Retailers at this time are prioritizing modern methods to retain and monetize their current buyer base, transferring away from conventional buyer acquisition strategies. This vital shift demonstrates how subscription-based companies are adapting to the prevailing macroeconomic atmosphere.

A pivotal discovery underlining this alteration comes from a current “2023 State of Trade Report” by subscription billing software program agency Chargebee.

In a research performed between March 18 and April 15, 2023, Chargebee researchers analyzed the shopper retention actions of over 318 leaders within the subscription enterprise business. The 28-question survey examined how these leaders tailored to altering market situations, overlaying income and churn expectations, enterprise methods, budgets, and retention techniques for subscription companies.

The analysis heralds the daybreak of a “Retention Period,” the place buyer retention has change into the highest precedence for 87% of the surveyed companies. The technique ranks on par with or surpasses conventional new buyer acquisition strategies.

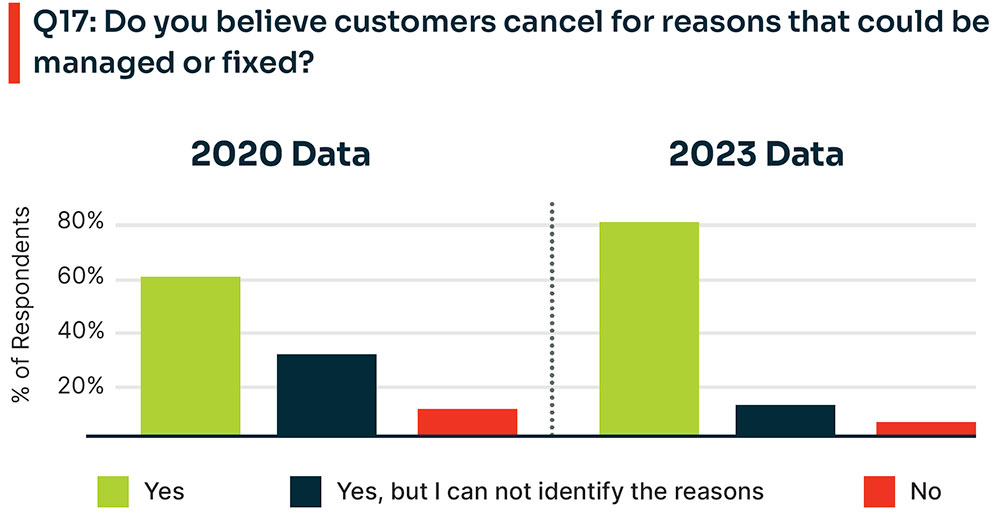

Chargebee’s findings additional reveal that 96% of subscription enterprise executives imagine clients cancel for causes that may very well be managed or fastened.

Supply: Chargebee 2023 State of Subscription Trade Report

Retention-Targeted Investments

Corporations are adjusting their methods this yr. The tactical shift has moved from battling churn by way of adjusting priorities and budgets to a extra targeted method — producing income from current clients.

The report signifies a rising pattern in buyer attrition, with 64% of respondent corporations anticipating a rise in churn this yr. The change in funding priorities displays 51% rising spending in know-how, 32% in initiatives, and 27% in loyalty packages.

“This yr has introduced fast change to the enterprise panorama, with corporations, it doesn’t matter what enterprise mannequin they make use of, discovering methods to prioritize funding for continued progress,” noticed Man Marion, chief advertising and marketing officer at Chargebee.

Information exhibits {that a} majority of business-to-business (B2B) and direct-to-customer (DTC) subscription companies anticipate a rise in churn and subsequently want a robust funding technique to take care of and develop income, he mentioned.

“The sensible wager is on retention, a extra direct and environment friendly method to long-term progress that locations clients on the heart of enterprise,” he supplied.

Considerations Prolong Past Churn

Respondents additionally report that their prime concern for this yr is maintaining with quickly altering know-how and the profound impression of synthetic intelligence (AI) on operations. Conserving tempo will show business-critical as corporations search to stay aggressive amid rising shopper demand and technological developments throughout all industries.

Regardless of challenges, optimism prevails, with 79% of companies forecasting progress this yr. As for pricing traits, the overwhelming majority anticipate both stability or escalation, with 92% of subscription companies predicting their costs to rise or preserve their present ranges.

The main progress technique includes enhancing the standard and responsiveness of buyer success and assist companies. Slowing down buyer churn stays the first enterprise problem for subscription-based gross sales.

That displays the numerous adjustments during the last two years. Pre-Covid, corporations have been nonetheless within the “progress in any respect prices” period. In response to Marion, cash flowed extra freely, and that impression was seen in how product market methods and shopper spending behaviors have been fairing.

Churn Chaos

“At this stage, corporations have been simply beginning to perceive the significance of retention. In our 2020 report, 93% of respondents felt retention was as or extra essential than acquisition,” he advised The E-Commerce Occasions.

Churn was at 2% to three.9%, and 69% of B2C corporations had a churn goal. In 2020, 96% of the surveyed corporations believed they might handle the explanations inflicting clients to depart. However 31% have been unable to establish these causes, famous Marion.

Then, the pandemic hit. Disposable revenue was extra available throughout this era, and companies skilled a buyer surge. Many retailers switched to digital, and the impression was optimistic throughout the board.

“As we eased out of the pandemic right into a extra economically tight panorama, spending went down, and B2C companies began to expertise pullbacks from what has been referred to as subscription fatigue,” he defined.

At the moment, elevated churn charges throughout the business mirror this fatigue. Primarily based on Chargebee benchmark knowledge, 42% of B2C corporations are churning 3% or extra month-to-month, and 16% are churning 4% or extra. In response to Marion, the typical is shut to six%, almost double the pre-pandemic common.

Tech Spend, Loyalty Applications Options to Churn

Not all indicators have been unfavourable, nonetheless. On this present report, Marion sees the same statistic of those that imagine buyer cancellations may very well be addressed and resolved (96%). Nonetheless, solely 15% state they have no idea the explanation — a 52% decline.

“This tells us that perceptions haven’t dramatically modified previously few years, however the potential to execute has improved considerably. Corporations are exhibiting a maturation in managing and curbing cancellations on account of enhancements in operational efficiencies and capabilities,” Marion reported.

The spending on know-how, instruments, and retention initiatives differ considerably from 2020 to 2023. In 2020, companies spent 15% on know-how and instruments. Now they’re spending 51%. In the meantime, retention initiative spending went from 14% in 2020 to 32% in 2023.

This knowledge demonstrates that companies have gained a way more sturdy understanding of shopper behaviors with applied sciences like Chargebee Retention that supply predictive analytics and knowledge for making extra clever enterprise selections, he instructed.

As one instance, a self-care and sweetness model decreased churn from 12.5% to lower than 9% by providing improved personalization and improve gives on the annual renewal second. That lowered cancelations by way of proactive churn deflection and assist gestures. In addition they launched new loyalty packages to construct model loyalty and retention and anticipate progress within the subsequent yr.

Development and Retention Methods

Retailers and entrepreneurs should adapt to falling budgets and rising prices as shoppers scale down their talents to take care of their earlier purchasing patterns. The very first thing this report tells Marion is that the one fixed is change.

“We see comparable traits through the years, however the response to these traits exhibits progress. Corporations are investing in know-how and automation to enhance productiveness and effectivity, to enhance the shopper expertise, and to trace the precise outcomes to enhance the accuracy of determination making,” he noticed.

From AI applied sciences like ChatGPT, that are remodeling customer support and content material technology, to the tight labor market and rising rates of interest, B2C corporations are most involved in regards to the impression of exterior forces on their enterprise. They plan on spending extra on tech to assist their progress and retention efforts, he added.

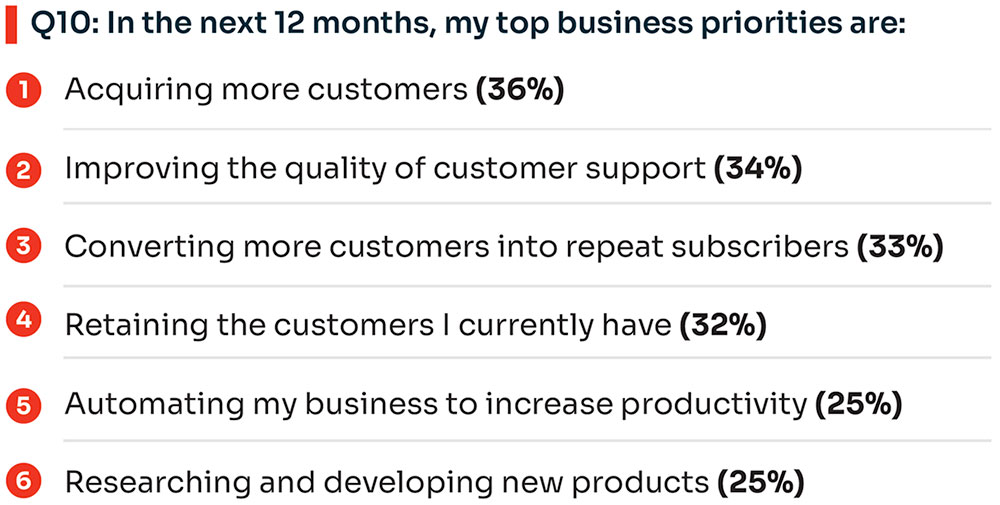

“Of the highest 5 priorities that B2C corporations are spending extra on, three are retention-related,” mentioned Marion.

B2C corporations are additionally responding to the rise in churn with progress methods that prioritize preserving current clients comfortable. This yr, enhancing customer support and onboarding are major focuses for B2C companies.

Supply: Chargebee 2023 State of Subscription Trade Report

Fluid Retention Methods Wanted

The subscription mannequin is evolving, requiring corporations to realign with shopper behaviors frequently, suggested Marion.

He sees extra corporations innovating their enterprise fashions to current new experiences for purchasers. Think about Porsche’s new drive product that gained a Dice award at SubSummit 2023. It’s a membership-based subscription for Porsche fanatics to entry near-new autos on a versatile month-to-month foundation.

“Corporations that solely supply one-size-fits-all options could battle to maintain up with the altering wants of consumers, particularly when mixed with an elevated want for effectivity,” he concluded.

In response to Marion, churn shouldn’t be as scary because it as soon as was, particularly with new applied sciences to fight it, and with 27% of corporations now prioritizing loyalty packages.

A giant shock for him was the final sense of optimism within the report. It confirmed that 94% of companies who imagine their churn charges will improve additionally anticipate their income to extend.

Companies are proactively reallocating budgets to enhance buyer expertise by leveraging new techniques and applied sciences. Virtually half (46%) of respondents think about enhancing the standard and responsiveness of buyer assist as a vital technique for the yr.