Large knowledge has led to many vital breakthroughs within the Fintech sector. The business is rising at a outstanding price as a consequence of this new expertise.

Constructive buyer expertise sits atop probably the most priceless issues crucial to the longevity of any enterprise. It helps construct model fame, enhances an organization’s visibility, and encourages buyer loyalty, which interprets to elevated revenues.

Statistics present that 93% of shoppers will provide repeat enterprise after they encounter a constructive buyer expertise. For these causes, fintech corporations actively search alternatives to nurture higher buyer experiences.

World corporations are projected to spend $19.8 billion on monetary analytics by 2030. The fintech sector will likely be among the many largest proponents.

And Large Knowledge is one such glorious alternative!

Large Knowledge is the gathering and processing of giant volumes of various knowledge sorts, which monetary establishments use to achieve insights into their enterprise processes and make key firm selections.

This text focuses on massive knowledge in monetary business, its function, and the way it helps fintech corporations defend their clients and enhance the client expertise.

The Function Of Large Knowledge In Fintech

We now have witnessed enormous developments within the monetary business’s service provision, due to massive knowledge.

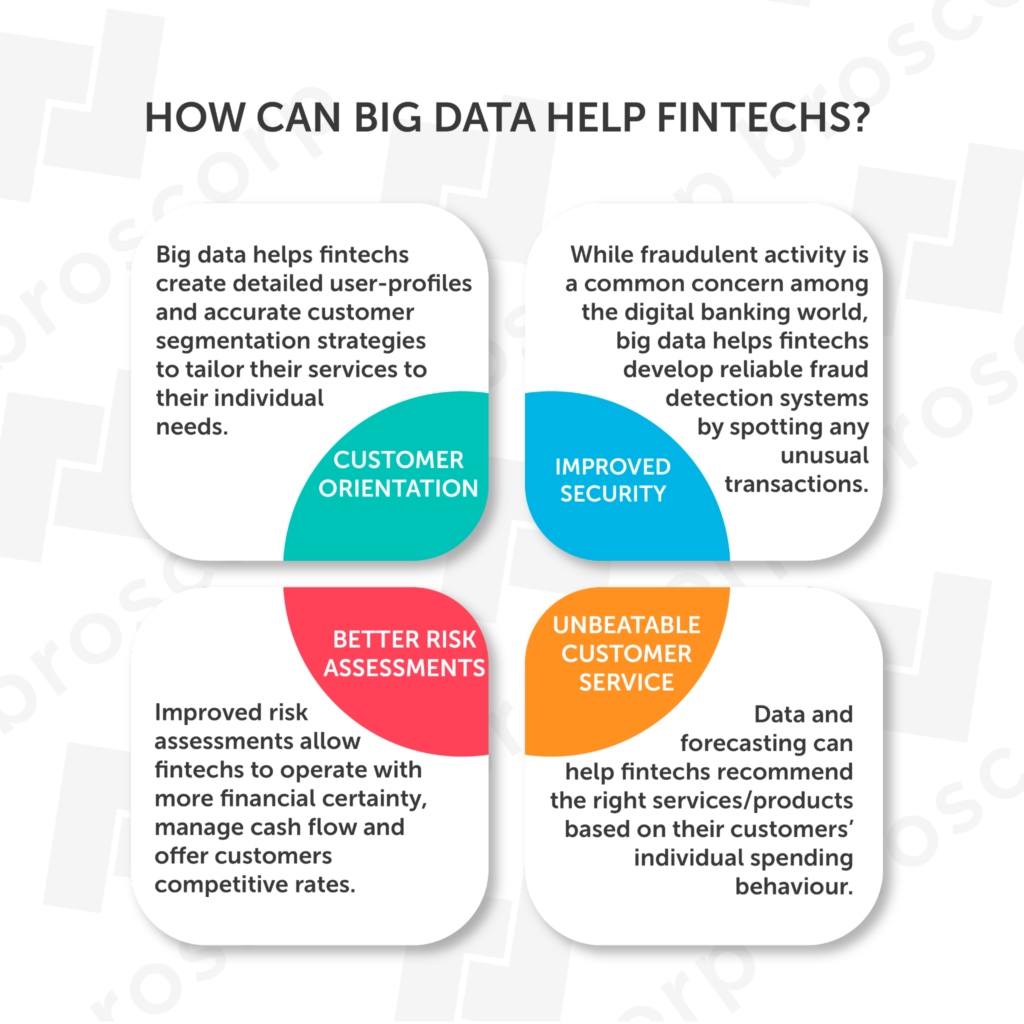

Large knowledge in fintech performs an important function, offering essential content material that impacts service supply. Via massive knowledge insights, monetary establishments can provide personalised companies in addition to predict client habits. They will additionally anticipate business developments, assess dangers, and make strategic steps to raise the client expertise.

How Large Knowledge Helps Fintech Firms And Startups To Higher Serve And Shield Their Prospects

Fintech analytics helps companies within the monetary and banking business provide passable companies by:

Enhancing View Of Buyer Profiling

Large Knowledge gives knowledge that fintech corporations can leverage to construct buyer profiles. Via segmentation, these establishments can simply perceive buyer needs, wants, and expectations. They will additionally use this info to research client habits and create tailor-made companies.

Bettering Threat Evaluation

Knowledge analytics fintech gives essential info monetary establishments must construct a strong threat evaluation technique. This enables companies to establish potential dangers quick and keep away from them or instantly discover the suitable mitigation methods.

Bettering Safety

Fraud is a trigger for concern within the banking business, particularly now that cellular banking takes a middle stage. Nevertheless, fintech companies can use massive knowledge and machine studying to construct fraud detection techniques that uncover anomalies in actual time. They are going to detect illicit actions similar to suspicious transactions, logins, and bot exercise.

Forecasting Future Market Traits

Begin-ups and established fintech corporations can use massive knowledge to grasp the altering monetary business. With entry to earlier knowledge, these corporations can monitor buying habits and predict future developments. Consequently, they’ll make essential selections that elevate buyer expertise, primarily based on these info.

Personalizing Help With Chatbots

Companies within the Fintech business can harness the facility of huge knowledge to personalize chatbot customer support. AI-powered chatbots will entry uncooked knowledge, permitting them to reply buyer questions precisely and straight to the purpose.

Guaranteeing Friction-less Multi-channel Expertise

Altering client preferences and the necessity to seize market share drove monetary establishments to embrace multi-channel service supply. To make sure their clients have a passable expertise, monetary companies will use massive knowledge analytics to tweak their companies throughout numerous platforms to swimsuit a buyer’s wants. They may also use historic and real-time knowledge to establish potential buyer challenges.

How Can Large Knowledge In Fintech Affect The Buyer Expertise?

Knowledge science in fintech has influenced buyer expertise in additional methods than one. Due to it, the monetary business can now:

Analyze buyer habits to suggest new merchandise

Buyer likes and dislikes shift relying on want. Historic monetary massive knowledge helps companies scrutinize evolving buyer behaviors, permitting them to give you invaluable services that streamline banking processes.

A wonderful instance is how the Oversea-Chinese language Banking Company (OCBC) designed a profitable event-based advertising and marketing technique primarily based on the excessive quantities of historic buyer knowledge they collected.

Higher UI/UX primarily based on A/B testing

Due to massive knowledge, Fintech companies can entry real-time knowledge that reveals how customers work together with their merchandise, the common time spent on the portal/system/app, and the most-used options.

With such info, these companies can assess two product variations to see which gives a superior UI/UX design. Moreover, they perceive in-depth the variations between the merchandise and the way they have an effect on the client expertise.

Analyze buyer satisfaction survey outcomes.

Large knowledge evaluates buyer satisfaction charges from survey outcomes. For example, it helps monetary establishments establish the speed of and causes for buyer churn, serving to them devise newer methods to maintain their viewers concerned with their companies. Additionally, it has been used within the administration of product and have requests, in addition to in analyzing buyer assist ticket developments.

Scoring

Monetary corporations can present correct credit score scores primarily based on the variety of missed or delayed funds, how a lot cash a buyer owes, and the way promptly they make funds.

Fraud detection

Large knowledge for monetary companies along with digital applied sciences similar to machine studying has proved fruitful within the detection of suspicious actions. They forestall numerous forms of refined fraud and elaborate hacking makes an attempt.

Deutsche Financial institution is one such monetary establishment that’s profiting from massive knowledge analytics to establish strategies utilized in cash laundering, safe the know-your-customer processes, and forestall bank card theft.

Measure the ROI from delivering an amazing buyer expertise

With insights from massive knowledge, fintech corporations can measure the success of their efforts geared towards offering a constructive buyer expertise. By measuring ROI, they’ll establish the place to enhance and what to give attention to.

The Fintech Sector is Exploding On account of Large Knowledge

Large knowledge is, undoubtedly, a tech development revolutionizing the Fintech business. It permits entry to giant knowledge volumes that can be utilized to enhance a buyer’s person expertise in retail banking, on-line buying and selling, and different monetary processes. Nevertheless, to take full benefit of huge knowledge’s highly effective capabilities, selecting BI and ETL options can’t be over-emphasized.

ETL and Enterprise Intelligence options make coping with giant volumes of information straightforward. They assist system integrations, serving to create dependable knowledge pipelines that ship actionable insights. Moreover, they assist fintech corporations predict market developments, driving profitability.