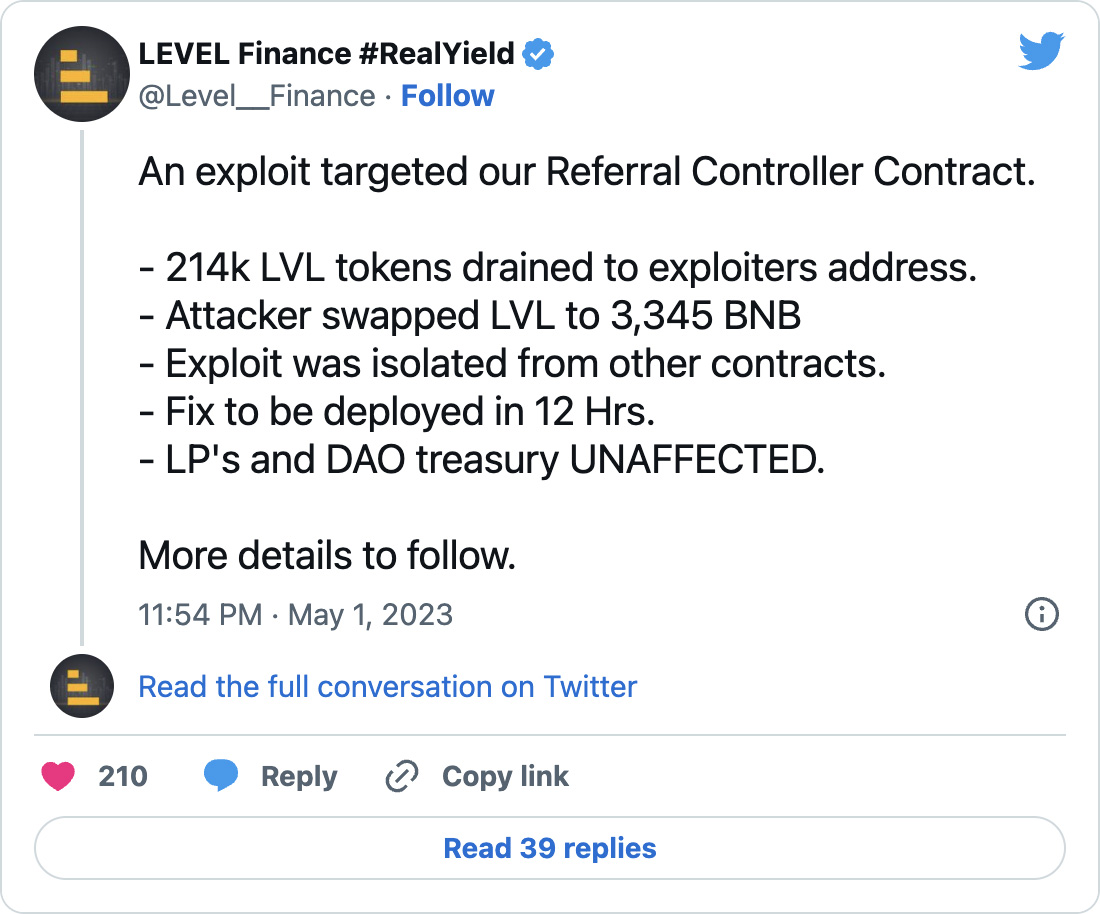

Hackers exploited a Degree Finance good contract vulnerability to empty 214,000 LVL tokens from the decentralized alternate and swapped them for 3,345 BNB, price roughly $1,100,000.

Whereas Degree Finance mentioned the assault didn’t have an effect on its liquidity pool and the DAO treasury, and the exploit was remoted from all different contracts, the LVL token misplaced roughly 50% of its worth instantly after the assault was made recognized.

The corporate has promised to supply updates on the state of affairs as quickly because the investigation reveals extra. The DAO has since launched a proposal asking for votes on how the group ought to deal with the 214K LVL tokens added to circulation by the assault.

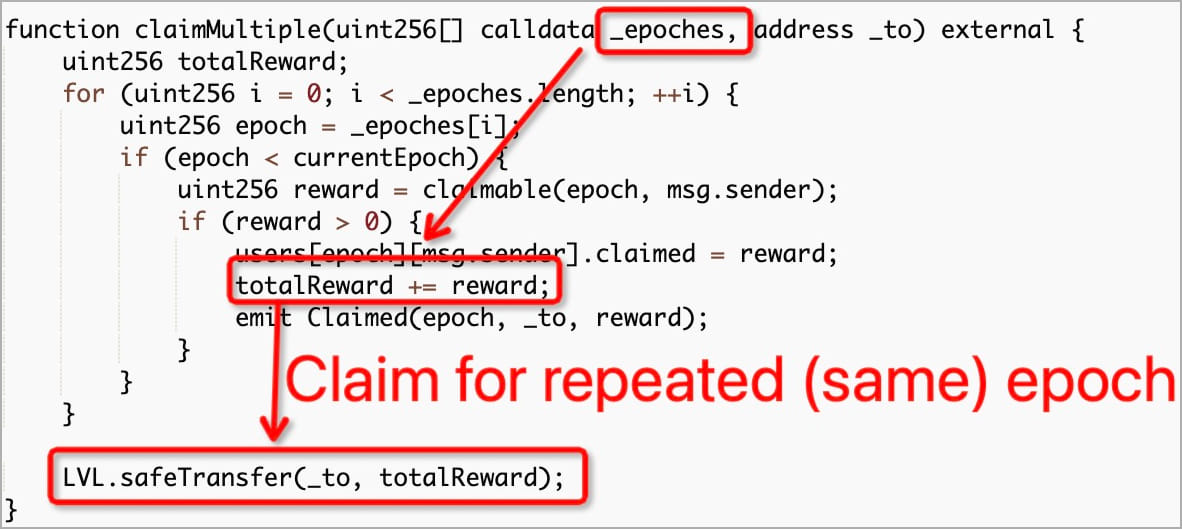

Blockchain safety and information analytics firm PeckShield defined that the breached good contract, ‘LevelReferralControllerV2,’ had a logic bug within the claimMultiple perform that enables customers to repeatedly declare referral rewards throughout the identical epoch (time frame).

Good contract auditor BlockSec has reached the identical conclusion, including that the hacker has tried to take advantage of the flaw a number of instances since final week and failed.

“Particularly, the declare reward was decided by the tier of referral and reward factors, therefore the attacker made the next preparation: 1) creating and setting many referrals; 2) utilizing flashloan to carry out dozens of swap (the reward was up to date within the postSwap perform),” defined BlockSec on Twitter.

The attacker created a number of referral accounts to maximise the rewards they may acquire by exploiting the good contract bug.

Flashloans (single-transaction borrow and return) have been used to amplify the referral rewards additional, permitting the attacker to carry out dozens of swaps from one token to a different, getting a reward for the motion each time.

Ultimately, the attacker carried out the right steps yesterday and launched the hack that made them $1.1 million.

Audited doesn’t imply safe

Though Degree Finance did its finest to guard property by ordering two audits from unbiased corporations, the hacker nonetheless discovered a technique to exploit the code to steal cash utilizing missed bugs.

Nevertheless, whereas Degree Finance was audited twice in 2023, it’s unclear if the susceptible perform was audited or added afterwards.

Safety audits are neither bulletproof nor ought to they be handled as an assurance of security and safety as we’ve seen a number of instances up to now.

Final week, DEX Merlin was compromised resulting from a “main fault within the structural integrity and controls of the platform,” dropping $1.82 million that rogue insiders drained from its liquidity pool. This occurred mere days after DEX Merlin introduced a profitable audit by blockchain safety agency CertiK.

Final yr, decentralized music platform Audius misplaced $6 million price of tokens after an attacker exploited a flaw in a system that had undergone two in-depth safety assessments from separate auditors because it was launched.