Gone are the times of the spreadsheet for holding tabs on essential enterprise funds. Now, software program platforms can be found to do the heavy lifting for you.

Enterprise accounting software program helps corporations handle and observe their financials, from accounts payable to payroll. Nonetheless, these platforms don’t cease there. Enterprise accounting software program contains the instruments mandatory for accounting automation, stock administration, compliance and a lot extra.

There are various examples of accounting software program enterprises can select from. On this information, we showcase the highest software program choices out there and break down the fundamentals of enterprise accounting software program.

SEE: Function comparability: Time monitoring software program and techniques (TechRepublic Premium)

Soar to:

Function comparability of prime accounting software program

| Oracle NetSuite ERP | SAP BRIM |

QuickBooks Enterprise | Sage Intacct | Xero | Monetary Power | Acumatica Cloud ERP | Microsoft Dynamics 365 Finance | |

|---|---|---|---|---|---|---|---|---|

| Fundamental accounting processes | Sure | Sure | Sure | Sure | Sure | Sure | Sure | Sure |

| Monetary forecast |

Sure | Sure | Sure | No | No | Sure | No | Sure |

| Integrations | Sure | Sure | Sure | Sure | Sure | Sure | No | Sure |

| Tax instruments | Sure | Sure | Sure | No | No | No | Sure | Sure |

| Billing | Sure | Sure | Sure | Sure | No | Sure | Sure | Sure |

| Payroll | No | No | Varies by tier | No | Sure | Sure | Sure | Sure |

| Cell app | Sure | Sure | Sure | No | Sure | Sure | No | Sure |

| Regulatory reporting | Sure | No | No | No | No | Sure | Sure | Sure |

Greatest enterprise accounting software program

Oracle NetSuite ERP

Oracle NetSuite is a pacesetter in enterprise useful resource planning software program. Oracle NetSuite ERP presents sturdy accounting options, together with every little thing from money administration to tax administration.

NetSuite’s accounting software program integrates seamlessly with the remainder of NetSuite’s capabilities similar to buyer administration and e-commerce. The result’s a full-service suite that allows enterprises in any business to achieve a 360-degree view of their funds.

Key options

- Fundamental accounting options, together with a basic ledger, accounts receivable and accounts payable

- Actual-time, easy visibility into all monetary information

- Automation options to eradicate handbook accounting processes

- Cell capabilities to entry monetary instruments and information from anyplace

- Simplified regulatory compliance with requirements similar to ASC 606 and GAAP

Professionals

- Extremely customizable

- Automation scripts will be handy

- Simple

- Scalable

Cons

- Greatest for customers with earlier accounting software program expertise, so the training curve could also be steep for some customers

- Setup and getting into into the bigger Oracle ecosystem will be cumbersome

Pricing

- Contact the seller for pricing particulars.

SAP

SAP, an business chief in ERP software program, presents full monetary administration for the enterprise, from primary accounting to governance, threat and compliance. For instance, by SAP Billing and Income Innovation Administration, enterprises can automate their billing and invoicing processes. And thru SAP S/4HANA Cloud, corporations can enhance the accuracy of their monetary closing processes.

Key options

- Help for primary and complicated accounting processes, together with income administration

- Automated workflows to simplify monetary closing

- Help for subscription and usage-based billing and accounts receivable

- Full monetary forecasting and budgeting

- Actual-time visibility of money by SAP Money Administration

- Automation of tax administration processes by SAP Tax Compliance

- Cloud deployment

Professionals

- Designed for bigger, subscription- or usage-based income fashions

- On-line evaluations reward agility and pace

- Cloud deployment

Cons

- Greatest for workers with current ERP expertise

- Will not be well-suited for small or medium companies

Pricing

See SAP’s web site to request a demo first.

QuickBooks Enterprise

QuickBooks is understood for its easy-to-use but feature-rich accounting software program. QuickBooks Enterprise contains all the streamlined accounting instruments conventional QuickBooks does together with enterprise-specific instruments.

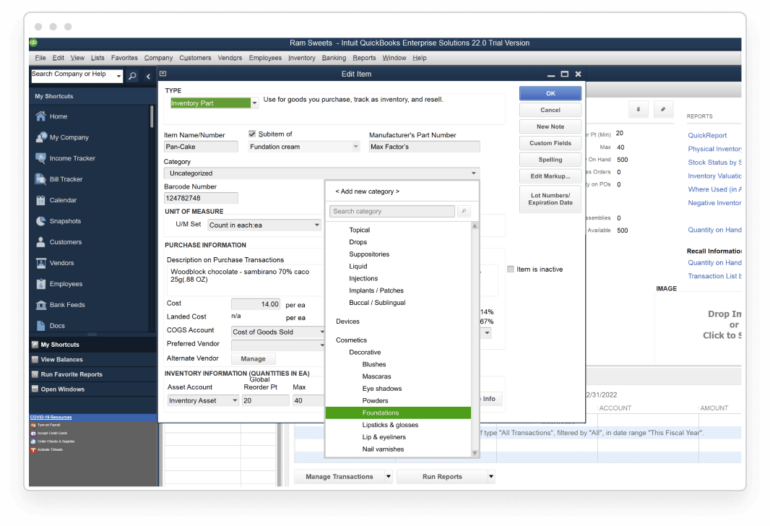

For instance, corporations achieve entry to superior stock administration, order administration and even area service administration. QuickBooks Enterprise additionally contains sturdy reporting instruments, together with 200+ customizable experiences, in addition to built-in budgeting and forecasting instruments.

In accordance with QuickBooks, enterprise customers expertise six instances the listing capability by benefiting from QuickBooks’ automation instruments, together with batch transactions, automated time monitoring and extra.

Key options

- Business-specific options can be found to suit any business

- Constructed-in automation instruments for every little thing from accounting to time monitoring

- Superior stock and order administration capabilities

- Help for advanced pricing buildings

- Superior, totally customizable reporting for improved monetary visibility

Professionals

- Good for small and medium companies

- Typically constructive evaluations for person help

- Handles detailed, advanced inventories

Cons

- Distant entry is simply out there by a third-party integration

- Multi-user mode will be cumbersome and expensive

- Payroll will be advanced and typically requires a third-party integration

Pricing

Pricing begins at $1,410 yearly. See the QuickBooks Enterprise website for extra specifics about plans and pricing.

Sage Intacct

Sage Intacct is a whole, cloud-based accounting platform. Sage Intacct presents the essential accounting instruments all enterprises want, together with accounts payable and receivable, money administration, and a basic ledger.

Along with these core accounting instruments, Sage Intacct goes additional by providing superior instruments similar to dynamic allocations, AI-powered timesheets, project-based accounting, and even time and expense administration.

One hallmark function of Sage Intacct is the platform’s clever basic ledger. This instrument is pushed by AI and permits enterprises to profit from varied capabilities. For instance, enterprises have the flexibility to shut repeatedly as a substitute of unexpectedly on the finish of every month, saving effort and time.

Key options

- Core monetary options, together with accounts payable and receivable and money administration

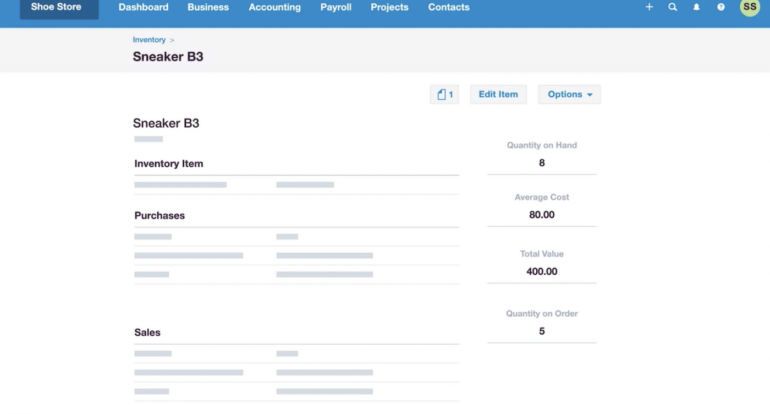

- Superior capabilities similar to dynamic allocations and stock administration

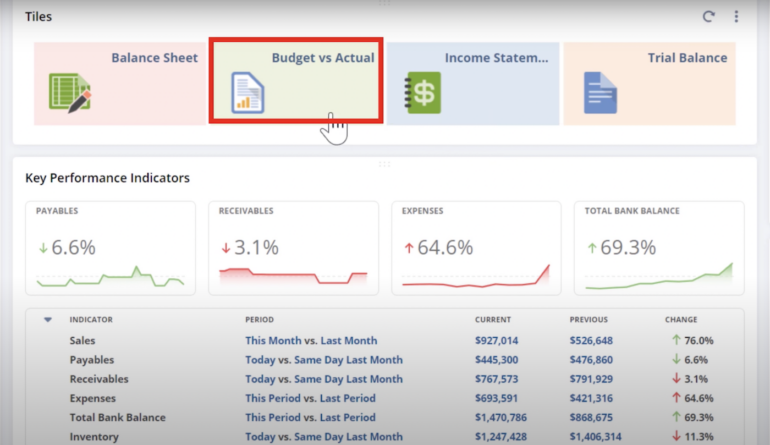

- Strong monetary reporting and dashboard capabilities

- Clever basic ledger

- Integrations with different platforms, together with Salesforce and ADP

Pricing

Contact the seller for pricing particulars.

Xero

Whereas Xero is an accounting answer geared towards small companies, the platform does provide options for enterprise accounting corporations. For instance, Xero’s accounting instruments embody every little thing from cost processing to mounted asset administration.

As well as, enterprise accounting corporations can use Xero to automate compliance processes utilizing Xero Workpapers. Enterprise corporations can even reap the advantages of sturdy experiences and analytics that embody in-depth information about shopper money flows. And with Analytics Plus, corporations can make the most of predictions for much more insights.

Key options

- Core accounting instruments similar to invoicing, price capturing, cost processing, financial institution reconciliation and extra

- Full platform customization by add-ons similar to Xero Bills and third-party integrations

- Automation capabilities to streamline accounting duties

- Accountant and bookkeeper-specific instruments similar to Xero Apply Supervisor and Xero HQ

Professionals

- Lives fully throughout the cloud

- Evaluations reward easy-to-use person interface

- Constructed-in connections to banks make transactions straightforward.

Cons

- Lacks payroll instrument

- Invoicing instruments are restricted.

- Some evaluations report issue reaching customer support.

Pricing

Pricing begins at $3.25 per thirty days for the bottom tier, with a 30-day free trial. See Xero’s website for the pricing plans.

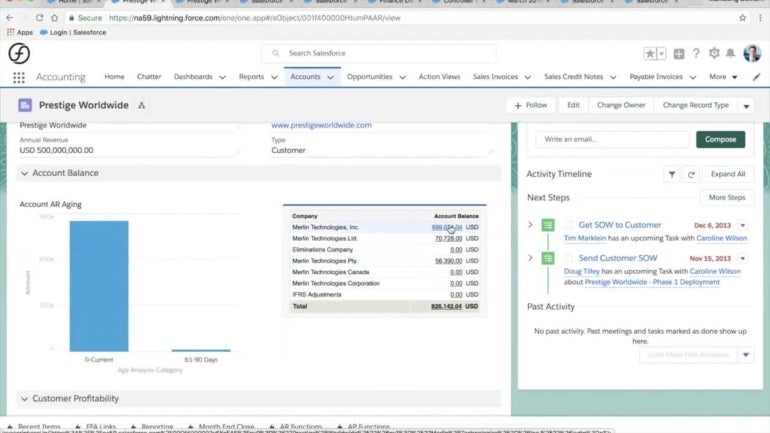

FinancialForce

FinancialForce is an enterprise-grade accounting answer that’s good for corporations working globally. FinancialForce options multi-language and multi-currency capabilities, together with accounts payable and receivable, asset administration and money administration.

FinancialForce is constructed on the highest buyer relationship administration platform Salesforce; attributable to this truth, enterprises can make the most of in-depth analytics powered by Salesforce Einstein. The result’s clear monetary forecasting full with predictions.

Whereas FinancialForce presents many superior options, it additionally delivers easy options similar to invoicing.

Key options

- Core accounting instruments, together with a basic ledger, accounts receivable and payable, and money administration

- Constructed-in compliance experiences and monetary assertion templates

- Multi-currency, multi-language and multi-company options

- Salesforce Einstein for clever monetary insights

- Buyer success greatest practices playbook built-in with Salesforce

Professionals

- Takes benefit of associated Salesforce merchandise

- Evaluations reward the clear, easy-to-use structure.

- Covers big selection of kinds of accounting processes

Cons

- Doesn’t have built-in instruments for past-due invoices

- Some evaluations word setup could also be time-consuming.

- Could also be obscure with out earlier Salesforce expertise

Pricing

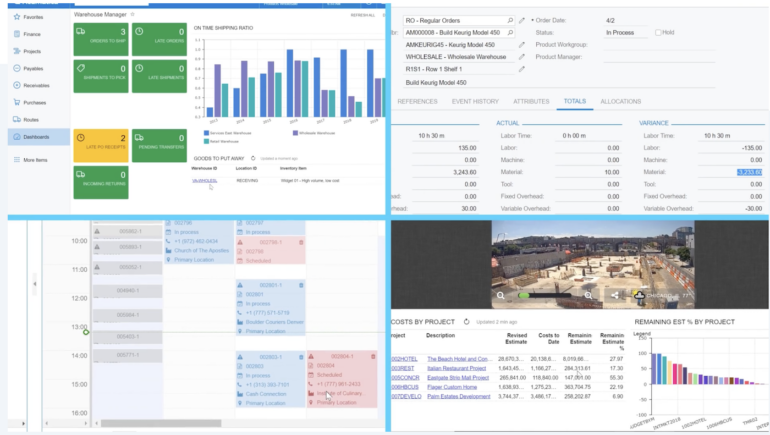

Acumatica Cloud ERP

Acumatica Cloud ERP presents a variety of economic administration and accounting options for enterprises, together with these with a number of entities. Utilizing Acumatica Cloud ERP, enterprises can centralize their monetary information and processes throughout places of work and subsidiaries.

Along with multi-entity accounting, Acumatica gives project-specific accounting, enabling groups to handle billing, budgeting and different components for particular person enterprise initiatives.

Acumatica customers have entry to a variety of accounting instruments, together with accounts receivable and payable, forex administration, tax administration, time administration and payroll administration.

Key options

- Help for multi-entity and intercompany accounting

- Undertaking-based accounting capabilities

- Customizable workflows for automating accounting and monetary administration processes

- Steady closing capabilities

- Fundamental accounting options, together with a basic ledger, in addition to sturdy options similar to superior expense administration

Professionals

- Good framework wherein to customise to a person enterprise

- Versatile

- Evaluations reward the cellular app

- Intuitive invoicing instruments

Cons

- Lacks some forecasting instruments

- Some evaluations report clunky charts.

- Subscription mannequin could also be pricy and complicated.

Pricing

Microsoft Dynamics 365 Finance

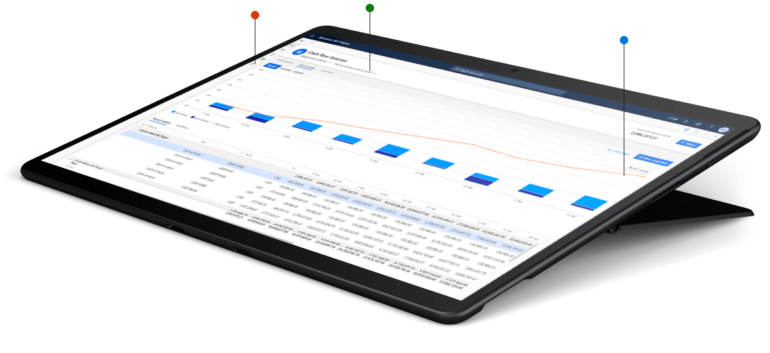

Microsoft Dynamics 365 is a set of clever ERP instruments for companies of all sizes. Microsoft Dynamics 365 Finance is a instrument centered on the monitoring of economic operations.

Utilizing Dynamics 365 Finance, enterprises could make sound monetary selections by forecasting money move and buyer funds shortly. Plus, enterprises can use the built-in monetary reporting capabilities to simplify closing.

Dynamics 365 Finance integrates seamlessly with different Microsoft platforms similar to Dynamics 365 Gross sales and Dynamics 365 Commerce.

Key options

- Automated vendor bill processing

- Help for contemporary, subscription-based billing fashions

- Constructed-in tax calculation instruments to make sure tax compliance

- Monetary administration instruments that align with requirements similar to IFRS 15

- Strong monetary reporting capabilities and real-time analytics

- Cell capabilities for simplified entry to monetary information and instruments

Professionals

- Integrates with different Microsoft merchandise easily

- Compliance and threat administration instruments assist companies develop into extra resilient

- Up to date usually with course of enhancements

Cons

- Compelled upgrades can disrupt work.

- Some reviewers request higher coaching and help.

Pricing

What’s enterprise accounting software program?

Enterprise accounting software program permits giant corporations to trace and handle their funds – this contains every little thing from accounts receivable and tax administration to worker payroll.

Accounting software program gives automation, eliminating the necessity for tedious handbook processes that usually end in pricey errors. Plus, accounting software program integrates with different essential enterprise instruments similar to ERP and CRM platforms.

Utilizing enterprise accounting software program together with different platforms offers corporations a real-time overview of all monetary information in a single place.

The enterprise accounting software program market

The accounting software program market is experiencing fast development. In accordance with information by Allied Market Analysis, the worldwide accounting software program market was valued at $11.9 billion in 2020; by 2030, the market is anticipated to succeed in $70.2 billion.

In accordance with the report, the expansion of accounting software program use will be attributed to a rise within the adoption of know-how used for bettering enterprise productiveness. One other inspiration behind the expansion is the push to make the most of automation to eradicate handbook processes and accounting errors.

It’s necessary to notice the consequences of COVID-19 when contemplating the fast development of accounting software program. In an effort to be proactive and struggle again towards future threats, many enterprises are prioritizing automation and different instruments to modernize their accounting practices. As well as, many companies are on the lookout for cloud-based software program options for straightforward entry, whether or not workers are working within the workplace or remotely.

Key advantages of enterprise accounting software program

Elevated effectivity

Effectivity is the important thing driver behind many software program implementation tasks. Accounting software program will increase operational effectivity in some ways.

For instance, automation options eradicate the necessity for handbook information entry. Plus, accounting software program shops all monetary information in a single place, eliminating the necessity for workers to go looking a number of databases for the knowledge they should carry out work-related duties.

Utilizing a centralized, cloud-based platform, workers can entry accounting instruments and information from anyplace.

Decreased prices

Accounting errors similar to constant bill errors and unmonitored spending can shortly drain an enterprise’s sources; thankfully, accounting software program options similar to automation and reporting assist corporations eradicate these errors, decreasing total prices.

Accounting software program can even scale back the prices related to hiring accounting professionals or outsourcing accounting procedures.

Improved accuracy of economic information

Errors throughout the steadiness sheet are irritating and sometimes end in hours of wasted time. As well as, accounting errors result in poor enterprise decision-making, denial of credit score, unfavourable money move and a slew of different penalties.

Enterprise accounting software program makes use of built-in controls and instruments to eradicate errors. These controls alert enterprises to errors earlier than they take maintain. In some circumstances, the software program will repair any errors mechanically.

Simplified monetary decision-making

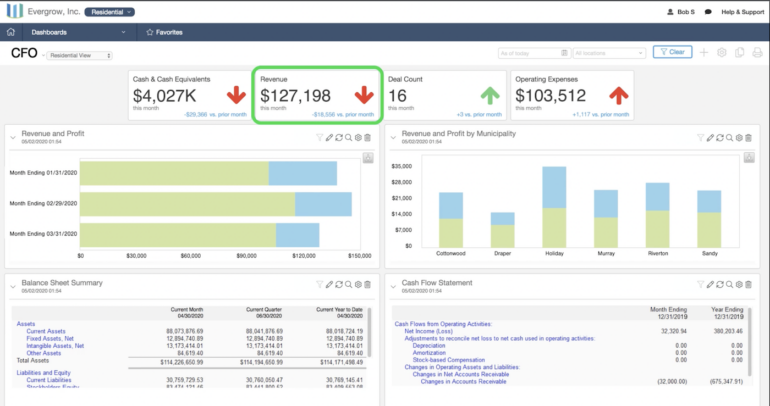

Enterprise accounting software program permits real-time visibility into an organization’s funds and key efficiency indicators. With a transparent image of an organization’s well being, stakeholders could make knowledgeable monetary selections.

Simpler tax compliance

Monetary laws change quickly, and attempting to maintain up with tax laws in addition to on a regular basis accounting duties is usually a problem for giant enterprises. Enterprise accounting software program presents constant and automated software program updates to make sure accounting processes observe the evolving requirements of GAAP and different tips; because of this, enterprises can stay in compliance with out almost as a lot effort.

SEE: Fast glossary: Accounting (TechRepublic Premium)

Key enterprise accounting software program options

Automation capabilities

Enterprises should transfer quick, and meaning decreasing the variety of handbook duties that should be accomplished every day. Automation may help.

Enterprise accounting software program may help to automate nearly any accounting activity, from tax submitting to invoicing. Automation permits accounting and finance groups to spend much less time on the numbers and extra time on higher-value duties.

Fundamental accounting

Enterprise accounting software program contains instruments that simplify all primary accounting procedures; for instance, capabilities embody a basic ledger, accounts payable and receivable, money administration and tax preparation. Plus, all primary accounting processes will be automated to save lots of enterprises effort and time.

Billing and invoicing

Fashionable enterprises want trendy billing and cost capabilities. Enterprise accounting software program permits the automation of invoices, which reduces prices. For instance, accounting software program helps to cut back pricey bill errors and time wasted on handbook billing duties.

Accounting software program can automate each bill despatched, together with those who recur every week, month or quarter.

Enterprise accounting software program can even observe invoices all through the billing cycle and ship reminders to make sure clients pay on time. One other key function of accounting software program is built-in cost processing instruments, offering the flexibility to simply accept credit score and debit funds.

SEE: FreshBooks vs QuickBooks: Which accounting answer is greatest for what you are promoting? (TechRepublic)

Payroll processing

Though it’s a essential enterprise course of, payroll is usually difficult and complicated. Timesheets should be wrangled, wages and withholding should be calculated, and funds should be processed, all in a well timed method. Enterprise accounting software program automates these tedious payroll duties.

For instance, accounting software program can shortly calculate an worker’s wage, taking taxes, bonuses and extra time under consideration. It might probably then report payroll within the appropriate locations, together with the overall ledger.

Different duties similar to sending the precise cost to workers and the operating of detailed payroll experiences will be accomplished by an enterprise accounting platform.

Tax administration

Identical to payroll, tax administration is a draining course of. There are various duties concerned in managing taxes, from calculating gross sales tax to submitting quarterly taxes. These processes are made much more difficult when each home and worldwide taxes are concerned, which is widespread for giant enterprises.

Enterprise accounting software program gives help for all tax administration processes inside an enterprise. For instance, accounting software program can observe payroll taxes, calculate advanced figures similar to value-added tax, mechanically file annual taxes and a lot extra. Plus, an accounting platform helps enterprises stay compliant with ever-changing tax laws.

Fee processing

Many enterprise accounting platforms provide cost processing constructed proper into the software program. Utilizing these instruments, funds can simply be accepted from credit score and debit accounts along with conventional test or Automated Clearing Home funds.

Entry to extra cost strategies simplifies the cost course of for purchasers, which can scale back the time spent ready on money.

Monetary forecasting

Monetary forecasting is probably not a normal accounting course of; nevertheless, it’s an answer supplied by many enterprise accounting software program suites. For instance, some platforms provide information visualizations, so finance groups can see present budgets and tendencies in real-time.

Instruments similar to Oracle NetSuite enable groups to generate what-if situations based mostly on monetary information, to allow them to create customized forecasts to suit their wants.

Reporting and analytics

Maybe essentially the most coveted function of enterprise accounting software program is reporting and analytics. Monetary information about each transaction is wrangled and saved proper throughout the software program. Firms can then use this information for monetary forecasting, compliance, tax planning and making strategic enterprise selections.

Enterprise accounting software program sometimes comes customary with a variety of pre-built experiences. For instance, the software program could comprise accounting-specific experiences similar to revenue and loss statements, money move statements and tax summaries.

Though, many platforms enable customers to create their very own customized monetary experiences to suit their distinctive wants. Enterprise accounting software program additionally gives entry to monetary dashboards that function visible experiences that talk the enterprise’s real-time monetary well being by way of graphs and charts.

Safety

Monetary information ought to be saved underneath lock and key – in spite of everything, information breaches are on the rise. And in keeping with latest information by IBM, the typical price of a knowledge breach reached $4.35 million in 2022. The extra safety layers that may be added to information, the higher protected an enterprise will likely be.

Fortunately, enterprise accounting software program platforms sometimes include sturdy safety features similar to two-factor authentication, bank-level encryption, entry management and permissions. Utilizing these instruments, corporations can guarantee those that want information have entry, and those that don’t — effectively, don’t.

How to decide on the best enterprise accounting software program for what you are promoting

Which accounting software program is correct in your enterprise will rely upon a number of elements together with the kind of enterprise, the variety of workers, how a lot what you are promoting earns, and your funds for software program purchases. Does any explicit kind of accounting software program match the area of interest you’re employed in? You might be able to discover particular software program for manufacturing, for instance. Plus, it would be best to steadiness what the software program can do along with your accounting group’s monetary literacy. Does your accounting group need hand-holding, or a variety of customization, or one thing in between? Ask the individuals who will likely be instantly utilizing the software program, possibly day by day, for his or her enter.

Different necessary elements to take into accounts embody whether or not the software program has a cellular app or a cloud service. The place will your workers be bodily once they entry it? What sorts of units do they already use on the job? This may occasionally matter to how handy the accounting software program will be for them. In spite of everything, totally different software program meets totally different enterprise wants.