Mobility. Particularly, we are going to cowl the use case of Telematics Pricing for Private Auto Insurance coverage.

As insurance coverage corporations attempt to supply customized and real-time merchandise, the transfer in direction of refined and real-time data-driven underwriting fashions is inevitable. To course of all of this data effectively, software program supply groups might want to turn out to be consultants at constructing and sustaining information processing pipelines. Thifollowing instance exhibits how insurers can revolutionize the underwriting course of inside your group, by demonstrating how straightforward it’s to create a usage-based insurance coverage mannequin utilizing MongoDB and Databricks.

Check out this video, that exhibits how this telematics, utilization primarily based insurance coverage demo works end-to-end.

Please additionally reference our code companion to the answer demo in our Github repository. Within the GitHub repo, you will discover detailed step-by-step directions on how you can construct the information add and transformation pipeline leveraging MongoDB Atlas platform options, in addition to how you can generate, ship, and course of occasions to and from Databricks.

Half 1: The use case information mannequin

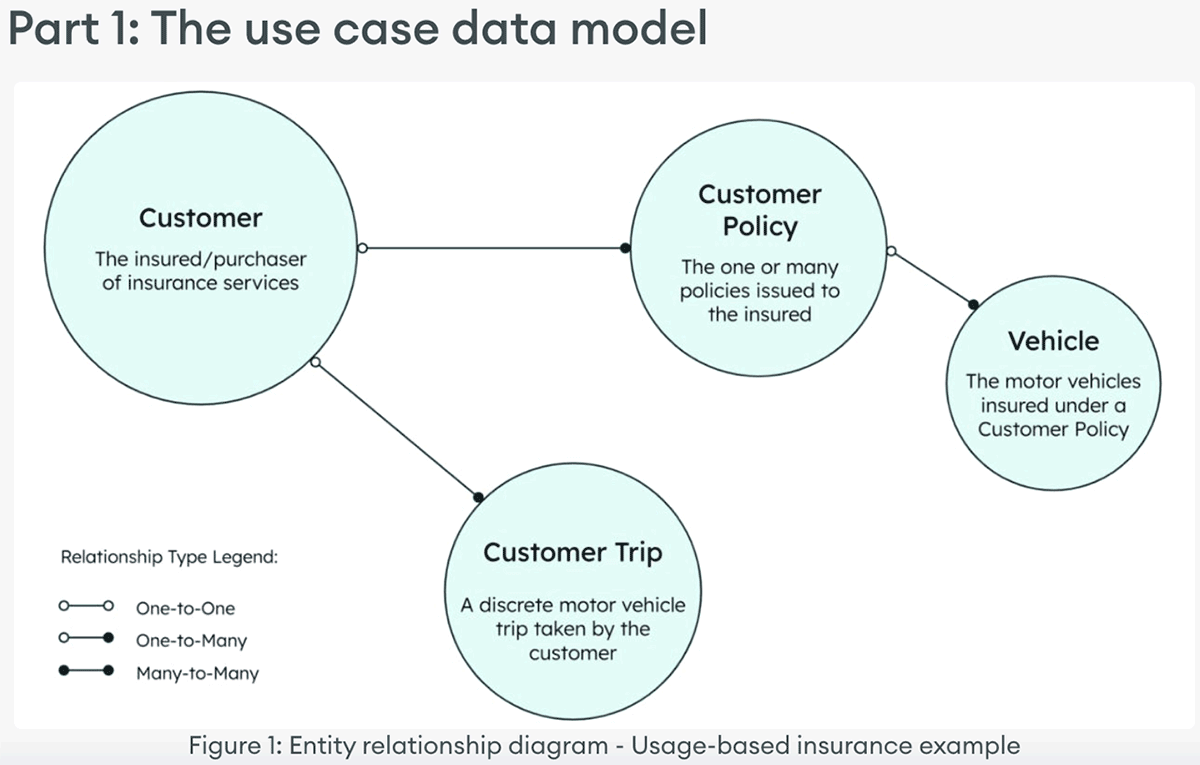

Think about with the ability to provide your clients customized usage-based premiums that keep in mind their driving habits and conduct. To do that, you may want to collect information from related autos, ship it to a Machine Studying platform for evaluation, after which use the outcomes to create a personalised premium in your clients. You will additionally need to visualize the information to establish tendencies and achieve insights. This distinctive, tailor-made method will give your clients better management over their insurance coverage prices whereas serving to you to supply extra correct and honest pricing.

A fundamental instance information mannequin to help this use case would come with clients, the journeys they take, the insurance policies they buy, and the autos insured by these insurance policies.

This instance builds out three MongoDB collections, as nicely two Materialized Views.

Half 2: The information pipeline

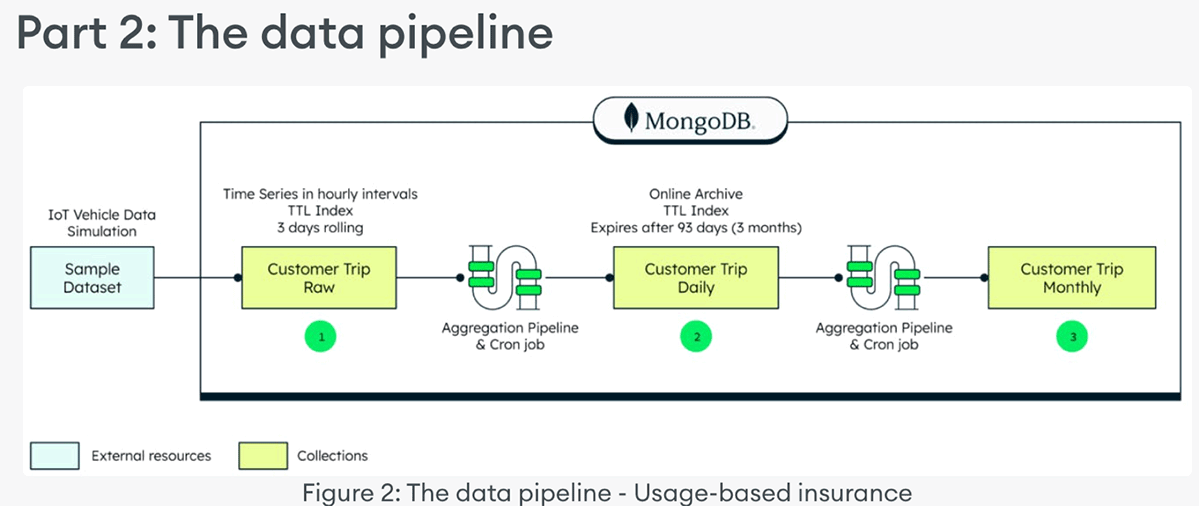

The information processing pipeline part of this instance consists of pattern information, a day by day materialized view, and a month-to-month materialized view. A pattern dataset of IoT car telemetry information represents the motorcar journeys taken by clients. It is loaded into the gathering named ‘customerTripRaw’. The dataset may be discovered right here and may be loaded through MongoImport, or different strategies.

To create a materialized view, a scheduled Set off executes a operate that runs an Aggregation Pipeline. This then generates a day by day abstract of the uncooked IoT information, and lands that in a Materialized View assortment named ‘customerTripDaily’. Equally for a month-to-month materialized view, a scheduled Set off executes a operate that runs an Aggregation Pipeline that, on a month-to-month foundation, summarizes the data within the ‘customerTripDaily’ assortment, and lands that in a Materialized View assortment named ‘customerTripMonthly'(3).

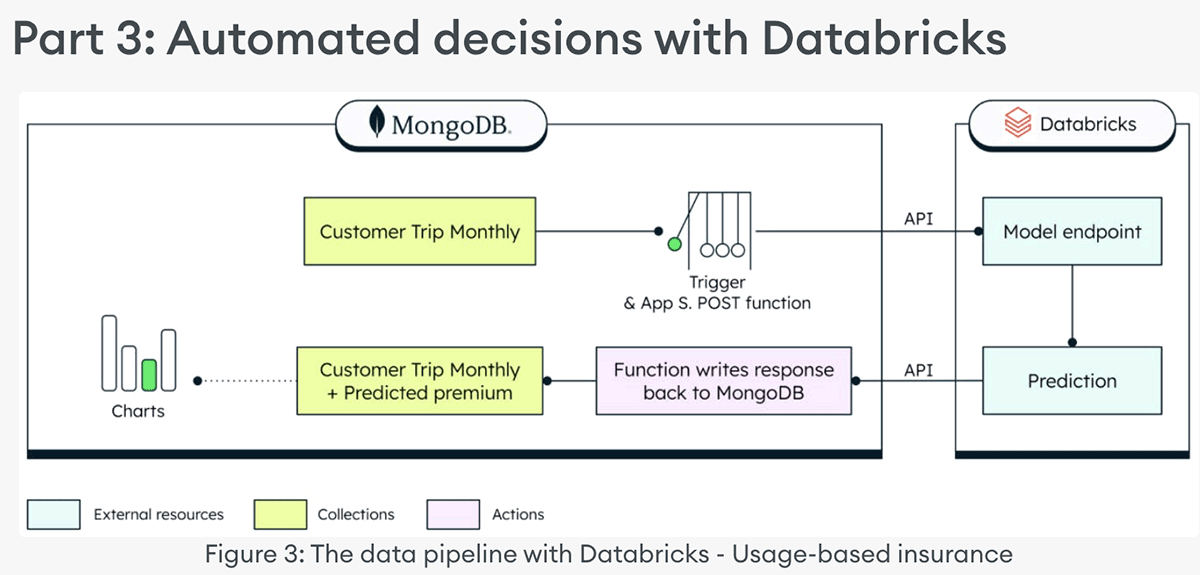

Half 3: Automated choices with Databricks

The choice-processing part of this instance consists of a scheduled set off and an Atlas Chart. The scheduled set off collects the required information and posts the payload to a Databricks ML Stream API endpoint (the mannequin was beforehand educated utilizing the MongoDB Spark Connector on Databricks). It then waits for the mannequin to reply with a calculated premium primarily based on the miles pushed by a given buyer in a month. Then the scheduled set off updates the ‘customerPolicy’ assortment, to append a brand new month-to-month premium calculation as a brand new subdocument inside the ‘monthlyPremium’ array. You possibly can then visualize your newly calculated usage-based premiums with an Atlas Chart!

Within the GitHub repo are step-by-step directions on how you can construct the information add and transformation pipeline leveraging MongoDB Atlas platform options, in addition to how you can generate, ship, and course of occasions to and from Databricks.