Up to date June 2023

Because the world is evolving, so is the digital atmosphere. Consequently, pace has change into a continuing within the common buyer’s life, particularly when hitting the checkout web page.

Being on top of things on the on-line fee strategies is a compulsory apply for your small business, as 4.11 billion folks bought items on-line in 2022.

There are numerous methods wherein on-line funds will be processed, their reputation will depend on particular person zones across the globe and so retailers should adapt to present developments and specifics.

Positive, chances are you’ll concentrate on playing cards’ and PayPal’s reputation, however is your small business actually catering to the preferences of all audiences you’re focusing on?

Let’s go over the finest fee strategies on-line and see if there are any you might be omitting.

International eCommerce fee strategies

Whether or not they’re buying from a desktop browser or out of your cellular app, customers these days anticipate totally different fee strategies to be featured in on-line shops, to allow them to select the one which fits that particular want. With the intention to be related to the widest viewers you should guarantee your website has capabilities to help these fee means that are hottest on-line.

Contemplating this, it’s essential for companies to grasp the most well-liked on-line fee strategies obtainable available in the market. By doing so, they’ll be certain that their clients have entry to a seamless and safe checkout course of.

Bonus: See how simple it’s to go international and different advantages of going past funds.

Credit score & debit playing cards

Bank cards stay one of the crucial common decisions globally for on-line purchases, though their market share has been dented in recent times by eWallets. Bank card transactions elevated roughly six p.c between 2020 and 2019. However, debit playing cards have prolonged their lead as probably the most used card product, with 94 transactions per capita globally, versus 49 between 2020 and 2021.

Playing cards’ reputation as on-line fee strategies was constructed on the safety options supplied – card transactions have been regulated for a few years by international or regional compliance requirements and in addition by shopper protections issued by fee processors, similar to these upheld by American Categorical, Mastercard and Visa.

Bank cards have a barely extra marked desire in Western markets vs debit playing cards, given a few of their further options. For instance, some buyers are incentivized to make use of bank cards to have entry to the financial institution’s reward applications. Within the US, extra so, bank card spending impacts the person’s credit score scoring and serves as an additional motivation to go for it as a web-based fee technique.

Bank cards have a barely extra marked desire in Western markets vs debit playing cards, given a few of their further options. For instance, some buyers are incentivized to make use of bank cards to have entry to the financial institution’s reward applications. Within the US, extra so, bank card spending impacts the person’s credit score scoring and serves as an additional motivation to go for it as a web-based fee technique.

For a few years, card funds have been thought-about the best choice for customers in terms of making on-line purchases. Nonetheless, in latest occasions, their declare to the primary spot has been fiercely contested.

As we transfer ahead, it’s clear that the panorama of on-line fee strategies is consistently evolving, with new and revolutionary choices rising often. Shoppers have gotten more and more tech-savvy and demand extra handy and safe fee choices.

Within the face of this shifting atmosphere, fee playing cards are going through stiff competitors from different fee strategies similar to e-wallets, cellular funds, and cryptocurrency.

eWallets

Also called digital wallets, eWallets are one of many quickest rising on-line fee strategies in B2C eCommerce all around the world, Juniper Analysis raveling that digital and cellular pockets funds accounted for 3.4 billion customers in 2022, projecting to exceed 5.2 billion globally in 2026. On-line wallets had the best market share within the Asia-Pacific Area with roughly 69 p.c of eCommerce funds. Center East, Africa, and Latin America are forecasted to have the best enhance in cellular wallets market share on-line by 2024.

This various fee technique works like a pay as you go credit score account, and shops the client’s private knowledge and funds. When utilizing an eWallet, the person now not has to enter his checking account particulars to finish the acquisition, being redirected from the checkout to the eWallet’s web page the place they merely need to log in with their username and password to conclude a purchase order.

The most well-liked digital wallets embody PayPal (predominantly within the Western world), AliPay (common in Asia Pacific), ApplePay, GooglePay, WeChat or Venmo. eWallets additionally work together with cellular wallets, using a smartphone’s biometric choices, which assist the client authenticate sooner thus ending their funds sooner.

A brand new examine from Juniper Analysis projected QR code funds as the most well-liked digital pockets transaction kind in 2026 accounting for 380 billion transactions globally, and for over 40% of all transactions by quantity.

Financial institution transfers

This on-line fee technique entails the client paying from their banking account with their very own funds. It’s perceived as having an additional layer of safety, as transactions require authentication by means of the client’s financial institution. Principally, when chosen as fee technique throughout checkout, a financial institution switch redirects the person to their web banking portal, the place they need to log in and authorize the transaction.

Financial institution transfers accounted for 9% of worldwide eCommerce transaction volumes in 2019, chosen primarily in Europe. In 2021 they elevated by 8.6% to 2.5 billion, accounting for 22% of the entire variety of transactions.

Purchase now, pay later

An internet fee technique that has gathered consideration recently and which registered final yr an estimate of 360 million folks worldwide utilizing BNPL providers is Purchase Now, Pay Later. This can be a type of instantaneous lending which an increasing number of younger customers are turning to, as Teen Vogue additionally stories.

The rationale for its rising reputation is that BNPL provides a handy technique to make purchases with out having to pay the complete quantity upfront. This feature permits customers to unfold their funds over a time period, with out having to open up a bank card account. With BNPL, buyers can defer funds for just a few weeks and even months, relying on the phrases of the service. Availability of this selection throughout checkout has been reported to persuading 30% further consumers to finalize a purchase order they wouldn’t have in any other case.

This various fee technique is experiencing accelerated progress, reaching an estimate of $179.5 billion market worth in 2022, and by 2025, this determine is predicted to nearly triple.

A few of the choices for this fee technique embody Klarna, AfterPay, and Bread.

Pay as you go playing cards

One other various on-line fee technique is pay as you go playing cards, chosen primarily by unbanked customers or minors. Prospects go for a pay as you go card from a set of predefined obtainable values after which they use the small print on that card for on-line transactions.

Market penetration of pay as you go playing cards has accounted 1.6 market share in 2020, among the hottest playing cards chosen by customers together with Paysafecard or Mint.

Utilization of this fee technique is extra marked within the gaming trade, pushed more than likely by viewers demographics.

One of many greatest benefits of pay as you go playing cards is that they may help customers handle their spending and keep inside their funds. Since pay as you go playing cards have a pre-loaded steadiness, customers are unable to spend greater than what they’ve on the cardboard, thereby avoiding the chance of overdrafts and accruing debt. Pay as you go playing cards additionally provide customers the power to observe their spending simply, because of on-line account administration instruments that enable them to trace their steadiness and transactions in real-time.

As pay as you go playing cards proceed to realize reputation, we are able to anticipate to see much more innovation and new options on this quickly evolving market. As an example, some pay as you go playing cards now provide rewards applications that enable customers to earn cashback, factors, or reductions for sure purchases.

Digital checks

E-checks are a type of on-line fee which might be regulated by the Automated Clearing Home (ACH) and contain drawing cash straight from a checking account. With e-checks, the person authorizes the fee straight from their web banking account, and the processing is much like that of conventional paper checks, however a lot sooner.

One of many benefits of utilizing e-checks is that they provide a safe and dependable fee possibility for each people and companies. This fee technique is especially helpful for recurring funds, similar to lease or utility payments, as customers can arrange automated funds to be deducted from their checking account at common intervals.

Digital checks are common amongst American retailers with giant gross sales volumes and a excessive common quantity and they’re perceived as an reasonably priced on-line fee technique. Apparently, e-checks have been the primary Web primarily based fee utilized by the US Treasury for making giant on-line funds, which may clarify their reputation on this class of customers.

30% of B2B funds within the U.S. and Canada proceed to be made by checok and at a worldwide degree, funds made by verify account for less than 31 p.c of B2B funds.

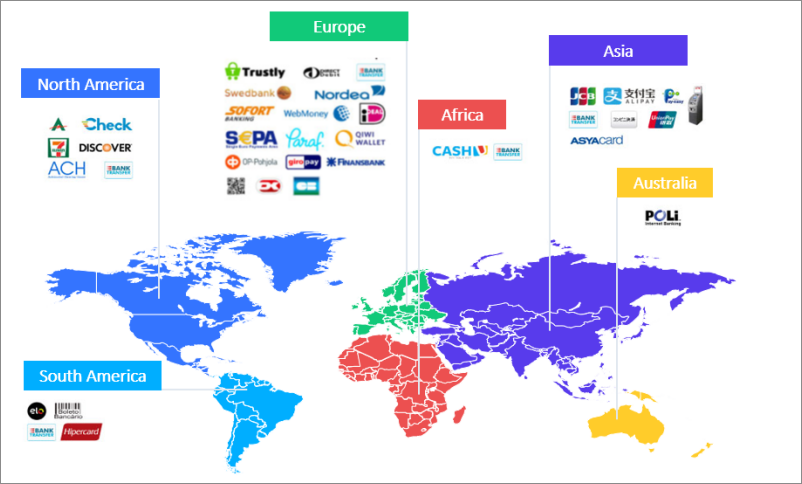

Native eCommerce fee strategies

Whereas understanding finest fee strategies for on-line companies focusing on international markets is crucial, to be able to enter some native markets, it’s important to perceive how preferences differ in every area. Some markets, for instance, have a stronger desire for playing cards, whereas in others the eWallet is king.

And, past the fee strategies detailed above, sure markets additionally make use of on-line strategies developed particularly for residents in that jurisdiction.

Native fee strategies can vary anyplace between 10% to 50% in adoption in a rustic, so you’ll want to think about native flavors when establishing an eShop there.

For instance, in China, there is a prevalent utilization of Peer–to–Peer fee apps (P2P), the place you possibly can switch cash to household members or associates for small bills. Some of the most used fee suppliers are WeChat, Venmo and PayPal.

Europe

Total, most European customers go for playing cards or eWallets for his or her on-line buying, with some marked desire for various on-line fee strategies in several markets.

In Germany, PayPal is utilized by for on-line shoppping with a 95 p.c price as of 2021, whereas simply 16% of French go for it. SEPA Direct debit can be a well-liked possibility amongst Germans, used for one time and for recurring funds as properly.

Within the Netherlands, the most well-liked fee technique is iDEAL, with 66% of buyers selecting in accordance with Statista. On a market with a excessive adoption price for web banking, it comes naturally that buyers favor iDEAL, a standardized on-line banking-based fee technique.

In France, a market with a excessive banking penetration price, buyers might go for their playing cards, however as a service provider you continue to need to know their preferences. 2Checkout’s benchmark examine discovered that 14% of buyers right here favor their Cart Bancaire, a neighborhood fee technique obtainable solely on this market.

Over in Turkey, 17% of buyers additionally favor native playing cards, nonetheless, they achieve this as a result of these native playing cards include installment options. 80% of card transactions listed here are recorded by means of installment playing cards similar to Most or Bonus Card.

As reported in latest analysis, in Spain, debit and bank cards are the preffered fee technique, with digital wallets coming in second place. In 2023 is forecasted that playing cards will likely be used much less and fewer, with digital wallets and financial institution transfers beginning to take over.

North America and Latin America

Bank cards and debit playing cards stay the most well-liked on-line fee strategies within the Americas, with greater than 50% of market share in every area, however, past playing cards, preferences diverge.

The place North People usually tend to go for their PayPal or different most popular digital pockets, South People are extra seemingly to make use of a neighborhood bank card with installments. In 2022, bank cards have been estimated at greater than half of all e-commerce funds in Brazil and Chile, though, in Mexico, they’d make up 4 out of each ten of these transactions. Coming second place in reputation is the moment fee platform Pix amongst Brazilian web shoppers, with debit playing cards rating second amongst Chileans.

11.5% of the entire quantity of eCommerce purchases throughout the Latam area are e-wallets transactions because the web penetration price has reached 68.8%.

Asia Pacific

Asia-Pacific leads international preferences for cellular/ digital wallets, with greater than 50% of this area’s on-line transactions being pockets primarily based.

Chinese language customers are the most important followers of this on-line fee technique, on a market dominated by AliPay and WeChat Pay. 42%, nearly half of all on-line transactions in China are paid by way of AliPay. Playing cards come second in desire in Asia Pacific, adopted by financial institution transfers.

In relation to digital funds, China is the most important market, It has been reported that on the finish of 2020, 1.22 billion folks subscribed to cellular providers in China, comparable to 83% of the area’s inhabitants.

By way of native preferences, about 5% of Japanese go for Konbini, a neighborhood cash-based fee technique in that nation, which permits buyers to order on-line after which pay in a comfort retailer. Given Japanese folks’s propensity to go to comfort shops usually, ATM funds at these shops grew to become fairly common for buyers right here. JCB card funds are additionally a consumer favourite in Japan, given the very fact there are 146 million card holders in Japan and not too long ago JCB has additionally launched an app.

Africa

Cellular funds are gaining reputation in African American on-line buying markets as a result of lack of entry to conventional banking providers for almost all of African American customers. This has created a necessity for various fee choices, similar to cellular funds, which might be accessible and handy for these customers. Cellular funds enable customers to hyperlink their cell phone quantity to their fee account, enabling them to make purchases straight from their cellular system.

Shoppers who purchase on-line in Africa will be inclined to pay by money as of 2022, although in international locations similar to Morocco card-based funds and financial institution transfers are prevalent

On this space, money remains to be the most well-liked fee technique, accounting for a 60 p.c of the entire transactions in 2022. Moreover, in Kenya, 44% of transactions have been by card and 19% by financial institution switch.

In a majorly digitalized world the place pace is the brand new norm, security is a variable all customers take note when making an attempt to keep away from fee fraud. So, what are the most secure on-line fee strategies?

Bank cards use encryption and fraud monitoring to maintain the delicate knowledge and accounts safe, and they’re the most secure fee technique.

ACH fees are processed to a community (Automated Clearing Home involving a collection of security measures like encryption and the implementation of entry controls.

No matter whether or not you’re a enterprise proprietor or a consumer, it’s essential to conduct thorough analysis to make sure monetary security. Select fee strategies which might be respected, safe, and have a confirmed observe file of defending customers towards fraud. By taking these precautions, you possibly can benefit from the comfort of on-line buying with peace of thoughts.

For those who’ve made it this far, you now have a a lot stronger grip on what are the most well-liked fee strategies on-line and you’ve got a great begin on learn how to method every market. Attending to know the totally different on-line fee strategies will enable you to adapt domestically, which in time will result in higher conversion charges in your website. Maintain cultural preferences in thoughts whereas tailoring native methods and select these digital instruments that can ease your entry into new eCommerce markets.

If you wish to study extra about eCommerce in particular international locations all all over the world and learn how to attain new audiences with the 2Checkout assist, learn our ‘Enter New eCommerce Markets with 2Checkout Steerage’ collection.