Relating to monetary modeling, presentation issues. A monetary mannequin is greater than only a spreadsheet stuffed with numbers; it’s a strong device that tells the story of your corporation, outlining its potential and demonstrating its viability. If you’re pitching to traders, your startup’s monetary mannequin may also help you talk your organization’s worth proposition, navigate negotiations, and safe the funding you must develop.

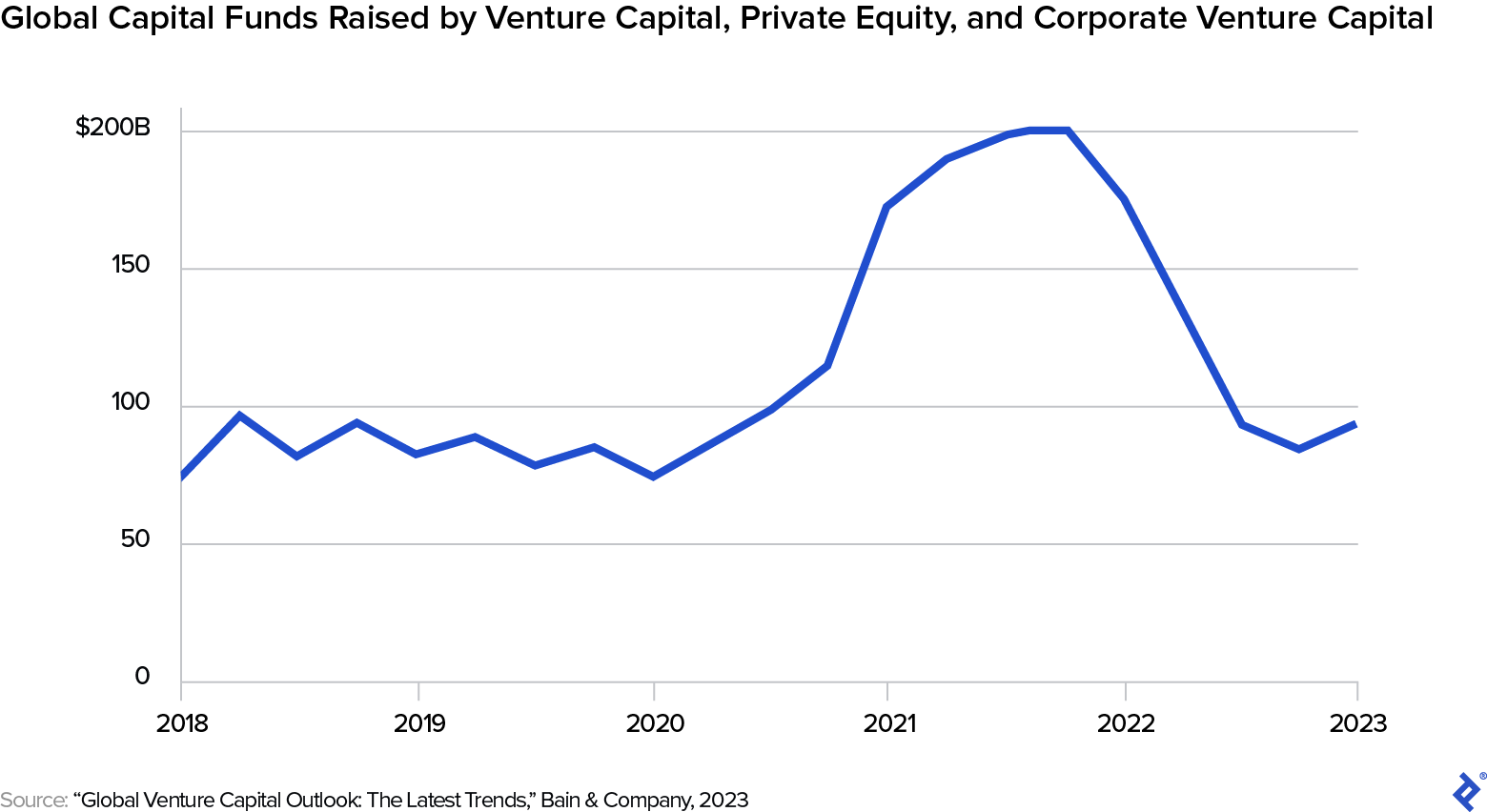

With enterprise capital now considerably extra scarce than it was in 2021, a robust monetary mannequin is all of the extra necessary. In line with Crunchbase, not even the frenzy to fund AI startups within the second quarter of 2023 was sufficient to tug international VC out of the doldrums.

As a startup advisor, I help my shoppers in M&A advisory, fundraising technique, pitch shows, monetary modeling, valuation evaluation, and extra. I’ve witnessed firsthand the challenges startup founders face once they don’t comply with one easy rule: Think about your monetary fashions from an investor’s perspective.

With traders paying such shut consideration to an organization’s financials, chances are you’ll be tempted—particularly for those who don’t have a substantial amount of monetary expertise your self—to show to a professionally designed monetary mannequin template for startups. However I don’t advocate this as a result of, usually, a template isn’t as plug-and-play because it appears. You might end up caught with massive clean areas that don’t apply to your organization’s enterprise mannequin, or, even worse, elements of the mannequin which you can’t use since you are unable to tweak the embedded formulation the best way you must. Though it’s extra work on the entrance finish, you’ll get a extra helpful and professional-looking outcome for those who begin from scratch.

On this article, I talk about how I’ve helped founders construct a monetary mannequin with traders in thoughts—and easy methods to use the mannequin to create a persuasive pitch.

Give attention to Key Efficiency Indicators (KPIs)

In your monetary modeling, it’s necessary to strike the suitable stability between together with sufficient info to supply a complete image of your startup’s monetary well being, and never overwhelming traders with extreme element. Zoom in on the most necessary metrics, often called key efficiency indicators (KPIs), which exhibit your startup’s progress and potential. This will appear apparent on the strategic degree, however startup founders typically get mired intimately.

I as soon as labored with a startup that had developed an revolutionary e-commerce platform. It was getting ready to pitch to traders for its subsequent funding spherical, and had constructed a monetary mannequin so overwhelmingly detailed that the first KPIs had been troublesome to search out. I helped the founders establish and prioritize their startup’s most necessary KPIs and included them into the monetary mannequin. Right here’s easy methods to strategy getting the stability proper:

Perceive Your Enterprise and Business

Begin by creating a deep understanding of your corporation mannequin, your business, and the components that drive development and profitability. This data will enable you to pinpoint the precise metrics that traders are more likely to give attention to when evaluating your startup’s potential. For instance, a software program as a service (SaaS) startup would possibly prioritize metrics like month-to-month recurring income (MRR) and buyer acquisition value (CAC), whereas a retail enterprise would possibly give attention to metrics like common transaction worth and stock turnover. Within the case of the e-commerce startup, we decided that metrics for buyer acquisition value, lifetime worth, and month-to-month common customers would have to be outstanding.

Align KPIs With Strategic Objectives

Ensure you spotlight the KPIs that the majority clearly mirror your startup’s general strategic goals and development plan. For instance, in case your major purpose is to quickly develop your buyer base, you would possibly prioritize KPIs such because the variety of new prospects, buyer acquisition value, and buyer lifetime worth. In case your purpose is to enhance operational effectivity, you would possibly give attention to KPIs associated to value management, similar to gross margin and working bills as a share of income. The aforementioned e-commerce startup I labored with knew how a lot cash it wanted to make in gross sales to interrupt even, however not how that translated to the sort and variety of prospects it wanted. We created a dashboard that tracked the variety of prospects for every gross sales channel to make sure the startup stayed on the right track.

Make KPIs Clear and Distinguished

Be sure that your chosen KPIs are simple for traders to search out and perceive inside your monetary mannequin. Think about making a devoted KPI dashboard or tab that presents these metrics in a visually interesting and easy-to-read format, utilizing charts, graphs, and tables the place acceptable. You can too embody KPIs inside your monetary statements or in a separate evaluation part. Wherever they’re, at all times make sure that they’re clearly labeled and straightforward to interpret.

I helped the e-commerce startup create a devoted dashboard that highlighted its key metrics, making it a lot simpler for the traders to see the startup’s efficiency and potential at a look. In the long run, the corporate was in a position to safe its desired funding. The traders particularly talked about how the clear presentation of KPIs helped them perceive the enterprise higher and gave them the boldness to take a position.

Combine Your Cap Desk

An equally important step to exhibit a complete understanding of your startup’s monetary and possession buildings is to include the capitalization (or “cap”) desk into your monetary mannequin presentation. The cap desk serves as a snapshot of your startup’s possession, detailing the next elements:

- Founder fairness: Possession percentages held by every founder, reflecting their roles and contributions to the startup

- Investor fairness: Shares owned by angel traders, enterprise capitalists, and different monetary backers, together with their respective funding rounds

- Worker fairness: Inventory choices and grants allotted to staff as a part of their compensation packages

- Convertible securities: Convertible notes or SAFE agreements, specifying the conversion phrases and potential dilution results

- Dilution eventualities: Potential outcomes of future fundraising rounds, demonstrating your startup’s potential development and the affect on present stakeholders

Guaranteeing consistency between your monetary mannequin and the cap desk supplies traders with a cohesive and correct image.

Create a Sense of Urgency

A sturdy monetary mannequin may also help you emphasize any alternatives and market tendencies that current distinctive home windows on your startup’s development—if traders act quick. You possibly can exhibit urgency by highlighting plenty of necessary components:

- Time-sensitive alternatives: I as soon as labored with an revolutionary firm that developed a groundbreaking AI healthcare answer. It used its monetary mannequin to spotlight the potential for substantial income from a brand new authorities initiative in telehealth with a restricted software window.

- Penalties of inaction: A tech agency has developed a brand new IoT gadget for sensible properties that’s distinctive, however there are rivals on the horizon. Traders would be capable of inform from the monetary mannequin that delays in funding might quickly compromise the corporate’s projected market share.

- Velocity to market: A meals tech enterprise with a lean enterprise mannequin and established partnerships would possibly use its monetary mannequin to indicate how shortly it might generate income after receiving funding.

- Early-mover benefit: A fintech startup that’s first in its area of interest might leverage its monetary mannequin to indicate the potential for elevated market share and model recognition with investor help.

- Scalability and development potential: A SaaS agency with a formidable development technique would possibly use its monetary mannequin to spotlight its scalable enterprise mannequin, demonstrating how month-to-month recurring income might skyrocket with elevated funding.

Highlighting time-sensitive alternatives may also help persuade traders that performing quick is crucial for a stronger market place and better returns—particularly helpful at present, when capital is way much less accessible than it was a number of years in the past, and traders are more and more cautious.

Format Your Monetary Mannequin for Readability and Affect

Now that what you must embody, it’s time to take a seat down and construct your mannequin. Thoroughness is necessary, after all, however don’t underestimate the ability of sensible design too. A great monetary mannequin must be as simple to navigate as a well-organized submitting cupboard. Right here’s easy methods to do it:

- Separate every main part of your monetary knowledge into its personal tab. The must-have tabs often embody assumptions, revenue statements, stability sheets, and money circulation statements. There might also be tabs for state of affairs planning and your cap desk.

- Keep away from muddle: You don’t want a separate tab for each view or evaluation. Use a single tab for every assertion or matter, and easily tweak variables to toggle between related views.

- Differentiate your content material: Use outstanding headings and subheadings to divide sections. Use daring textual content for headings, totally different font colours for assumptions, inputs, and outputs, and italics for feedback or notes. If you must, use strains and background colours to additional differentiate tables, dashboards, and different chunks of knowledge.

- Be constant: Apply constant formatting and styling all through. Which means all headers ought to look the identical, all subheads ought to look the identical, all inputs ought to look the identical, all outputs ought to look the identical, and so on. It will go a good distance towards making your mannequin’s hierarchies and equivalencies simpler to grasp.

- Develop visible aids to current your mannequin: Create clear and concise charts, graphs, or tables that signify key points of your monetary mannequin. These knowledge visualizations may also help traders shortly grasp a very powerful info and make your presentation extra participating.

Presentation could appear to be a superficial facet of your mannequin, in comparison with your precise concept, however I can’t overemphasize how a lot affect it could have. Let’s think about a real-life instance, a SaaS firm that I as soon as helped. Its product was nice—a monetary administration and funds device focused at SMBs— and its pitch deck was spectacular. Its monetary mannequin, nevertheless, was like a kitchen the place you couldn’t inform the components from the cooked meals; the traders informed the founders that their mannequin made it not possible for them to see the corporate’s monetary potential.

I noticed that the corporate wanted somebody to step in and assist clear up its “kitchen.” I utilized constant formatting to distinguish between the inputs and the outputs, and to make every tab simpler to navigate. Instantly, it was a lot simpler for the founders to handle their very own numbers and for the traders to grasp the corporate’s potential. Consequently, the SaaS startup secured the funding it wanted.

Check Your Monetary Mannequin—and By no means Cease Testing It

A sturdy, well-tested monetary mannequin demonstrates your understanding of the enterprise and will increase your credibility. To guarantee your mannequin is correct, dependable, and successfully communicates your startup’s potential, think about this recommendation:

- Double-check assumptions, inputs, and calculations: Make sure that all of the assumptions and inputs in your monetary mannequin are primarily based on stable knowledge and market analysis. Verify that your calculations are correct and logically derived out of your inputs. Use business benchmarks or historic knowledge to validate your assumptions and supply a basis on your projections.

- Stress-test your mannequin: Conduct sensitivity analyses by altering key variables and assumptions in your mannequin to see how the outcomes are affected. This helps you perceive the potential dangers and uncertainties related to your corporation, and prepares you to handle investor considerations or questions on totally different eventualities.

- Search suggestions from trusted specialists: Share your monetary mannequin with skilled professionals, similar to advisors, mentors, or friends who’ve efficiently navigated the fundraising course of. They may also help you establish any weaknesses, inconsistencies, or areas for enchancment.

- Revisit and replace your mannequin repeatedly: As your corporation evolves, so ought to your monetary mannequin. Commonly replace your mannequin with new knowledge, market analysis, and any adjustments in your corporation technique. This not solely ensures that your mannequin stays correct but additionally demonstrates your ongoing dedication to understanding and managing your startup’s monetary well being.

Be Ready to Reply Questions and Defend Your Assumptions

In my expertise, traders—particularly for early-stage firms—prioritize two issues: whether or not the numbers are cheap, and whether or not the founder truly understands how their enterprise works. To successfully deal with inquiries and instill confidence, you will need to know each facet of your mannequin inside and outside so you may clarify and defend your assumptions, calculations, and monetary projections intimately. Right here’s easy methods to put together:

- Perceive your assumptions: It could appear apparent, however you’ll want to have the ability to clarify to traders the place your assumptions come from—for instance, business analysis could reveal tendencies or cycles you may anticipate to copy.

- Clarify your methodology: How precisely did you arrive at your numbers? Transparency and willingness to share your course of reassures traders and builds credibility.

- Do your analysis: Your traders doubtless know extra about your business than you do. Use respected sources related to your subject to indicate that your assumptions are primarily based on info your traders can and do belief.

- Anticipate widespread questions: Put together for doubtless inquiries about your mannequin and observe your responses. For instance, you probably have a SaaS firm, you have to be able to reply questions on the way you handle your churn charge, how you intend to scale buyer help, and different related questions.

Time and time once more, I’ve seen how a lot a easy mannequin refresh can change the sport for a startup struggling to interrupt via to traders. A well-formatted monetary mannequin ensures that traders can shortly grasp key insights and see the potential in your startup. A poorly formatted mannequin, alternatively, can create confusion, which undermines the story you’re making an attempt to inform.

Simply as necessary, a mannequin that’s well-organized and customised to your corporation makes it simpler for you, because the founder, to learn and use. A monetary mannequin is the muse upon which you’ll construct your organization. It’s what you’ll use to make nearly each resolution that impacts your organization’s future: monitoring your progress, testing your concepts, allocating sources, in search of funding, analyzing threat, and projecting your development. Think about how damaging it could be to decide primarily based on unclear, inaccurate, or incomplete info, just because your mannequin was too complicated.

Not each founder is a nuts-and-bolts finance knowledgeable—and also you don’t need to be. With knowledgeable design and routine tending, your startup’s monetary mannequin could make it simpler to run your organization and improve your possibilities of securing the funding you must develop your corporation and obtain lasting success.