Expertise to the rescue? As rates of interest for mortgages fluctuate at a fast price, debtors are pissed off by the hoops they typically should have to leap by to even get information for his or her purposes. In England, lenders are searching for workarounds utilizing the cloud and expertise. The Mansfield Constructing Society, for instance, has launched and open banking platform with DirectID to make it simpler for mortgage candidates to supply their financial institution statements on-line.

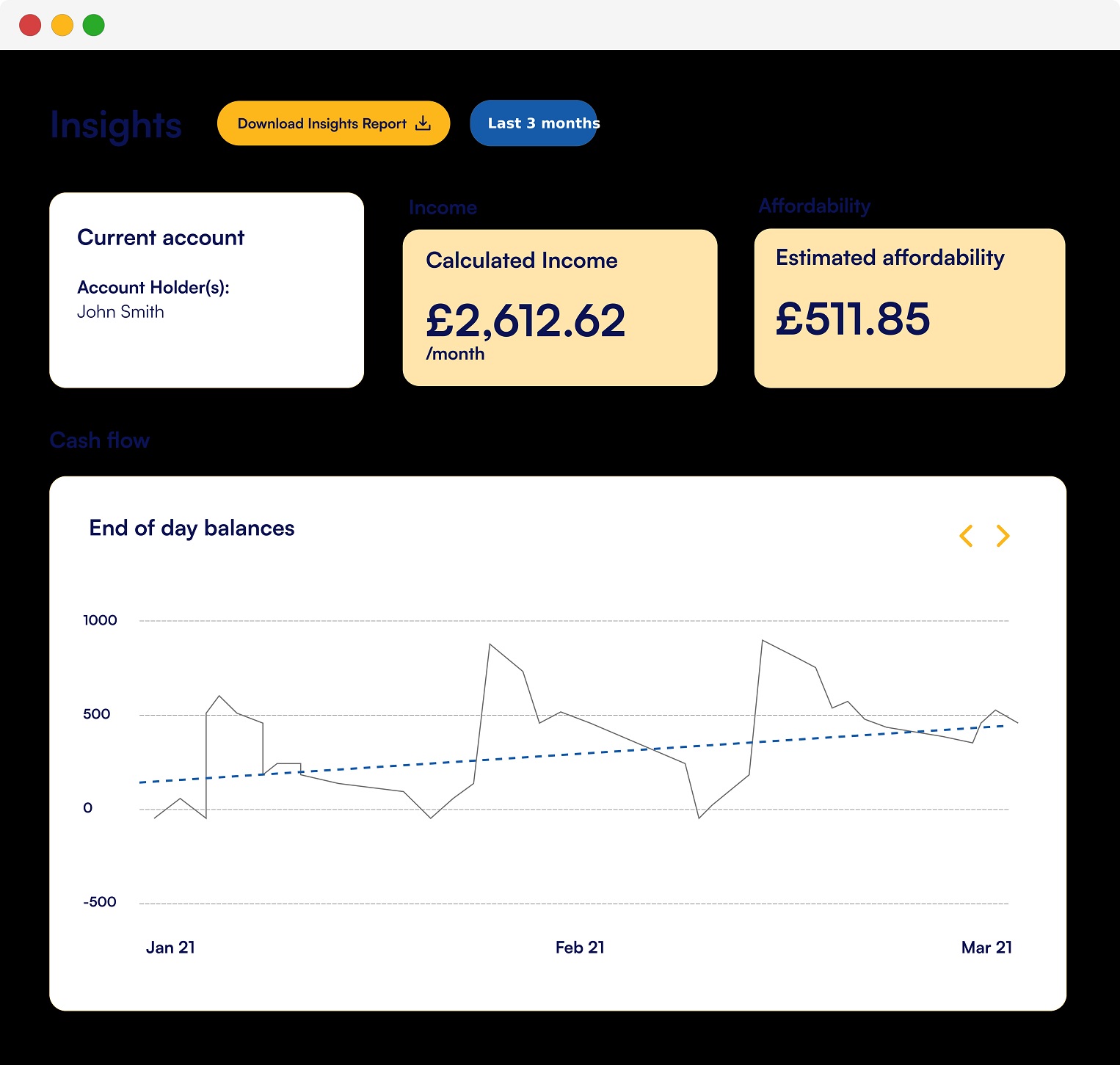

The brand new service permits debtors to offer consent for his or her financial institution to share their statements on-line with The Mansfield. Debtors merely have to login to their on-line banking through DirectID to offer entry to the Society for a restricted interval. The service replace is predicted to enhance the pace of validating earnings and expenditure and assist stop brokers from having to chase down authorized PDFs or paper-based submissions from their purchasers.

This newest transfer additionally coincides with additional updates to The Mansfield’s mortgage processing with using robotics to allow the swift switch of knowledge between programs moderately than requiring processers to re-key info. Not solely will using robotics assist pace up mortgage processing, but it surely additionally permits Society colleagues to give attention to giving extra high quality buyer contact and a much bigger give attention to the person method that brokers and their purchasers worth.

This new service is a secure and handy method for debtors to supply their financial institution statements on-line through DirectID’s open banking platform. This enchancment may help brokers scale back the quantity of chasing round they do for his or her purchasers and assist us ship a quicker pace to supply.

Need to tweet about this text? Use hashtags #building # #cloud