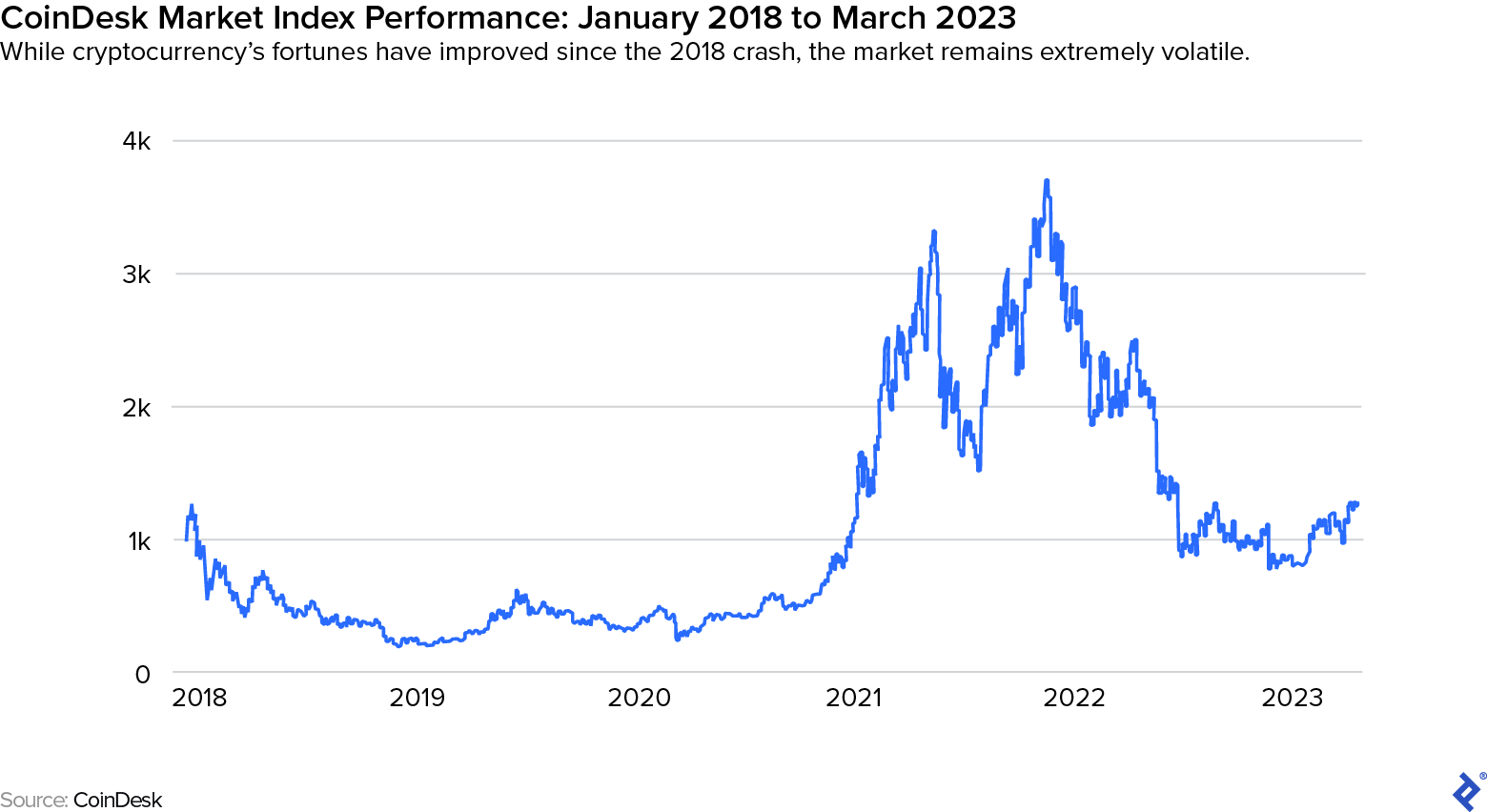

The cryptocurrency market crash of 2022 has bolstered ongoing considerations about crypto’s future, at the same time as many traders nonetheless preserve a excessive degree of curiosity in digital property. Anybody contemplating investing within the area ought to be sure they’ve a strong basis in each crypto’s challenges and prospects.

The challenges are appreciable: Hype, bubble mentalities, and fraud have periodically inflated digital currencies’ values over time. Fiduciary accountability, regulation, and oversight are nonetheless missing within the sector. And the environmental toll of crypto’s energy-intensive computing calls for is alarming to shoppers and governments alike.

Regardless of these considerations, optimism stays excessive amongst fans. The worldwide cryptocurrency market cap exceeded $1 trillion as of Might 2023. Additionally commanding consideration are the noncrypto prospects of the blockchain expertise underlying the cash, which has highly effective purposes in varied sectors, from healthcare to media to provide chain administration.

On this article, I element a number of the controversies and crises which have characterised the crypto market lately. I additionally present a longer-range overview of the character of crypto, its regulatory and accounting therapy, and what potential traders have to know as they think about this unstable sector.

Present Points within the Cryptocurrency Market

The vast majority of People don’t belief the protection and reliability of cryptocurrencies, in keeping with a 2023 Pew Analysis Basis research. Even for crypto-enthusiasts, there are a number of elements that may be retaining them awake at evening.

Volatility and the Crypto Crash

Many crypto tokens are unstable and susceptible to scams, however even these marketed as secure and supposedly backed by property to make sure their worth have collapsed.

In Might 2022, the digital stablecoin TerraUSD and the algorithmic stablecoin tied to it, LUNA, crashed, tanking the crypto market and inflicting traders to lose greater than $400 billion. Then, in November of the identical yr, crypto alternate FTX crashed because of inadequate liquidity, mismanagement of funds, and extreme withdrawals from unnerved traders—miserable the worth of its token, FTT, in addition to these of quite a few different cryptocurrencies, together with Bitcoin and Ethereum.

Different main exchanges have additionally been affected by the autumn of FTX: BlockFi froze withdrawals, as did Gemini’s third-party lending associate, Genesis International Capital. Crypto.com additionally froze withdrawals of the stablecoins USDC and Tether (USDT), the values of that are primarily based on the US greenback. Coinbase laid off virtually 1,000 workers in reference to the fallout from the crash.

The crypto crash additionally introduced down the NFT market. The most well-liked NFTs, like Bored Ape Yacht Membership and CryptoPunks, noticed their costs slashed by greater than half in August 2022. Whereas the collapse paralleled a lower in cryptocurrency costs, different elements like high-profile scams and market oversaturation additionally performed a big position.

Nicely earlier than these nosedives, the crypto market had already crashed a number of instances, together with in 2021, 2020, 2018, 2013, and earlier, largely because of investor hypothesis and media hype. Whereas this demonstrates that instability is endemic to crypto, it additionally reveals that the expertise and currencies are resilient.

Criminality and Deception

In 2022 alone, a number of the most revered gamers liable for retaining digital currencies functioning have been charged with crimes equivalent to fraud—together with Sam Bankman-Fried of FTX; Do Kwon, head of Terraform Labs, the dad or mum firm of TerraUSD and LUNA; and Su Zhu and Kyle Davies of Three Arrows Capital.

Additionally in 2022, criminals generated 117,000 rip-off tokens, robbing traders of billions of {dollars}. Many preliminary coin choices (ICOs) are additionally suspect, notably for cryptocurrencies with speculative enterprise fashions, and have been broadly criticized as scams as effectively.

The pseudonymous and unregulated nature of blockchain and Bitcoin transactions additionally raises considerations when transactions must be disputed. In a typical centralized transaction, if the great or service is flawed, the transaction may be canceled and funds returned to the client. Nonetheless, there isn’t any central group within the cryptocurrency ecosystem to facilitate recourse in opposition to the vendor.

Safety and Privateness Issues

Whereas the blockchain itself is extraordinarily tough to hack, the identical can’t be stated for the exchanges the place cryptocurrency is traded. Laptop hacking and theft have plagued the marketplace for almost a decade. The primary main alternate hack came about in 2015, when hackers made off with as much as 850,000 Bitcoin from the Tokyo-based Mt. Gox. In November 2022, when FTX declared chapter, criminals hacked the alternate and made off with $600 million. The earlier month, hackers stole $570 million from Binance. Different assaults occurred in 2021 and early 2022, with mixed stolen funds totaling greater than$1 billion.

The code that powers sensible contracts can be hacked. In one of many “largest digital heists in historical past,” a hacker stole $613 million from Poly Community in 2021. This decentralized finance (DeFi) platform enabled peer-to-peer (P2P) transactions—that’s, direct exchanges of tokens throughout blockchains. The theft was doable due to a vulnerability within the sensible contract that automated the switch of tokens. Despite the fact that the hacker returned the cash after a couple of days, claiming he simply wished to “expose the vulnerability,” the incident highlighted the numerous dangers that these platforms and their customers face.

Additionally widespread are ransomware assaults during which hackers infiltrate customers’ accounts, encrypt their targets’ private info to make it inaccessible, and extort them by demanding fee in crypto.

Environmental Impression

Cash that confirm consensus via proof-of-work, equivalent to Bitcoin, use monumental quantities of vitality. Proof-of-stake tokens, like Ethereum after its 2022 transition, devour a lot much less. Ethereum says it makes use of 99.9% much less vitality than earlier than, whereas Cambridge College’s Centre for Various Finance says that evaluating Ethereum’s pre- and post-merge vitality utilization is like evaluating the London Eye commentary wheel to a raspberry.

In keeping with a US authorities reality sheet, as of August 2022, crypto is believed to devour between 120 and 240 billion kilowatt-hours per yr—greater than the annual electrical energy utilization of some international locations. Whereas it doesn’t prime the listing, it’s one of many contributors to world local weather change.

Moreover, crypto mining has brought about issues with the ability grids of a number of nations, together with Iran and Kosovo, resulting in important electrical energy outages.

Accountability, Regulation, and Oversight

As a result of cryptocurrency expertise transcends political boundaries, nationwide regulators’ affect is proscribed. International regulators Monetary Stability Board and the Worldwide Financial Fund have joined forces to create a constant world framework for regulation, with new guidelines anticipated by September 2023.

Many particular person international locations have determined to not wait, nonetheless. Because of considerations in regards to the atmosphere and/or crime, a handful of countries—together with China, Egypt, Iraq, Morocco, Algeria, and Tunisia—have forbidden the issuance or holding of the tokens, whereas 42 extra have carried out restrictions that prohibit crypto exchanges or impose limitations on how banks can have interaction with the currencies. But different international locations have tried to entice firms to create markets for these property.

Japan, Switzerland, and the United Arab Emirates have modified legal guidelines or launched new ones between September 2022 and January 2023. PwC has referred to as the Swiss framework some of the mature up to now and reported that the UAE has created the primary authority on the planet solely devoted to digital currencies. Different nations, like Canada, the UK, and Australia, are nonetheless drafting laws, with the EU near enacting these rules.

Within the US, Congress has begun monitoring cryptocurrency extra carefully lately, and occasions like the autumn of FTX will seemingly set off further scrutiny.

Nonetheless, since cryptocurrencies had been conceived particularly to keep away from governmental controls, it’s unsure whether or not regulation efforts shall be profitable.

Why Do Buyers Select Cryptocurrency?

Whereas the considerations round cryptocurrency are many, it nonetheless holds plenty of attraction for sure traders for plenty of causes. Many are drawn to the speculative factor inherent in crypto’s shifting costs, which entices traders trying to revenue from market worth adjustments.

Different traders like cryptocurrencies for the distinctive qualities they provide, equivalent to decentralization, safety, and anonymity, that conventional currencies don’t present. These perceived benefits are largely theoretical in the meanwhile, however crypto fans consider sooner and cheaper transactions, improved safety and privateness, and higher monetary inclusion are coming, and can deliver extra mainstream adoption.

Safety Towards Political Crises

Many spend money on cryptocurrencies as a geopolitical hedge. Throughout instances of political uncertainty, the costs of those currencies have a tendency to extend. As political and financial uncertainty in Brazil grew in 2015, for instance, Bitcoin alternate commerce elevated by 322% whereas pockets adoption expanded by 461%. Bitcoin costs have additionally elevated in response to destabilizing political occasions equivalent to Brexit.

Pseudonymity (Close to Anonymity)

A standard false impression is that cryptocurrencies assure solely nameless transactions. They don’t. As an alternative, they provide pseudonymity, a near-anonymous state permitting shoppers to finish purchases with out offering private info to retailers. Nonetheless, these transactions should be topic to anti-money laundering (AML) rules and the buying and selling platform could require clients to offer proof of identification equivalent to a authorized type of ID (known as “know your buyer” or KYC). AML and KYC info might be utilized by regulation enforcement to hint transactions again to an individual or entity.

Programmable “Sensible” Capabilities

Sensible capabilities are options that present some degree of programmability or superior performance inside a blockchain or cryptocurrency protocol. Sure cryptocurrencies can present different advantages to holders, together with restricted possession and “stockholder” voting rights of their software program code.

One well-known instance is non-fungible tokens (NFTs). These digital property signify possession of a selected merchandise or piece of digital content material, equivalent to paintings, collectibles, or digital actual property, utilizing blockchain expertise for authentication and provenance. Digital tokens might additionally embody fractional possession pursuits in bodily property like artwork or actual property.

There are additionally mechanisms to lock out a transaction or an account till a predetermined time is reached or situation is met. Some cryptocurrencies implement superior “sensible” privateness options like stealth addresses, ring signatures, or zero-knowledge proofs. These permit customers to transact privately by obscuring transaction particulars, such because the sender, recipient, and quantity.

However the most well-liked purposes of this function are sensible contracts, self-executing agreements with the contract phrases written into the code. These contracts routinely implement the situations specified within the settlement with out the necessity for intermediaries.

Take, for instance, provide chain administration. Let’s say a clothes firm enters into a wise contract with its cotton provider that stipulates the standard, amount, and supply date of the cotton, in addition to the agreed-upon worth. As soon as the provider fulfills these situations, the sensible contract routinely releases the fee to the provider with out the necessity for handbook intervention or third-party verification. Subsequent, the cotton is shipped to the manufacturing facility, and the sensible contract data the receipt of the uncooked supplies. As manufacturing begins, the sensible contract logs every manufacturing stage, equivalent to dyeing, weaving, and chopping. This gives an correct and tamper-proof document of your entire manufacturing course of, making certain traceability and high quality management.

Peer-to-Peer Buying

Some of the important advantages of cryptocurrencies is that they permit P2P. P2P transactions cut back the chance of hacking or regulatory shutdowns that affect trades on centralized exchanges as a result of they don’t accumulate person and transaction info or require customers to carry their cryptocurrency within the alternate’s proprietary pockets. So long as the customers hold their info safe, P2P transactions provide higher privateness, decrease charges, and a wider vary of fee strategies than standard transactions funneled via centralized authorities.

What to Know Earlier than Investing in Cryptocurrency

Cryptocurrency may be obscure, as a result of it’s not merely digital cash. This could depart traders open to plenty of dangers, as many NFT house owners discovered the arduous manner in 2021 after they noticed how little management they retained over using the artwork that they had bought. So it’s necessary to completely perceive what you’re shopping for if you wish to keep away from any costly surprises down the street.

What Is Cryptocurrency?

A cryptocurrency is a digital asset that makes use of cryptography, an encryption approach, for safety. Cryptocurrencies are primarily used to purchase and promote items and providers, although some have further sensible capabilities. Most cryptocurrencies usually are not backed by one other commodity, equivalent to gold, and are sometimes not thought-about authorized tender. They’re additionally typically issued by non-public organizations.

Nonetheless, this isn’t universally the case. Latest years have seen the event of stablecoins—cash pegged to a different asset, just like the greenback, gold, or one other cryptocurrency—in addition to the issuance of digital currencies from the central banks of some international locations together with Nigeria and the Bahamas.

Typically corporations increase money to develop new blockchain and cryptocurrency applied sciences via ICOs. As an alternative of providing shares of possession, they provide digital tokens. Buyers profit by gaining early entry to the cryptocurrency and any related sensible capabilities. Blockchain-related initiatives have raised billions of {dollars} by way of ICOs.

As of 2023, estimates point out round 420 million individuals worldwide personal cryptocurrencies.

Forms of Cryptocurrencies

There are two main classes of cryptocurrencies: coin-only currencies like Bitcoin, utilized for buying items and providers, and tokens like Ethereum. Tokens additionally assist different digital data like NFTs and sensible contracts.

Bitcoin

Launched in 2009 by somebody below the alias Satoshi Nakamoto, Bitcoin is the most well-liked cryptocurrency, with a market share of roughly 45%. In a transaction, the client and vendor make the most of cell wallets to ship and obtain funds. The listing of retailers accepting Bitcoin has expanded lately, though some, together with Microsoft and Twitch, have quickly stopped taking it at instances because of extreme volatility.

Bitcoin has its shortcomings. For instance, it could actually course of solely seven transactions a second, whereas Visa handles 1000’s. The foreign money’s performance can be restricted: Because it was developed primarily as a tradeable coin, it doesn’t assist sensible contracts and decentralized purposes. Bitcoin’s worth has fluctuated dramatically over time, crashing in response to 2018 developments like more durable regulation from China and India, the SEC’s announcement of a crackdown on crypto exchanges, and the reported hacking of the Binance crypto alternate. Bitcoin recovered and boomed once more in 2021 as institutional traders started to take the cryptocurrency extra significantly—after which crashed as soon as extra in 2022 following the FTX fraud case.

Ethereum and Ether

Ethereum is a blockchain that enables for the comparatively straightforward creation of sensible contracts, whereas Ether is a token used to enter into transactions on the Ethereum blockchain. Ether and different currencies primarily based on the Ethereum blockchain have grow to be more and more well-liked. As of Might 2023, Ethereum’s market capitalization was round $218 billion. The foreign money has seen its share of volatility over the past a number of years, partly because of points with its expertise, although its market share of about 19% is a couple of factors greater than it was two years in the past.

Although Bitcoin and Ethereum account for a lot of the market share, the final decade or so has seen the emergence and speedy development of many new digital cash and tokens, together with Litecoin, Zcash, Sprint, and Dogecoin. Almost 23,000 completely different cryptocurrencies exist right this moment.

How Does Cryptocurrency Work?

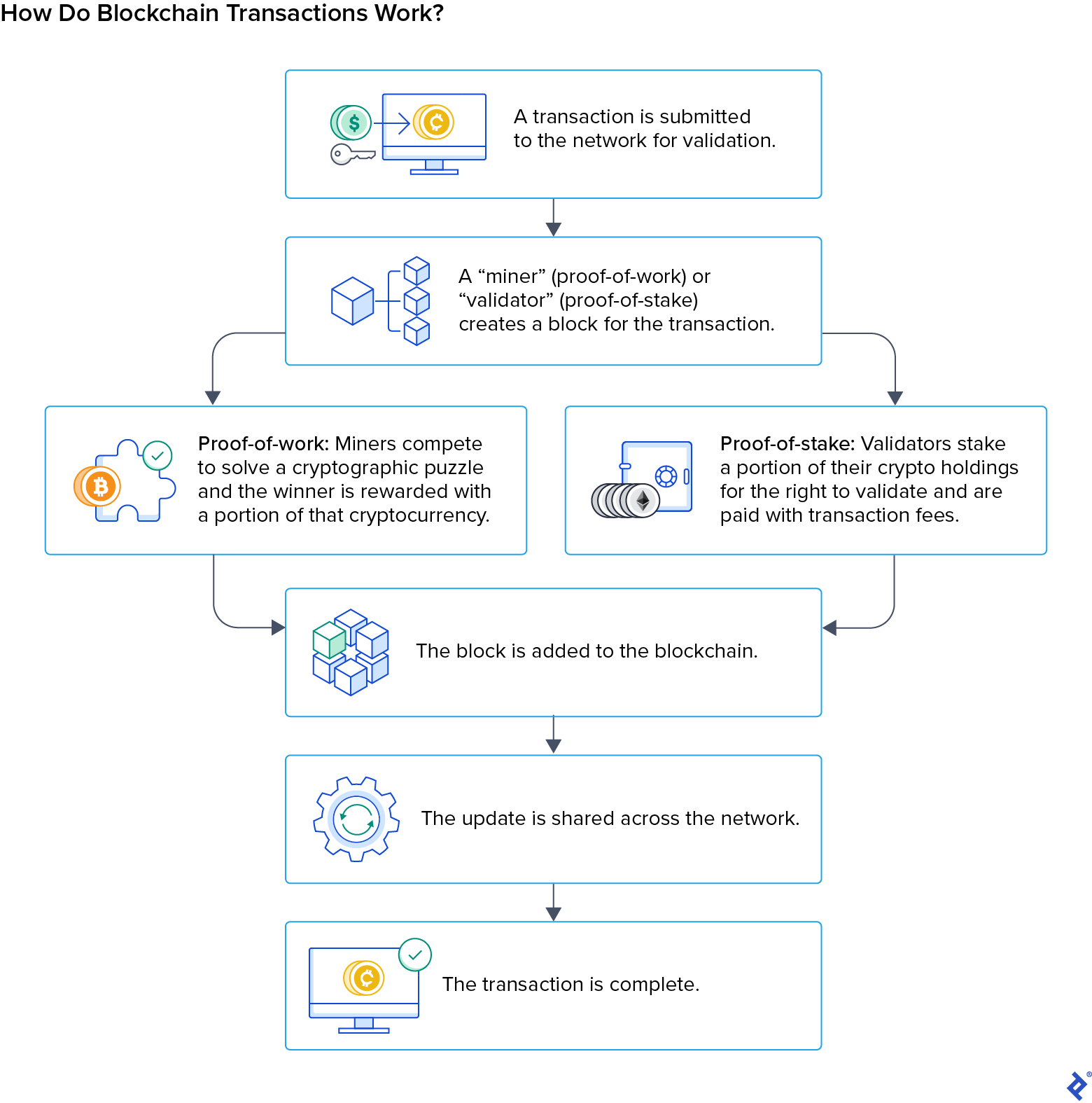

Blockchain expertise underlies Bitcoin and most different cryptocurrencies. It depends on constantly up to date public or non-public ledgers that document all transactions. The blockchain is decentralized, processing and verifying transactions with out a government like a financial institution, authorities, or funds firm concerned. (That is referred to as a trustless system.)

As an alternative, the blockchain makes use of consensus mechanisms to confirm transactions, that are then recorded in a number of nodes. A node is a pc related to the blockchain community that routinely downloads a replica of the blockchain upon becoming a member of stated community. For a transaction to be legitimate, all nodes should lend a hand.

For any transaction, each purchaser and vendor have to approve and confirm it to ensure that it to be added to the chain. A 3rd person—referred to as a “miner” or “validator,” relying on the validation methodology—secures the chain. The transaction info can’t be altered until all events agree. There are two main mechanisms for consensus verification (proof-of-work and proof-of-stake) and the method varies, relying on which one a specific blockchain makes use of.

Many cryptocurrencies, together with Bitcoin, the juggernaut, use proof-of-work. The method of confirming transactions and minting new models of foreign money for proof-of-work programs is known as mining. Miners should remedy a particularly tough cryptographic puzzle in an effort to confirm the transaction. Whoever solves it first is rewarded in cryptocurrency.

Anybody with enough computing energy can mine in a proof-of-work system, however the overhead may be appreciable, as a person laptop merely isn’t highly effective sufficient to mine cryptocurrencies profitably. As an alternative, miners sometimes use a number of computer systems and sometimes be part of swimming pools to extend collective computing energy, competing with different swimming pools to confirm pending transactions and reap the earnings.

However these earnings are declining. As Bitcoin miners’ overhead bills balloon, the profitability of mining has plummeted, dropping by 70% from October 2021 to Might 2023. In that very same interval, the worth of Bitcoin fell 63%. Many international locations have banned mining as a result of pressure on energy grids. And a few cryptocurrencies are taking away the anyone-can-mine method altogether, together with the second hottest cryptocurrency, Ethereum.

In September 2022, Ethereum switched to a much less energy-intensive consensus mechanism referred to as proof-of-stake. In a proof-of-stake system, customers stake a portion of their very own cash for the privilege of validating a transaction. With a view to get their staked cash again, these validators should verify the transaction precisely. The validator is then compensated for his or her work with a transaction charge. As a result of only one validator is chosen randomly by an algorithm, proof-of-stake avoids the race between a number of miners—or mining farms—to validate first. This dramatically reduces the electrical energy required to validate a transaction and considerably lowers prices and emissions.

How Is Cryptocurrency Used?

Though you’ll have seen cryptocurrency ATMs in public locations like buying facilities, most cryptocurrency transactions happen on-line via exchanges and wallets.

Cryptocurrency Exchanges

Cryptocurrency exchanges are web sites the place people can purchase, promote, or commerce cryptocurrencies for different digital or conventional currencies. The websites can convert cash into main government-backed monies or convert one crypto token into one other. A number of the largest exchanges, Binance, Coinbase Change, Kraken, and KuCoin, can every commerce greater than $10 billion day by day. Most legally working exchanges adjust to authorities AML and KYC necessities. Nonetheless, there are a couple of decentralized exchanges that don’t require customers to provide KYC info. With elevated anonymity comes added threat, nonetheless, and customers concerned with buying and selling on these platforms ought to accomplish that rigorously.

Cryptocurrency Wallets

One solution to mitigate threat is to carry crypto property in a cryptocurrency pockets as an alternative of an alternate. Crypto wallets allow customers to work together with blockchain networks by producing and storing non-public and public keys. The general public key serves because the pockets’s handle for receiving funds, and the non-public secret’s used for signing transactions and authorizing the switch of property. A pockets doesn’t maintain a person’s cash themselves however moderately the important thing to the cash, that are saved on public blockchain networks. Whereas a crypto pockets gained’t make funds resistant to drops in worth, it could actually protect them from lockups, withdrawal suspensions, and cyberattacks. Wallets may be both {hardware} or software program, although {hardware} is mostly thought-about safer. The Ledger pockets, for instance, resembles a USB drive and connects to a pc.

Despite the fact that digital software program wallets are riskier as a result of they’re housed on-line—and thus are probably accessible by hackers—in addition they provide decrease prices, may be put in simply on completely different gadgets, and are typically extra user-friendly than their {hardware} counterparts.

Components Affecting Cryptocurrency Costs

The worth of conventional government-backed currencies is usually decided by a number of parts, together with the differential in rates of interest, inflation, capital circulation, and cash provide between two international locations. Nonetheless, the price of crypto cash is topic to completely different forces:

Provide and Demand

The blockchain code limits the availability of Bitcoin to a most of 21 million, and with greater than 19 million Bitcoin already mined, specialists undertaking that miners will attain this whole by the yr 2140. If adoption charges rise, the slowing development within the variety of out there tokens would seemingly trigger the worth to extend. However not all cryptocurrencies work this manner. Many have their very own distinctive tokenomics, which outline their whole provide and issuance fashions.

Functions

Cryptocurrencies have worth as a way of alternate. They’ll improve their attraction by bettering on the Bitcoin mannequin or, like Ether, by incorporating different capabilities, equivalent to sensible contracts, that create further worth.

Ongoing Regulatory Modifications

Cryptocurrencies’ worth is strongly influenced by future expectations, and growing regulation is certain to have an effect on each. In contrast to a lot of the world, Japan already has a powerful and rising regulatory equipment, knowledgeable largely by the Mt. Gox and different hacks. Europe will implement new rules as early as July 2024. How the US will regulate digital property is unclear, however US President Joe Biden signed an govt order in 2022 authorizing elevated oversight and regulation of cryptocurrencies in response to their “dramatic development.”

Technological Developments

Cryptocurrency costs typically react to adjustments in expertise. For instance Bitcoin worth dropped in 2017 throughout an issue about altering the underlying expertise to enhance transaction instances. However two weeks after the change was accomplished, the worth shot as much as a document excessive of $1,600. Likewise, the worth of Ethereum dropped greater than 20% when the foreign money switched from the proof-of-work to proof-of-stake. Information studies about crypto alternate hacking typically result in worth decreases as effectively.

Investor Conduct (and Misbehavior)

Bubble mentalities can inflate crypto values. These accountable for these currencies drive up values by limiting the availability of tokens for buying and selling and growing demand via hype and hypothesis. One other important explanation for inflated worth is fraud. Con artists capitalize on crypto hype by partaking in ways like grift, pump-and-dump schemes, and exit scams to reinforce their wealth earlier than the autumn.

How Is Cryptocurrency Taxed?

Below present accounting tips, cryptocurrencies aren’t thought-about money or money equivalents since they lack the previous’s liquidity and the latter’s secure worth. Nonetheless, the accounting therapy of cryptocurrencies remains to be unsure as neither the Worldwide Finance Reporting Requirements or the American Institute of CPAs has but to challenge official steering.

Within the US, the IRS instructs holders of digital property to deal with them as private property and topic to the identical tax obligations as property transactions. On a steadiness sheet, the worth of cryptocurrency holdings is the same as the truthful market worth on the time of acquisition.

Outdoors the US, accounting therapy varies. In 2015, the European Courtroom of Justice dominated that crypto ought to be handled like government-backed currencies, and holders shouldn’t be taxed on purchases or gross sales. However a brand new proposal from the European Parliament is together with taxes on traders’ capital good points, transactions, and mining.

Equally, in Japan in 2017, cryptocurrencies had been reclassified as a “technique of settlement” of transactions and exempted from the 8% consumption tax.

Cryptocurrency’s Final Problem

5 years on from its heyday in 2017 and 2018, cryptocurrency nonetheless has many individuals to win over, together with Warren Buffet, who has referred to as Bitcoin ingenious however in the end “a delusion.” However different funding specialists, like Invoice Miller, stay bullish.

Within the easiest phrases, cryptocurrency is a fintech phenomenon; on a extra advanced degree, it’s a revolutionary expertise difficult the political, financial, and social underpinnings of society.

Even when cryptocurrency’s fortunes proceed to wane, the blockchain expertise that emerged from it has the ability to rework the best way we do enterprise. Expertise consulting agency CB Insights has recognized how the blockchain can basically change processes as numerous as banking, cybersecurity, voting, academia, and provide chain administration. Monetary analysts predict that by 2030, the worldwide blockchain expertise market will produce revenues near $1.24 trillion, up from $5.85 billion in 2021.

The problem that crypto-enthusiasts should meet is advancing the expertise to its full potential whereas constructing the general public’s confidence within the cryptocurrency market sufficient to attain mainstream adoption.

This text has just lately undergone a complete replace to include the newest and most correct info. Feedback under could predate these adjustments.